What information does a balance sheet contain

What information does a balance sheet contain

What are balance sheets and why are they important?

Owen was formerly a Digital and Social Content Manager for Sage Canada. He provided helpful and problem-solving content to both local and global audiences.

It’s important business owners and accountants understand how to read and interpret balance sheets. These documents offer a quick view of a business’s financial standing. Without this snapshot, business owners and accountants may make decisions that have negative repercussions on their companies’ financial standing.

A balance sheet is one of several major financial statements you can use to track spending and earnings. Also called a statement of financial position, a balance sheet shows what your company owns and what it owes through the date listed, as Accounting Coach stated. It displays this information in terms of your company’s assets, liabilities, and equity.

Assets are any items your business owns. Liabilities are payments your business needs to make. Equity is the amount your business’s shareholders own. On balance sheets, the assets are ideally equal to, or balance out, the liabilities and the equity.

Assets

There are two primary types of assets: current and noncurrent. Current assets are items your business has acquired over time that will be used up or converted into cash within one year, or one business cycle, of the date on the balance sheet. Prepaid insurance, accounts receivables, temporary investments, cash, inventories, and liabilities are considered current assets.

Noncurrent assets are any fixed assets or items your business owns. Things that fall into this category are office equipment, building property, land, long-term investments, stocks, and bonds.

Liabilities

Just like assets, there are current and noncurrent liabilities. Current liabilities represent payment obligations your company has to pay within 12 months of the date on the balance sheet. For example, an outstanding bill to an equipment supplier could be a current liability, as could salaries payable and income taxes payable.

Noncurrent liabilities are amounts your company has more than one year to pay. Bondholder and bank debt are considered noncurrent liabilities. You and your accountant can identify the liabilities on balance sheets by looking for the word “payable.” Again, these liabilities are some of the sources of your company’s assets.

Equity

Another asset source is equity. If you are the sole proprietor of your business, this is referred to as owner’s equity. If your business is a corporation, equity is called stakeholder’s equity. When all liabilities are subtracted from your company’s assets, the result is equity.

Equity is made up of paid-in capital and retained earnings. Paid-in capital is the amount each shareholder initially paid for his or her stock. Retained earnings refers to the amount of money your business didn’t sell to shareholders and instead reinvested into itself.

Why are balance sheets important?

It’s clear that balance sheets are critical documents because they keep business owners like you informed about your company’s financial standing. As Inc. magazine pointed out, many business owners fail to recognize their companies are in trouble until it’s too late. This is because some business owners aren’t examining their balance sheets. Typically, if the ratio of your business’s assets to liabilities is less than 1 to 1, your company is in danger of going bankrupt, and you’ll have to make some strategic moves to improve its financial health.

Balance sheets are also important because these documents let banks know if your business qualifies for additional loans or credit. Balance sheets help current and potential investors better understand where their funding will go and what they can expect to receive in the future. Investors appreciate businesses with high cash assets, as this insinuates a company will grow and prosper.

The balance sheet is a snapshot of a business’s financial records at a given date. The total of the owner’s equity is the book value of your business as at that date.

This report helps a small business owner quickly understand what their business is worth.

A balance sheet can help you identify trends in your business’s finances, particularly when it comes to relationships with customers and suppliers.

Are your customers taking longer to pay you? Is your debt collection out of control? Are you taking longer to pay your suppliers due to cash shortages? Are you over/understocked? Then download our free guide “The Art of Getting Paid” and say hello to more good news in your balance sheet.

Reading the Balance Sheet

A company’s balance sheet, also known as a «statement of financial position,» reveals the firm’s assets, liabilities and owners’ equity (net worth). The balance sheet, together with the income statement and cash flow statement, make up the cornerstone of any company’s financial statements.

If you are a shareholder of a company or a potential investor, it is important to understand how the balance sheet is structured, how to analyze it and how to read it.

How the Balance Sheet Works

The balance sheet is divided into two parts that, based on the following equation, must equal each other or balance each other out. The main formula behind a balance sheet is:

Assets = Liabilities + Shareholders’ Equity

This means that assets, or the means used to operate the company, are balanced by a company’s financial obligations, along with the equity investment brought into the company and its retained earnings.

