What does china export to the us

What does china export to the us

Quick Answer: What Is China Biggest Export To The Us?

China’s Top 10 Exports

What is the main export of China?

China is the largest cotton spinner in the world and the textile industry is also the biggest globally in terms of overall production and exports.

How much does China export to the US?

What is the largest US export to China?

What is America’s biggest exports?

What are China’s major imports?

As of 2012, China’s main imports were: crude oil ($220.7 billion), iron ore ($95.6 billion), plastics in primary forms ($46.2 billion), copper and copper alloys ($38.6 billion), and soybeans ($35 billion). China’s major trading partners were the European Union, ASEAN, Japan, South Korea, and the United States.

What are the top 3 Imports of China?

China’s Top 10 Imports

What food does China export to the US?

The top U.S. import commodities from China are fruits and vegetables (fresh/processed), snack food, spices, and tea – the combined which accounts for nearly one-half of the total U.S. agricultural imports from China.

How much of China’s GDP is from the US?

12.24 trillion USD (2017)

Who is China’s biggest trade partner?

China’s Top Trading Partners

Who imports the most from China?

List of largest trading partners of China

| No. | Country | Imports |

|---|---|---|

| Total | 1,679.6 | |

| 1 | United States | 147.8 |

| 2 | Japan | 142.9 |

| 3 | Korea Republic | 174.5 |

How much do we owe China?

What food do we import from China?

Here are 10 commonly used foods that are made in China – but they don’t have to be.

What is California’s biggest export?

California is a top exporter in the nation of computers, electronic products, transportation equipment, machinery except electrical, and miscellaneous manufactured commodities. Computers and electronic products are California’s top export, accounting for 25.3 percent of all the state’s exports.

What are imports and exports?

An import is a good brought into a jurisdiction, especially across a national border, from an external source. The party bringing in the good is called an importer. An import in the receiving country is an export from the sending country. The importing and exporting jurisdictions may impose a tariff (tax) on the goods.

2021 State Export Report

On this page, you can find the full text of our 2021 State Export Report, an interactive map to find data from your home state, and a link to the full report PDF!

Executive Summary

In 2020, the global economy underwent significant shifts, and the US-China commercial relationship was no exception. Early in the year, the United States and China signed and implemented the Phase One trade agreement and halted tariff escalations for the first time in two years. Last year saw a healthy recovery of goods exports to China, though services exports—the data for which lag a year behind—have fallen for the first time since 2003. Combined exports of goods and services to China still supported nearly 1 million US jobs in 2019, the most recent year for which data are available.

Methodology

This year’s edition of the US-China Business Council State Export Report draws on data obtained from The Trade Partnership, an economic research firm. The report provides a breakdown of each US state’s goods and services exports to China, and the national export totals include the export data for each state. Goods export figures are primarily based on data from the US Census Bureau, the US Department of Agriculture, and Moody’s Analytics. Goods export figures are classified according to the US government’s North American Industry Classification System. Services export figures are primarily based on data from the US Bureau of Economic Analysis (BEA) and Moody’s Analytics. Services export figures are classified according to BEA categories. This year’s edition of the State Export Report uses the same sector categories for goods and services as last year’s. Goods exports cover 2011–2020; services exports cover 2010–2019, the most recent year for which detailed data are available from BEA. Because historical data from each of these sources are revised annually, this edition of the State Export Report replaces all prior editions. As in previous editions, this report uses a methodology that credits agricultural exports to states in which crops are grown as opposed to states with large ports where bulk commodities are aggregated prior to export. Average annual growth is calculated with an average annual growth rate formula. A detailed explanation of the methodology for jobs, goods, and services exports estimates is available on The Trade Partnership’s website.

Sponsors

Goods

US goods exports to China posted a strong recovery last year

Growth in US goods exports to China last year significantly outpaced growth in exports to the rest of the world

Exports to China increased by 18 percent in 2020, while exports to the rest of the world fell by 15 percent. The disparity in exports is the result of China’s early recovery from the pandemic-induced economic slowdown.

Top US Goods Export Markets, 2020

China’s Top 5 Goods Import Sources, 2020

Note: Data for this chart are based on PRC government statistics. The value of PRC imports from the United States may differ from US exports to China due to discrepancies between US and PRC trade statistics, methodological differences regarding shipping costs, and tariffs that were applied as goods passed through other customs territories on their way to China.

Top US State Goods Exporters to China, 2020

Most states exported more goods to China in 2020 than in 2019

Oil and gas exports rebounded in Texas (+$6.1 billion) and Louisiana (+$1.8 billion)

Semiconductor exports continued to grow in Oregon (+$2.2 billion)

A recovery in oilseeds, grains, and meat exports helped farmers in agriculture-dominant states

Washington (-$2.0 billion) and South Carolina (-$2.6 billion) were clobbered by falling aircraft sales

Services

Note: Full-year services export data are available only through year-end 2019.

