What are prepaid expenses

What are prepaid expenses

Prepaid Expense

What Is a Prepaid Expense?

A prepaid expense is a type of asset on the balance sheet that results from a business making advanced payments for goods or services to be received in the future. Prepaid expenses are initially recorded as assets, but their value is expensed over time onto the income statement. Unlike conventional expenses, the business will receive something of value from the prepaid expense over the course of several accounting periods.

Prepaid Expense

Understanding Prepaid Expenses

Companies make prepayments for goods or services such as leased office equipment or insurance coverage that provide continual benefits over time. Goods or services of this nature cannot be expensed immediately because the expense would not line up with the benefit incurred over time from using the asset.

According to generally accepted accounting principles (GAAP), expenses should be recorded in the same accounting period as the benefit generated from the related asset. For example, if a large copying machine is leased by a company for a period of 12 months, the company benefits from its use over the full time period. Recording an advanced payment made for the lease as an expense in the first month would not adequately match expenses with revenues generated from its use. Therefore, it should be recorded as a prepaid expense and allocated out to expense over the full twelve months.

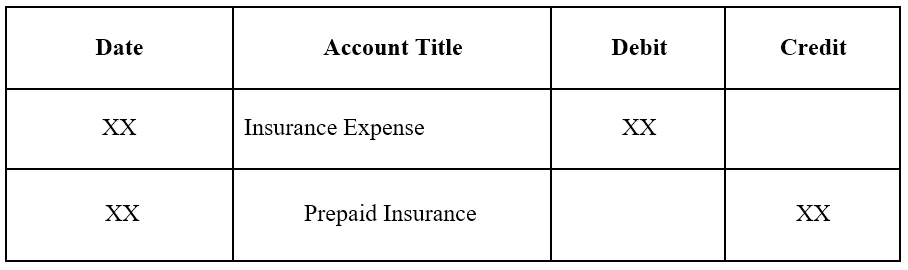

Journal entries that recognize expenses related to previously recorded prepaids are called adjusting entries. They do not record new business transactions but simply adjust previously recorded transactions. Adjusting entries for prepaid expenses are necessary to ensure that expenses are recognized in the period in which they are incurred.

Due to the nature of certain goods and services, prepaid expenses will always exist. For example, insurance is a prepaid expense because the purpose of purchasing insurance is to buy proactive protection in case something unfortunate happens in the future. Clearly, no insurance company would sell insurance that covers an unfortunate event after the fact, so insurance expenses must be prepaid by businesses.

Example of Prepaid Expense

Prepaid Expenses

What are Prepaid Expenses in Accounting?

Prepaid expenses refer to advance payments made by a firm whose benefits are acquired in the future. Payment for the goods is made in the current accounting period, but the delivery is received in the upcoming accounting period.

Table of contents

Key Takeaways

You are free to use this image on your website, templates, etc, Please provide us with an attribution link How to Provide Attribution? Article Link to be Hyperlinked

For eg:

Source: Prepaid Expenses (wallstreetmojo.com)

Understanding Prepaid Expenses in Accounting

Prepaid expenses are computed in scenarios where the payment has been made in advance, but the goods are not used in the same accounting period—yet to be recorded in the company’s books of accounts. In simple terms, these are expenses to be incurred in the future, but the amount has been paid in advance.

Many business owners prepay some of their future expenses to avail themselves of advantages like tax deductions. However, businesses are not allowed to adjust the amount in the same financial year. For example, let us assume that a company pays lumpsum vehicle maintenance expenses for five years. In such a scenario, the annual tax deduction would be applicable only up to a portion of the five-year benefit and not the entire amount.

How to Record Prepaid Expenses?

Prepayment expenses have an important place in a company’s books of accounts. They are not treated like other business expenses.

Prepaid Expense Journal Entries

1. At the time of payment:

| Date | Particulars | Dr | Cr |

| Prepaid Expense A/c… Dr | |||

| To Cash A/c |

2. At the time of recognizing its benefit or receiving the goods or service:

| Date | Particulars | Dr | Cr |

| Expense A/c… Dr | |||

| To Prepaid Expense A/c |

Prepaid expenses recorded in one company’s accounting books are unearned revenues for another company’s accounting statements.

Prepaid Expenses in Balance Sheet

Also, if a partial benefit is received, only the remaining balance of the prepaid expense appears on the balance sheet. This is because the benefit of the remaining balance is not yet realized. If it were likely not to be consumed within the next 12 months, it would be classified on the balance sheet as a long-term asset.