Assets are what a company uses to operate its business, while its liabilities and equity are two sources that support these assets. Owners’ equity, referred to as shareholders’ equity, in a publicly traded company, is the amount of money initially invested into the company plus any retained earnings, and it represents a source of funding for the business.

It is important to note that a balance sheet is a snapshot of the company’s financial position at a single point in time.

An Introduction To The Balance Sheet

Know the Types of Assets

Current Assets

Current assets have a lifespan of one year or less, meaning they can be converted easily into cash. Such asset classes include cash and cash equivalents, accounts receivable and inventory.

Cash, the most fundamental of current assets, also includes non-restricted bank accounts and checks. Cash equivalents are very safe assets that can be readily converted into cash; U.S. Treasuries are one such example.

Accounts receivables consist of the short-term obligations owed to the company by its clients. Companies often sell products or services to customers on credit; these obligations are held in the current assets account until they are paid off by the clients.

Lastly, inventory represents the company’s raw materials, work-in-progress goods and finished goods. Depending on the company, the exact makeup of the inventory account will differ. For example, a manufacturing firm will carry a large number of raw materials, while a retail firm carries none. The makeup of a retailer’s inventory typically consists of goods purchased from manufacturers and wholesalers.

Non-Current Assets

Non-current assets are assets that are not turned into cash easily, are expected to be turned into cash within a year, and/or have a lifespan of more than a year. They can refer to tangible assets, such as machinery, computers, buildings and land. Non-current assets also can be intangible assets, such as goodwill, patents or copyright. While these assets are not physical in nature, they are often the resources that can make or break a company—the value of a brand name, for instance, should not be underestimated.

Depreciation is calculated and deducted from most of these assets, which represents the economic cost of the asset over its useful life.

Learn the Different Liabilities

On the other side of the balance sheet are the liabilities. These are the financial obligations a company owes to outside parties. Like assets, they can be both current and long-term.

Long-term liabilities are debts and other non-debt financial obligations, which are due after a period of at least one year from the date of the balance sheet. Current liabilities are the company’s liabilities that will come due, or must be paid, within one year. This includes both shorter-term borrowings, such as accounts payables, along with the current portion of longer-term borrowing, such as the latest interest payment on a 10-year loan.

Shareholders’ Equity

Shareholders’ equity is the initial amount of money invested in a business. If at the end of the fiscal year, a company decides to reinvest its net earnings into the company (after taxes), these retained earnings will be transferred from the income statement onto the balance sheet and into the shareholder’s equity account. This account represents a company’s total net worth. In order for the balance sheet to balance, total assets on one side have to equal total liabilities plus shareholders’ equity on the other side.

Read a Balance Sheet

Below is an example of a corporate balance sheet for Walmart, circa 2016:

As you can see from the balance sheet above, it is broken into two main areas. Assets are on the top, and below them are the company’s liabilities and shareholders’ equity. It is also clear that this balance sheet is in balance where the value of the assets equals the combined value of the liabilities and shareholders’ equity.

Another interesting aspect of the balance sheet is how it is organized. The assets and liabilities sections of the balance sheet are organized by how current the account is. So for the asset side, the accounts are classified typically from most liquid to least liquid. For the liabilities side, the accounts are organized from short to long-term borrowings and other obligations.

Analyze a Balance Sheet with Ratios

With a greater understanding of a balance sheet and how it is constructed, we can review some techniques used to analyze the information contained within a balance sheet. The main technique is financial ratio analysis.

Financial ratio analysis uses formulas to gain insight into a company and its operations. For a balance sheet, using financial ratios (like the debt-to-equity ratio) can provide a good sense of the company’s financial condition, along with its operational efficiency. It is important to note that some ratios will need information from more than one financial statement, such as from the balance sheet and the income statement.

The main types of ratios that use information from a balance sheet are financial strength ratios and activity ratios. Financial strength ratios, such as the working capital and debt-to-equity ratios, provide information on how well the company can meet its obligations and how the obligations are leveraged.