US services exports to China contracted in 2019, the first time in more than a decade

China was not the only services export market in decline in 2019

Overall, US services exports to the world increased by an anemic 1 percent in 2019, compared to around 5 percent in 2018. Services exports to the United Kingdom and Canada, the top two purchasers of US services, also fell by a margin similar to China’s.

Top US Services Export Markets, 2019

Top US State Services Exporters to China, 2019

Digging into the numbers

Exports and US Jobs

Exports to China constitute more than cars or computer parts on container ships bound across the ocean—they also represent the livelihoods of thousands of Americans in industries from agriculture to high-tech manufacturing. Estimates of jobs supported by exports to China take both goods and services exports into account; as a result, the most recent job estimates are from 2019. That year, US goods exports to China had fallen for the second year in a row as the United States and China leveled steep tariffs against each other and services exports plateaued. In turn, the number of jobs supported by exports to China fell to 916,000, down from 1.1 million in 2017.

The impact of US exports to China on US employment in 2019 varied across states

Sixteen states saw jobs supported by exports to China increase, while the other 34 saw them decline. Seventeen states saw jobs supported by exports to China fall by more than 1,000, and two states—Texas and Washington—saw a decline of more than 10,000. However, 12 states saw more than 1,000 new jobs added.

Not all the news in 2019 was negative

An increase in exports of oilseeds and grains in 2019 helped boost jobs supported by exports to China in the US heartland, where agricultural exports are a key pillar of the local economy. Illinois, Iowa, Minnesota, Nebraska, and the Dakotas saw exports of oilseeds and grains more than double in 2019 as China made goodwill purchases during trade negotiations. In 2019, these states all saw the number of jobs supported by those exports grow by more than 2,000 each, with Iowa adding around 6,000. Further west, Oregon continued its rapid growth of exports in semiconductors and parts, more than doubling the value of exports in 2019. Along with that expansion of exports came an additional 8,659 jobs across the state.

Appendix: State Reports

Here, you can find data from your state. State reports can be accessed by clicking on your state. Each individual state report includes information about the top goods exports, top services exports, how they have grown, and what markets they go to.

Prefer a PDF of the report? Download it below:

How to manage your shipping procedures?

If you are new to imports and exports, you should get a shipping agent for managing shipping services. Such a person can help manage your imports from China.

They can also help you keep a record of your total imports and suggest some better ways for your imports and exports to China.

Although enlisting the help of an agent will make your task easier, it can cost you some extra bucks for the services.

The following options will help you discover some cost and time-effective ways of managing shipping, imports, and exports.

This strategy will require you to directly reserve a space with airlines or shipping lines.

Not only that, but you will also have to manage Customs Declarations on both ends (China and USA). In short, you will need to take full responsibility for your u.s imports.

This approach, although effective, can eat up a lot of your time.

This trade option is best suited for well-established exports category businesses.

As the title indicates, this approach requires you to enlist the help of an appropriate freight forwarder in America.

The only drawback of this approach is that many forwarders don’t have their offices in China to provide services.

So, when you order u.s imports through them, they hire local agents, and you have to pay the agent’s fee for his support in addition to the forwarder’s commission.

This approach has gained quite a prominence.

The forwarders can easily keep you updated about your order since they can interact with the supplier in person.

If any issues arise, the forwarder can easily help address and attempt to resolve them. This shipping trade option is also pretty cost-effective and save you multiple dollars.

A pretty effective option, to say the least. By recruiting two freight forwarders, one in the US and the other in China, you can get the best of both worlds.

You gain extra control over the shipping management and let the experienced forwarders handle the technicalities.

Do not hesitate to contact Leeline Sourcing at any time regarding your shipments from China.

What are the Product Compliance Requirements in the USA?

As an importer, you need to ensure your products are safe and do not create injury or hazardous release substances in the market.

Thus, always choose your imports and export categories with diligence after knowing its proper detail. The U.S federal agencies specify each product category’s safety regulations and standards.

That is also why U.S imports mostly come from China as it is a safe place for doing this exports, etc. business.

If you are an Amazon seller, besides the national standards, you also need to know which products category requires pre-approval before you can send them on Amazon as exports.

For products such as hoverboard products, laser pointers, and specific products in the software industry will require prior support and approval from Amazon.

You can also find a list of Amazon-restricted products and FBA product restrictions on the Amazon website.

Make sure to go through that before attempting to go further with the u.s imports and exports.

To know which product certifications are needed for customs clearance, you can double-check with your customs broker or freight forwarder to prepare for all the certificates.

All the products imported to the USA must have the country of origin label-“Made in China”. However, the certification required for different products volume varies.

We list some of the most popular requirements by each subject category for your ease.

| Product Category | Regulations and Certificates |

| Children’s products, such as toys, etc | CPC (Children’s Product Certificate) ASTM F963 |

| Auto, motorcycles | EPA compliant (Environmental Protection Agency) |

| Electrical and electronic products | FCC compliant (Federal Communications Commission) |

| Food, drugs, biologics, cosmetics, tobacco products, etc | FDA compliant (Food and Drug Administration) |

| Kitchen & Dining products | California Proposition 65 Food Contact Materials Testing: FDA CFR 21 |

| Medical devices | Premarket approval under FDA |

Besides the above products, the FDA regulates and do research on a range of products to ensure the safety of products available in the US market.