Prepaid Expenses in Income Statement

If the benefit is derived from a portion of the prepaid expense, then the income statement only reflects the amount for which benefits are received. Therefore, this amount is shown as an expense. Also, the balance sheet shows the remaining balance as a current asset.

Prepaid Expenses Examples

Following is a list of prepaid payments in accounting:

Let us now look at practical examples to understand the application of this expense:

Example #1

Solution:

Following are the Journal Entries in the books of XYZ Ltd.:

| Date | Particulars | Dr ($) | Cr ($) |

| 29/07/21 | Prepaid Insurance A/c… Dr | 12000 | |

| To Cash A/c | 12000 |

| Date | Particulars | Dr ($) | Cr ($) |

| 01/01/22 | Insurance A/c… Dr | 12000 | |

| To Prepaid Insurance A/c | 12000 |

Example #2

Solution:

Following are the journal entries in the books of C Corp:

| Date | Particulars | Dr ($) | Cr ($) |

| 31/12/21 | Prepaid Rent A/c… Dr | 120000 | |

| To Cash A/c | 120000 |

| Date | Particulars | Dr ($) | Cr ($) |

|---|---|---|---|

| 01/01/22 | Rent A/c… Dr | 10000 | |

| To Prepaid Rent A/c | 10000 | ||

| 01/01/22 | Rent A/c… Dr | 10000 | |

| To Prepaid Rent A/c | 10000 | ||

| 01/01/22 | Rent A/c… Dr | 10000 | |

| To Prepaid Rent A/c | 10000 |

Frequently Asked Questions (FAQs)

It is an assurance that the company will receive a future benefit, goods, or service in lieu of the prepayment made to the vendor. Therefore, such expenditure is recorded as a current asset in the firm’s balance sheet—till the benefits are received.

Such expenses are shown on income statements, only when the benefits are realized in the specific accounting period.

Examples of prepayments include prepaid insurance, rent, salary, tax, electricity bill, and telephone bill.

Prepaid Expenses Video

Recommended Articles

This article has been a guide to what is Prepaid Expense & its meaning in accounting. We study prepaid expenses as current assets in journal entries, balance sheets & their amortization along with examples. You may have a look at the articles below to learn more about accounting –

Prepaid Expenses

Future expenses that are paid in advance

What are Prepaid Expenses?

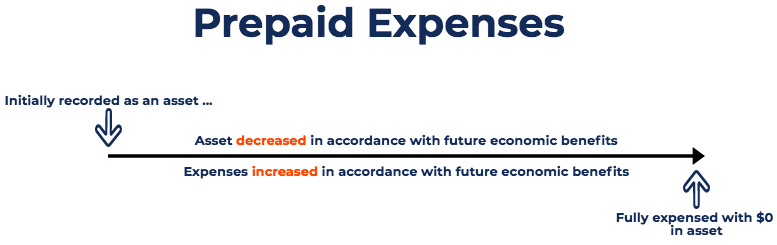

Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but have been paid for in advance. In other words, prepaid expenses are expenditures paid in one accounting period, but will not be recognized until a later accounting period. Prepaid expenses are initially recorded as assets, because they have future economic benefits, and are expensed at the time when the benefits are realized (the matching principle).

Summary

Common Reasons for Prepaid Expenses

The two most common uses of prepaid expenses are rent and insurance.

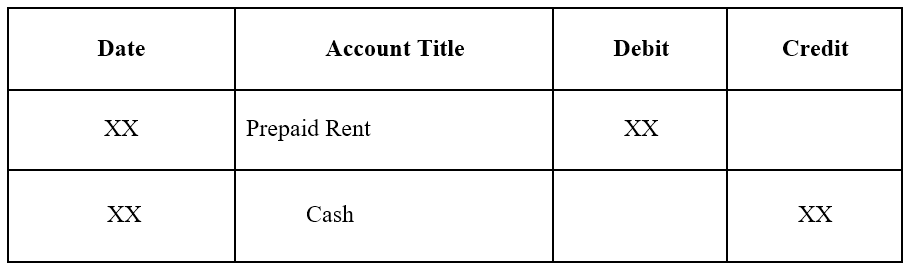

1. Prepaid rent is rent paid in advance of the rental period. The journal entries for prepaid rent are as follows:

Initial journal entry for prepaid rent:

Adjusting journal entry as the prepaid rent expires:

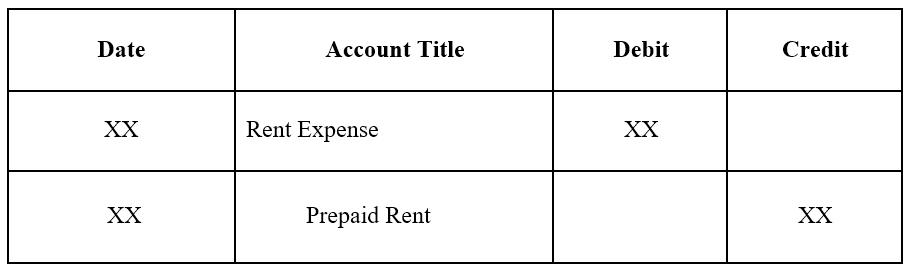

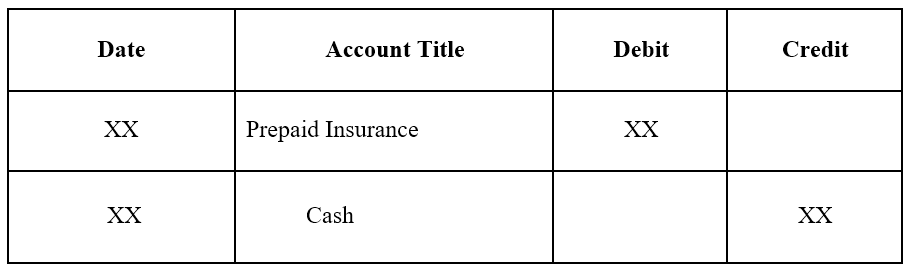

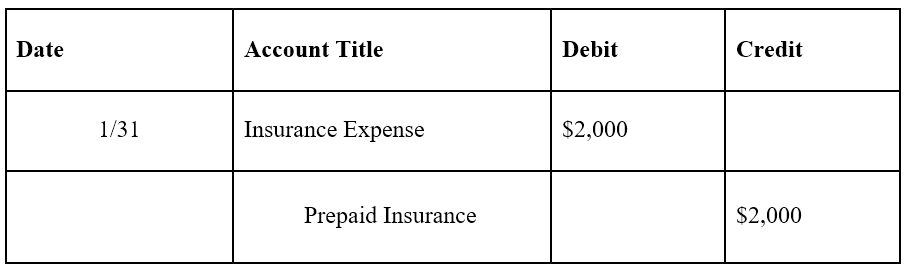

Initial journal entry for prepaid insurance:

Adjusting journal entry as the prepaid insurance expires:

Prepaid Expenses Example

We will look at two examples of prepaid expenses:

Example #1

The initial journal entry for Company A would be as follows:

At the end of one month, Company A would’ve used up one month of its lease agreement. Therefore, prepaid rent must be adjusted:

The adjusting journal entry is done each month, and at the end of the year, when the lease agreement has no future economic benefits, the prepaid rent balance would be 0.

Example #2

The initial journal entry for Company A would be as follows:

At the end of one month, Company A would have used up one month of its insurance policy. Therefore, prepaid insurance must be adjusted:

The adjusting journal entry is done each month, and at the end of the year, when the insurance policy has no future economic benefits, the prepaid insurance balance would be 0.

Effect of Prepaid Expenses on Financial Statements

The initial journal entry for a prepaid expense does not affect a company’s financial statements. For example, refer to the first example of prepaid rent. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash.

These are both asset accounts and do not increase or decrease a company’s balance sheet. Recall that prepaid expenses are considered an asset because they provide future economic benefits to the company.

More Resources

Thank you for reading CFI’s guide to Prepaid Expenses. To keep learning and advancing your career, the following CFI resources will be helpful:

What are Prepaid Expenses?

Featured in:

Some stories don’t end up the way they were meant to be. If you want things to be as they are, you need to know how to plan ahead. Whether it’s your life or your business, you need to take into account future payments, for instance.

Unless you prepare well, you could get into a financial rut, one you would most likely want to avoid.

And that’s what prepaid expenses are all about. It helps you stay ahead, and prepare from before.

Let’s say you recently bought a car and paid insurance for it.

The insurance isn’t going to help you right now. You will benefit if you meet with an accident or any unforeseen incident in the future. Or, you may claim the insurance if you want to replace an expensive part of your car.

Insurance, however, is just one of the types of prepaid expenses. Even though they are a liability, in the beginning, they become beneficial over a long period of time. Businesses will want to have enough prepaid expenses to cover future payments, and have the money ready when you need it.