This can give investors an idea of how financially stable the company is and how the company finances itself. Activity ratios focus mainly on current accounts to show how well the company manages its operating cycle (which include receivables, inventory, and payables). These ratios can provide insight into the company’s operational efficiency.

The Bottom Line

A balance sheet, along with the income and cash flow statement, is an important tool for investors to gain insight into a company and its operations. It is a snapshot at a single point in time of the company’s accounts—covering its assets, liabilities and shareholders’ equity.

The purpose of a balance sheet is to give interested parties an idea of the company’s financial position, in addition to displaying what the company owns and owes. It is important that all investors know how to use, analyze and read a balance sheet. A balance sheet may give insight or reason to invest in a stock.

Balance Sheet

What is the Balance Sheet?

The balance sheet is one of the financial statements of the company which presents the shareholders’ equity, liabilities, and the assets of the company at a particular point in time and is based on an accounting equation that states that the sum of the total liabilities and the owner’s capital is equal to the company’s total assets.

A balance sheet is the “Snapshot” of a company’s financial position at a given moment and reports the amount of a company’s

Remember the most important equation while forming the Balance Sheet –

Assets = Liabilities + Shareholders’ Equity

Let’s get started.

Table of contents

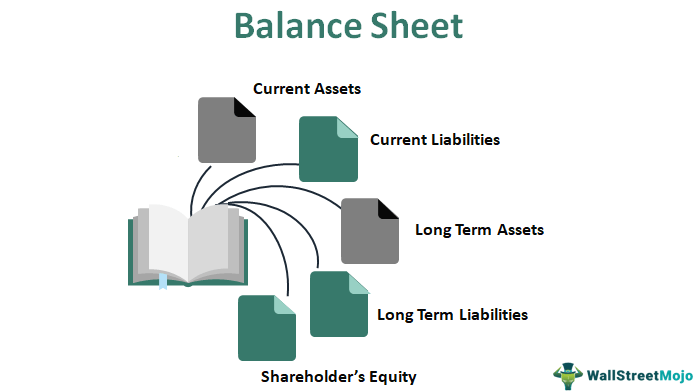

Balance Sheet Structure

You are free to use this image on your website, templates, etc, Please provide us with an attribution link How to Provide Attribution? Article Link to be Hyperlinked

For eg:

Source: Balance Sheet (wallstreetmojo.com)

Assets are arranged on the left-hand side, and the liabilities and shareholder’ equity Equity Shareholder’s equity is the residual interest of the shareholders in the company and is calculated as the difference between Assets and Liabilities. The Shareholders’ Equity Statement on the balance sheet details the change in the value of shareholder’s equity from the beginning to the end of an accounting period. read more would be on the right-hand side. However, in most cases, companies put the assets first, and then they set up liabilities and at the bottom shareholders’ equity. The total assets should equal the total liabilities and total shareholders’ equity.

Assets = Liabilities + Shareholders’ Equity

The balance Sheet Format is as follows –

#1 – Current Assets

Assets are arranged based on how quickly they can be converted into cash (how liquid they are). That means the first things we will put in our current assets on the balance sheet. Under current assets, these are the items you can consider –

Other current assets also include Derivative Assets, Current Income Tax Assets, Assets Held for Sale, etc.

Current Assets will look like the following –

#2 – Current Liabilities

Current Liabilities are probable future payments of assets or services that a firm is obligated to make due to previous operations. These obligations are expected to require existing current assets or the creation of other current liabilities.

You are free to use this image on your website, templates, etc, Please provide us with an attribution link How to Provide Attribution? Article Link to be Hyperlinked

For eg:

Source: Balance Sheet (wallstreetmojo.com)

“Current Liabilities” generally include the following –

Current Liabilities will look like the following –

#3 – Long Term Assets

Long-term assets are typically physical assets that the company owns and are employed in the firm’s production process and have a useful life greater than one year. Long-term assets are not for sale to the firm’s customers (they are not inventory!)

Long-term assets can be classified into three main categories

#4 – Long Term Liabilities

Long-Term Liabilities are obligations that are not expected to require the use of current assets or not expected to create current liabilities within one year or the normal operating cycle (whichever is longer).