To know if your products are under FDA regulations, you can check here for more details and enhance your services. For apparel and textile products, there are several federal agencies administering relevant regulations as shown below.

For more information on goods exports and imports, you can check the apparel compliance requirements chart here.

| Agency | Scope |

| Consumer Product Safety Commission (CPSC) | Flammability, children’s products; hazardous substances |

| Customs and Border Protection (CBP) | State of origin for most imported products |

| Environmental Protection Agency (EPA) | Pesticides, toxic substances |

| Federal Trade Commission (FTC) | Labeling (care labeling, fiber content labeling, environmental labeling, country of origin labeling, advertising) |

| United States Department of Agriculture | Organic claims |

To know more about the electrical compliance requirements, you can click and download this document here.

| Agency | Scope |

| Consumer Product Safety Commission | Children’s products, hazardous substances, labeling of hazardous products, consumer product safety |

| Customs and Border Protection | Country of Origin for most imported products |

| Department of Energy (DOE) | Energy efficiency |

| Environmental Protection Agency(EPA) | Toxic substances, Energy Star |

| Federal Communication Commission (FCC) | Radio frequency and digital devices |

| Federal Trade Commission (FTC) | Labeling, EnergyGuide standards, environmental claims |

| Occupational Safety and Health Administration (OSHA) | Occupational safety, nationally recognized testing program |

| Food and Drug Administration (FDA) | Food contact substances, medical products and devices |

Suggested reading: Us tariff codes

Suggested reading: China import tax

Predicting the Future of U.S. Imports from China

The goods trade between the US and China is at its peak nowadays. The rate of u.s imports is touching the sky.

According to the census bureau reports, around 42% of the US total imports are from China.

It’s a huge number that includes a lot of trade categories.

The main thing to take into account is the fact that this volume is rising every day. More and more dollars are being invested in this trade source.

However, there was a disturbance in the global economy during the COVID.

All the goods exports and imports processes had to face problematic circumstances.

But after this downfall and disturbance, this importation was enhanced. Millions of goods from China were imported to the US.

And in the future, the census bureau has predicted this top us imports from china percentage to go up to 60% easily.

So, it doesn’t matter in which department or category you trade and invest your dollars, you can get details about it and hire suppliers in China easily.

FAQs about how to import from China to USA

What does the US import from China the most?

There are millions of import categories.

But usually, the highest percentage of Chinese goods imported by the US are machinery and equipment. It also includes various seasonally adjusted items.

But for now, the research shows that the top U.S imports from china areas

According to the Census Bureau, how much does the us import from china?

You will be stunned to know ‘what percentage of us imports come from china.’ In 2018, the goods imports volume coming from China was 21.2%.

However, this percentage dropped during the COVID time.

In the same period, everything stopped, including the goods exports and imports. But after that, the percentage of u.s imports has again risen to 42%, according to 2021 latest data.

And the most intriguing thing about this data is, it’s not seasonally adjusted and is still rising.

Every day, more and more people are starting to trade in Chinese imports and goods exports.

Who trades the most with China?

The United States is the number one site for goods trade with China.

Both countries make successful exports and imports business trade. Then there comes Hong Kong, Japan, Vietnam, etc., that get goods from China.

But at this moment, the total u.s imports from China are US$452.6 billion, according to the census bureau.

This makes 17.5% of China’s total goods exports. And this is the highest volume of commerce business compared to any other country.

Why do countries trade with China?

Chinese suppliers give direct access to their working process and stock. They ensure high-quality trade services at good rates.

And thus, save you millions of dollars in this commerce business.

Plus, usually, you are only offered to supply services in commerce, whereas, in China, you also get manufacturing assistance.

You need to share details with them and let them take care of the trade. You can also ask for free samples to ensure quality to trade with China.

People often don’t get the right value for their hard-earned dollars.

But when you do trade and get the Chinese manufacturing services, they assure the best work done within the described deadlines.

Plus, the shipping costs of goods from China are comparably cheaper too. That is why most of the state’s total imports and stock of goods come from China.

According to a detailed chart, the u.s imports that come from China are reliable, useful, and are in large volume.

Final thoughts

If you want to trade successfully in this 2021 period, the most effective thing to do right now would be to contact suppliers in China.

And do imports business with their proficient manufacturers. You will not have to spend millions of extra dollars and still get trustworthy services.

So search for the best company for trade, and start earning millions of dollars right away!

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

As you found this post useful.

Follow us on social media!

We are sorry that this post was not useful for you!

