What is an ipo

What is an ipo

What Is an Initial Public Offering (IPO)?

IPOs Explained in Less Than Five Minutes

An IPO, or initial public offering, refers to the process a private company participates in as it offers shares of stock to investors for the first time. When a company goes through an IPO, we often say it is “going public.”

Learn the ins and outs of the IPO process, what a company needs to do as it prepares to go public, and what IPOs mean for individual investors.

Definition and Examples of an Initial Public Offering (IPO)

When a company wishes to move from private to public ownership, it undertakes an IPO.

The IPO process allows a company to raise money to fund operations, fuel growth, and pay down debt. An IPO also gives companies the opportunity to pay back its investors, who have the option of selling their private shares into the IPO. Generally speaking, a private company with considerable growth potential will consider going public, primarily for the reasons mentioned earlier. In many ways, it’s the logical and expected next step for successful startups.

One of the more high-profile, recent examples of a company going public is the story of Airbnb, which went public in the winter of 2020. Airbnb’s IPO prospectus will serve as a guide throughout the following sections, which detail how an IPO functions and what recent public companies mean for individual investors.

How an IPO Works

To go public, a private company must register its IPO with the U.S. Securities and Exchange Commission (SEC). Companies typically use Form S-1 to register with the SEC. Within that S-1, you’ll find the company’s IPO prospectus, which spells out the details of the IPO process. It’s a crucial document investors must read when considering an investment in a newly public company.

IPO Terms and Underwriters

The S-1 lays out the terms of a company’s IPO, particularly focusing on the number of shares it will issue to the public.

As a company prepares to go public, it hires underwriters. These are the financial institutions that receive the shares of the IPO before distributing them to the public. Companies select lead underwriters, who help guide the IPO process and allocate shares. In the case of Airbnb, Morgan Stanley and Goldman Sachs were selected as its lead underwriters.

History, Story, Present Condition, and Risks

Companies use their prospectus to sell potential investors on their IPO.

As such, the company does a bit of a dance in the IPO prospectus—tooting its own horn and providing a straightforward assessment of challenges it faces and what could go wrong.

Most S-1 forms look like Airbnb’s, which begins with a look at the company’s history and how it became a viable force in its industry. From there, it outlines the climate the company operates in ahead of its IPO, along with specific financial metrics.

Form S-1 often marks the first time investors get to see details about revenue, profit, and expenses from a private company.

Here’s an example of how this looks in Airbnb’s prospectus summary:

In early 2020, as COVID-19 disrupted travel across the world, Airbnb’s business declined significantly. But within two months, our business model started to rebound even with limited international travel, demonstrating its resilience … We believe that the lines between travel and living are blurring, and the global pandemic has accelerated the ability to live anywhere. Our platform has proven adaptable to serve these new ways of traveling …

This summary is a great look at what a company must disclose in its S-1. Of course, COVID-19 became a risk for most companies, particularly Airbnb, given that it’s part of the travel industry.

How Will a Company Use the IPO Proceeds?

The S-1 also includes details on how the company plans to allocate shares to investors, as well as how the company intends to use the capital it receives after going public.

Here’s part of Airbnb’s description on how it intended to use its IPO proceeds:

We currently intend to use the net proceeds from this offering for general corporate purposes, including working capital, operating expenses, and capital expenditures. We may also use a portion of the net proceeds to acquire or make investments in businesses, products, offerings, and technologies, although we do not have agreements or commitments for any material acquisitions or investments at this time.

From there, the company provides specifics on its business model, risks it faces, and all of the key metrics it uses to assess its performance. The S-1 gives prospective investors a true look under the hood of a private company as it takes the steps to go public.

What an IPO Means for the Economy, the Consumer, and the Investor

You may have heard the phrase “hot IPO market.” Generally speaking, this means that the investing public have received companies that go public well. This can cause other private companies to take the plunge into going public. This can also indicate a potentially strong economy, if a significant swath of private companies are doing well enough to increase investors’ appetite for risk.

When an IPO does well, it’s often referred to as a “hot IPO.” This means the demand for shares paces ahead of supply, making the IPO more attractive, thus driving its initial offering price higher. Underwriters generally set aside those shares for their most valued and highest net-worth clients.