#5 – Shareholder’s Equity

You are free to use this image on your website, templates, etc, Please provide us with an attribution link How to Provide Attribution? Article Link to be Hyperlinked

For eg:

Source: Balance Sheet (wallstreetmojo.com)

Each share of common stock conveys certain rights to the

Shareholder’s Accounts need to be maintained for

How to read the Balance Sheet?

These are the steps that can help you read it –

Balance Sheet Example (Colgate Case Study)

# 1 – Current Assets

# 2 – Current Liabilities

#3 – Long Term Assets

#4 – Long Term Liabilities

#5 – Shareholder’s Equity

Also, you can check Colgate’s Assets = Liabilities + Shareholders’ Equity.

Balance Sheet Example – Vertical Analysis

Conclusion

Learning to read a balance sheet is important if you want to succeed as an investor. And it starts with pulling out a company’s balance sheet and reading it through and through. If it’s your first annual report Annual Report An annual report is a document that a corporation publishes for its internal and external stakeholders to describe the company’s performance, financial information, and disclosures related to its operations. Over time, these reports have become legal and regulatory requirements. read more reading, please do not get intimidated. Stay put. You will master financial analysis over some time.

Video on Balance Sheet

Recommended Articles

This has been a guide to What is a Balance Sheet? Here we discuss balance sheet structure, Assets = Liabilities + Equity, Balance Sheet Analysis using practical examples of Colgate, etc. You may learn more about accounting from the following articles –

Balance Sheet

What Is a Balance Sheet?

The term balance sheet refers to a financial statement that reports a company’s assets, liabilities, and shareholder equity at a specific point in time. Balance sheets provide the basis for computing rates of return for investors and evaluating a company’s capital structure.

In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. Balance sheets can be used with other important financial statements to conduct fundamental analysis or calculate financial ratios.

Key Takeaways

An Introduction To The Balance Sheet

How Balance Sheets Work

The balance sheet provides an overview of the state of a company’s finances at a moment in time. It cannot give a sense of the trends playing out over a longer period on its own. For this reason, the balance sheet should be compared with those of previous periods.

Investors can get a sense of a company’s financial wellbeing by using a number of ratios that can be derived from a balance sheet, including the debt-to-equity ratio and the acid-test ratio, along with many others. The income statement and statement of cash flows also provide valuable context for assessing a company’s finances, as do any notes or addenda in an earnings report that might refer back to the balance sheet.

The balance sheet adheres to the following accounting equation, with assets on one side, and liabilities plus shareholder equity on the other, balance out:

This formula is intuitive. That’s because a company has to pay for all the things it owns (assets) by either borrowing money (taking on liabilities) or taking it from investors (issuing shareholder equity).

Balance sheets should also be compared with those of other businesses in the same industry since different industries have unique approaches to financing.

Special Considerations

As noted above, you can find information about assets, liabilities, and shareholder equity on a company’s balance sheet. The assets should always equal the liabilities and shareholder equity. This means that the balance sheet should always balance, hence the name. If they don’t balance, there may be some problems, including incorrect or misplaced data, inventory or exchange rate errors, or miscalculations.

Each category consists of several smaller accounts that break down the specifics of a company’s finances. These accounts vary widely by industry, and the same terms can have different implications depending on the nature of the business. But there are a few common components that investors are likely to come across.

Theresa Chiechi

Components of a Balance Sheet

Assets

Accounts within this segment are listed from top to bottom in order of their liquidity. This is the ease with which they can be converted into cash. They are divided into current assets, which can be converted to cash in one year or less; and non-current or long-term assets, which cannot.

Here is the general order of accounts within current assets:

Long-term assets include the following:

Liabilities

A liability is any money that a company owes to outside parties, from bills it has to pay to suppliers to interest on bonds issued to creditors to rent, utilities and salaries. Current liabilities are due within one year and are listed in order of their due date. Long-term liabilities, on the other hand, are due at any point after one year.

Some liabilities are considered off the balance sheet, meaning they do not appear on the balance sheet.

Shareholder Equity

Shareholder equity is the money attributable to the owners of a business or its shareholders. It is also known as net assets since it is equivalent to the total assets of a company minus its liabilities or the debt it owes to non-shareholders.