What is China’s biggest export?

| Rank | China’s Export Product | 2019 Value (US$) |

|---|---|---|

| 1 | Phone system devices including smartphones | $224,069,819,000 |

| 2 | Computers, optical readers | $148,463,426,000 |

| 3 | Integrated circuits/microassemblies | $102,187,884,000 |

| 4 | Processed petroleum oils | $38,345,208,000 |

What are China’s main exports?

List of exports of China

| # | Product | Value |

|---|---|---|

| 1 | Computers | 210.231 |

| 2 | Broadcasting equipment | 110.979 |

| 3 | Telephones | 91.759 |

| 4 | Office Machine Parts | 47.079 |

What are China’s top 5 exports?

China’s Top Exports

What is China’s main export to the US?

The top goods exported from China to the U.S. and their total values for 2018 were electrical machinery ($152 billion), machinery ($117 billion), furniture and bedding ($35 billion), toys and sports equipment ($27 billion), and plastics ($19 billion).

What is China’s biggest import?

Searchable List of China’s Most Valuable Import Products

| Rank | China’s Import Product | 2018 Value (US$) |

|---|---|---|

| 1 | Integrated circuits/microassemblies | $312.7 billion |

| 2 | Crude oil | $239.2 billion |

| 3 | Iron ores, concentrates | $75 billion |

| 4 | Petroleum gases | $50 billion |

Who is China’s largest trading partner?

China’s Top Trading Partners

How much of our stuff comes from China?

U.S. imports from China account for 21.2% of overall U.S. imports in 2018. The largest categories of those imports for 2018 included electrical machinery ($152 billion), machinery ($117 billion), furniture ($35 billion), toys and outdoor equipment ($27 billion), and plastics and plastic parts ($19 billion).

What is US biggest export?

Which country exports the most?

Top 20 export countries worldwide in 2019 (in billion U.S. dollars)

| Exports in billion U.S. dollars | |

|---|---|

| China | 2,499.03 |

| United States of America | 1,645.63 |

| Germany | 1,489.16 |

| Netherlands | 709.23 |

What food does the US get from China?

The top U.S. import commodities from China are fruits and vegetables (fresh/processed), snack food, spices, and tea – the combined which accounts for nearly one-half of the total U.S. agricultural imports from China.

Does China rely on the US?

But various data suggest that such a process may be challenging as the two economies have grown more connected over the years. The U.S. and China have been major trading partners for years, and they rely on each other’s supply chain for input into goods and services consumed within their borders.

Does US import from China?

Who is the US biggest trading partner?

Also shown is each import country’s percentage of total American exports.

Which country imports most from China?

List of largest trading partners of China

| No. | Country / Region | Imports |

|---|---|---|

| Total | 1,843.7 | |

| 1 | United States | 153.9 |

| 2 | European Union | 197.9 |

| 3 | Japan | 165.8 |

What is the religion of China?

The government formally recognizes five religions: Buddhism, Taoism, Catholicism, Protestantism, and Islam. In the early twenty-first century there has been increasing official recognition of Confucianism and Chinese folk religion as part of China’s cultural inheritance.

What does China import from the world?

China is the world’s largest importer of soybeans and meat and among the leading importers of dairy, wine, and other food products and beverages. In terms of service trade, travel and transportation-related service imports take up around 75 percent of all service imports in China.

Importing from China to USA:Customs & Duties

Importing from China to USA:Customs & Duties

When importing products from China, it is important to understand import duties, customs fees and clearance documents. As an importer, Chinese manufacturing is a good choice for many products that can be sold locally or online and reap huge profits. Tariffs depend on the products and commodities you import from China to the United States, which makes the entire international trade process for new importers seem complicated. This article will help you understand the tariffs on goods imported from China to the United States and how to check each product tariff. Let us delve into the import tax from China to the United States.

This article will let you learn more about import tariffs and customs clearance issues.

Since February 24, 2016, former U.S. President Barack Obama signed the Trade Facilitation and Trade Enforcement Act of 2015, which will increase import tax exemption from 200 U.S. dollars to 800 U.S. dollars, The act was implemented by the United States Customs and Border Protection Agency on March 10, 2016. The amount of tax exemption means that the goods that meet the conditions are less than the stated dollar amount of USD 800, and can be exempted from making customs declaration without paying customs duties or taxes. This means that most goods shipments of less than 800 U.S. dollars will be exempt from customs clearance and import duties.

This move not only motivated the US consumers but also inspired a lot of e-commerce sellers to consider shipping with express delivery. However, the exemption rules are conditional and exceptional, and under the United States Customs regulations (U.s.customs regulation 19cfr10.151), the goods subject to this exemption need to meet the following requirements:

(1) The goods must be imported by the same person on the same day.

If the Customs considers that the goods are one of several batches under a single order or contract and are shipped separately for the purpose of free entry (tax exemption) or to avoid compliance with any relevant laws and regulations, this situation cannot be exempted tax. Goods that are part of a tariff quota cannot be tax-free (for example, products that are tariff quotas cannot be exempt from taxation). Goods that are regulated if one or more of the cooperating government agencies require information are not exempt from taxation (for example, goods subject to FDA regulation are not exempt from taxation).

