Bitcoin what is what

Bitcoin what is what

Bitcoin (BTC)

What Is Bitcoin?

Bitcoin is a cryptocurrency, a virtual currency designed to act as money and a form of payment outside the control of any one person, group, or entity, and thus removing the need for third-party involvement in financial transactions. It is rewarded to blockchain miners for the work done to verify transactions and can be purchased on several exchanges.

Bitcoin was introduced to the public in 2009 by an anonymous developer or group of developers using the name Satoshi Nakamoto.

It has since become the most well-known cryptocurrency in the world. Its popularity has inspired the development of many other cryptocurrencies. These competitors either attempt to replace it as a payment system or are used as utility or security tokens in other blockchains and emerging financial technologies.

Learn more about the cryptocurrency that started it all—the history behind it, how it works, how to get it, and what it can be used for.

Key Takeaways

Investopedia / Julie Bang

Understanding Bitcoin

In August 2008, the domain name Bitcoin.org was registered. Today, at least, this domain is WhoisGuard Protected, meaning the identity of the person who registered it is not public information.

In October 2008, a person or group using the name Satoshi Nakamoto announced the Cryptography Mailing List at metzdowd.com: «I’ve been working on a new electronic cash system that’s fully peer-to-peer, with no trusted third party.» This now-famous white paper published on Bitcoin.org, entitled «Bitcoin: A Peer-to-Peer Electronic Cash System,» would become the Magna Carta for how Bitcoin operates today.

On Jan. 3, 2009, the first Bitcoin block was mined—Block 0. This is also known as the «genesis block» and contains the text: «The Times 03/Jan/2009 Chancellor on brink of second bailout for banks,» perhaps proof that the block was mined on or after that date, and maybe also as relevant political commentary.

On Jan. 8, 2009, the first version of the Bitcoin software was announced to the Cryptography Mailing List, and on Jan. 9, 2009, Block 1 was mined, and Bitcoin mining commenced in earnest.

Bitcoin rewards are halved every 210,000 blocks. For example, the block reward was 50 new bitcoins in 2009. On May 11, 2020, the third halving occurred, bringing the reward for each block discovery down to 6.25 bitcoins.

One bitcoin is divisible to eight decimal places (100 millionths of one bitcoin), and this smallest unit is referred to as a satoshi. If necessary, and if the participating miners accept the change, Bitcoin could eventually be made divisible to even more decimal places.

Bitcoin, as a form of currency, isn’t too complicated to understand. For example, if you own a bitcoin, you can use your cryptocurrency wallet to send smaller portions of that bitcoin as payment for goods or services. However, it becomes very complex when you try to understand how it works.

What Is Bitcoin

Bitcoin’s Blockchain Technology

Cryptocurrencies are part of a blockchain and the network required to power it. A blockchain is a distributed ledger, a shared database that stores data. Data within the blockchain are secured by encryption methods. When a transaction takes place on the blockchain, information from the previous block is copied to a new block with the new data, encrypted, and the transaction is verified by validators—called miners—in the network. When a transaction is verified, a new block is opened, and a Bitcoin is created and given as a reward to the miner(s) who verified the data within the block—they are then free to use it, hold it, or sell it.

Bitcoin uses the SHA-256 hashing algorithm to encrypt the data stored in the blocks on the blockchain. Simply put, transaction data stored in a block is encrypted into a 256-bit hexadecimal number. That number contains all of the transaction data and information linked to the blocks before that block.

Data linked between blocks is what led to the ledger being called a blockchain.

Transactions are placed into a queue to be validated by miners within the network. Miners in the Bitcoin blockchain network all attempt to verify the same transaction simultaneously. The mining software and hardware work to solve the nonce, a four-byte number included in the block header that miners are attempting to solve. The block header is hashed, or randomly regenerated by a miner repeatedly until it meets a target number specified by the blockchain. The block header is «solved,» and a new block is created for more transactions to be encrypted and verified.

How to Mine Bitcoin

A variety of hardware and software can be used to mine Bitcoin. When Bitcoin was first released, it was possible to mine it competitively on a personal computer. However, as it became more popular, more miners joined the network, which lowered the chances of being the one to solve the hash. You can still use your personal computer as a miner if it has newer hardware, but the chances of solving a hash are individually are minuscule.

This is because you’re competing with a network of miners that generate around 220 quintillion hashes (220 exa hashes) per second. Machines, called Application Specific Integrated Circuits (ASICs), have been built specifically for mining—can generate around 255 trillion hashes per second. In contrast, a computer with the latest hardware hashes around 100 mega hashes per second (100 million).

To successfully become a Bitcoin miner, you have several options. You can use your existing personal computer to use mining software compatible with Bitcoin and join a mining pool. Mining pools are groups of miners that combine their computational power to compete with the large ASIC mining farms.

You increase your chances of being rewarded by joining a pool, but rewards are significantly decreased because they are shared.

There are several mining programs to choose from and many pools you can join. Two of the most well-known programs are CGMiner and BFGMiner. When choosing a pool, it’s important to make sure you find out how they pay out rewards, what any fees might be, and read some mining pool reviews.

Newsround

5 Feb 2021 5 February 2021

When the richest person in the world gives his support to a virtual currency you know it’s big business.

Elon Musk has told users of an online social media app that he thinks the virtual currency, Bitcoin, is a «good thing.»

His comments resulted in the value of Bitcoin rising significantly.

So much so, that a singular Bitcoin went from being worth £3,600 in March last year to more than £27,000 now.

As talk of the currency has gone global, the Bank of Singapore has suggested that the 12-year-old currency could replace gold as its store of value.

However, in October, the head of the Bank of England, Andrew Bailey, warned about the unpredictability of Bitcoin, saying it makes him, «very nervous».

Here’s everything you need to know.

It’s like an online version of cash. You can use it to buy products and services, but not many shops accept Bitcoin yet and some countries have banned it altogether.

However, some companies are beginning to buy into its growing influence.

In October last year, for example, the online payment service, PayPal, announced that it would be allowing its customers to buy and sell Bitcoin.

The physical Bitcoins you see in photos are a novelty. They would be worthless without the private codes printed inside them.

Each Bitcoin is basically a computer file which is stored in a ‘digital wallet’ app on a smartphone or computer.

People can send Bitcoins (or part of one) to your digital wallet, and you can send Bitcoins to other people.

Every single transaction is recorded in a public list called the blockchain.

This makes it possible to trace the history of Bitcoins to stop people from spending coins they do not own, making copies or undo-ing transactions.

There are three main ways people get Bitcoins.

In order for the Bitcoin system to work, people can make their computer process transactions for everybody.

The computers are made to work out incredibly difficult sums. Occasionally they are rewarded with a Bitcoin for the owner to keep.

People set up powerful computers just to try and get Bitcoins. This is called mining.

But the sums are becoming more and more difficult to stop too many Bitcoins being generated.

If you started mining now it could be years before you got a single Bitcoin.

You could end up spending more money on electricity for your computer than the Bitcoin would be worth.

There are lots of things other than money which we consider valuable like gold and diamonds. The Aztecs used cocoa beans as money!

Bitcoins are valuable because people are willing to exchange them for real goods and services, and even cash.

Some people like the fact that Bitcoin is not controlled by the government or banks.

People can also spend their Bitcoins fairly anonymously. Although all transactions are recorded, nobody would know which ‘account number’ was yours unless you told them.

In an online chat with social media users in January 2021, the world’s richest man, Elon Musk, said he was a big supporter of Bitcoin.

He even went as far as to change his Twitter bio to «#bitcoin».

He has repeatedly shown his support to online currencies in recent years and caused major movements in their values due to his own personal wealth and influence.

This particular endorsement led to the value of Bitcoin to rise significantly.

Every transaction is recorded publicly so it’s very difficult to copy Bitcoins, make fake ones or spend ones you don’t own.

It is possible to lose your Bitcoin wallet or delete your Bitcoins and lose them forever. There have also been thefts from websites that let you store your Bitcoins remotely.

The value of Bitcoins has gone up and down over the years since it was created in 2009 and some people don’t think it’s safe to turn your ‘real’ money into Bitcoins.

This concern was expressed by the head of The Bank of England, Andrew Bailey, in October 2020.

He said that he was «very nervous» about people using Bitcoin for payments pointing out that investors should realise its price is extremely volatile.

By this, he meant that the value could drop significantly at any moment and investors could lose a lot of money.

What Is Bitcoin in Simple Terms: From Theory To Practice

In this article, we are going to give you a brief and simple rundown of all things related to cryptocurrencies. It’s so straightforward that you can print it out and show it to your grandmother. Our blog contains all the necessary information about mining. All articles are written in simple terms. However, not everyone wants to dive deep into the matter. Moreover, this post also covers other cryptocurrency usage aspects such as investing.

That’s why this article is a real gem. We processed tons of information in order to present it to you in a short and simple manner. Stephen Hawking succeeded in a similar endeavor. He wrote a book about the origin and structure of the Universe without mathematical formulas titled A Brief History of Time. We will try to reproduce his success. Not in physics, but in modern finance, or better yet, in the finance of the future.

Throughout the article, we are going to share links to the articles from the blog, Wikipedia, and lots of other resources. Feel free to dive deep in various aspects of cryptocurrencies that interest you. Some might argue that we oversimplified some things in the article. We are looking forward to your feedback in our 2Miners chat on Telegram.

Bitcoin: the First and the Most Popular Cryptocurrency

There are thousands of cryptocurrencies in the world. The first cryptocurrency ever created is Bitcoin or BTC. For the sake of simplicity, we are going to talk mainly about Bitcoin.

All other cryptocurrencies are Bitcoin clones. They were fully or partially copied and sprinkled with new ideas here and there. It’s no secret that Bitcoin is open-source. Anyone in the world can see how it’s built and how it operates.

Bitcoin code is available on GitHub in the Bitcoin repository.

If you don’t know anything about programming, don’t worry. It’s worth pointing out that we must accept the work of Bitcoin code creators in good faith. Should we worry about it? Not at all. You don’t know the purpose of every little screw in your car or how its computer works. It’s the same here. Programmers all around the world would be happy to find even a tiny fault in the Bitcoin network operation. So rest assured, if there was a fault, they would have already found it. We simply put our trust in experts that built our car and tested it. Same with Bitcoin. Millions of programmers in the world read and examine the Bitcoin code every day.

What Is Cryptocurrency and Who Controls It? Are Physical Bitcoins Real?

Bitcoin: Digital Currency

Based on the name “cryptocurrency”, you clearly understand that it’s some sort of money. Crypto means that this money is encrypted. What exactly is encrypted and how is irrelevant at this point. Let’s assume that cryptocurrency is digital money.

What does digital mean? Traditional money can be printed (in the form of banknotes) or digital (on bank accounts). When you transfer money from your account to your friend’s account, pay for utilities via online banking, or pay with a credit card in a shop, you don’t actually see your money. It is stored virtually on computer servers. You can’t either see or touch it.

You can use an ATM to withdraw cash from your credit card and put it under the mattress. In this case, your digital, virtual money becomes real. You can touch it, look at it, or hang it on the wall. You can’t do that with Bitcoins. You can’t go to the bank, withdraw Bitcoins in cash, and put them under the mattress in the form of physical BTC coins. Of course, you can exchange Bitcoins for dollars and bring them home. At this point though, they are dollars, not Bitcoins.

How crucial is it? We think not at all. Even most of our grandparents have been receiving pensions on bank accounts. They don’t use cash much.

How Many Bitcoins and Dollars Exist?

