What international financial centers can you name

What international financial centers can you name

The Top 3 Financial Centers in the World

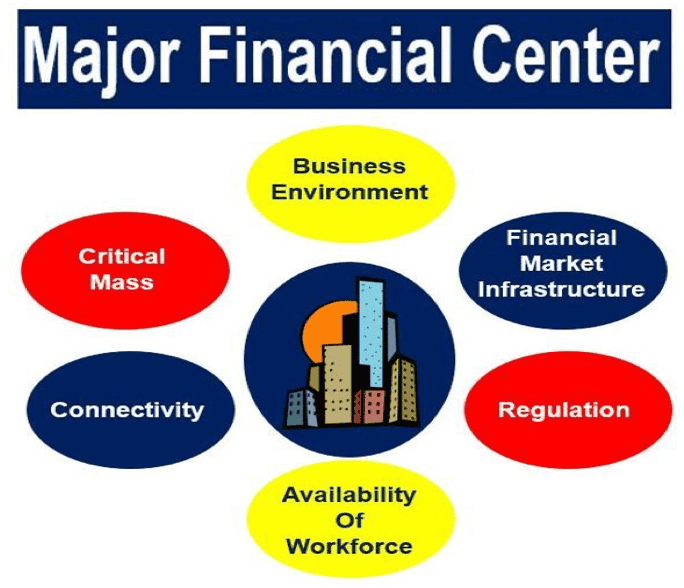

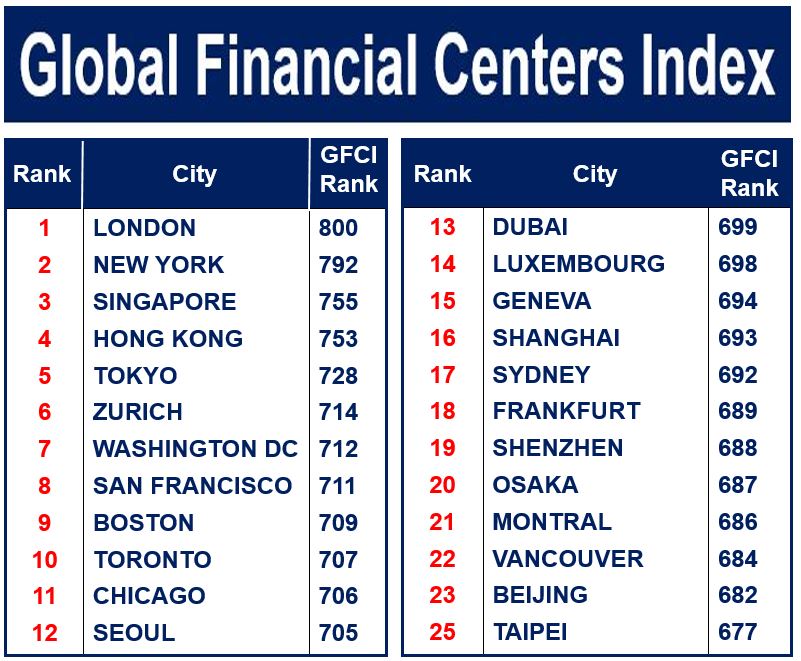

A dominant global financial center has international connectedness, diversity, and expertise in a variety of financial products and services. The Z/Yen Group, a London-based commercial think tank, publishes the Global Financial Centres Index (GFCI) every six months to provide a ranking of the world’s top financial centers according to their levels of international competitiveness.

Below is a summary of the top three, as published in the Group’s September 2020 edition. These cities were rated at the top of the rankings of 121 financial centers around the world. All were graded for their competitiveness in categories including business environment, human capital, infrastructure, financial sector development, and reputation.

Key Takeaways

3. Shanghai

Shanghai moved up to third place in the latest index, pushing Tokyo to fourth place, though the authors point out that there’s only a one-point difference in their scores.

The center of Shanghai’s financial world is the humongous Shanghai World Financial Centre, which looms over the Pudong district.

The city’s strengths include the Shanghai Gold Exchange, the world’s largest by spot gold trading volume, and the Shanghai Futures Exchange, which ranks first globally by trading volume of several futures products. It also dominates China’s interbank bond market at 87% of the balance.

