What is a cartel what do members of the cartel do

What is a cartel what do members of the cartel do

Cartel

James Chen, CMT is an expert trader, investment adviser, and global market strategist. He has authored books on technical analysis and foreign exchange trading published by John Wiley and Sons and served as a guest expert on CNBC, BloombergTV, Forbes, and Reuters among other financial media.

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

What Is a Cartel?

A cartel is an organization created from a formal agreement between a group of producers of a good or service to regulate supply in order to regulate or manipulate prices. In other words, a cartel is a collection of otherwise independent businesses or countries that act together as if they were a single producer and thus can fix prices for the goods they produce and the services they render, without competition.

Key Takeaways

Cartel

Understanding a Cartel

A cartel has less command over an industry than a monopoly—a situation where a single group or company owns all or nearly all of a given product or service’s market. Some cartels are formed to influence the price of legally traded goods and services, while others exist in illegal industries, such as the drug trade. In the United States, virtually all cartels, regardless of their line of business, are illegal by virtue of American antitrust laws.

Cartels have a negative effect on consumers because their existence results in higher prices and restricted supply. The Organization for Economic Cooperation and Development (OECD) has made the detection and prosecution of cartels one of its primary policy objectives. In doing so, it has identified four major categories that define how cartels conduct themselves: price-fixing, output restrictions, market allocation, and bid-rigging (the submission of collusive tenders).

Disadvantages of a Cartel

Cartels operate at a detriment to the consumer in that their activities aim to increase the price of a product or service over the market price. Their behavior, however, is also adversely impactful in other ways. Cartels discourage new entrants into the market, acting as a barrier to entry. Lack of competition due to price-fixing agreements lead to a lack of innovation.

In non-collusive agreements, companies would seek to improve their production or product to gain a competitive edge. In a cartel, these companies don’t have an incentive to do so.

The World’s Biggest Cartel

The Organization of Petroleum Exporting Countries (OPEC) is the world’s largest cartel. It is a group of 13 oil-producing countries whose mission is to coordinate and unify the petroleum policies of its member countries and ensure the stabilization of oil markets. OPEC’s activities are legal because U.S. foreign trade laws protect it.

Amid the controversy in the mid-2000s, concerns over retaliation and potential negative effects on U.S. businesses led to the blocking of the U.S. Congress’ attempt to penalize OPEC as an illegal cartel. Despite the fact that OPEC is considered by most to be a cartel, members of OPEC have maintained it is not a cartel at all but rather an international organization with a legal, permanent, and necessary mission.

Illegal Activities

Drug trafficking organizations, especially in South America, are often referred to as «drug cartels.» These organizations do meet the technical definition of being cartels. They are loosely affiliated groups who set rules among themselves to control the price and supply of a good, namely illegal drugs.

The best-known example of this is the Medellin Cartel, which was headed by Pablo Escobar in the 1980s until his death in 1993. The cartel famously trafficked large amounts of cocaine into the United States and was known for its violent methods.

Cartel

A cartel is an association of independent firms or individuals for the purpose of exerting some form of restrictive or monopolistic influence on the production or sale of a commodity. The most common arrangements are aimed at regulating prices or output or dividing up markets. Members of a cartel maintain their separate identities and financial independence while engaging in common policies. [1]

Contents

Properties of cartels

One criticism of cartels is that they collude with one another. Murray Rothbard criticizes these terms for being emotive. What is really occurring is cooperation. For what is the essence of a cartel action? Individual producers agree to pool their assets into a common lot, this single central organization to make the decisions on production and price policies for all the owners and then to allocate the monetary gain among them. But is this process not the same as any sort of joint partnership or the formation of a single corporation?

The main criticism of cartels seems to be their size, but as Rothbard points out, «We do not know, and economics cannot tell us, the optimum size of a firm in any given industry. The optimum size depends on the concrete technological conditions of each situation, as well as on the state of consumer demand in relation to the given supply of various factors in this and in other industries.» [2]

Restriction of production

Producers restrict production whenever they discover an inelastic demand curve, meaning they can produce less and ask for a higher price. This means that it is possible that the producer simply misidentified the proper amount of production in his initial calculations, and now the restriction is merely a correction of his miscalculations. There is nothing inherently immoral or wrong about asking for a higher price and producing less. In fact, it is what all producers engage in. Consumers have no right to a certain amount of goods, and the producer is still subject to market forces. He cannot keep raising the price without making the demand curve elastic.