Things are much more straightforward with Bitcoins. As of now, there are almost 19 million Bitcoins (BTC) in the world. About 900 new BTC are created every day, but the daily amount of new Bitcoins is decreasing with time. In total, there will be 21 million Bitcoins in the world. The precise amount is 20,999,999.9769 BTC. That’s it. No more, no less.

If the Federal Reserve decides to print 100 million dollars, they just print them. They are not going to ask you or us. It doesn’t work this way with Bitcoins. Their amount is limited to 21 million coins. You can’t “print” a few more BTC at a later time. It’s simply impossible.

Who Controls Currencies?

Traditional currencies are controlled by central banks of respective countries. The US Federal Reserve System controls the dollar, the European Central Bank controls the euro, the People’s Bank of China controls the yuan, and the Central Bank of Russia controls the ruble, etc.

Nobody controls Bitcoin. Bitcoin is an anarchic system. It doesn’t have a boss. The source code prescribes everything that should be happening in the system of this currency. In the next chapter, we are going to see how it works.

How Does Bitcoin Work? Transactions in Traditional Currencies and Bitcoins. What Is Bitcoin Mining Actually Doing?

Dollar Transactions

Can anyone but you and bank workers find out that you sent money to your grandmother? No, nobody knows and can’t find out. Bank account information is not public, that is, it’s not accessible to everyone.

You can’t even track the transaction. Did it go through? Will it go through in 20 minutes or in 24 hours? Your grandmother might say, “I didn’t receive the money.” Your bank would say, “Money is on its way. Please wait.” The system is not transparent.

Bitcoin Transactions

All Bitcoin wallets are interconnected. They communicate with each other all the time sharing information about all cryptocurrency transactions. Here’s an example.

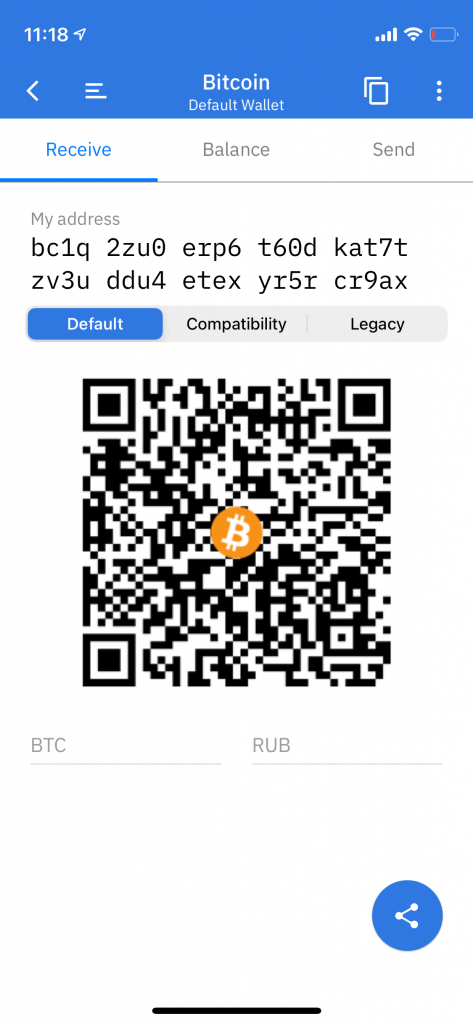

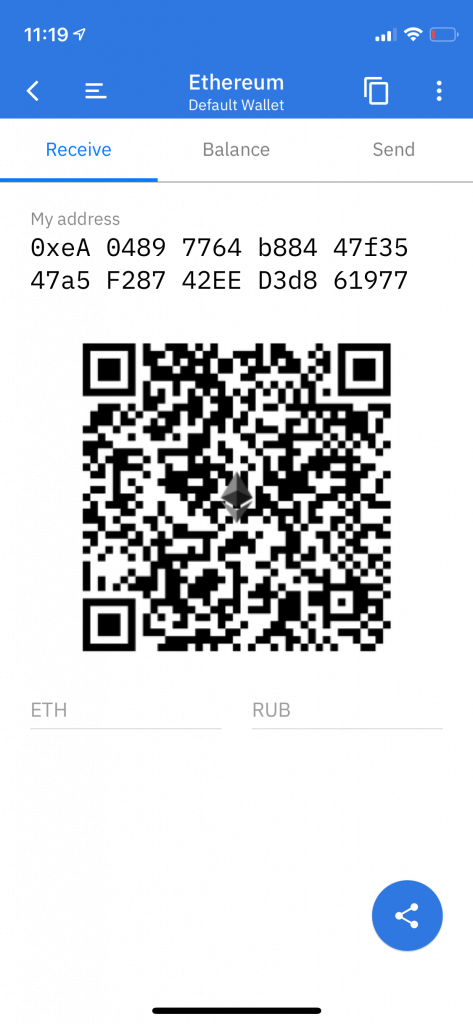

You have 1 BTC, and you want to send 0.1 BTC to your grandmother. Like with traditional money, you have your grandmother’s account number (wallet address). Up until this point, everything is the same with the only difference being that the Bitcoin account number contains more letters and has more symbols overall. A typical US bank account number looks like this: 408178100999, the rest of the World uses IBAN accounts: FR7630006040011234567800289, whereas a typical Bitcoin wallet address looks like this: 32qoXh82StQpvgCwhQdKpxoLTrcAX5EqyG.

You go to the app with your Bitcoin wallet on your desktop or mobile, enter your grandmother’s address, the amount you want to transfer, and confirm. You wait for about 10 minutes, after which the cryptocurrency is transferred from your account to your grandmother’s.

What’s behind this? Your wallet transmitted the information about the transaction to all other wallets. However, simply transmitting the information is not enough. Somebody should execute (validate) this transaction. In the case of traditional money, banks do it. In the case of Bitcoin, a computer or a group of computers do it. The computer gets a reward for the transaction.

However, it’s not easy to become such a computer. It must solve a complicated math problem that changes every 10 minutes in a highly competitive environment. This process is called mining, and we are going to discuss it in the next chapter.

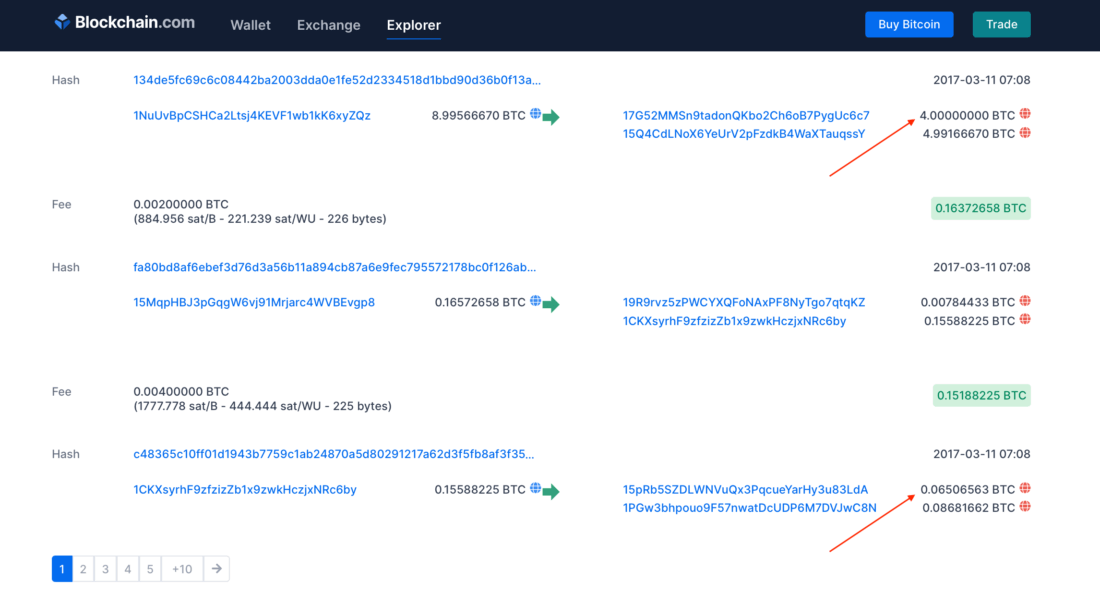

All the data in the Bitcoin system is open to any person. All information about transactions is public. However, this information is anonymous. For example, 0.0138 BTC was transferred from wallet bc1q3hq0rrkzvw48fgs3c9ceyxvjwe9zn5z0y7pkgc to wallet 14o9CArVto8yPfo5W4bMSM7spmEK9E1q3Z on September 21, 2021, at 12:46 am. Any person in the world can verify it. You won’t hear, “I didn’t receive money,” from your grandmother, or, “Today we are closed. Please expect the money tomorrow,” from the bank. You will see for yourself that your money is transferred to your grandmother and is now in her wallet. You can show it to other family members. Everyone can see your transaction details and your grandmother’s balance.

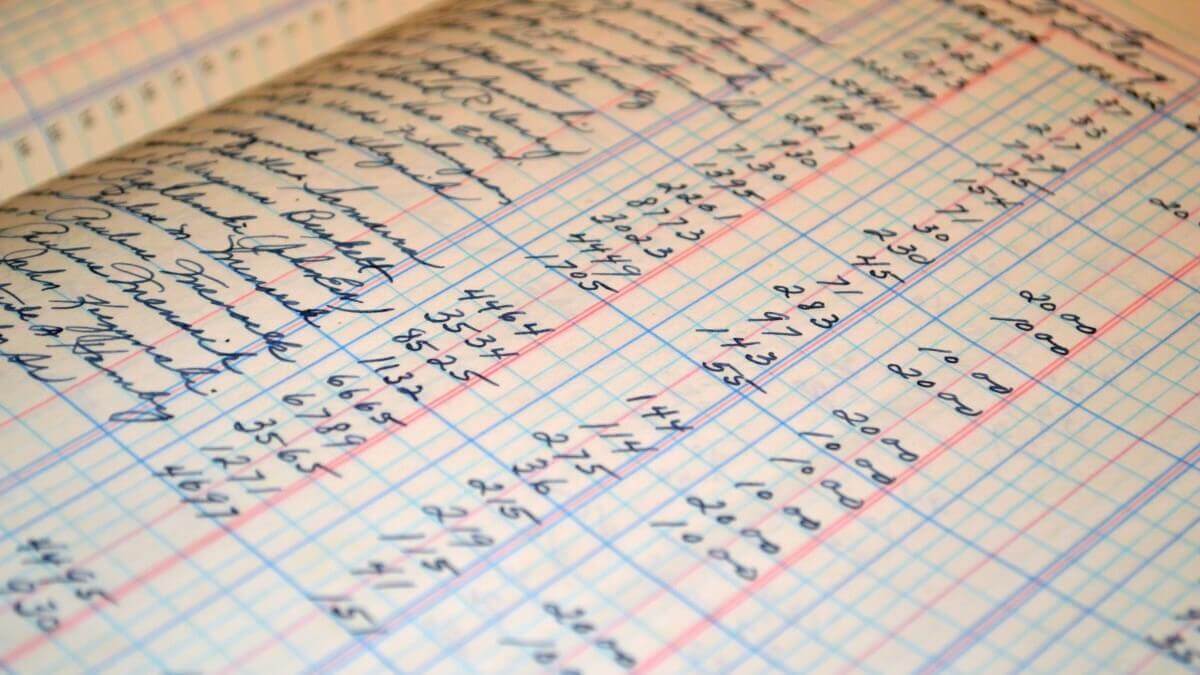

What Is Blockchain

Apart from “Bitcoin” and “Cryptocurrency”, you probably also heard about two other important concepts: “Blockchain” and “Mining”. They are interconnected and serve as a foundation for cryptocurrencies.