Other U.S. cities in the top 20: San Francisco ranked 8th, Los Angeles 11th, Boston 15th, Washington D.C. 19th, and Chicago 20th.

2. London

London and New York regularly swap places for top and second places on this list. In the latest edition, London comes in second. London is home to the Bank of England (BoE), one of the oldest and most prestigious central banks in the world. The London Stock Exchange (LSE) is among the world’s top five stock exchanges, and the city has one of the world’s largest banking sectors.

In the GFCI financial competitiveness categories, London ranked second across the board in the competitive categories weighed for the index. They include its business environment, human capital, infrastructure, financial sector development, and reputational qualities.

Brexit is expected to continue to have a substantial impact on the business environment globally, and particularly in the United Kingdom. London could see its financial institutional density eroded as part of the eventual outcome. Many firms are choosing to relocate, or at least put down stakes in Europe, because of an uncertain future.

The number of financial centers ranked in the index.

1. New York

New York’s Wall Street continues to be synonymous with finance, so it’s no surprise that it took first place in the GFCI rankings. The city is home to the two largest stock exchanges—the New York Stock Exchange (NYSE) and the NASDAQ—based on market capitalization, and some of the world’s largest banks have their headquarters there, including JP Morgan Chase & Co. and Citigroup Inc.

New York ranked first in all of the competitive areas considered—business environment, human capital, infrastructure, financial sector development, and reputational factors.

World Financial Centers

The Specificity of Main World Financial Centers

National currency, credit and equity markets are participating in the transactions of the global financial market, which are closely intertwined with similar world markets. With that, on the basis of large national markets for international transactions, such world financial centers as New York, London, Zurich, Luxembourg, Frankfurt-am-Main, Singapore, Hong Kong, Bahamas, Panama, Bahrain have developed. The international banks, consortiums of banks, the stock exchanges are concentrated in these centers and carry out the international currency and credit transactions, as well as transactions with securities and gold.

World financial centers arise in the countries that have:

• sustainable monetary and economic situation;

• the developed credit system and a well-organized market;

• preferential currency legislation, which allows access to foreign borrowers and securities to the stock-exchange quotation;

• convenient geographical location;

• relative stability of the political regime;

• high degree of standardization and information technology paperless transactions.

The most influential world financial centers are London, New York and Tokyo [16, p. 108].

Feature of New York as a financial center is that it is only the international capital markets and the basic source of Eurodollars. The main place among components of this financial center belongs to the market of the bank credits. The international activity of large American banks is connected not only with credit transactions, but also with investment. They offer the clients various transactions with securities, place securities in primary market, operate as brokers in the secondary market.

The efficiency of the New York capital market is reached at the expense of issue of new bonds by internal financial institutions at lower price in comparison with other foreign markets.

The currency market is developed poorly, but in accordance with such indicators as «the volume of turnover», «quantity of circulating currencies» it is considered as the world largest center on trade in currency.

The important place is taken by the securities market, which connects the American financial markets with the international financial markets. On the New York Stock Exchange are turning 2768 shares of companies with a total value of 19.8 trillion doll., and the daily trading volume is around 47 billion dollars [13]. In 2012 net income of the stock exchange was 2324 million dollars, that increase of 13% compared to 2011 [13]. In this market the wide choice of financial instruments is presented: shares, bonds, shares of unit funds, depository receipts, convertible debt papers, index shares, forwards, swaps, warrants, etc.

The securities market of New York, as well as the common stock market of the USA, is attractive to investors of the whole world by lack of the taxation for nonresidents of the USA. Where the resident will pay 35%, the nonresident won’t pay anything. The most essential characteristic of the stock market is the adjusted mechanism of the regulable legislation. It is the most effective and the most rigid in the world. Investment companies and funds are constantly regulated by the organizations granting licenses. The market of gold doesn’t play a significant role.

London is a financial center of Europe. It is the greatest national financial center in the world with the equally well developed markets of the short-term credits and long-term loans, the powerful exchange, the high-organized insurance and freight business.

A characteristic feature of London is the domination of actually international components over national ones. In contrast to national ones, the foreign exchange market and the loan capitals market is a basis of its financial power. One of the features is considered the ability of banks, the exchanges, bill brokers to react quickly to any new situation and financial innovations. London as world financial center includes four markets: gold, currencies, short and medium-term crediting, insurance.