The whole concept of «restricting production,» is a fallacy when applied to the free market. In the real world of scarce resources in relation to possible ends, all production involves choice and the allocation of factors to serve the most highly valued ends. In short, the production of any product is necessarily always «restricted.» Such «restriction» follows simply from the universal scarcity of factors and the diminishing marginal utility of any one product. But then it is absurd to speak of «restriction» at all. [2]

There are other reasons to restrict production may be restricted, and «withhold» goods from the market. It may be for speculative purposes. If the owner of merchandise expects that the price of his commodity will be higher in the next period than in the present, he will hold off sales, in the hope of gaining greater profit, but this will imply fewer sales right now.

An entrepreneur with low time preference is likely to «bide his time», and not allow himself to be rushed into premature sales; his optimal pattern of sales will call for «withholding» goods from the market now, and selling more and more as time goes on. He, too, benefits financially from his «withholding» pattern of exchange, for his subsequent sales are worth relatively more to him than to the high time preference person, since he discounts the future less heavily.

Conservation is yet another reason for selling less of a natural resource than might otherwise be sold. The owner who is motivated to conserve his resource will refuse to sell it all in the present period. He will «hold back» some of it. The owner does not try to maximize his sales in the present period; rather, he tries to maximize his return over the whole period during which the good is sold. He will only sell it all right away if he calculates that this is the best method of maximizing his profit. It is impossible to distinguish the conservationist motivation for withholding the sale of resources from the «monopolistic» one (if there is such a thing).

Still another alternative explanation for «monopolistic withholding» is that producers are also consumers, and may derive pleasure from less production. An owner of forests may refuse to cut them down, not out of a desire to balk the «use of a scarce resource to the fullest extent compatible with the pattern of other consumer’s tastes for wood in the market'» but because he enjoys the vista of a virgin forest. [3]

Predatory practices

It is usually not rational for a dominant firm to attempt to eliminate all of its competitors through severe price-cutting since this practice is inherently expensive and uncertain, especially if the market is easily open to new supply. Even if a dominant firm were to succeed temporarily and eliminate some of its rivals, competitors would likely return when and if prices were increased to profitable levels. How, then, are dominant firms to profit from predation and how are consumers to be injured by price reductions?

Lower prices, for whatever reason and for whatever length of time, are extremely proconsumer and are never to be regretted. Would critics of predation rather have dominant firms fix prices and not ever reduce them, or not respond to lower costs or the lower prices of rivals?

Consumers, of course, can always decide whether they prefer the lower prices of the dominant firm or not. If they prefer lower prices, then they buy more from the dominant firm; if they don’t, then they continue to support the higher-priced rivals of the dominant firm. Either way, there is nothing whatever to be regretted about lower prices either initiated by (or matched by or undercut by) dominant firms. No antitrust regulation is justified. [4]

Weaknesses of cartels

Analysis demonstrates that a cartel is an inherently unstable form of operation:

Particularly likely to be restive under the imposed joint action will be the more efficient producers, who will be eager to expand their business rather than be fettered by shackles and quotas to provide shelter for their less efficient competitors. If the cartel does not break up from within, it is even more likely to do so from without. To the extent that it has earned unusual monopoly profits, outside firms and outside producers will enter the same field of production. [2]

Examples of cartels

The SEC created in 1975 a designation for credit-raters: Nationally Recognized Statistical Rating Organization (NRSRO.) The SEC rule created a cartel of 3 firms: Standard & Poor’s Credit Market Services, Moody’s Investors Service, and Fitch, Inc. — these being the only firms that qualified for use by broker-dealers for satisfying another of the SEC’s rules on net capital. This has led to more regulation of the credit rating agencies. [9]

A commonly mentioned cartel is the Phoebus lightbulb cartel from the 1930’s. It is often used to illustrate the concept of «planned obsolescence» (intentional reduction of quality or durability).

Legal cartels

Cartels are very difficult to sustain on the market, even if they are to each firm’s advantage, unless the governments enforces the cartel. The Federal Reserve System is an example of such a cartel. [10]

cartel

Our editors will review what you’ve submitted and determine whether to revise the article.

Our editors will review what you’ve submitted and determine whether to revise the article.

cartel, association of independent firms or individuals for the purpose of exerting some form of restrictive or monopolistic influence on the production or sale of a commodity. The most common arrangements are aimed at regulating prices or output or dividing up markets. Members of a cartel maintain their separate identities and financial independence while engaging in common policies. They have a common interest in exploiting the monopoly position that the combination helps to maintain. Combinations of cartel-like form originated at least as early as the Middle Ages, and some writers claim to have found evidence of cartels even in ancient Greece and Rome.