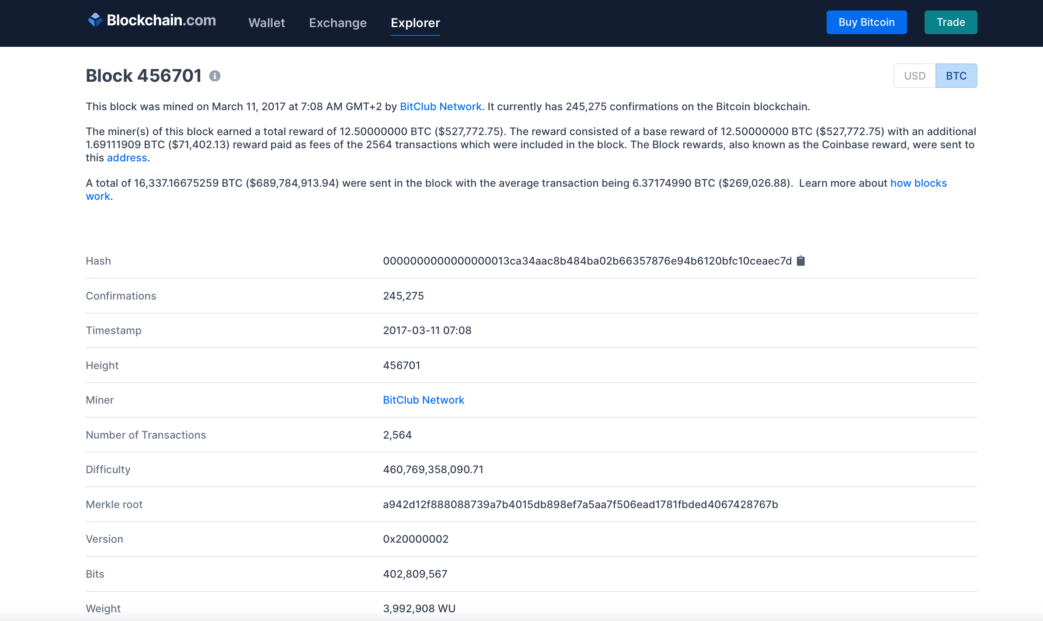

We already mentioned that information about all transactions in the Bitcoin system is available to all people. This information is stored on the blockchain. Blockchain literally means the chain of blocks. There is nothing complicated about this term. Blockchain is like a ledger where pages are numbered sequentially, each page contains the data of creation and a list of transactions performed at this moment of time. One page is called a block.

For the sake of simplicity, let’s say that Jack sent 0.065 BTC to Mary, and Kate sent 4 BTC to Peter. By the way, this data is real. You can find it in the Bitcoin network by following the link.

Similar ledgers have existed since the times of Ancient Rome. However, one thing distinguishes blockchain. As soon as you close one page and open the new one, you can’t make any changes to previous pages. Ever. That’s why it’s called a chain. Such a ledger doesn’t let you paste a page somewhere in the middle. It’s impossible.

Let’s create a ledger, that is, a blockchain, together. We have a notebook with an endless number of pages and start filling out the first page. All wallets in the Bitcoin network communicate with each other. We receive new data.

And so on. Of course, we don’t see names like Gary or Stephen. We see anonymous addresses like 15pRb5SZDLWNVuQx3PqcueYarHy3u83LdA.

We record all the data on the first page of the notebook. We keep receiving more information about transactions. We keep recording.

We keep recording. Until we turn the page, all these transactions are void. How to turn the page? Only cryptocurrency miners can do it. If we are not miners, there is no way for us to do it. We ask a miner for help, and he turns the page. He also puts time and his name on it. Miners get rewards for their work, which is also recorded on the page before turning and sealing it.

Then we fill the second page with new transactions. To turn it, we ask a miner again. There is no way around it. This process is endless.

Blockchain is open to all people at all times. You can open any page of the so-called ledger and see who made a transfer, to whom, when, and how much. You can also see the balance of any wallet in Bitcoin. You won’t see a name like Mary or Peter. You will only see addresses, but all the information is public. If you want to see it for yourself, you can go to blockchain.com.

Easy, right? Now that we know how blockchain works, let’s talk about mining. We are sure that now you too want to become an important person that everyone needs to close a new block on the blockchain (i.e., to turn the page in a ledger called Bitcoin). Plus, they say you get paid well for it.

What Is Mining

Bitcoin mining is the process of solving a math problem using computing equipment. The problem is the same for all the computers in the world. A miner that solved the problem turns the page in Bitcoin’s “ledger”, that is, he creates a new block on the blockchain. By doing so, he validates all the transactions recorded since the closure of the previous block. Once the problem is solved, another problem appears. The whole world starts working on it. It’s important to be the first to solve the problem, otherwise, you don’t get the reward.

Too hard? Let’s try again.

How often do problems change? Bitcoin source code is written in such a way that it takes about 10 minutes to solve a problem. It is enabled through a simple algorithm. The more miners are working on the problem, the more difficult it is. And vice versa: less miners would be solving an easier problem.

Bitcoin and Other Cryptocurrencies Use Cases

Unlike traditional currencies, cryptocurrencies are anonymous but completely transparent. Ironic but true. It means that you can find any Bitcoin transaction at any point of Bitcoin’s existence. Senders and recipients are identified with wallet addresses instead of names, like the gibberish we already mentioned above: 1CKXsyrhF9zfzizZb1x9zwkHczjxNRc6by.

On the one hand, it guarantees full anonymity. On the other hand, if you match a real person with his Bitcoin address, you can see all his transactions: how much he transferred and to which addresses. The number of Bitcoin wallets a person can have is endless, but it’s not always possible to remain completely anonymous.

One important thing that distinguishes Bitcoin from the dollar or euro is that nobody regulates or safeguards Bitcoin in any way. Here is a simple example.

If you transfer 0.1 BTC to a stranger’s address instead of your grandmother’s, it is very likely that you will never get your money back. There is no mechanism that would let you get your money back. You can’t contact the recipient to ask him to give the money back. There is no Bitcoin police. You don’t have any leverage at all.

In this case, cryptocurrencies are like cash. If your cash gets stolen, you won’t be able to get it back. Storing cryptocurrencies is as unsafe as storing cash. The only difference is that banknotes are pieces of paper, and you can only stash a limited number of those. On the contrary, an unlimited number of Bitcoins can be stored on a flash drive, or even in a tiny file on your computer.

Keep in mind the important difference between transactions in cryptocurrencies and traditional currencies. When you transfer Bitcoins and the transaction gets sealed on the blockchain, your money has already left your account and reached the recipient. It can’t be changed. Any person in the world can verify it. When you transfer dollars from one account to another, they may be already gone from the sending account but only reach the recipient in a day or two, or they may get lost due to the negligence of the bank.

Where and How Can You Use Cryptocurrencies?

Cryptocurrencies are mainly used for the following purposes.

You shouldn’t confuse mining with investing. A person can be engaged in both activities, but there is a difference. Mining brings immediate profits, whereas investment brings profits in the long run.