Retained earnings are the net earnings a company either reinvests in the business or uses to pay off debt. The remaining amount is distributed to shareholders in the form of dividends.

Treasury stock is the stock a company has repurchased. It can be sold at a later date to raise cash or reserved to repel a hostile takeover.

Some companies issue preferred stock, which will be listed separately from common stock under this section. Preferred stock is assigned an arbitrary par value (as is common stock, in some cases) that has no bearing on the market value of the shares. The common stock and preferred stock accounts are calculated by multiplying the par value by the number of shares issued.

Additional paid-in capital or capital surplus represents the amount shareholders have invested in excess of the common or preferred stock accounts, which are based on par value rather than market price. Shareholder equity is not directly related to a company’s market capitalization. The latter is based on the current price of a stock, while paid-in capital is the sum of the equity that has been purchased at any price.

Importance of a Balance Sheet

Regardless of the size of a company or industry in which it operates, there are many benefits of a balance sheet,

Balance sheets determine risk. This financial statement lists everything a company owns and all of its debt. A company will be able to quickly assess whether it has borrowed too much money, whether the assets it owns are not liquid enough, or whether it has enough cash on hand to meet current demands.

Balance sheets are also used to secure capital. A company usually must provide a balance sheet to a lender in order to secure a business loan. A company must also usually provide a balance sheet to private investors when attempting to secure private equity funding. In both cases, the external party wants to assess the financial health of a company, the creditworthiness of the business, and whether the company will be able to repay its short-term debts.

Managers can opt to use financial ratios to measure the liquidity, profitability, solvency, and cadence (turnover) of a company using financial ratios, and some financial ratios need numbers taken from the balance sheet. When analyzed over time or comparatively against competing companies, managers can better understand ways to improve the financial health of a company.

Last, balance sheets can lure and retain talent. Employees usually prefer knowing their jobs are secure and that the company they are working for is in good health. For public companies that must disclose their balance sheet, this requirement gives employees a chance to review how much cash the company has on hand, whether the company is making smart decisions when managing debt, and whether they feel the company’s financial health is in line with what they expect from their employer.

Limitations of a Balance Sheet

Although the balance sheet is an invaluable piece of information for investors and analysts, there are some drawbacks. Because it is static, many financial ratios draw on data included in both the balance sheet and the more dynamic income statement and statement of cash flows to paint a fuller picture of what’s going on with a company’s business. For this reason, a balance alone may not paint the full picture of a company’s financial health.

Different accounting systems and ways of dealing with depreciation and inventories will also change the figures posted to a balance sheet. Because of this, managers have some ability to game the numbers to look more favorable. Pay attention to the balance sheet’s footnotes in order to determine which systems are being used in their accounting and to look out for red flags.

Last, a balance sheet is subject to several areas of professional judgement that may materially impact the report. For example, accounts receivable must be continually assessed for impairment and adjusted to reflect potential uncollectible accounts. Without knowing which receivables a company is likely to actually receive, a company must make estimates and reflect their best guess as part of the balance sheet.

Example of a Balance Sheet

The image below is an example of a comparative balance sheet of Apple, Inc. This balance sheet compares the financial position of the company as of September 2020 to the financial position of the company from the year prior.

This balance sheet also reports Apple’s liabilities and equity, each with its own section in the lower half of the report. The liabilities section is broken out similarly as the assets section, with current liabilities and non-current liabilities reporting balances by account. The total shareholder’s equity section reports common stock value, retained earnings, and accumulated other comprehensive income. Apple’s total liabilities increased, total equity decreased, and the combination of the two reconcile to the company’s total assets.

Why Is a Balance Sheet Important?

The balance sheet is an essential tool used by executives, investors, analysts, and regulators to understand the current financial health of a business. It is generally used alongside the two other types of financial statements: the income statement and the cash flow statement.

Balance sheets allow the user to get an at-a-glance view of the assets and liabilities of the company. The balance sheet can help users answer questions such as whether the company has a positive net worth, whether it has enough cash and short-term assets to cover its obligations, and whether the company is highly indebted relative to its peers.