The main justification usually advanced for the establishment of cartels is for protection from “ruinous” competition, which, it is alleged, causes the entire industry’s profits to be too low. Cartelization is said to provide for distributing fair shares of the total market among all competing firms. The most common practices employed by cartels in maintaining and enforcing their industry’s monopoly position include the fixing of prices, the allocation of sales quotas or exclusive sales territories and productive activities among members, the guarantee of minimum profit to each member, and agreements on the conditions of sale, rebates, discounts, and terms.

Cartels result in a price to the consumer higher than the competitive price. Cartels may also sustain inefficient firms in an industry and prevent the adoption of cost-saving technological advances that would result in lower prices. Though a cartel tends to establish price stability as long as it lasts, it does not typically last long. The reasons are twofold. First, whereas each member of the cartel would like the other members to keep the agreement, each member is also motivated to break the agreement, usually by cutting its price a little below the cartel’s price or by selling a much higher output. Second, even in the unlikely case that the cartel members hold to their agreement, price-cutting by new entrants or by existing firms that are not part of the cartel will undermine the cartel.

In Germany the cartel, often supported and enforced by the government, has been the most common form of monopolistic organization in modern times. German cartels are usually horizontal combinations of producers—firms that turn out competing goods. A strong impetus to form cartels came from German industry’s increasing desire to dominate foreign markets in the decade before World War I. Tariff protection kept domestic prices high, enabling the firms to sell abroad at a loss.

International cartel agreements, normally among firms enjoying monopoly positions in their own countries, were first concluded in the period between World Wars I and II. Most such cartels, especially those in which German firms were partners, were dissolved during World War II, but some continued to exist. Later, some steps were taken in the chemical and allied fields to revive some of the old cartel agreements.

Cartel: Goals, Examples, Characteristics, Effects, and Reasons for Failure

By Ahmad Nasrudin · Updated on April 9, 2022

What’s it: A cartel is a formal agreement between several parties to increase economic benefits. It can appear on both the market demand and supply sides, although the latter is more common.

Cartel objectives

A cartel is a form of anti-competitive behavior. Its purpose is to limit competition among the members. By forming a collective agreement, companies will act as one entity by creating a cooperative agreement (a monopolist or monopsonist).

The parties make a profitable agreement between them, especially regarding the determination of price, quantity, and marketing area.

Cartel examples

Cartels are common in markets for legally traded goods and services. However, we can also find it in illegal industries, such as drug cartels.

In some countries, almost all cartels are illegal. It distorts fair competition and harms others. Cartels in the supply chain hurt consumers as they will paying higher prices than they get from a competitive market.

The Organization of the Petroleum Exporting Countries (OPEC) is an example of the world’s largest cartel. Its members consist of oil-producing countries. OPEC’s mission is to coordinate and unify member countries’ petroleum policies and ensure the oil market’s stability.

Some other examples of cartels in the world are:

Cartel characteristics

Cartels are usually present in oligopoly or oligopsony markets. The few numbers of companies make it easier for companies to collude. It would be difficult or even impossible for a monopolistic or perfectly competitive market structure.

In an oligopolistic market, several producers dominate the market. Each manufacturer seeks to evaluate the competitive reaction of competitors when developing strategies and making decisions.

For example, when a company lowers prices, competitors are likely to take similar steps to maintain market share. That can lead to a price war and push market prices down further, reducing all market producers’ profits.

Such circumstances provide strong incentives for players to collude. The goal, of course, is to maximize their mutual benefits.

Cartel members generally agree to avoid various competitive practices between them, especially price reductions. They can also decide on production quotas to keep market supply low and prices high.

Cartels have less market control than monopolies. Some companies may not take part in cartel members. In contrast, the monopolist can easily manipulate because there is only a single player.

For this reason, cartel prices are generally not as high as in monopoly markets. However, it is well above the price in perfectly competitive or monopolistic competitive markets.

When did the cartels appear

In general, cartels often appear in markets where:

First, there are very few companies. Each of these companies has some market power. Such market power allows companies to do credible counterattack when competitors employ a detrimental strategy.

One example is price wars. If one company lowered its price, it would encourage competitors to take similar steps. Because they have market power, competitors are also able to retaliate even more. In the end, it leads to a price war and sends market prices down even further.