How to Store Bitcoins

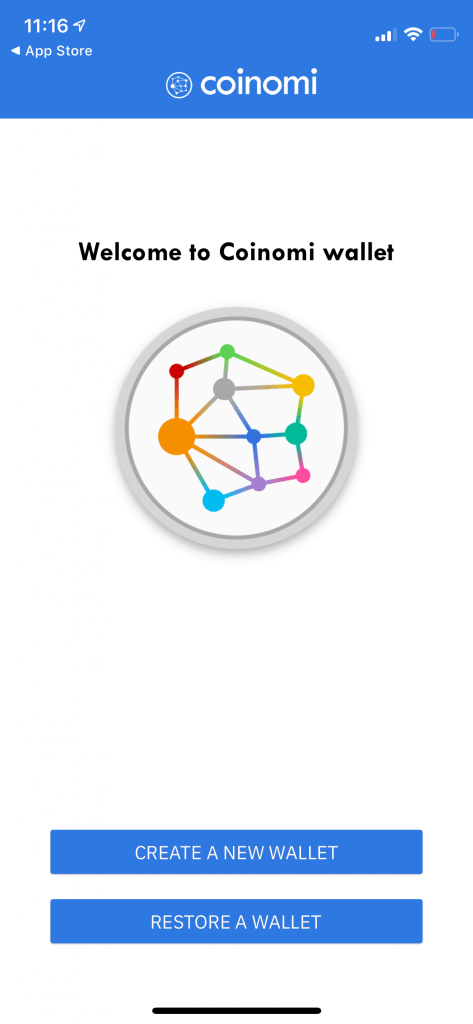

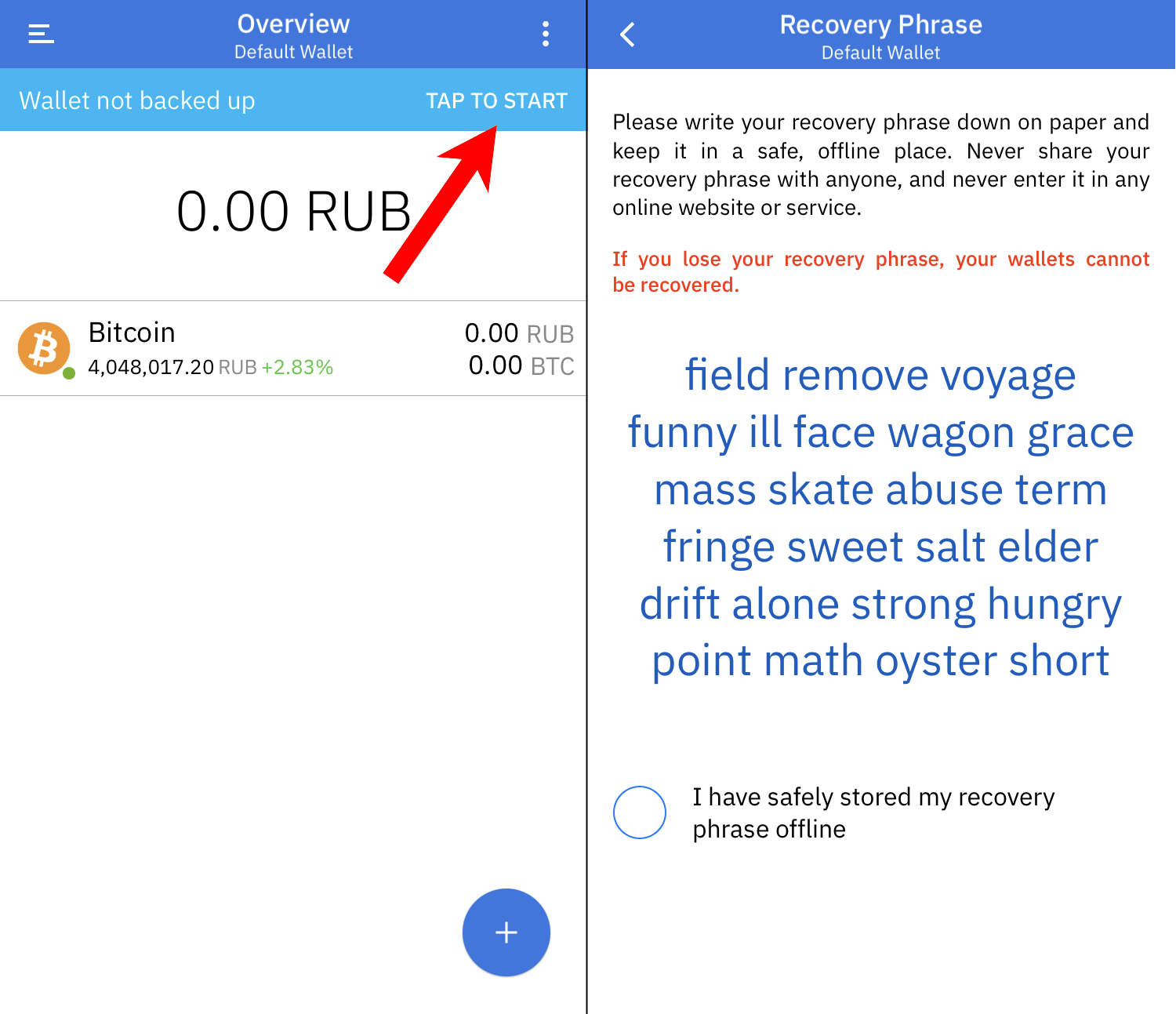

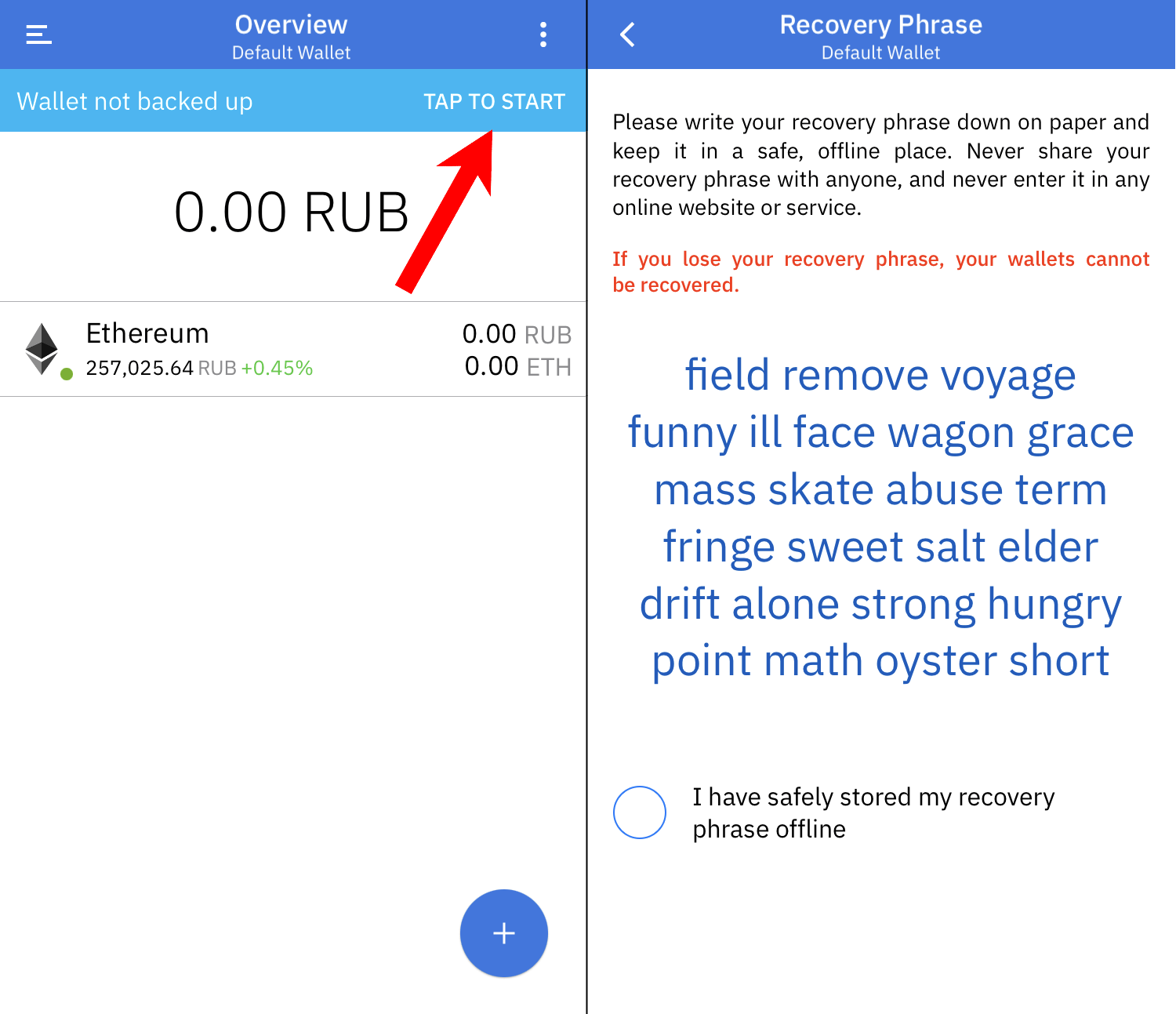

Regardless of how you are planning to use Bitcoins, you need a wallet. Choosing the right wallet is important. You are responsible for the safety of your cryptocurrency. Remember that if your cryptocurrency gets stolen or lost, nobody will be able to restore it. Whichever wallet you choose, there is a risk of losing your Bitcoins. Depending on the wallet and type of storage, the risk may be higher or lower.

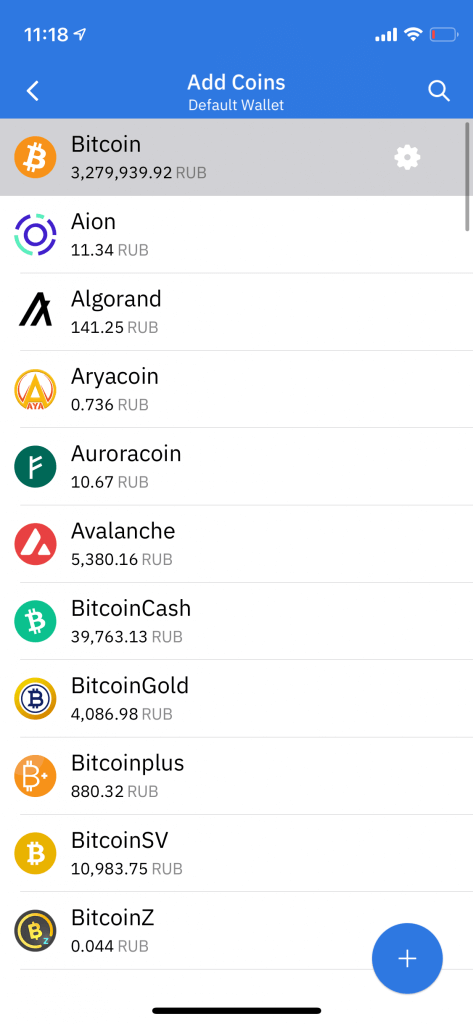

If you are not planning to store large sums of money or you are only starting out, we recommend one of the multicurrency cryptowallets. They are available on desktop and mobile. For example, Coinomi or Trust. Make sure to secure your passwords and recovery phrases as recommended by wallets’ creators.

Hardware wallets offer a higher level of security. They are special flash drives that you connect to your computer. In the case of such wallets, avoid buying used wallets or wallets from unverified sources. Hardware wallets must be new and bought directly from the manufacturing company.

If you plan to store large sums, you need more secure storage. For example, you may want to buy a separate computer and a few flash drives to store cryptocurrencies.

There are plenty of scammers and hackers. When you use cryptocurrencies, it’s up to you to protect yourself against them. Don’t expect anyone to help you.

How to Pay For, Buy, Sell, and Exchange Bitcoins and Other Cryptocurrencies

There are special cryptocurrency exchanges and platforms that let you buy, sell, and exchange Bitcoins for other cryptocurrencies. Most of them require registration and ID verification. You can still find some exchanges that operate anonymously.

In any case, exchanging one cryptocurrency for another is much easier than exchanging cryptocurrency for dollars. All you need to do is to go to one of the exchanges with multiple exchange options. The most popular exchanges in the world are Coinbase, Gemini, Kraken, and Binance.

Is Cryptocurrency Legal?

The regulations differ depending on the country. Some countries legalized cryptocurrency, others didn’t. In some countries, it’s still not regulated in any way.

Mining

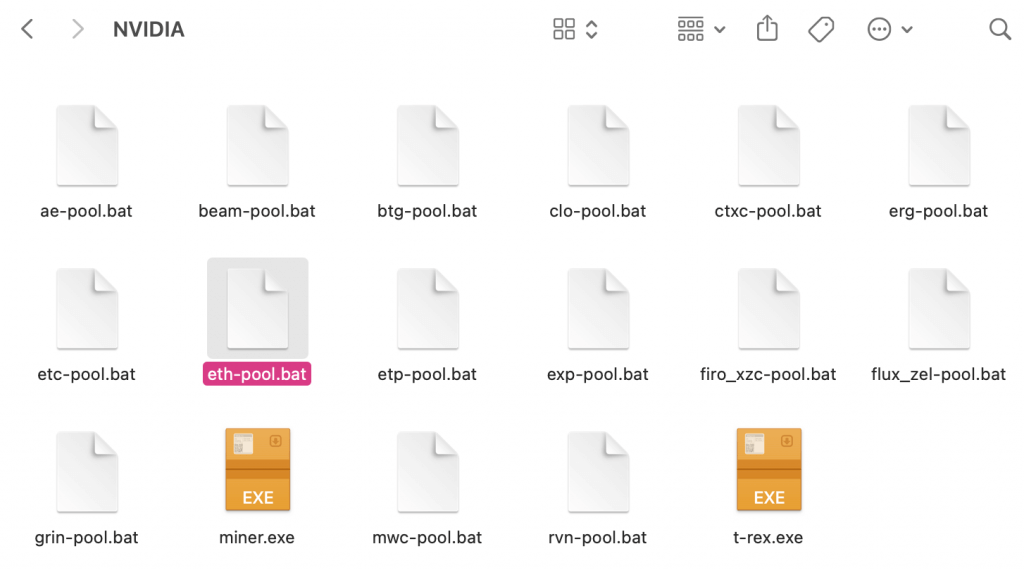

Mining is not as hard as it may seem at first glance. You may have already heard of a “cryptocurrency mining rig”.

Mining Equipment

There are two types of mining equipment:

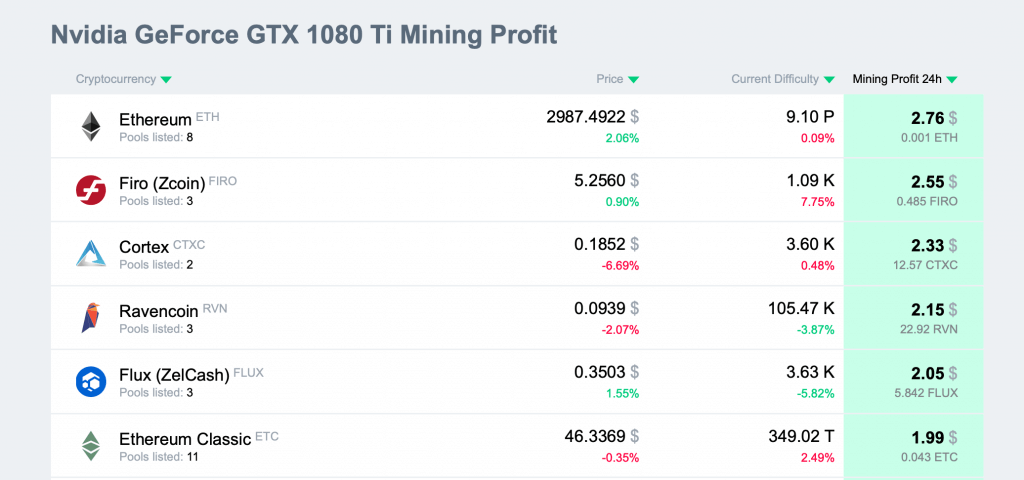

Bitcoin is mined exclusively on ASICs, while Ethereum is mined on GPUs.