The market of gold is valid from 1919 that was a consequence of gold demonetization. Gold received property to be a mainly usual good with the price which is expressed in credit and paper money.

The London exchange market is the greatest in the world. Through its currency exchange passes 30% of all contracts with currency, and the volume of currency transactions makes about 1000 billion dollars a day.

Transformation of London into the leading world exchange market was promoted by the maximum freedom of currency transactions. Restriction of such freedom in other world financial centers didn’t allow the exchange markets to develop to competitive level.

The market of the bank credits takes a leading place in the world. In London a large number of foreign banks is located, and English banks have a wide network of the foreign branches. Thanks to concentration of large banks of the world in London, this financial center became the main one on credit operations where borrowers can receive any sums. The main borrower of the London international credit market is Great Britain. English firms and the companies receive from the American banks in London 4 times more foreign currency, than from clearing

The London stock exchange is the most international one in the world by number of the foreign companies trading on it: more than 445 international companies from 63 countries have listing in London. The exchange includes some markets: market of governmental securities, the equity market and the bond market of local firms and companies, the market of foreign securities, the market of the South African gold-mining companies, etc.

The total volume of trading with the assistance of the international companies exceeds volumes of the leading world exchanges, including the New York stock exchange. The average trading volume makes 199 thousand transactions daily, and the average day turnover reaches 22,5 billion US dollars [53].

Tokyo becomes the international financial center after 1970. The strengthening of its positions was promoted by:

• growth of issue of the government bonds that caused development of their secondary market;

• liberalization of the markets of yen and the capital that gave the chance to foreign banks and the companies on trade in securities actively to work at securities market;

• increase in foreign capital investments in Japanese bonds and shares;

• growth of openness of the monetary market. The greatest activity of foreign participants is observed in the market of on-call loans (it is the short-term commercial credit which is paid by the borrower for the first requirement of the creditor), deposit certificates and short-term commercial bills.

Tokyo is the large foreign exchange market thanks to a big daily turn of foreign currency, especially in transactions yen/dollar.

The Tokyo stock exchange is one of the greatest exchanges of the world but as the trading floor gradually loses popularity. In 2012 the total volume of transactions in the shares of the main trading floor amounted to approximately 3.6 trillion U.S. dollars. This indicator is 10% lower compared to 2011, a marked decline over the last 5 years. The result in 2012 was less than half of the maximum rate achieved in 2007. Total number of the companies registered in it doesn’t change decade. Foreign investors consider that listing rules on the exchanges too rigid and observance of rules of the publication manage expensively. As a whole the exchange carries out functions of the quotation of securities.

In Tokyo financial center authorized Japanese banks (currency banks) and foreign banks which are engaged to crediting of the industry and trade in yens and foreign currency, granting the credits to the foreign Japanese enterprises through the parent banks, the accounting of export bills, etc.

Financial centers work round the clock, directing movement of the international financial flows. Efficiency of the international currency, credit and payment transactions is provided by the Society for Worldwide Interbank Financial Telecommunications which doesn’t recognize national limits (SWIFT).

What is a financial center? Definition and meaning

A financial center is an area where there is a high concentration of financial institutions. The area may be a city, county, or somewhere larger.

Financial centers have the best commercial and communications infrastructure where people conduct huge volumes of international and domestic trading transactions. The world’s most important financial centers are New York, London, and Tokyo.

Regional and national financial centers interact with the leading centers and may function as business feeders. They may also provide them with local access.

An offshore financial center is a smaller, lower-tax jurisdiction whose clients are mainly non-residents. We also refer to them as OFCs. OFCs do not have strict rules and regulations.

The ‘Big 7’ offshore financial centers are Ireland, Hong Kong, Liberia, Singapore, Panama, Switzerland, and Lebanon.

We sometimes call financial centers financial hubs.The Financial Times’ glossary of terms defines a financial center as a “city in which a large amount of a country’s financial transactions take place, and where the main exchanges are located.”

Participants in a financial center

In a financial center, there are institutional investors including investment managers. There are also financial intermediaries such as asset management funds, brokers and banks, and central banks.

Trading takes place at special exchanges and involves clearing houses. However, many transactions take place OTC, i.e. directly between participants. OTC stands for Over The Counter.