To avoid a worse situation, the players will try to collude. If they do it formally, it gives rise to a cartel.

The small number of players makes it easier for them to coordinate and come to a mutual agreement.

Second, participating companies control a large market share. It allows them to control market supply.

Third, barriers to entry are high. Apart from the increasing supply, newcomers can take advantage of the cartel without having to become members.

For example, suppose a cartel charges a high price. Newcomers are also likely to set prices at the same level and enjoy the benefits. That way, new entrants can quickly reach a strong market position and threaten the cartel.

Long story short, high entry barriers protect the monopoly power of cartels and maintain long-term profits.

Fourth, the signal and information are more abundant. Companies have complete information about their competitors’ motivations and strategies. That way, they can communicate well and induce collusion tacitly.

Fifth, market demand is inelastic. I mean, consumers are less sensitive to price changes. When a cartel charges a high price, consumers do not switch to substitute products. In this way, cartel members get high revenue from the high price.

Sixth, the product is standardized. It reduces consumer preference among members’ products. Conversely, if the products between competitors are relatively differentiated, consumers prefer products from individual members over others. That leads to a break up of the cartel.

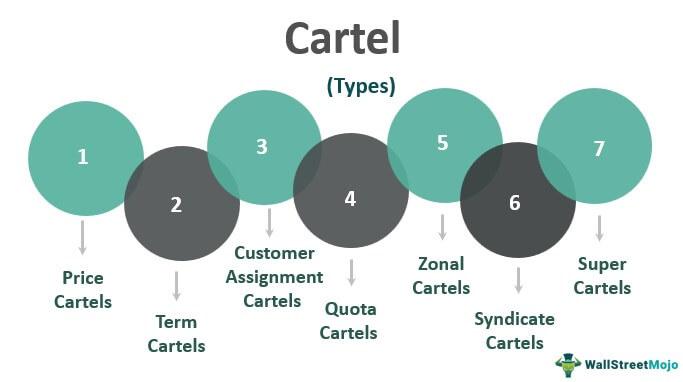

Cartel types

There are many different types of cartels. On the demand side, there is a buying cartel, in which the members consist of buyers in the market. On the other hand, there is a selling cartel with members of the sellers or producers.

Furthermore, based on the scope of operations, there are domestic cartels and international cartels.

Then, price cartels try to fix prices above competitive prices. The quota cartel distributes a proportional market share to its members.

Common sell cartels sell their joint produce through centralized sales agents. We call this type of cartel a syndicate.

The territorial cartel divides the marketing area into several parts, and each part is controlled by one member.

The standardization cartel applies common standards to the products of the members.

Finally, a hard core cartel is the most serious form of cartel under competition law. This deal cost customers a lot of money as it raised prices and restricted supply. As a result, goods and services are completely unavailable to some buyers and expensive for others.

The OECD identifies four main categories that define how cartels behave:

Cartel effects on the economy

Cartel is anti-competitive behavior and is a formal agreement of collusion. The members can make decisions together as if they were the only players in the market.

It’s an easy way to maintain profits. Competition actually produces even more significant losses. Therefore, forming a cartel is the best solution to avoid losses.

A cartel is likely to make policies to their advantage. If it appears in the supply chain, it will have monopoly power over the market’s quantity, quality, and supply. The members can agree on a high price by fixing the market supply. They can also set about product quality in the market.

Such agreements hurt the public interest and the economy. It ultimately distorts the market.

In pursuit of profit, the cartel will try to convert consumer surplus into producer profit. They can also agree on ways to build high market barriers.

Why did the cartels fail

Cartels might not last long, especially in markets with low entry barriers. Newcomers reduce the profits of the members.

Newcomers may join the cartel. But, as members increased, it made communication, negotiation, and enforcement more difficult.

The self-interest motive is also another cause of cartel failure. Indeed, members are bound by mutual agreement. However, when cartel rulings do not match its goal, a cartel member has a strong economic incentive to violate the deal.

For example, cartels set production limits. Some members can choose to increase production quietly. They can sell more to make a higher profit. During the meeting, they may report that their production levels remain as agreed.

There are other ways to break a deal. Member companies can provide better credit terms, faster delivery, or related freebies. Although prices remain in line with cartel prices, companies provide better offerings, allowing consumers to switch to them.

Furthermore, several factors that led to cartel failure were:

Government Discretionary Spending: What Is It? What are some examples?

What’s it: Government discretionary spending is an item in government spending where the allocation is at the government’s discretion and is

Leadership Style: What Is It? What are the types?