Keep in mind that both ASICs and GPUs consume a lot of power and tend to heat a lot.

Is it Hard to Mine Crypto?

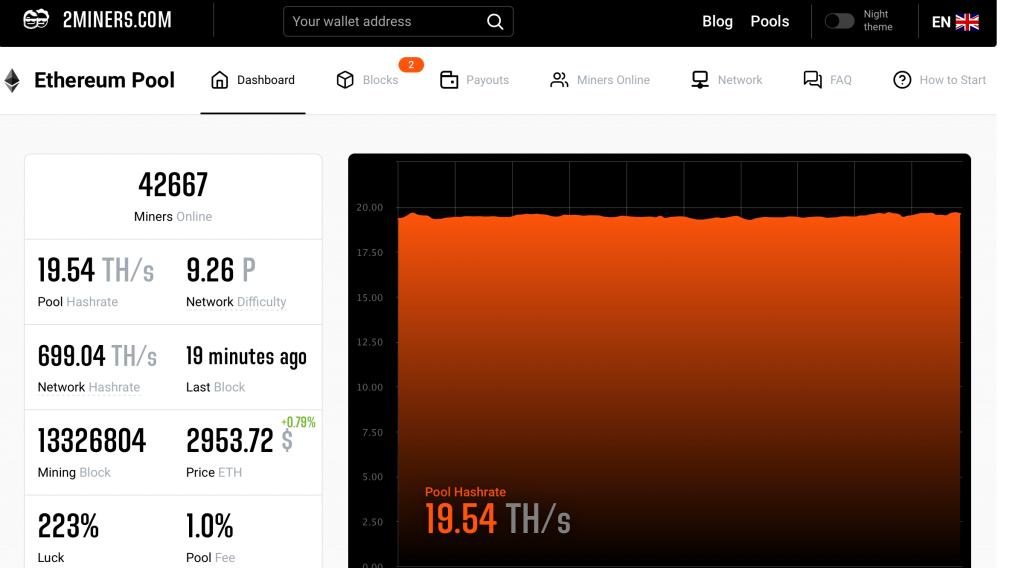

Mining difficulty is extremely high today, so it’s mostly possible through so-called mining pools. Mining pools are servers that connect miners. Miners work together and get a reward. Mining pools distribute the reward fairly and pay out the earned cryptocurrency to each miner.

If you have a desktop gaming computer with a graphics card, you can start mining even today. Go to 2CryptoCalc and check which cryptocurrency is the best for mining on your graphics card. Then follow the instructions of a mining pool. You will need to install a special mining software and a wallet for the cryptocurrency you are going to mine.

If you want to mine Bitcoin, a graphics card won’t do. You can only mine it on specialized ASIC devices. As of now, one of the most advanced devices is the Antminer S19 Pro by Bitmain. It consumes 3.5 kWh and makes as much noise as an airplane. You can’t keep such a device at home.

However, it’s quite easy to set up. You just need to open your ASIC settings to add the mining pool address and your Bitcoin wallet address, connect your device to the Internet, and plug it in.

Putting Theory into Practice

So you think you’ve had enough of theory, and you are ready to start. In this small chapter, we will show you the two most common ways people become part of the cryptocurrency world.

You Decided to Become a Cryptocurrency Investor

You Decided to Become a Cryptocurrency Miner

You have a computer you use to play GTA, so why not make full use of it?

Congrats! You are now a cryptocurrency miner.

We are sure you learned a lot about cryptocurrencies thanks to this article. Feel free to share it with friends.

Remember to follow us on Twitter to get all the news as soon as possible.

The 2Miners pool co-founder, businessman, miner. In 2017 started mining cryptocurrencies and built many rigs on his own. As a result, he gained lots of practical knowledge and became interested in sharing it with others. In his articles on 2Miners, he shares useful tips that he tried and tested himself. For example, Darek gives advice on how to buy hardware components for the basic mining rig and how to connect them to each other correctly. He also explained lots of complicated terms in simple words, such as shares, mining luck, block types, and cryptocurrency wallets. After the pool was launched, he published a series of articles ‘Crypto Mythbusters’ where he explained how to protect the network against 51% attack, talked about cryptocurrency mining difficulty and difficulties of launching your own node.

Bitcoin

Enjoyed the article? Share:

Bitcoin is a decentralized digital currency created by an unknown person or group of people under the name Satoshi Nakamoto and released as open-source software in 2009. It does not rely on a central server to process transactions or store funds.

There are a maximum of 2,099,999,997,690,000 Bitcoin elements (called Satoshis, the unit has been named in collective homage to the original creator), which are currently most commonly measured in units of 100,000,000 known as BTC. There will only ever be 21 million Bitcoin (BTC) to ever be created.

As of January 2018, it is the most widely used alternative currency, now with the total market cap around 250 billion US dollars.

Bitcoin has no central issuer; instead, the peer-to-peer network regulates Bitcoins, transactions and issuance according to consensus in network software. These transactions are verified by network nodes through the use of cryptography and recorded in a public distributed ledger called a blockchain.

Bitcoins are issued to various nodes that verify transactions through computing power. It is established that there will be a limited and scheduled release of no more than 21 million BTC worth of coins, which will be fully issued by the year 2140.

Bitcoins are created as a reward for a process known as mining. They can be exchanged for other currencies, products, and services. As of February 2015, CoinJolt provided over 100,000 merchants and vendors accepted Bitcoin as payment. Research produced by the University of Cambridge estimates that in 2017, there were 2.9 to 5.8 million unique users using a cryptocurrency wallet, most of them using Bitcoin.

Internationally, Bitcoins can be exchanged and managed through various websites and software along with physical banknotes and coins.

Contents

Basic Concepts [ edit ]

Currency [ edit ]

Alice wants to buy alpaca socks which Bob has for sale. In return, she must provide something of equal value to Bob. The most efficient way to do this is by using a medium of exchange that Bob accepts which would be classified as currency. Currency makes trade easier by eliminating the need for coincidence of wants required in other systems of trade such as barter. Currency adoption and acceptance can be global, national, or in some cases local or community-based.

Legal Tender [ edit ]

The government of every country decides what type of money must be used. Once that decision is made, everyone in that country must accept that type of money for the goods and services they sell. In the U.S. for example, legal tender is the US$. In El Salvador both the US$ and Bitcoin are legal tender.

Banks facilitate Legal Tender Transactions in a cumbersome way [ edit ]

Alice doesn’t necessarily need to be in direct contact with bob in order for the funds to be transferred. She may instead transfer this value by first entrusting her currency to a bank who promises to store and protect Alice’s currency notes. The bank gives Alice a written promise (called a «bank statement») that entitles her to withdraw the same number of currency bills that she deposited. Since the money is still Alice’s, she is entitled to do with it whatever she pleases, and the bank (like most banks), for a small fee, will do Alice the service of passing on the currency bills to Bob on her behalf. This is done by Alice’s bank by giving the dollar bills to Bob’s bank and informing them that the money is for Bob, who will then see the amount the next time he checks his balance or receives his bank statement.

Since banks have many customers, and bank employees require money for doing the job of talking to people and signing documents, banks in recent times have been using machines such as ATMs and web servers that do the job of interacting with customers instead of paid bank employees. The task of these machines is to learn what each customer wants to do with their money and, to the extent that it is possible, act on what the customer wants (for example, ATMs can hand out cash). Customers can always know how much money they have in their accounts, and they are confident that the numbers they see in their bank statements and on their computer screens accurately reflect the number of dollars that they can get from the bank on demand. They can be so sure of this that they can accept those numbers in the same way they accept paper banknotes (this is similar to the way people started accepting paper dollars when they had been accepting gold or silver).

Such a system has several disadvantages:

Bitcoin is a bartering alternative [ edit ]

In many countries both parties in a transaction may choose to barter instead of using legal tender. This choice still requires the transaction to be fully reported and taxed. One common example is border towns: People in the very south of Canada frequently trade in American dollars.

Bitcoin is a global bartering alternative: It is a system of owning and voluntarily transferring amounts of so-called bitcoins, in a manner similar to online banking, but pseudonymously and without reliance on a central authority to maintain account balances. If bitcoins are valuable, it is because they are useful and limited in supply.

Bitcoin Basics [ edit ]

Buying Bitcoin [ edit ]

How to buy Bitcoin? There are many ways to buy Bitcoin cryptocurrency, with debit or credit card, PayPal, online on cryptocurrency exchange, with bank transfers and etc. It’s difficult to say what is the best way to buy Bitcoin. After the opening Bitcoin address-account you can start buying coins.

Buying and selling coins to individuals is carried on specialized sites, such as LocalBitcoins. User should select the country and the city in the special window, fill in the information on the number of coins and select the purchase payment method.

Seller should be chosen according to the grade level on the site. Purchasing Bitcoins at the unaccredited sites or from individuals is not recommended due to the high fraud risk.

Creation of coins [ edit ]

The creation of coins must be limited for the currency to have any value.

New coins are slowly mined into existence by following a mutually agreed-upon set of rules. A user mining bitcoins is running a software program that searches tirelessly for a solution to a very difficult math problem whose difficulty is precisely known. The difficulty is automatically adjusted regularly so that the number of solutions found globally, by everyone, for a given unit of time is constant: an average of 6 per hour. When a solution is found, the user may tell everyone of the existence of this newly found solution, along with other information, packaged together in what is called a «block».

Blocks create 12.5 new bitcoins at present. This amount, known as the block reward, is an incentive for people to perform the computation work required for generating blocks. Every 210,000 new blocks generated (roughly every 4 years), the number of bitcoins that can be «mined» in a block reduces by 50%. Originally the block reward was 50 bitcoins; it halved in November 2012 and then once more in July 2016. Any block that is created by a malicious user that does not follow this rule (or any other rules) will be rejected by everyone else. In the end, no more than 21 million bitcoins will ever exist.

Because the block reward will decrease over the long term, miners will some day instead pay for their hardware and electricity costs by collecting transaction fees. The sender of money may voluntarily pay a small transaction fee which will be kept by whoever finds the next block. Paying this fee will encourage miners to include the transaction in a block more quickly.

Bitcoin Mining [ edit ]

Bitcoin Mining is the process of adding transaction records to Bitcoin’s public ledger of past transactions (and a mining rig is a colloquial metaphor for a single computer system that performs the necessary computations for mining). This ledger of past transactions is called the block chain as it is a chain of blocks. The block chain serves to confirm transactions to the rest of the network as having taken place. Bitcoin nodes use the block chain to distinguish legitimate Bitcoin transactions from attempts to re-spend coins that have already been spent elsewhere.

Bitcoin mining’ is intentionally designed to be resource-intensive and difficult so that the number of blocks found each day by miners remains steady. Individual blocks must contain a proof of work to be considered valid. This proof of work is verified by other Bitcoin nodes each time they receive a block. Bitcoin uses the hashcash proof-of-work function.