You will need to report it on the balance sheet, and only when the asset expires will you need to write it on the expense sheet.

Confused as to how that happens?

Read on, as we talk about all the prepaid expenses that your company needs to deal with, and the income statement that you need to make.

After all, just understanding the management expense ratios isn’t going to help you when it comes to having a successful business.

HOW DO PREPAID EXPENSES HELP YOU IN YOUR BUSINESS?

Do you own company vehicles? We are sure you have vehicle insurances for them. The prepaid expense will refer to the yearly insurance payment in advance that you have made for all the vehicles.

So, your income statement for the year will actually have one twelfth of the amount you have prepaid at a time, and will be debited to the insurance expense head.

These expenses are valid only for a limited amount of it. In the business world, a prepaid expense is considered as an asset. Only when the asset goes unused during its validity period, it is considered as an expense.

Here is a look at another example of a prepaid expense.

In business terms, a prepaid expense is money you pay in the present for services or products that will be used in the future. You can pay for a prepaid expense in the current financial year and use it in the next financial year until and unless it is valid.

Prepaid expenses are subject to time and affect a company’s balance sheet and income statement. They are balanced at the end of the company’s billing period, which can be monthly, quarterly, half-yearly, and yearly.

DIFFERENT TYPES OF PREPAID EXPENSES

When you talk about prepaid expenses, you talk about accounting, which makes it a purely business term. Companies use it as a part of their balance sheet to identify its profits and losses.

Insurance is just one of the prepaid expenses that you pay. Let’s take a look at the remaining types of prepaid expenses.

1. Legal fees

Lawyers and companies enter a retainer agreement, which binds them together in a business contract. The companies have to pay retainer fees to the lawyer as a sign of appreciation, which is calculated in terms of the professional services the lawyer will offer in the future.

When the business renders a service, the amount is deducted from the prepaid credit tab and added to the legal expenses account.

2. Rent

Many commercial rent agreements ask businesses to pay the first and last month’s rent along with the deposit to make the contract valid. Just like legal fees, when the first month is over, the prepaid rent amount is transferred from the credit tab to the rent expenses account.

The same transaction takes place during the last month of the lease period. Rent payment of the months in between is typically paid after the month ends.

3. Tax

Corporate firms pay quarterly estimated tax to reduce the tax liability at the end of the financial year. Even though companies have to pay the amount, it is considered as a prepaid tax until they make the final tax payment.

Businesses do this to reduce the work at the end of the year so that they can concentrate on the core business activities. The accounts are cleared quarter-wise and the process is a lot faster.

4. Utility bills

Utility bills include water, gas, and electricity bills but are usually charged at the end of the month, depending on how much you used each of the resources.

However, corporate firms go for prepaid utility bills, wherein they pay for a fixed usage at the beginning of the month or decided period. It like paying for an internet plan, which you have access to only after paying the fees.

5. Supplies

Companies have to pay in advance when they order supplies in bulk quantity. It is recorded as a prepaid expense until the company receives the stock.

6. Insurance

Cash management seems to be the keyword here.

WHY DO YOU CONSIDER PREPAID EXPENSES AS ASSETS?

Every aspect of business is important, whether it is understanding financial ratios or the money you’ve to incur every year.

Like we explained before, a prepaid expense is something you have already paid for either partially or completely and haven’t used yet. It is valid for a limited period of time, during which you can take its benefit. Any expense that hasn’t expired and can be used in the future is termed as an asset on the balance sheet.

For example, you want to claim insurance on the electronics used in your office that were damaged because of a rainstorm. The insurance company will pay for the new electronics. You won’t have to take out any money from your pocket. You can consider prepaid expenses as emergency funds that offer relief during times of distress. When the time limit expired, it is moved to the expense section.

Let’s talk about something more simple. You have to fly from Miami to Chicago, where your family stays, during Easter weekend and you book an airplane ticket for it. You make the payment and receive an email about it. The booking that you made in advance is an asset. When you go to the airport and show the ticket, you will be directed towards your flight. Your flight booking is a prepaid expense that you made to visit Chicago.

If you would have directly gone to the airport on Easter morning and booked a flight, which leaves in two hours, you didn’t make a prepaid expense. You booked at the time of check-in and flew to Chicago.

Many people get confused between a liability and an asset. They put a prepaid expense as a liability, but that is a wrong consideration. A liability is an unpaid or outstanding expense, which you pay after you receive the service. One good example of liability is the utility bill that you have to pay after calculating meter readings.