What’s it: A leadership style is a person’s approach to leadership to encourage people to move toward and achieve their goals. It is about how

What are the roles and functions of management according to Mintzberg and Fayol?

Management roles and functions are vital for a company. Managers determine not only the direction of the company but also how the company is operated.

Difference Between A Leader And A Manager, Here, The Details

The difference between a leader and a manager is in their focus. Leaders focus on creating a vision. Then, they inspire and encourage people to

Management Style: Importance, Type, When Appropriate Adopted

What’s it: Management style is a manager’s approach to managing resources to achieve goals. It includes how a manager organizes work, exercises

Government Revenue: Types and Why Does It Matter?

What’s it: Government revenue is money earned by the government for carrying out its activities. Taxes are the main source. In addition, the

Government Capital Expenditures: Examples, Why It Matters

What’s it: Government capital expenditure refers to spending to create long-term assets in the economy. An example is money spent on building

Government Current Expenditure: Example, Calculation in GDP

What’s it: Government current expenditures represent spending on day-to-day operations, including administrative activities and public services.

Cartel

Cartel Definition

A cartel is a group of producers of goods or suppliers of services formed through an agreement amongst themselves, whether or not through a formal agreement in writing, to regulate the supply of goods or services with the basic intent to control the prices illegally or to restrict competition in respect of the said goods or services. There are even some legalized cartels over the globe, such as OPEC, which regulates petrol prices.

Table of contents

Purpose

How does it Work?

Another way for consolidation is to form an undisclosed cartel to lead the industry’s prices. The members may never agree to a price reduction in their selfish interests. Instead, members usually agree to restrict the supply to maintain high prices. However, some members may cheat and supply more to fetch more margins at higher prevailing prices. The competitors who are not part of the cartel may distort the market by significantly reducing the costs for said goods. In such a case, customers may approach the new competitor.

Cartel Examples

Example #1

We can consider the example of legalized cartels famous over the globe, such as the Organisation of Petroleum Exporting Countries(OPEC). Fourteen oil-producing countries formed OPEC cartels worldwide, whose objective is to stabilize the oil market in the countries. They aim to sell oil at reasonable prices to consuming countries.

Example #2

The European Commission has imposed a whopping fine of 750 million Euros on 11-group of companies who participated in illegal cartels for gas-insulated switchgear projects. The group created public utility companies and consumers. The commission collected evidence through easily available documentation. For manipulating the tenders, the member units prepared sham bids. However, Swiss-based ABB did not attract the fine since it was the whistleblower and has supported the commission in providing sufficient evidence to unfold the cartel.

Types of Cartels

You are free to use this image on your website, templates, etc, Please provide us with an attribution link How to Provide Attribution? Article Link to be Hyperlinked

For eg:

Source: Cartel (wallstreetmojo.com)

How do Cartels Cause Inefficiencies in the Market?

One may form cartels to fix the prices, quantum, or terms of trade, allocate the trade zones, or achieve economies of scale. However, the extra revenue earned by the member is not due to additional efforts of producers or extra production supplies. Rather such agreements make the producers inefficient in the long run.

From the consumer’s perspective, they are concerned with only the prices for a specific product. Therefore, the formation of cartels affects their balanced disposable income. Since the supplies are restricted through agreement, the production capacities of large-scale producers are underutilized to the said extent. The large-scale producers may have produced more and abandoned excess production in the foreign market. However, super cartels restrict such extra export of goods in the short term.

Effects

When is it Powerful?

That is usually powerful when the country’s sovereignty is at stake. In such a situation, cartels are not questioned about the prices they charge or the production supplies. They are also powerful when one of the cartel members has complete control over the market and is dominant.

Even high entry barriers are another reason for powerful cartels. The reason is that fewer competitors drive the market prices, and it is not under the control of the demand-supply ratio.

Advantages

Disadvantages

Recommended Articles

This article has been a Guide to What is Cartel and its Definition. Here, we discuss its purpose, examples, types, how it works, advantages and disadvantages. You can learn more about it from the following articles: –

:max_bytes(150000):strip_icc()/photo__james_chen-5bfc26144cedfd0026c00af8.jpeg)

:max_bytes(150000):strip_icc()/P2-ThomasCatalano-d5607267f385443798ae950ece178afd.jpg)

:max_bytes(150000):strip_icc()/SuzannesHeadshot-3dcd99dc3f2e405e8bd37271894491ac.jpg)