The primary purpose of mining is to allow Bitcoin nodes to reach a secure, tamper-resistant consensus. Bitcoin Mining is also the mechanism used to introduce Bitcoins into the system: Miners are paid any transaction fees as well as a subsidy of newly created coins. This both serves the purpose of disseminating new coins in a decentralized manner as well as motivating people to provide security for the system.

Bitcoin mining is so called because it resembles the mining of other commodities: it requires exertion and it slowly makes new currency available at a rate that resembles the rate at which commodities like gold are mined from the ground.

Sending payments [ edit ]

There are two ways to send payments:

For retail, it is best to use the Lightning network, because its transactions are instant. The Lighting Network has been operational since 2017, and it is as simple to use as the vendor showing a QR code on their phone to the buyer, and the buyer scanning that code and clicking ok to pay.

Larger transactions happen on the blockchain:

To guarantee that a third-party, let’s call her Eve, cannot spend other people’s bitcoins by creating transactions in their names, Bitcoin uses public key cryptography to make and verify digital signatures. In this system, each person, such as Alice or Bob, has one or more addresses each with an associated pair of public and private keys that they may hold in a wallet. Only the user with the private key can sign a transaction to give some of their bitcoins to somebody else, but anyone can validate the signature using that user’s public key.

Suppose Alice wants to send some bitcoin to Bob.

(Only the first two steps require human action. The rest is done by the Bitcoin client software.)

Looking at this transaction from the outside, anyone who knows that these addresses belong to Alice and Bobcan see that Alice has agreed to transfer the amount to Bob, because nobody else has Alice’s private key. Alice would be foolish to give her private key to other people, as this would allow them to sign transactions in her name, removing funds from her control.

Later on, when Bob wishes to transfer the same bitcoins to Charlie, he will do the same thing:

Only Bob can do this because only he has the private key that can create a valid signature for the transaction.

Eve cannot change whose coins these are by replacing Bob’s address with her address, because Alice signed the transfer to Bob using her own private key, which is kept secret from Eve, and instructing that the coins which were hers now belong to Bob. So if Charlie accepts that the original coin was in the hands of Alice, he will also accept the fact that this coin was later passed to Bob, and now Bob is passing this same coin to him.

Preventing double-spending [ edit ]

The process described above does not prevent Alice from using the same bitcoins in more than one transaction. The following process does; this is the primary innovation behind Bitcoin.

When Bob sees that his transaction has been included in a block, which has been made part of the single longest and fastest-growing blockchain (extended with significant computational effort), he can be confident that the transaction by Alice has been accepted by the computers in the network and is permanently recorded, preventing Alice from creating a second transaction with the same coin. In order for Alice to thwart this system and double-spend her coins, she would need to muster more computing power than all other Bitcoin users combined.

Anonymity [ edit ]

When it comes to the Bitcoin network itself, there are no «accounts» to set up, and no e-mail addresses, user-names or passwords are required to hold or spend bitcoins. Each balance is simply associated with an address and its public-private key pair. The money «belongs» to anyone who has the private key and can sign transactions with it. Moreover, those keys do not have to be registered anywhere in advance, as they are only used when required for a transaction. Transacting parties do not need to know each other’s identity in the same way that a store owner does not know a cash-paying customer’s name.

A Bitcoin address mathematically corresponds to a public key and looks like this:

Each person can have many such addresses, each with its own balance, which makes it very difficult to know which person owns what amount. In order to protect his privacy, Bob can generate a new public-private key pair for each individual receiving transaction and the Bitcoin software encourages this behavior by default. Continuing the example from above, when Charlie receives the bitcoins from Bob, Charlie will not be able to identify who owned the bitcoins before Bob.

Capitalization / Nomenclature [ edit ]

Since Bitcoin is both a currency and a protocol, capitalization can be confusing. Accepted practice is to use Bitcoin (singular with an upper case letter B) to label the protocol, software, and community, and bitcoins (with a lower case b) to label units of the currency.

Bitcoin Halving [ edit ]

Bitcoin price [ edit ]

The price of BTC token or Bitcoin is always changing, however, BitcoinWiki gives you a chance to see the prices online on Coin360 widget.

Mathematically inclined readers could plot the price of Bitcoin across time since its inceptions. Those who would like to see the result as a straight line might use a log scale for the y-axis.

Where to see and explore [ edit ]

You can directly explore the system in action by visiting Biteasy.com, Blockchain.info, Blokr.io Bitcoin Block Explorer or Bitcoin Block Explorer. This last site will show the latest blocks in the blockchain. The blockchain contains the agreed history of all transactions that took place in the system. Note how many blocks were generated in the last hour, which on average will be 6. Also notice the number of transactions; in just one hour there are between 6000 to 7000 transactions. This indicates how active the system currently is.

Next, navigate to one of these blocks. The block’s hash begins with a run of zeros. This is what made creating the block so difficult; a hash that begins with many zeros is much more difficult to find than a hash with few or no zeros. The computer that generated this block had to try many Nonce values (also listed on the block’s page) until it found one that generated this run of zeros. Next, see the line titled Previous block. Each block contains the hash of the block that came before it. This is what forms the chain of blocks. Now take a look at all the transactions the block contains. The first transaction is the income earned by the computer that generated this block. It includes a fixed amount of coins created out of «thin air» and possibly a fee collected from other transactions in the same block.

Drill down into any of the transactions and you will see how it is made up of one or more amounts coming in and out. Having more than one incoming and outgoing amount in a transaction enables the system to join and break amounts in any possible way, allowing for any fractional amount needed. Each incoming amount is a past transaction (which you can also view) from someone’s address, and each outgoing amount is addressed to someone and will be part of a future transaction (which you can also navigate down into if it has already taken place.)

Finally you can follow any of the addresses links and see what public information is available for them.

To get an impression of the amount of activity on the Bitcoin network, you might like to visit the monitoring websites Bitcoin Monitor and Bitcoin Watch. The first shows a real-time visualization of events on the Bitcoin network, and the second lists general statistics on the amount and size of recent transactions.

How many people use Bitcoin? [ edit ]

This is quite a difficult question to answer accurately. One approach is to count how many bitcoin clients connected to the network in the last 24 hours. We can do this because some clients transmit their addresses to the other members of the network periodically. In September 2011 this method suggested that there were about 60,000 users.

How do people use Bitcoin? [ edit ]

For retail: See the Lightning Network.

For savings/investment: People who expect instant returns, gamblers, and people who only invest for Fear Of Missing Out (FOMO), frequently lose much money. Steady investors who buy with money they can afford to lose and hold for several years usually come out ahead.

For Lending: Tread with care. Many bad actors have made this area risky.

How do people store their Bitcoin? [ edit ]

Without banks in the middle, the owner selects the method for storing their Bitcoin, and takes full responsibility for that choice. Common methods include:

Giving the Bitcoin to an intermediary (a Bitcoin Exchange, lightning node owned by someone else, or some lending scheme) to hold it for them.

Using a software wallet on a smart phone, computer, or dedicated hardware device. Security is relegated to the user remembering 24 words to reconstruct it.

Creating own cold addresses, which requires understanding of Private Keys: Either Highly randomized, stored in a text file Or mnemonic, that one is supposed to remember. (Many algorithms out there successfully guess these.) Such users receive the bitcoin into these addresses. When it is time to spend it, they import («sweep») the Private Keys into a hot wallet and spend from there.

White Paper [ edit ]

Bitcoin WhitePaper (WP) is a document that helps your prospective customer make an informed decision in favor of your company or a specific product. If the document does not facilitate a decision, it may be anything but not WP. Speaking in the most understandable language, white paper is something between an article and an advertising brochure. The document contains quite useful information and at the same time leads to the fact that the best solution is to purchase a certain product or service.

You can read English (Original) Bitcoin White Paper here.

What Is Bitcoin (The Definitive Guide)

We’ve all heard of it. Many of you will own some.

But what do you actually know about it? And what do you want to know about it?

Keep reading this definitive guide for everything you need to know about Bitcoin.

Let’s get started!

A good place to start would probably be to ask actually what is Bitcoin?

Bitcoin is the first cryptocurrency that was created. It was invented by pseudonymous creator Satoshi Nakamoto, with the first block created on 3rd January 2009. Although it can be used as an alternative to fiat, it is popular with many investors because of its perceived status as a store of value.

What makes Bitcoin special?

Bitcoin has been through many challenges from hardforks to mining bans, but it still remains the top blue-chip cryptocurrency, it has been around the longest and is the most likely to survive, but have you wondered what makes it special? It is because of its combination of properties:

Decentralized Governance: Anyone can run a Bitcoin node and help to govern the network, it is not owned by any single group or entity, unlike banks or governments.

Peer-to-peer: Transactions are done directly from person to person, without any third party (like a bank) to approve transactions, meaning transactions and accounts cannot be frozen or censored.

Borderless: International transactions can be made with whoever and wherever, for cheaper fees and at faster speeds than the current money system.

Immutable: Transactions are final once it is validated and it is near impossible to change the history of blockchain transactions. All transactions are also public and can be viewed on the public ledger.

Prevents double-spending: Thanks to its consensus mechanism, Bitcoin cannot be spent twice, ensuring that users do not spend Bitcoin that they do not have, which was a breakthrough in digital currency for its time.

Scarcity: There can only be 21 million Bitcoin, and this number has been hardcoded into the source code. The emission rate also halves every four years, making it disinflationary which is unlike Fiat currency.

Proof Of Work

Crypto mining isn’t mining in the traditional sense – obviously – but rather through a process in which miners verify any new transactions, with the data being added to and stored on the blockchain.

This blockchain, which is basically a public ledger, stores these transactions through a secure peer-to-peer network, which is connected through devices called nodes.

All Bitcoin miners, those who create the new Bitcoin, must agree to and verify any new transactions before they are added to the blockchain, through the Proof of Work (PoW) consensus mechanism.

PoW helps to maintain the integrity and safety of Bitcoin by ensuring that double-spending and 51% attacks don’t occur. Essentially, miners compete against each other to verify and confirm new transactions on the blockchain.

This works by rewarding miners who can solve complex mathematical problems called hashes with new Bitcoin. The current block reward, after the 2020 Bitcoin halving, is 6.25 Bitcoins. A halving occurs just under every 4 years, or 210,000 blocks.

The next bitcoin halving will take place estimated in March or April 2024 when the protocol is set to repeat the halving once more, dropping the block reward to 3.125 BTC.

The power needed to mine Bitcoin is huge, and so miners pool their resources together with other miners in mining pools to perform Bitcoin mining. This also means that normal computers just won’t do the job. Therefore, specialist hardware called mining rigs are used to perform the task.

But how is this power measured?

This power is measured through something called hash rate, which indicates how much computer processing power is needed to mine Bitcoin.

A high hash rate is good news for the safety of the network, as it means more power is needed to launch a 51% attack, where a group of individuals can take over more than half the network and reverse transactions.

Luckily, the power needed to launch such an attack on the Bitcoin blockchain is so immense that it has never happened, and is extremely unlikely ever to happen.

Related to the hash rate is mining difficulty, which is a measurement of the difficulty of adding new blocks to the blockchain.

Bitcoin is added every 10 minutes to the network, and mining difficulty acts as a sort of checks and balances system, ensuring that this regularity is kept up.

As the hashrate increases, so does the security on the blockchain. However, this hashrate can’t get out of control, because then so would the number of blocks being produced.

Therefore, if the hash rate increases, then the mining difficulty increases too. On the other hand, if the hash rate decreases, the mining difficulty also decreases. Mining rigs are congregated in places called mining farms, where the Bitcoin mining takes place.