HS coding

Tariffs are not based entirely on declared value – it also varies from product to product. However, customs officials are busy people. They don’t have time to open each carton and sort it by itself. Instead, the HS code specifies the type of product. HS coding (coordinating commodity description and coding systems) is part of the international classification system, making the process very simple.

However, you can be sure to specify the correct HS code on the commercial invoice. Otherwise, you will end up paying a customs tax rate based on the wrong product. Regarding the correct coding of HS, you can check it online on the US Customs, or let your customs clearance agent provide it to you. If you use a customs clearance agent to help you clear customs, you should do it according to the requirements of the customs clearance agent.

Declared value

Tariffs and taxes are calculated as a percentage of customs value. The value of the customs is based on the declared value, and the declared value should be indicated on the commercial invoice – the document issued by the supplier. Declaring the correct value on a commercial invoice is critical, otherwise, you may end up paying the wrong amount. It is always the responsibility of the importer to ensure that the correct declared value is indicated on the commercial invoice. This responsibility cannot be transferred to Chinese suppliers. You must confirm with your Chinese supplier the value of all declared products before shipping.

Tip: As we all know, low declarations can reduce the cost of goods entering the customs and enhance the competitiveness of products. However, customs is not a fool. Every product is declared by the customs according to the market price when it enters the customs system. If your goods are significantly lower than the customs-defined price, then the goods will be directly transferred to the inspection department by the customs, and the customs will charge hundreds to thousands of dollars for inspection fees.

What is the US import tariff rate?

US tariffs are a problem that every Chinese-to-American express parcel cannot avoid. US airfreight and US shipping will have US tariffs, with a minimum of 30 USD and no limit. Goods value below 800USD is duty-free. Of course, there are also many customers who choose to use the US express channel to avoid tariffs.

(1) Tariffs for clothing products (cotton category: 16%).

Customers who have worked in the apparel industry know that the tariff classification of clothing is simply too much. It is possible to have clothing of the same style, different materials but the tariffs will be different. There are also gaps in the tariffs for men’s wear women’s wear and children’s wear, there are also gaps between formal wear and casual wear, and there are also gaps before the different tariffs on apparel fabrics.

(2) LED product tariffs (LED lights: 3.9%).

LEDs may not be as diverse as the classification tariffs for clothing products. The tariffs on LED lamps are generally 3.9%, but the tariffs on LEDs are different from the tariffs on LED lamps.

(3) Tariffs for furniture products (furniture: 1%).

Furniture is also a relatively large proportion of China’s exports to the United States. The tariffs on furniture products are, generally around 1%. However, sometimes there are products related to anti-dumping in the furniture, anti-dumping duties will be as high as 227%, such as the bedroom bed.

(4) Tariffs for solar products (anti-dumping).

At present, solar energy products are in the anti-dumping stage in the United States, so many customers who export such products are discouraged from seeing this high anti-dumping tariff.