Companies that operate in financial centers offer a wide range of financial advisory services, such as those related to M&A. M&A stands for Mergers & Acquisitions. They also offer reinsurance, private equity, and several other areas of finance.

Financial center in a changing world

The financial center league tables are likely to change significantly over the next twenty years. This is because emerging economies like China and India are growing rapidly.

With progressive globalization and the increase in online trading, the need for financial centers will probably decline.

We can do things today from anywhere in the world that we could only do through an intermediary before. In other words, we do not need middlemen as much as in the past. As long as you have an Internet connection, you can do many things on your own now.

Experts predict, however, that the world’s three main centers will probably remain important regardless of the changes.

Europe’s financial centers

In Europe, financial centers began in 11th century England at the annual fair of St. Giles. Later, the Champaign Fairs emerged in France.

The City State of Venice hosted the first proper international financial center. In fact, it started off as a tiny entity in the 9th century and gradually grew. The center reached its peak in the 14th century.

English Common Law was the first globally to attempt to enforce regulations on the dangerous practice of fractional reserve banking.

London

Silicon Valley has been the cradle of innovation for technology and electronic gadgets. Similarly, London has been the cradle of innovation for finance.

The first two banks to function in a similar way to modern banks were Barclays and the Bank of England. They have been around since 1690 and 1694 respectively.

During this time, the City of London became an important financial center. Sir Thomas Gresham founded The Royal Exchange in 1565 as a center of commerce for the City’s merchants. It subsequently gained Royal patronage in 1571.

In the 18th century, London grew rapidly. This was due to a growing national population and the early stirrings of the Industrial Revolution. The city was also the hub of the mighty British Empire.

Throughout the 19th century, London (The City) was the world’s main business center. In 2008, it came first in the Worldwide Centers of Commerce Index.

Today, the insurance industry is focused around the City’s eastern side, around Lloyd’s building. Canary Wharf, 2.5 miles (4 km) to the east hosts a secondary financial district.

London today is the world’s largest center for foreign exchange markets, derivatives markets, and money markets. It also leader in the issuance of international debt securities, trading in precious and base metals, and international bank lending.

Will BREXIT kill London’s status?

Since Britons voted for BREXIT, many fear for London’s future. BREXIT stands for BRitain EXITing the European Union. How many financial institutions will move across the channel to Paris or Frankfurt?

USA’s main financial center

During the 19th century, Philadelphia was developing rapidly. In fact, it looked like it would eventually become the USA’s major financial center.

Unfortunately for Philadelphia, national politics erased its advantage in the 1830s and 1840s. This subsequently set the stage for New York to start establishing itself.

Before the Civil War, Philadelphia was home to America’s largest banks, such as the Second Bank of the United States. It also housed The First Bank of the United States, the Bank of North America, and the Bank of Pennsylvania.

New York Stock Exchange (NYSE)

The first US stock exchange emerged in Philadelphia in 1790. In 1792, a group of New York traders met and considered setting up a security business. These twenty-four men were the founders of the New York Stock Exchange.

In 1817, the New York merchants were not happy about the state of their stock exchange. One of their members went to Philadelphia to see how trading was done there.

The merchant returned to New York and reported on what he had witnessed in Philadelphia.

Not long after, the twenty-four men established the New York Stock and Exchange Board in Wall Street.

From a troubled beginning, the NYSE turned into a Goliath of a trading area. Today, billions of dollars worth of stocks and bonds change hands in the NYSE each day.

New York City’s financial center occupies an area in the island of Manhattan, specifically around Wall Street. It is a 0.7-mile-long (1.1 km) street running eight blocks. Locals call the area the Financial District of Lower Manhattan.

Today, the term ‘Wall Street’ refers to the financial markets of the USA as a whole or the US financial sector. It also refers to the financial interests of companies with their headquarters in New York.

In other words, when somebody says Wall Street, we think of America’s financial community.