What Is Included in the Balance Sheet?

The balance sheet includes information about a company’s assets and liabilities. Depending on the company, this might include short-term assets, such as cash and accounts receivable, or long-term assets such as property, plant, and equipment (PP&E). Likewise, its liabilities may include short-term obligations such as accounts payable and wages payable, or long-term liabilities such as bank loans and other debt obligations.

Who Prepares the Balance Sheet?

Depending on the company, different parties may be responsible for preparing the balance sheet. For small privately-held businesses, the balance sheet might be prepared by the owner or by a company bookkeeper. For mid-size private firms, they might be prepared internally and then looked over by an external accountant.

Public companies, on the other hand, are required to obtain external audits by public accountants, and must also ensure that their books are kept to a much higher standard. The balance sheets and other financial statements of these companies must be prepared in accordance with Generally Accepted Accounting Principles (GAAP) and must be filed regularly with the Securities and Exchange Commission (SEC).

What Are the Uses of a Balance Sheet?

A balance sheet explains the financial position of a company at a specific point in time. As opposed to an income statement which reports financial information over a period of time, a balance sheet is used to determine the health of a company on a specific day.

A bank statement is often used by parties outside of a company to gauge the company’s health. Banks, lenders, and other institutions may calculate financial ratios off of the balance sheet balances to gauge how much risk a company carries, how liquid its assets are, and how likely the company will remain solvent.

A company can use its balance sheet to craft internal decisions, though the information presented is usually not as helpful as an income statement. A company may look at its balance sheet to measure risk, make sure it has enough cash on hand, and evaluate how it wants to raise more capital (through debt or equity).

What Is the Balance Sheet Formula?

A balance sheet is calculated by balancing a company’s assets with its liabilities and equity. The formula is: total assets = total liabilities + total equity.

Total assets is calculated as the sum of all short-term, long-term, and other assets. Total liabilities is calculated as the sum of all short-term, long-term and other liabilities. Total equity is calculated as the sum of net income, retained earnings, owner contributions, and share of stock issued.

Balance Sheet

Assets = Liabilities + Shareholders’ Equity

What is the Balance Sheet?

The balance sheet is one of the three fundamental financial statements and is key to both financial modeling and accounting. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. It can also be referred to as a statement of net worth or a statement of financial position. The balance sheet is based on the fundamental equation: Assets = Liabilities + Equity.

As such, the balance sheet is divided into two sides (or sections). The left side of the balance sheet outlines all of a company’s assets. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity.

T he assets and liabilities are separated into two categories: current asset/liabilities and non-current (long-term) assets/liabilities. More liquid accounts, such as Inventory, Cash, and Trades Payables, are placed in the current section before illiquid accounts (or non-current) such as Plant, Property, and Equipment (PP&E) and Long-Term Debt.

Balance Sheet Example

Below is an example of Amazon’s 2017 balance sheet taken from CFI’s Amazon Case Study Course. As you will see, it starts with current assets, then non-current assets, and total assets. Below that are liabilities and stockholders’ equity, which includes current liabilities, non-current liabilities, and finally shareholders’ equity.

View Amazon’s investor relations website to view the full balance sheet and annual report.

Download the Free Template

Enter your name and email in the form below and download the free template now! You can use the Excel file to enter the numbers for any company and gain a deeper understanding of how balance sheets work.

How the Balance Sheet is Structured

Balance sheets, like all financial statements, will have minor differences between organizations and industries. However, there are several “buckets” and line items that are almost always included in common balance sheets. We briefly go through commonly found line items under Current Assets, Long-Term Assets, Current Liabilities, Long-term Liabilities, and Equity.

Current Assets

Cash and Equivalents

The most liquid of all assets, cash, appears on the first line of the balance sheet. Cash Equivalents are also lumped under this line item and include assets that have short-term maturities under three months or assets that the company can liquidate on short notice, such as marketable securities. Companies will generally disclose what equivalents it includes in the footnotes to the balance sheet.