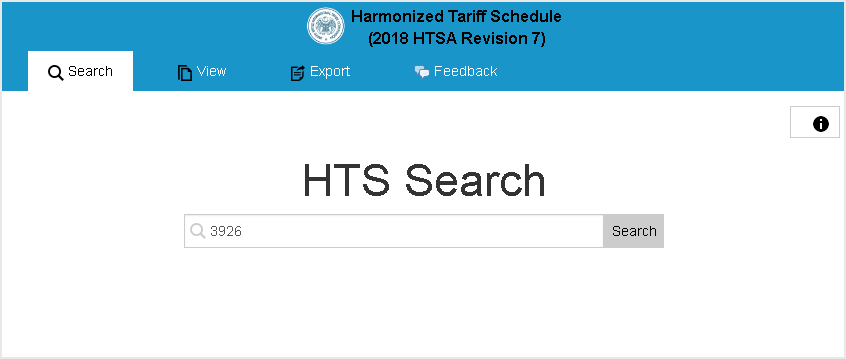

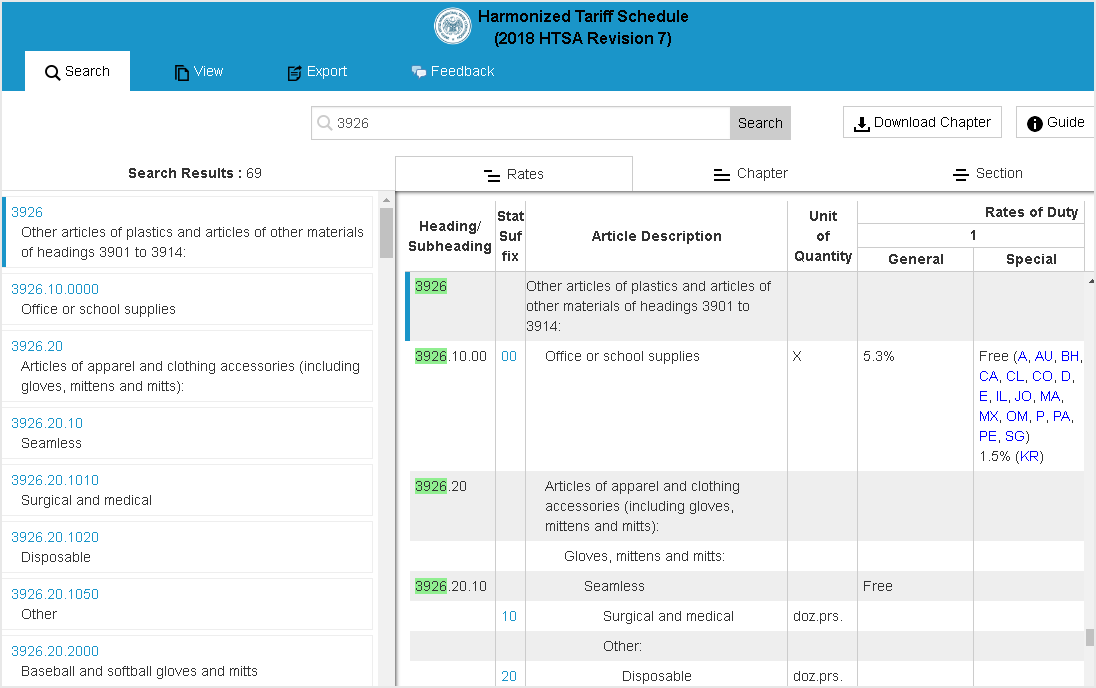

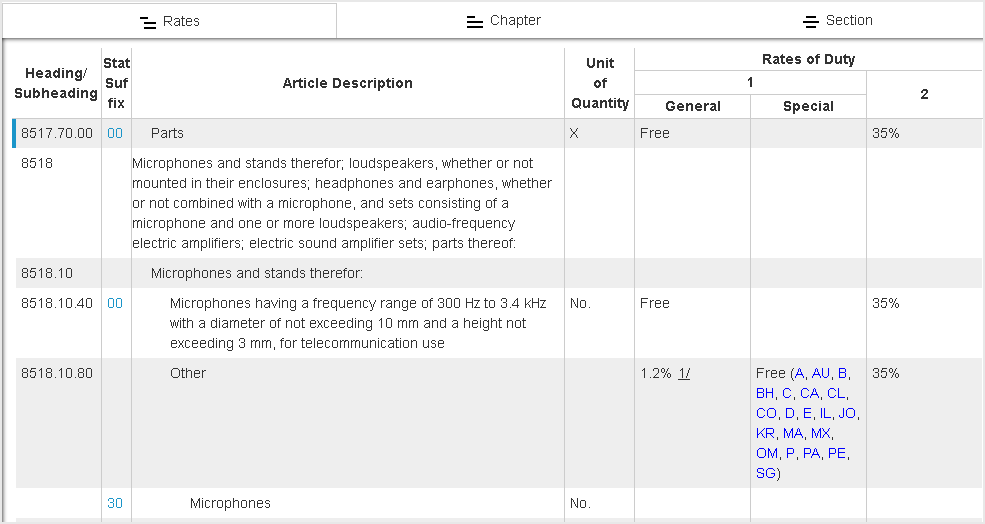

How to check the US tariff?

1. The US tariffs are very detailed. Open the US import tariff website: https://hts.usitc.gov/. Enter the product name After entering the website, then click “Search” or enter the first 4 digits of the HS code or 6 digits.

2. Enter your product name to view the import tariff (Rates of Duty)

What are the meanings of 1 and 2 of the US import tariffs?

Customs clearance procedures in the United States

US Customs Clearance Process and Required Documents.

A: After receiving the ARRIVAL NOTICE, the customs broker must have the documents required by the customs (please refer to B) to be able to arrive at the port or arrive at the inland station within 5 days (5 DAYS PRIOR TO ETA). Apply to customs for customs clearance. Customs usually will decide whether to release or not (sea freight) within 48 hours. Air cargo will be notified within 24 hours. (US Customs actually works at any time so air cargo can be cleared even if it arrives on Saturdays and Sundays, but it must be taken care of by companies that are on duty over the weekend. Some cargo ships have not arrived in the US, and the customs have decided to check? Most inland stations can make a pre-declaration (PRE-CLEAR) before the arrival of the goods, but will only show the results after ARRIVAL IT.

There are two ways to declare to the customs.

1. The first one is an online declaration. The customs broker enters the contents that the customs need to know, into the US Customs Network (ABI), including what kind of goods and materials, value, number of pieces, bill of lading and container number, and extracts terminal information, and then send to the customs. If the customs release, you will get a notice from ABI. Most brokers are now used to online customs declaration. This method is quickly and usually, you will be notified by the ABI system within 48 hours, whether it is released or needs further inspection.