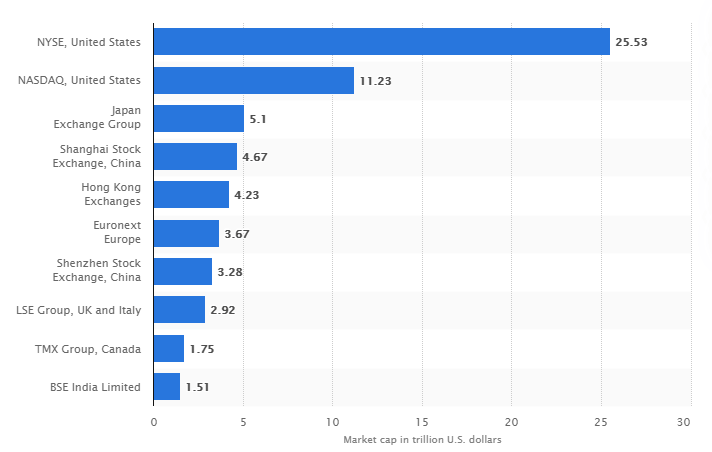

The USA is home to the two largest stock exchanges in the world by total market capitalization: 1. The New York Stock Exchange (NYSE), and 2. NASDAQ (National Association of Securities Dealers Automated Quotations).

Video – Building a modern financial center

This City of London video explains what it takes to turn a district of a city into a major financial center.

What do you need to know about the financial centres?

About the Financial Centre concept

Simply speaking, a Financial Centre (FC) is a place (a city or a business district of a city), where a big number of major financial market participants are physically concentrated. These participants are:

Sometimes, financial centres are called Financial Hubs. Examples of FC are City in London and Manhattan in New York.

Start to use ATAS absolutely free of charge! The first two weeks of use of the platform give access to its full functionality with 7-day history limit.

Financial Centre categories

There are 3 categories of FC as classified by the International Monetary Fund (IMF):

Moreover, the above mentioned three categories do not have a strict division. For example, according to the IMF, Hong Kong, Singapore and some other centres could be simultaneously classified to the 2nd and 3rd categories.

Let’s consider these categories in more detail

International Financial Centres are full range FC. International FC have:

Regional Financial Centres also perform the function of development of financial markets and respective infrastructure. At the same time, their national economies are inferior to such countries as the United States, Great Britain and China.

Financial Centre ratings

Various ratings are used to rank Financial Centres by significance. Perhaps, the Global FC Index is the most popular among them.

It is calculated every half a year with participation of 2 analytical centres:

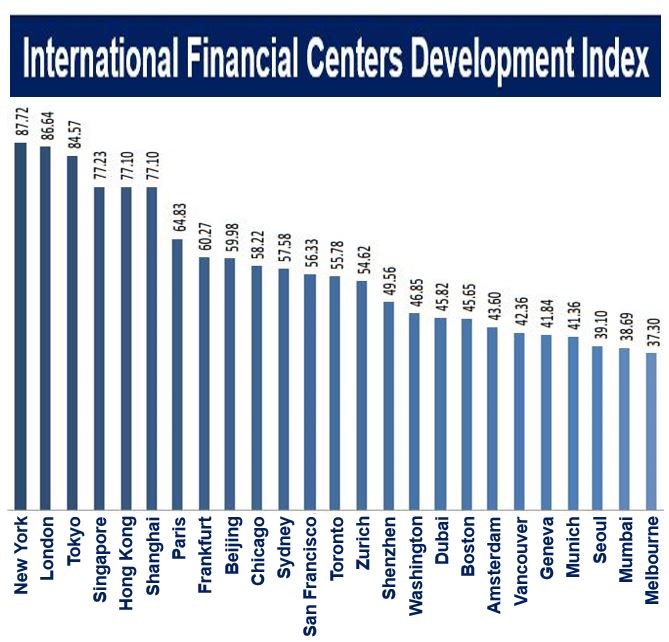

As of the second half of 2020, New York takes the leading place being a little bit ahead of London:

New York. The main financial centre of the world

According to multiple FC ratings, New York has taken the leading position for many decades.

Two world biggest exchanges are located in Manhattan:

For comparison, assess the sizes of stock exchanges by capitalization in the picture below (Statista data as of the end of 2020).

Apart from stock exchanges (more than 2 of them), headquarters of Standard & Poor’s, Moody’s Investors Service and Fitch Ratings are located in New York. These are three main agencies, which ratings exert influence on global investors.

The New York Federal Reserve Bank is also located in Manhattan. It is the largest subdivision in the Federal Reserve System structure, which regulates the United States monetary policy and, therefore, influences the whole world economy.

New York takes the leading place by concentration of the hedge fund capitals and volumes of Treasury Note trading. However, despite all its significance in the financial world, this Capital of Capital (as it is called in one Cambridge University study) is gradually losing its breakaway from the other Financial Centres.