Accounts Receivable

This account includes the balance of all sales revenue still on credit, net of any allowances for doubtful accounts (which generates a bad debt expense). As companies recover accounts receivables, this account decreases, and cash increases by the same amount.

Inventory

Inventory includes amounts for raw materials, work-in-progress goods, and finished goods. The company uses this account when it reports sales of goods, generally under cost of goods sold in the income statement.

Non-Current Assets

Plant, Property, and Equipment (PP&E)

Property, Plant, and Equipment (also known as PP&E) capture the company’s tangible fixed assets. The line item is noted net of accumulated depreciation. Some companies will class out their PP&E by the different types of assets, such as Land, Building, and various types of Equipment. All PP&E is depreciable except for Land.

Intangible Assets

This line item includes all of the company’s intangible fixed assets, which may or may not be identifiable. Identifiable intangible assets include patents, licenses, and secret formulas. Unidentifiable intangible assets include brand and goodwill.

Current Liabilities

Accounts Payable

Accounts Payables, or AP, is the amount a company owes suppliers for items or services purchased on credit. As the company pays off its AP, it decreases along with an equal amount decrease to the cash account.

Current Debt/Notes Payable

Includes non-AP obligations that are due within one year’s time or within one operating cycle for the company (whichever is longest). Notes payable may also have a long-term version, which includes notes with a maturity of more than one year.

Current Portion of Long-Term Debt

This account may or may not be lumped together with the above account, Current Debt. While they may seem similar, the current portion of long-term debt is specifically the portion due within this year of a piece of debt that has a maturity of more than one year. For example, if a company takes on a bank loan to be paid off in 5-years, this account will include the portion of that loan due in the next year.

Non-Current Liabilities

Bonds Payable

This account includes the amortized amount of any bonds the company has issued.

Long-Term Debt

This account includes the total amount of long-term debt (excluding the current portion, if that account is present under current liabilities). This account is derived from the debt schedule, which outlines all of the company’s outstanding debt, the interest expense, and the principal repayment for every period.

Shareholders’ Equity

Share Capital

Retained Earnings

This is the total amount of net income the company decides to keep. Every period, a company may pay out dividends from its net income. Any amount remaining (or exceeding) is added to (deducted from) retained earnings.

How is the Balance Sheet used in Financial Modeling?

This statement is a great way to analyze a company’s financial position. An analyst can generally use the balance sheet to calculate a lot of financial ratios that help determine how well a company is performing, how liquid or solvent a company is, and how efficient it is.

Changes in balance sheet accounts are also used to calculate cash flow in the cash flow statement. For example, a positive change in plant, property, and equipment is equal to capital expenditure minus depreciation expense. If depreciation expense is known, capital expenditure can be calculated and included as a cash outflow under cash flow from investing in the cash flow statement.

Importance of the Balance Sheet

The balance sheet is a very important financial statement for many reasons. It can be looked at on its own and in conjunction with other statements like the income statement and cash flow statement to get a full picture of a company’s health.

Four important financial performance metrics include:

All of the above ratios and metrics are covered in detail in CFI’s Financial Analysis Course.

Video Explanation of the Balance Sheet

Below is a video that quickly covers the key concepts outlined in this guide and the main things you need to know about a balance sheet, the items that make it up, and why it matters.

As discussed in the video, the equation Assets = Liabilities + Shareholders’ Equity must always be satisfied!

Learn More About the Financial Statements

To continue learning and advancing your career as a financial analyst, these additional CFI resources will be helpful:

:max_bytes(150000):strip_icc()/Group1805-3b9f749674f0434184ef75020339bd35.jpg)

:max_bytes(150000):strip_icc()/profile-EricEstevez-4439ff1611f74bbfbabfc9fa32af2072.jpg)

:max_bytes(150000):strip_icc()/michael-logan-dfd2643b24ea4fba87ff5ed5c28bd969.jpg)

:max_bytes(150000):strip_icc()/jason_mugshot__jason_fernando-5bfc261946e0fb00260a1cea.jpg)

:max_bytes(150000):strip_icc()/JamesHeadshot-PeggyJames-9f712f1197374a9b824289fe0d5ec842.jpg)

:max_bytes(150000):strip_icc()/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)