2. Customs needs to review documents. In this case, the customs broker must send the original or a copy of all the documents, including the original documents of the importer, to the customs, and the customs officers will review whether to release or check after checking all of your documents, the release will be very slow, and it may be around three days. Many precision electronic products, as well as most food products, such as textiles, are required to send customs documents. Products with quotas need to pass the original VISA and customs duties to the customs, and the customs will release them.

B: Documents required for customs declaration:

(1) BILL OF LADING (B/L).

(4) ARRIVAL NOTICE.

If there is wood packaging, Funimation CERTIFICATE or NON-WOOD PACKING STATEMENT. The name of the consignee on the bill of lading (CONSIGNEE) needs to be unified with the consignee shown on the last three documents. If there is any inconsistency, the consignee on the bill of lading must write the LETTER OF TRANSFER, and then the third party can go to customs clearance. The name, address and phone number of S/ & C/ are also required on the invoice and packing list. Some of the information on the S/ files in China if missing and will be required to be filled.

Import precautions (goods from China)

A: If it is heavy, the customs will determine that there must be a wooden package, you need to provide a fumigation certificate. If there is no wooden packaging, you must declare non-wood packaging (NON-WOOD PACKING) on all documents. Although the shipping company’s weight limit for the container is 44,000 pounds, the standard weight of the shipping company’s is 38,000 pounds. If the weight exceeds this weight in the US inland transportation, the truck company will require the use of its own special triangular or four-corner car frame. To ensure safe driving. In many states in the United States, this restriction is very strict and requires the transport of ultra-heavy container trucks for applications and permits. Since the cost of own car frame and license is extra, please note that the price is applicable to goods below 38,000 pounds when making inland-to-door service quotations. If the container exceeds 43,000 pounds, many inland states are not allowed to go on the road, and a special triangle or four-corner car frames must be used.

B: There must be a “MADE IN CHINA” label on the product. If not, the Customs will require a label to be sold, especially for mass consumer goods, so please be prepared.

C: Food.

The import requirements for food and food-related goods in the United States are very strict. In addition to reporting customs, it is also required to declare that the FDA (FOOD & DRUG ADMINISTRATION) will release the goods before both parties can pick up the goods. Customs agencies will usually add FDA service fees.

D: For customs clearance in the inland, you need to do a customs transit (cut I.T.—Immediate Transit). We need to provide I.T.#, DATE ISSUED, PLACE ISSUED AND ENDED. Inland Customs will use I.T# to control and release.

E: Since March 2003, U.S. Customs has been testing the AMS system. It was sent by NVOCC to the U.S. Customs through AMS within 24 hours of the ship’s departure. Some of the goods NVOCC still commissioned by the shipping company VOCC to do AMS. So we need to pay special attention to who does the AMS, the United States customs only use AMS No. to identify different goods, AMS No. includes an important part of the AMS FILER code SCAC Code, in the declaration is indispensable.

F: Release the goods.

(1) In the former ABI system, the shipping company and the terminal were directly connected to the customs, which means that if the customs is released in the ABI, the shipping company and the terminal can see it. After the trial of AMS, large-scale shipping companies such as EVERGREEN, APL, MAERSK, COSCO, CSCL, etc. are also connected to AMS, but the terminal is not. Therefore, customs can clear an AMS, these shipping companies and NVOCC AMS FILER can be seen simultaneously, the shipping company helps the terminal system to be updated at the same time; small shipping companies such as SINOTRANS, LYKES, GWS, etc. do not have networked AMS, so the only way it can be released is by NVOCC AMS FILER fax. NVOCC guarantees a letter and a copy of customs pass (CUSTOMS FORM 3461). These shipping companies will receive the fax and manual update through the terminal system. It is conceivable that manual release will result in a multiplication of workload, as well as human error and leakage of customer data.

(2) Dock/shipping company to release goods.

Terminals and shipping companies are networked, if the freight is prepaid, the bill of lading is telex released. as long as the customs clears, the dock will automatically release the goods to the truck company. In the United States, customers do not need to exchange bills of lading, so the US agent has no way to help detain the goods. This is quite different from China.

If the shipping company bill of lading is telex released, the freight is prepaid, then the shipping company will release the goods as soon as it receives the freight no matter who pays the freight. The only thing that can control the delivery is the original bill of lading of the shipowner. If there is no original bill of lading, the SSL will not release the goods.

All trucks that go to the docker must sign an agreement with the shipping company and the terminal (INTERCHANGE AGREEMENT). Guarantee to bear the box loss and demurrage fee. Otherwise, the shipping company and the terminal will not put the cabinets on the truck.

3) Inland release.

To the inland cargo, after the customs clearance, the shipping company will give a PICKUPnumber, the agent will get the PICKUP number and notify C/, then the truck company will pick up the goods by this number.

How to get Pick UP number?

A. The goods arrive and unloading is done.

B: After the customs has released the goods, the shipping company can collect the goods. If anyone of them is missing, it will not be available.