The Asian influence is growing year after year and, according to analysis from McKinsey & Company, namely, Asia will become the centre of the new world growth. And history knows many cases when the world financial centre moved from one country to another.

History of Financial Centres

The 11th century. It is believed that primary financial centres were formed during annual fairs in Europe. For example, St. Giles’ Fair near Oxford or the Autumn Fair in Frankfurt.

So, where was the very first international financial center formed? It is accepted in the economic literature that it was the city-state of Venice, which reached the peak of its development in the 14th century. Namely in Venice (and also in Genoa) such securities as bonds, which are widely used in the modern world, were introduced into circulation.

The 17th century. Amsterdam becomes the main financial centre of the world. It held leadership for more than 100 years (this period is known as the Dutch Golden Age). Three extremely important novelties, which predetermined the whole financial development, were introduced in Amsterdam:

London replaced Amsterdam by the beginning of the 1800s. The British capital became the world centre of lending and investing. Not only the capture of colonies facilitated it but also the English contractual law, which was widely disseminated in the sphere of international finance. London law and finance institutions provided services at the international level (for example, Lloyd’s of London, which was founded in 1686 and which functions until now).

London continues to play the leading role as the International Financial Centre at the beginning of the 21st century. It is interesting that namely the capital of Great Britain has the highest positive trading balance in the sphere of financial services. The London Stock Exchange, the global gold market and bond market are located here. The national FCA (Financial Conduct Authority) regulator controls operation of about 58 thousand financial firms, which:

Specific features of Offshore Financial Centres

As of the beginning of the 21st century, the IMF distinguished 46 Offshore Financial Centres.

The International Monetary Fund underlines that Offshore FC could be established:

In 2013, the Cornell University Press published the ‘Tax Havens: How Globalization Really Works’ article (authors: Palan R., Murphy R. and Chavagneux C. ).

According to the authors, 50% of the world trans-border assets and liabilities (USD 21-32 trillion a year) pass through Offshore Financial Centres.

The article contains visualization of links between Financial Centres (mainly European ones).

Starting from 2000, the IMF, Organisation for Economic Co-operation and Development and Financial Action Task Force (FATF) have dealt with implementation of initiatives for increasing offshore transparency. This resulted in a decrease of regulatory attractiveness of OFC. Nevertheless, they are still rather active.

What do FC do?

The world Financial Centres are influential regulators of the world financial flows. However, this is not the only function of such centres. The following functions could also be underlined:

Conclusions

Financial Centres are, as a rule, cities, where banking organizations and financial institutions are concentrated. However, it is not necessary to stay close to a FC in order to be an active participant of the financial markets. Due to the modern technologies, you can speculate and invest from any place in the world where the Internet is available.

Download the ATAS software for professional exchange trading. Its advanced functionality will help you to compete in modern trading.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.

What international financial centers can you name

Center for Strategic Assessment and forecasts

Autonomous non-profit organization

The GFCI ranking is compiled by the British consulting firm Z/Yen Group, which evaluates financial centres such indicators as the business environment, the level of financial development, human capital, etc.

Below represents the top 10 international financial centres in the world.

10. Toronto

Toronto is the largest city of Canada, province of Ontario.

Financial district is located in the business district in Toronto, in the heart of the city.

The modern district is the main financial center as the capital of the province of Ontario and across Canada.

The financial district is the most densely built-up quarters employed numerous banks, headquarters of large companies, law and accounting firms, insurance companies and brokerage firms.

9. Boston

Boston is the capital and largest city of Massachusetts in USA. Boston is also the largest city of the region known as New England, and one of the oldest and richest cities in the United States.

The most important sectors of the urban economy are Finance, banking and insurance.

So, in Boston hosted the headquarters of Fidelity Investments, Sovereign Bank and State Street Corporation.

The city is also one of the largest U.S. centers of publishing activity. Here are the publishing houses, such as Houghton Mifflin Harcourt, Bedford-St. Martin’s Press and Beacon.

8. San Francisco, CA

The city’s economy grew rapidly after appeared in the South Silicon valley that requires the involvement of specialists of high class. In the valley also hosted a biotechnology and biomedical research centre.