The biggest mining farms in the world are located in Russia, Switzerland, and China.

The rewards for miners are halved roughly every 4 years. In 2012, it was cut from 50 to 25 BTC. In 2016, it was cut from 25 to 12.5 BTC. In 2020, it was cut from 12.5 to 6.25 BTC.

It is estimated at the time of writing (February 2021) that out of the 21 million Bitcoins that will ever exist, there are around 2.3 million Bitcoins left to be mined. The last Bitcoin will be mined in 2141.

But is Bitcoin mining worth it? Several factors determine this.

Bitcoin Mining Equipment Costs

Bitcoin mining has come a long way since its humble origins.

Even by 2010, an average computer using a Central Processing Unit (CPU) wouldn’t do the job. By that point, you needed a Graphic Processing Unit (GPU) to do the job.

Soon after, mining rigs was the only way to do it, and Application-Specific Integrated Circuit (ASICs) were needed to mine Bitcoin. This equipment can be very expensive, running into several or hundreds of thousands of dollars.

Bitcoin Mining Energy Costs

The high energy consumption costs of Bitcoin mining has inevitably led to some negative media coverage.

A Guardian article in January 2019 proclaimed Bitcoin as being the “next big environmental fight” (after Oil) and “Bitcoin’s environmental footprint will haunt it”. Moreover, an article by BBC in February 2021 revealed the process of mining Bitcoin “consumes more energy than Argentina”.

It gives a caveat to Bitcoin miners that as the world moves away from oil and seeks cleaner energy, environmentalists could see Bitcoin mining as the next big enemy.

Bitcoin’s Price

Bitcoin is a highly volatile asset, but why is it so volatile?

This is because it is still an immature asset class with low liquidity, high leverage, and are largely driven by unsophisticated retail who are very susceptible to fear and greed, so the prices are very reflexive.

Not surprisingly, Bitcoin’s price can have a big impact on the cost of Bitcoin mining. If the price of Bitcoin increases, then more power is needed to power these machines.

This also means that smaller mining pools may not be able to cope with any long-term rises in Bitcoin’s price, and only the bigger ones survive.

To overcome these issues, improving efficiency is the key to lowering energy consumption and as a result, costs. To these ends, some improvements have been made such as Taproot which batches multiple signatures and transactions together, and the Lightning Network which is being hailed by some as the answer to Bitcoin’s scalability problems.

The Lightning Network allows many transactions to be completed without actually needing the blockchain to verify them. Therefore, the time and cost of transactions are a fraction of what it normally is. Several crypto exchanges have already implemented it.

This, along with the move towards green mining is being seen by some as the future of Bitcoin.

What’s The History Of Bitcoin?

Ok, Bitcoin doesn’t go that far back!

In fact, not that far back at all. The extraordinary rollercoaster ride of Bitcoin can be traced back to August 2008, amidst the backdrop of the financial crisis that was enveloping the globe.

This was when Bitcoin.org was registered as a domain. After this, on Halloween 2008, the Bitcoin white paper was published.

Entitled Bitcoin: A Peer-to-Peer Electronic Cash System, the white paper, coined by pseudonymous creator Satoshi Nakamoto, laid out a vision of how Bitcoin would revolutionize how we see money. But how so?

So, what happened next?

Then came the creation of Bitcoin itself on 3rd January 2009. On this fateful day, Nakamoto mined the genesis block. Embedded on this block was the following ominous words:

Chancellor on brink of second bailout for banks

But, what does this mean?

This was a headline taken from The Times newspaper on that day, that referred to a bank bailout by the then UK Chancellor of the Exchequer, Alistair Darling, as the UK and the whole world struggled to cope with a massive crash in the financial markets.

So, how does this relate to Bitcoin?

Well, this headline highlighted exactly the reason why Bitcoin was created. The reasons for the global financial crisis were numerous, but it was obvious the financial markets weren’t working for the masses.

Here was something that could function without the need for the intermediaries – the financial institutions and governments – who had failed millions of people: Bitcoin.

Buy things

Bitcoin is a currency, after all, so you can use it to pay for goods and services. It’s becoming increasingly accepted as a form of payment around the world.

Let’s look at some of the things you can buy with it:

Travel

Fancy whizzing around the world thanks to your Bitcoin (when we’re allowed)?

Well, you can! With Bitcoin, you can book hotels and accommodation on Travala, or book flights with Alternative Airlines.

Gold

Bitcoin is labeled by some as «digital gold», but you can actually buy real gold with it too.

JM Bullion allows you to buy gold and other precious metals such as silver and platinum with your Bitcoin. It could be a useful hedging option if you think Bitcoin’s price is going to fall.

Real Estate

Yep, you read that right. You can buy real estate with Bitcoin.

Bithome lists numerous properties that you can buy with Bitcoin around the world, including in France, Italy, Switzerland, and the United States. Check out our what can you buy with Bitcoin guide for a handy overview of other things you can buy too.

An increasing number of payment providers also offer crypto debit cards, meaning you can spend your cryptocurrency anywhere that will accept debit cards, online or offline. You can also withdraw from ATMs with them.

Crypto debit cards are a handy way round of spending your crypto, at a time when finding merchants that accept Bitcoin directly may still be a bit limited (but nevertheless, growing!)

Trade

The frequent price movements can give traders ample opportunities to make a profit. Two main types of Bitcoin trading exist: derivatives trading and spot trading.

Derivatives trading involves traders speculating on the future price of Bitcoin without actually owning it. Instead, you own a contract that reflects the price of Bitcoin.

Spot trading involves traders actually owning, buying, and selling the Bitcoin itself. As the name suggests, trades are settled instantly – on the spot.

On Bybit, you can trade BTCUSD derivative contacts with up to 100x leverage. This is a core component of margin trading.

Margin trading involves traders using borrowed funds (leverage) from an exchange to trade in an asset. It attracts traders as it gives them extra flexibility and the possibility of making big profits from relatively low amounts of capital.

You should also be aware of the risks involved when trading. Margin trading, with leverage, should be approached with caution. In crypto, the market can be very volatile and change very quickly.

When this happens, so can the liquidation of positions. Therefore, you should fully understand the ins and outs of margin trading before you take out positions with leverage.

Be careful, and only trade what you can afford to lose. Intrigued? Check our definitive guide to margin trading to learn more.

HODL

What does that mean you may ask?

Is it an acronym? Well, yes. But that’s not how the original term was coined. Confused? Don’t worry! It’s not complicated.

The term originates from a Bitcoin forum in 2013, where an excited forum member misspelled “I AM HODLING!” when referring to what he was doing with his Bitcoin. It has since gone into crypto folklore, and as a happy coincidence, now also serves as an acronym — hold on (for) dear life.

As Bitcoin becomes more and more seen as a store of value, the number of hodlers has grown exponentially in recent times.

Lend

If you’re HODLING your Bitcoin, you can actually lend your Bitcoin for a profit.

You can basically lend your Bitcoin to people who want to take out crypto-backed loans, and earn compound interest on what you’ve lent. Several platforms such as BlockFi and Crypto.com offer fixed interest rates on lending Bitcoin and other cryptocurrencies.

But why are people HODLing their Bitcoin anyway? Well, for the reasons that we’ll shortly explain as to why you should buy it in the first place. To answer why let’s look at what happened to the price of Bitcoin in the late stages of 2020 and early 2021.

Price History of Bitcoin

Whenever monetary easing happens on a large scale again, we will likely see Bitcoin rallying hard, fulfilling one of the original reasons it was created.

Societal impacts of Bitcoin

As everyone knows, the world has been gripped by the COVID-19 pandemic since early 2020. The consequences of this in every corner of the world have been far-reaching – both socially and economically.

One of the most significant societal changes that the pandemic has accelerated is the digitization of money.

While this process was well underway pre-pandemic, this train has sped up a few notches as a direct result of COVID-19.

As this Bloomberg article from November 2020 puts it:

Covid-19 has been good for Bitcoin and for cryptocurrency generally. First, the pandemic accelerated our advance into a more digital world: What might have taken 10 years has been achieved in 10 months. People who had never before risked an online transaction were forced to try, for the simple reason that banks were closed. Second, and as a result, the pandemic significantly increased our exposure to financial surveillance as well as financial fraud. Both these trends have been good for Bitcoin.

What the pandemic has also done is increase Bitcoin’s attractiveness as an investment – not just with retail investors, but with institutional investors too.

The surge in institutional investors is a key difference to the 2017 bull run. In 2017, Bitcoin’s surge was mostly down to investment from retail investors, who bought it over the fear of missing out (FOMO). It had all the hallmarks of a bubble. However, this time…

This time, some big investors are behind Bitcoin. Some big investors who even were against Bitcoin in the past.

Nick Maggilulli is one such investor.

Writing in CoinDesk, he says he has “come to realize that Bitcoin isn’t the one-trick pony I thought it was” and there is a “collective belief” that it “will have value in the future.”

But what’s behind this belief? There is a growing acceptance of its status as a store of value.

As the pandemic has led governments around the world to launch massive stimulus packages to keep their economies afloat, people have further lost confidence in financial institutions and the power of fiat.

This has also had the effect of driving up inflation and reducing purchasing power. What Bitcoin offers is an alternative – a safe haven from these issues.

Until recently, that assertion would have been widely ridiculed by financial experts, but more and more are now agreeing that actually, this is the case.

JP Morgan is a prime example.

In 2017, CEO Jamie Dimon called Bitcoin a ‘fraud’, and fit for people only in “Venezuela, Ecuador or North Korea”, or if you were a “drug dealer or murderer”.

So it’s fair to say he REALLY didn’t like it!

And they’re not the only ones bullish on Bitcoin’s long-term prospects.

Adam Draper, Co-Founder and Managing Director of Boost VC, makes this interesting point:

My 1 BTC is still worth 1 BTC. It’s that other currency, US Dollars, that keeps falling.

MicroStrategy

Can I use Bitcoin to spend?

All this talk about Bitcoin, but can I actually use Bitcoin in my daily life? At the moment, there are certain places that accept Bitcoin but generally, Bitcoin is not used for spending. How about years from now? What is the future of Bitcoin?

For this to happen, it needs to become mainstream. A 2020 report by Deutsche Bank, Imagine 2030, laid out barriers that Bitcoin and cryptocurrencies need to overcome to become mainstream (by 2030). They are:

1. To become legitimate in the eyes of governments and regulators

The report states that for this to happen, price stability must be achieved, and advantages adequately conveyed to merchants and customers.

While all-encompassing regulation worldwide will be impossible to implement, collaborative regulation in areas such as cryptocurrency trading can help to minimize market manipulation, thus leading to a boost in confidence in the markets and a decrease in volatility.

2. Allow for global reach in the payment market

To do this, Deutsche Bank asserts, major stakeholders in the payment market must embrace crypto. On this front, there was a very significant development with the news that from early 2021, PayPal customers will be able to buy, sell and hold cryptocurrencies on the platform, as well as pay for items with it.

This is a huge development, as it opens up Bitcoin and crypto to a huge number of people. On recent estimates, Paypal’s global customer base was over 350 million at the end of 2020. In another development, Mastercard announced in February 2021 that they will allow merchants to accept crypto later in the year.

So, while these barriers still exist, there are signs that they can be overcome.

Are there any other factors that may affect Bitcoin’s price going forward?

Well, there’s also the simple concept of supply and demand.