RECORDING PREPAID EXPENSES IN YOUR BALANCE SHEET

You can divide the process of recording prepaid expenses into two parts — journal entry of the prepaid expense and adjustment.

Journal entry of the prepaid expense

Step 1. You, the company, receive an invoice from the supplier and verify it with the concerned team members. They go through the terms of the agreement and judge it against their assets and company requirements.

Step 2. Both parties sign the agreement, and you make the payment and receive a receipt of an acknowledgement from the supplier.

Step 3. Add it under insurance in the prepaid expense tab, which falls under the assets category. Make sure you match the revenues with prepaid expenses because it becomes convenient to tie back the two in the future.

Adjustment of the prepaid expense

At the end of every accounting period, which can be monthly, quarterly, or annually, settle the prepaid expenses with the expense account. When it comes to insurance, you usually divide it into 12 months and deduct from the prepaid expense and add to the expense account as the time goes by.

In this part, you only adjust the expense, so there are no additional costs. Verify all accounts to make sure that is settled and match the expenses and revenue generated.

TIPS TO MANAGE PREPAID EXPENSES

Handling prepaid expenses can be challenging because they are easy to forget and take a lot of efforts to track over the period of time. Here are some tips that will help you while managing prepaid expenses:

Don’t record small prepaid expenses

It is best to not mention small prepaid expenses like stationery you order monthly because they are difficult to track. You will have to do a lot of back and forth, which is a huge waste of time.

Mention them in the balance sheet when you receive the order under the expense account. If you still want to record the small prepaid expenses, you can create a separate chart when you mention all the payment but don’t add them in the balance sheet until you receive the products or services.

Make multiple categories

Prepaid expenses are put under the asset category. To make sure you maintain a proper record, divide the prepaid expenses into sections and subsections according to their nature.

If your company has three insurances, for example — electronic insurance, business insurance, high-level management insurance, list them all separately, so you don’t have to worry about what money went where.

Other sections you can make under prepaid expenses include prepaid tax, utilities, supplies, and anything major you pay for in advance.

Set alarms for transactions

It is easy to forget the date to make transactions from prepaid expense to expense account. The best way to remember it is by setting the alarm or reminder for it at the very beginning. It takes away the stress and gives you more time to concentrate on ways to improve your company and bring in more business.

Set up a recurring journal entry

A journal is a document that you use to record all transactions. When you make the transaction from prepaid expense to expense account, mention it as a recurring entry in a journal. It will help you to cross check and settle the accounts at the end of the year.

WAYS TO RECORD PREPAID EXPENSES

The type of recording a company goes for, completely depends on the nature of the business and legal advice it received. It directly affects the company’s financial records.

Accrual accounting

This method aims at reducing the back and forth you have to do if you practice the cash accounting method.

Cash accounting

The cash accounting method is the traditional method in which you record the payment under prepaid expenses as soon as transfer the money. Its action doesn’t concern if you received the service or products as promised by the seller.

Traditional companies choose to follow the cash accounting method because it helps them remember the expenses incurred. However, startups are often going for the accrual account method. The primary reason remains that it requires less work. In such circumstances, the company keeps a journal for all the prepaid expenses.

BENEFITS OF A PREPAID EXPENSE

Practicing the art of prepaid expense offers only two but crucial benefits. Let’s take a look at the benefits:

Tax deduction

A tax deduction is the biggest advantage of the prepaid expense practice. When you mention it as an asset on your balance sheet, you pay the tax for it in advance. You also receive certain tax benefits when you invest in an insurance policy.

Savings

Many corporate firms prefer to pay the pay an entire year’s rent in advance as it lets them avoid future expenses. The company pays the amount at the current rate and is not subject to future increase in the price. You end up saving a lot of money, which is helpful during times of inflation.

SHORT-TERM AND LONG-TERM PREPAID EXPENSES ASSETS

A company typically divided prepaid expenses under two categories depending on its duration. All prepaid expenses that have a validity of 12 months or less are considered as short-term expenses. On the other hand, long-term prepaid expenses are all expenses that were made for longer than 12 months.

Companies only mention 12-month expenses of long-term prepaid expense assets in the net working capital calculation. The remaining amount and months are carried over to the next year.

DIFFERENCE BETWEEN PREPAID EXPENSE AND DEFERRED EXPENSE

The deferred expense is a prepaid expense that you use over a year after you make the payment. It is usually mentioned as a long-term asset on the yearly balance sheet.