Small companies, with fewer than 10 people, account for 85% of all businesses in the city. The number of employees in companies with a staff of more than 1 million people has been halved since 1977

7. Washington

The economy of Washington is primarily determined by employment in public administration and service delivery.

Many organizations, firms, independent contractors, nonprofit organizations, unions, trade groups have their headquarters in Washington or in its surroundings, to be «closer» to the Federal government by lobbying for their interests.

The city has industries that are not directly related to government; it applies primarily to education, Finance, public policy, and research.

6. Zurich

The financial sector is one of the most profitable sectors of the Swiss economy. 20% of jobs in the country related to Finance. In Zurich work in the financial sector are approximately 208 thousand people.

During the 2008 crisis, although the financial sector is the backbone of the entire economy of the region, happened the expected breakdown of the banks.

One of the world’s major financial centres has successfully passed all the storms of the economic crisis, advantageously distinguished from many other financial monsters.

5. Tokyo

Tokyo is not inferior to new York and London in the volume of currency-exchange operations, the number quoted on the stock exchange types of securities and the volume of sales, but it has weaknesses activities.

In Tokyo less than 100 accredited foreign banks, which is four times less than in new York and London.

4. Hong Kong

The Hong Kong, or Hong Kong — special administrative region of the people’s Republic of China, one of the leading financial centres of Asia and the world.

The territory’s economy is based on the free market, low taxation and state interference in the economy.

Hong Kong is not an offshore territory, it is a free port and does not levy customs duties on the imports, there is no value added tax or its equivalents.

Excise duties are levied only with the four types of goods irrespective of whether they are imported or locally produced. It alcoholic beverages, tobacco, mineral oil and methyl alcohol.

Hong Kong is an important centre for international Finance and trade, and the level of concentration of headquarters is the highest in the Asia-Pacific region.

Per capita gross domestic product and gross city product, Hong Kong is the richest city in China.

3. Singapore

Singapore is a highly developed country with a market economy and low taxation where an important role is played by transnational corporations. Gross national product per capita one of the highest in the world.

Singapore attractive to investors because of low tax rates. Only in Singapore 5 taxes, of which one income tax, one — on wages.

The total tax rate of 27.1%. Occupies the 5th place in the ranking of tax systems in the world.

All 4 types of imported goods are subject to taxation when imported: alcoholic beverages, tobacco products, petroleum products and cars

2. New York

New York as a financial centre is the city with the largest and most liquid stock markets of the world.

This contributes to the high confidence of investors, resulting in large volumes of foreign direct investment (FDI).

New York chose the location of their headquarters, such financial institutions as Citigroup, J. P. Morgan Chase & Co., American International Group, Goldman Sachs Group, Morgan Stanley, Merrill Lynch, etc.

In addition, the city has headquarters of many large non-financial corporations, including Verizon Communications, Pfizer, Alcoa, News Corp., Colgate-Palmolive, etc.

In the city there are such exchanges as the new York stock exchange, NASDAQ, American stock exchange, new York Mercantile exchange. New York financial industry is concentrated on wall street in lower Manhattan.

1. London

In the battle for the title of the world financial center on the first position goes to London, primarily because of more liberal legislation.

About 80% of investment banking transactions directly or indirectly pass through London, so British capital has rightfully been considered a leading financial center in the world.

Official statistics also suggests that London, apparently, is a leader in the global financial system.

It accounts for 70% of the secondary bond market and almost 50% of the derivatives market.

London is the largest centre of foreign exchange trading, and the market here is growing at 39% annually — much faster than in new York, with its 8% gain. Almost 80% of European hedge funds are managed from London.

Источники информации:

- http://ebrary.net/7297/economics/world_financial_centers

- http://marketbusinessnews.com/financial-glossary/financial-center-definition-meaning/

- http://atas.net/trading-preparation/for-beginner-traders/financial-centres/

- http://csef.ru/en/ekonomika-i-finansy/251/desyat-krupnejshih-finansovyh-czentrov-mira-6671

:max_bytes(150000):strip_icc()/resume_profile_4__matt_johnston-5bfc2627c9e77c00517ed813.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-03-23at2.04.43PM-8377f81c52324df1b62241b6fddc9d2d.png)

:max_bytes(150000):strip_icc()/_DianeCostagliola-8e8b0fa54fc946c282b909375b4184fe.jpg)