Around 900 Bitcoin are currently mined daily, but with institutional investors such as Paypal and Grayscale Bitcoin Trust buying more than 900 Bitcoin every day alone, that’s a very bullish sign for the world’s most popular cryptocurrency.

There’s also the matter of circulation. By 2025, it is estimated that there will be 20 million Bitcoin in supply. As we know, only 21 million will ever be mined – with the last to be mined still some way off (2141).

So it doesn’t take a genius here to see that demand is likely to be outstripping supply for some time to come. Another bullish sign if there ever was one. As with any investment though, if you’re thinking of investing, it’s important to do your own research. As ever, it’s wise to diversify your portfolio to minimize your risk.

Now that you understand why these investors are buying Bitcoin, are you wondering when is a good time to buy?

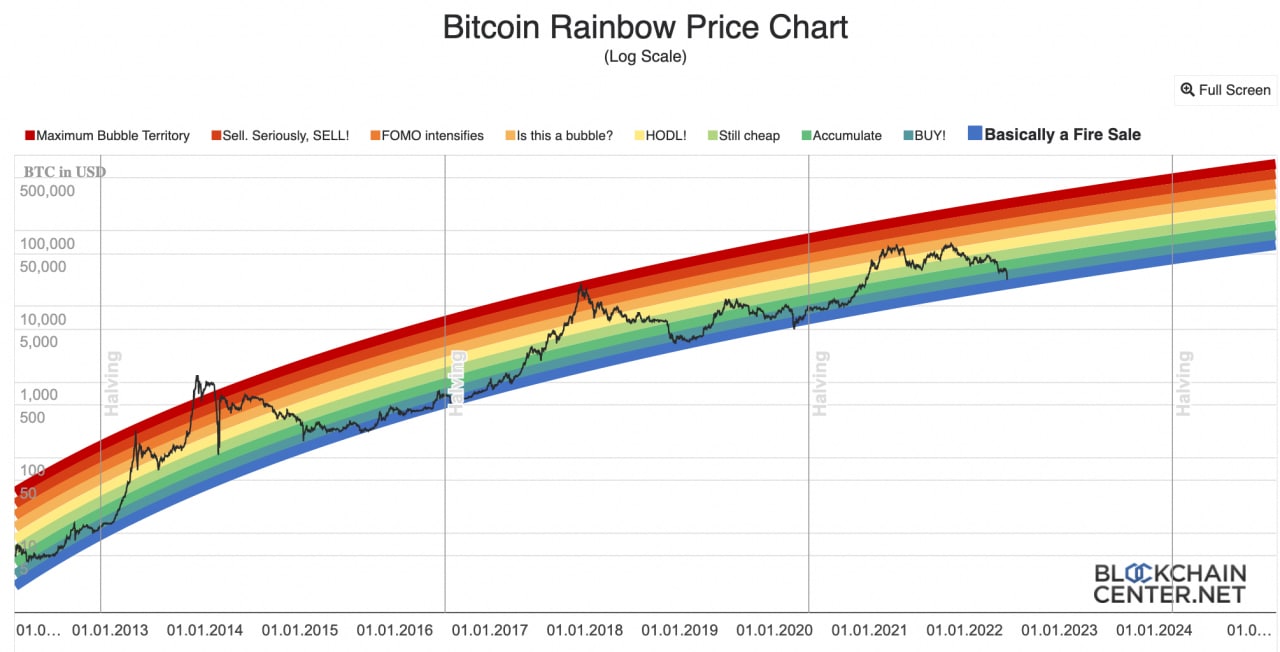

When is a good time to Buy Bitcoin?

We can use history to give us an idea, but none of this is financial advice or recommendation and is only for educational purposes, so please do your own research!

This is the famous Bitcoin rainbow chart that shows Bitcoin’s estimated price projection over a long-term timeframe. Every time we approach the blue zone, it is a buy or fire sale, but it is usually when there is also mass panic in the markets. It is important to take note that past performance is not an indication of future results!

You can view the chart here.

Are you keen on buying Bitcoins now? Let’s find out how!

How Can I Buy Bitcoin?

Well, as a matter of a fact, it’s very easy!

Here on Bybit, you can buy crypto in 3 quick steps.

Check out our how to buy Bitcoin guide for a step-by-step walkthrough (spoiler: it’s not difficult!)

Bitcoin, Ethereum, and USDT are all available to buy and can be in your wallet in a matter of minutes. If you prefer, you can buy offline too, from a Bitcoin ATM, but you’ll still need a wallet for that too.

A wallet, I hear you say? In crypto terms, a wallet is a medium in which you can store your Bitcoin and other cryptocurrencies.

These can be offline (cold wallets), or online (hot wallets).

No Bitcoin is actually stored in a wallet, though. They are all stored on the blockchain. Every wallet is essentially a software program that communicates with the Bitcoin network.

Every wallet has a public key and a private key.

A public key can be given to anyone and is used as an identifier to receive Bitcoin, like an email address.

A private key on the other hand should only be known to you, and is essentially a password that you use to sign off on transactions.

Check out our what is a crypto wallet guide for a run-through of everything you need to know on the topic, including how to set one up, and how to send and receive Bitcoin.

On Bybit, you can be assured of the safety of your funds thanks to our industry-leading HD cold wallet system.

Talking about safety…

What are the risks of investing in Bitcoin?

Like all investments, there are risks when it comes to investing. To be an informed investor is to understand the potential as well as the risk involved. Let’s explore some of the key risks of investing in Bitcoin so that you are familiar with the downside of this investment as well.

Regulations risk: As Bitcoin is still a relatively new asset, there is still uncertainty and constantly changing regulations over Bitcoin with different districts and countries having their own rules over it. An example of this is in the USA, where some cities such as New York are banning Bitcoin mining, and some such as Texas are more receptive to Bitcoin mining. But rules can also change anytime, A recent example is China banning Bitcoin mining and trading suddenly in 2021 which caused the price of Bitcoin to plummet.

Security risk: Many individuals who hold Bitcoin bought it on an exchange and keep it there. There is a famous saying in crypto, ‘not your keys, not your coins’. This means that if the exchange gets hacked or goes down, your Bitcoin is at risk of being lost as well.

Market risk: The price of Bitcoin can vary greatly and is highly volatile. In some extreme scenarios, the price of Bitcoin fell by 61% in a single day in 2013, while the one-day price drop record in 2014 was as big as 80%. When investing in Bitcoin, it is recommended to be mentally prepared for such volatility and have a long-term horizon of 3 years or more.

Is Bitcoin Safe?

Understandably, this is often a question that beginners to Bitcoin will ponder.

Just how safe is Bitcoin, exactly? It’s very safe — as long as you follow procedures. Everyone will have a private key that is used to authorize a transaction. You cannot withdraw Bitcoin from your wallet without using your private key.

The private key can also be in the form of a 24-word seed phrase. It is very important therefore that you keep this in a safe place and give it out to no one. If you are wondering about how to back up your seed phrase or private keys safely, we have a written article for you here.

And we’ve already explored, the blockchain is set up in a way that hacks such as 51% attacks are very hard to pull off.

So now you know about Bitcoin, but how does it compare to some of the other cryptocurrencies out there?

Bitcoin vs. Ethereum

Bitcoin and Ethereum (technically known as Ether. Ethereum is the platform it lies upon) are the two biggest cryptocurrencies by market capitalization today. But in reality, that’s about as far as the similarity goes.

That’s because, essentially, they have different goals as cryptocurrencies.

To clue up on all things Ethereum, read our comprehensive What is Ethereum guide. You can trade ETHUSD contracts right here on Bybit.

Bitcoin vs. Litecoin

Litecoin is another one of the cryptocurrency old boys, having been founded in 2011, but how does it compare to its big brother, Bitcoin?

Well…it’s just not Bitcoin. Despite Litecoin’s ostensible advantages, Bitcoin had a head start. It is accepted as a form of payment in far more places than Bitcoin.

Also, Litecoin has a higher absolute amount of coins, (84 million compared to 21 million). For investors, this is a big factor. The more there is of a coin, the lower the price probably will be.

Read up all about Litecoin in our what is Litecoin guide.

Bitcoin vs. USDT

Next in line, with the third-highest market capitalization, is Tether (USDT).

Bitcoin is a different kind of cryptocurrency to USDT. It is a stablecoin.

A stablecoin is a cryptocurrency that has its price pegged to the value of a stable asset, or group of assets. Most often than not this asset is a fiat currency, such as the US dollar. However, it may also be commodity assets such as gold or silver.

In the case of USDT, the asset it is pegged to is the US dollar. This means its price stays at, or very close to, the price of the US dollar at all times.

So what is its relation to Bitcoin?

Is Bitcoin Legal?

In most countries around the world, Bitcoin is legal to use. In fact, there are many crypto-friendly countries for crypto investors and traders.

However, discrepancies exist between countries of the legal status of Bitcoin. Some countries recognize it as a currency, some as a tradable financial asset with capital gains tax.

Few countries like El Salvador and Central African Republic have even declared bitcoin to be legal tender, but a limited number of countries ban Bitcoin completely for fear of it being a threat to their monetary system or for concerns about it being used for illicit activities.

How to Short BTC

Shorting BTC is the process of betting that its price will fall shortly, based on several factors. In such a case, one should first borrow some currency from an exchange or a broker and sell BTC at the current market price. Later, when the Bitcoin price falls, they should purchase it and return the loan to the lender. Following are the multiple ways one can short BTC.

Margin Trading

Margin trading platforms like Kraken and Binance allow users with margin trades to borrow currency from brokers to make a trade. This creates leverage for the buyer and enables him/her to get an increase on returns.

Bitcoin Futures

Like all other assets, Bitcoin has a futures market. Futures trading in Bitcoin has been popular since 2017. As of late, this capability is available on several exchanges. The most common is the Chicago Mercantile Exchange, also the world’s largest derivatives trading platform.

Binary Options Trading

Traders can short Bitcoin using call and put options. Binary options are available on offshore exchanges. However, their costs and risks are higher as compared to margin trading.

Bitcoin CFDs

Bitcoin contracts for difference (CFDs) are similar to Bitcoin futures. However, Bitcoin CFDs offer greater flexibility in settlement tenure than regular futures contracts.

In addition to these methods, traders can also use prediction markets or short-selling Bitcoin assets to short BTC.

The Bottom Line

Bitcoin has jumped over leaps and bounds in the last year – not just in the price – but the great thing is, the party is only just getting started.

Over the next decade, the digital revolution of money looks to be only going one way, and Bitcoin looks set to be at the center of it.

No one has a crystal ball, and it’s difficult to say how high its price can ultimately go, but signs are looking bullish for its prospects.

Of course, unexpected world events can occur at any time, some of which may affect the price of Bitcoin.

Indeed, the pandemic has ultimately helped Bitcoin’s cause. Not only has it accelerated the digital revolution of money, but more and more investors are also seeing Bitcoin as a safe haven asset.

One thing’s for sure: the future of Bitcoin looks bright.

With the new found knowledge in crypto, why not sign up to Bybit?

:max_bytes(150000):strip_icc()/img_9801__jake_frankenfield-5bfc261946e0fb002600684b.jpg)

:max_bytes(150000):strip_icc()/mansaPicture_08T-Copy-JuliusMansa-127908fd255745b5886a16fced0cdb7b.jpg)

:max_bytes(150000):strip_icc()/AmandaJackson-05f6b53318ed407aab6eea61a3d7fdf6.jpg)

:max_bytes(150000):strip_icc()/bitcoin-b2123c44e082417badbd62ab6ec24858.png)