On the other hand, a prepaid expense is something that you use up within a year. If a company doesn’t use the categories short-term and long-term prepaid expenses assets on the balance sheet, they replace it with the prepaid expense and deferred expense.

Common deferred expense examples include legal fees and rent paid for over a year. Let’s take an in-depth look into the world of deferred expense.

Some companies prefer to manage their balance sheet on a half-yearly basis. In such circumstances, the insurance premium that you pay for a year is put under deferred expense. Half of the amount is transferred under the insurance expense chart in the half-yearly balance sheet.

Other terms for deferred expenses include non-current expenses and long-lived expenses. Companies use these terms simultaneously to define deferred expenses, but they all mean the same thing. This also means that over time deferred expenses become prepaid expenses as its timeline shrinks.

Deferred expenses are different from deferred revenue as the latter term means payment the business receives for its products or services before the customer receives them. For example, you order a dress online for your daughter and pay using your credit or debit card. The fashion brand sends you the dress only after it receives the payment.

DIFFERENCE BETWEEN ACCRUED EXPENSES AND PREPAID EXPENSES

Accrued expenses and prepaid expenses are exactly the opposite to each other. While a prepaid expense is something that you pay in advance, an accrued expense is something that you pay for after receiving the products or services. Examples of accrued expenses include salaries, postpaid utility bills, and credit card payments.

Accrued expenses are usually a part of the business to business transactions. Accrued means on interest or on loan. Also known as a credit transaction, these type of expenses are done when one business uses products or services of another but doesn’t pay the money immediately. The company doesn’t receive an invoice for it. Accrued expenses are put under current liabilities tab in the balance sheet along with the company’s other short-term liabilities.

Other examples of accrued expenses include office supplies bills, interest on a loan, and income tax. Immaterial expenses like audits and inspections don’t come under the accrued expenses category because they are difficult to track and need back and forth journal entries. Accrued expenses are often confused with accrued revenue, which stands for the money earned in one accounting period but paid for in the next period. In other words, the seller recognized the sell but doesn’t raise an invoice until the next period. Accrued revenues are very rare in the manufacturing world as payment is made once the quote is finalized.

CONCLUSION

In this article, you learned everything about the prepaid expense, which includes what is a prepaid expense, different types, ways to add the expense to the balance sheet, and how to adjust it.

A prepaid expense is an old practice and is known for its two big benefits, which are tax deductions and savings. You also learned the difference between prepaid expense and deferred expense along with the difference between prepaid expense and accrued expense.

What Are Prepaid Expenses?

Why are prepaid expenses considered assets? Prepaid expenses are recorded as an asset on a business’s balance sheet because they signify a future benefit that is due to the company.

by Alicia Tuovila

updated June 03, 2022 · 3 min read

Prepaid expenses are amounts paid in advance by a business in exchange for goods or services to be delivered in the future. They usually relate to the purchase of something that provides value to the business over the course of multiple accounting periods. The business records a prepaid expense as an asset on the balance sheet because it signifies a future benefit due to the business. As the good or service is delivered, the asset’s value is decreased, and the amount is expensed to the income statement.

Examples of Prepaid Expenses

Prepaid expenses usually provide value to a company over an extended period of time, such as insurance or prepaid rent. Many types of business insurance are paid as a lump sum in advance of a specific coverage period. Similarly, when a business signs a rental agreement with a landlord, it may include a stipulation to prepay a certain number of months’ rent upfront.

Insurance

Prepaid Rent

Why are Prepaid Expenses an Asset?

Under the accrual method of accounting, income is recognized when it is earned and expenses are recognized when incurred, regardless of when cash exchanges hands for the transaction. Prepaid expenses are an asset because the business has not realized the value of the good or service when cash initially exchanges hands.

Instead, the value of the good or service must be recognized over time as the business realizes the benefit. In the insurance example, the service provided to the business is liability policy coverage. Each month, the value of this benefit is recognized when the business decreases its prepaid expense account. In the rent example, the good provided is the physical building. As the business enjoys the use of its rental location, it recognizes the benefit by decreasing the prepaid expense account.

:max_bytes(150000):strip_icc()/IMG_20171216_182148727_LL-4f9a9d7d74714f95b116a7182aa20ecf.jpg)

:max_bytes(150000):strip_icc()/JamesHeadshot-PeggyJames-9f712f1197374a9b824289fe0d5ec842.jpg)

:max_bytes(150000):strip_icc()/michael-logan-dfd2643b24ea4fba87ff5ed5c28bd969.jpg)