AMS IC and VSSL ARRIVAL

VSSL ARRIVAL: Notify Customs on the day the ship arrives at the port of destination. This is calculated by the actual arrival port, not counting when the previous port arrived.

AMS IC: When customs clearance is released, the AMS system will automatically display the IC, indicating customs clearance. Almost all of the goods to the port can be declared before the ship arrives and the customs clearance results are displayed. Although many inland goods can be used as PRE-CLEAR, the shipping company needs to know whether to release it after ARRIVAL I.T. After doing AMS, many NVOCCs forget ARRIVAL I.T. which leads to goods not being released after customs clearance.

Customs fines

If the customs duties are not paid on time, the customs will impose a fine and collect interest. It must be declared to the customs within 15 days of the goods. If there is still no one to report to the customs after 15 days, the customs will question the safety of the goods and transfer the goods to the supervision warehouse ( GO WAREHOUSE) Unloading to inspect the container. At this time, the customs clearance needs to be cleared by the supervision number (GONO). If the goods enter the supervision warehouse (G..O.WHSE-General Order). the following costs will be incurred.

1. Demurrage fee or railway Demurrage fee.

2. The cabinet fee and returning cabinet fee

3. Warehouse decommissioning fee and loading fee.

4. Warehouse storage fee. Container costs.

Only pay these fees and pay the shipping fee to the shipping company in exchange for the LIEN notice to pick up the goods. If the goods are not cleared by customs within six months, the customs will confiscate them and then auction to collateralize the storage costs.

Free storage period for docks

Most docks have a storage period of 5 days (from the time the container is hoisted from the ship, starting from the time of picking up). Note, after the free period, you have to pay the storage fee for holidays and weekends. Rickmers’ Houston dock has only a three-day free period.

Demurrage fees

Note: The shipping company has no control over the demurrage of the wharf. It does not mean that the shipping company can waive the demurrage fee, but it may help to discount or bear some demurrage. However, in some special areas such as SAVANNAH, CSCL and terminals have long-term contracts so they can have more space to control demurrage.

The customer does not pick up the goods after the arrival

Under normal circumstances, most shipping companies can contact the customs and auction after half a year. As usual, the proceeds from the auction must be pay off customs duties, terminal charges, shipping company shipping costs, and the remaining surplus are returned to C/ or S/. If the auction does not pay enough for all those expenses, the customs and shipping company have the right to request a difference from C/ or NVO. According to previous experience, there are very few cases of recourse by customs and shipping companies. The excess amount has never been refunded. So, usually, they handle it on their own.

The operation process of the US agent import goods

A. Receive the agent’s file (should include: 1+ B/L, M B/L COPY + D/C NOTE) and enter the computer.

ZF.

B. One week before the arrival of the goods, the request for the arrival of the goods to SSL or CO-LO is started, so the port OP must write the arrival date on the D/C NOTICE, which helps the US agent to check the arrival date in time.

C. Upon receipt of the arrival notification for SSL or CO-LO, enter the computer and send it to C/ and their customs broker (if known).

D. Receive the original bill of lading or sea freight sent by C/ or customs broker. Immediately use the messenger or courier to send the freight and original bill of lading that we need to pay to SSL or CO-LO. This usually arrives within 24 hours. If there is an IC, send it to SSL or FAX.

E. After receiving the bill of lading and the fee, SSL will enter the computer to release the goods. If it is sent to CO-LOADER, they will repeat (above D) and send it to SSL for delivery. Therefore, CO-LO goods, delivery will be one day to a day or so.

F. Going inland goods, tracking the goods itinerary until PICK UP # after FAX to C/

G. After delivery, send D.O. (DELIVERY ORDER) to the truck company and contact the harvest warehouse until confirmation, some C / need POD, and then get it from the truck to C /.

H. The SOC tracking box also returns to the designated yard (requires C/sign-in confirmation at the time of delivery).

Summary

You might feel that the customs clearance process looks very complicated. But with the help of a customs clearance agent, you can easily receive goods on time, because customs clearance agents are more professional and have a good understanding of the customs clearance process. In the end, you only have to pay a small fee.

Here is the estimated shipping cost included the US customs & duties to you for reference: Shipping from China to US

Related Post:

Importing from China:Step by Step for Beginners 2022

6 ways to reduce the risk of importing from China

Why Amazon sellers like to import products from China?

Import Customs Duties from China to Europe

60 Comments

I am considering importing a couple of thinks that I want to sell in the USA.

I Have located a source on Alibaba and I am looking for a custom agent, and I discovered your company.

I will start with about 1000 inexpensive pocket knives and some type if Led light that a person wears on their head. probably 1000 of these.

Is this something your company does?

If I. Purchasing a food cart? What fees would I have to pay to get it located to the US from.China?

can i have an information that US impose duty percentages on leather and synthetic bags/shoe??

I want to purchase Ss pipe 201 grade different sizes. Please guide me. I am from India. I want to know what is duty on this items.

So, according to post, if I import a smartphone of USD 300 I won’t pay any duty, right?