As with any investment, some IPOs do better than others. And as a consumer and individual investor, you typically have two options if you want to invest in an IPO.

If you are an underwriter or client initially involved with the IPO, the chances are high that you will have the opportunity to participate in the IPO. In this case, you will be able to purchase the shares at the offering price. However, with this option, you’re at the mercy of priority and luck to secure shares, so it’s best to not count on investing in an IPO this way.

For high-demand IPOs, there’s often a significant discrepancy between the offering price and the price the stock opens at on its first day of trading. From there, considerable volatility often follows.

The other way the individual investor can get in on an IPO is by waiting for the shares to hit the market, and purchasing in the following days after it goes public. In this case, an investor can place an order through their broker to purchase shares. However, there may also be a problem with this.

Not all IPOs perform as well as Airbnb’s did from the start. Some hit highs on the first day they go public, but only see downside from there. Simply put, IPOs can be volatile investments with a high risk level, particularly if you must wait to buy shares until they are on the public market.

Pros and Cons of IPOs for Investors

Alongside each benefit of investing in an IPO comes a downside for individual investors.

Pros Explained

Cons Explained

Tips for Investing in IPOs

Your best best is to consult a financial advisor and take a conservative approach when investing in IPOs. If you’re lucky enough to receive an allocation of shares at an IPO’s offering price, be sure to do the research and due diligence (like reading the prospectus thoroughly) before investing. Remember, an IPO can drop below its offering price after hitting the public market—its price won’t always go up.

If you plan on buying shares on IPO day or shortly after, treat your investment like any other. Ask yourself, do you believe in the company’s long-term growth prospects and potential for share price appreciation? Are you willing to ride out volatility? Are you confident enough in the company to purchase more shares when the price action sees considerable downside?

IPO — Initial Public Offering

What Is an IPO?

IPO stands for initial public offering, which refers to a listing of the company on the stock exchange for the first time, which consist of the process of offering shares of a private corporation to the public in a new stock issuance for the first time or in another word we can say first time sale of the shares by a privately owned company to the public. Initial Public Offering allows issuance helps a company to raise some amount of capital from public investors which consist of the big corporates or the retails investors (Anyone can apply for the IPO).

Generally, companies go public because of some reasons like raises the fund through IPO for their debt repayment, acquisitions, working capital, expansion of their operations and may be due to some other reasons.

The investors can easily apply for the IPO stocks by filling just the IPO Application Form, which is nowadays easily available online, one can easily apply for IPO using their net banking or stockbroker.

The necessary thing to have before applying for the IPO is

i) Demat Account

ii) Net banking (Optional)

Here, some stockbrokers like Zerodha provides the inbuilt platform for filling for IPO Application, where you have to place the bid instead of net banking.

and some brokers like Upstox, you can file for IPO using the Your DP Account number and your Client ID provided by Upstox, and just fill the form from your net banking and mention the details of DP id and Client id in the form. So, if you get the shares it will be credited to your Upstox Demat Account.

Currently, there are two application open for IPO & FPO

Exchange: BSE, NSE

Open: Jul 15, 2020

Close: Jul 17, 2020

Issue Price: 12 to 13

Issue Size (Rs Cr): 15,000.00

ii) Issuer Company: Rossari Biotech Ltd (IPO)

Exchange: BSE, NSE

Open: Jul 13, 2020

Close: Jul 15, 2020

Issue Price: 423 to 425

Open Your Demat Account Now

i) You will get Free Demat Account

ii) You will get 1 Year Free Moneycontrol Pro subscription

iii) You will get 1 Month Brokerage free trading

For more details go to the link and register now → https://bit.ly/2VFA1la

i) Pay 300 Rs. +Gst and get Demat account

ii) No other offers

For more details go to the link and register now → https://bit.ly/2WcLF7n

The above-mentioned offer for opening the Demat Account is for a limited period, So, open your account fast.

If you find some difficulty just fill this form, we are here to help you → https://bit.ly/313wcK6

Join our Telegram channel for more stay updated with offers → https://bit.ly/EGraspsKnowledge

Love, from EGrasps, we are here to help you, just fill the above form, and we will help you in opening the Demat Account.

What is an IPO? And How They Work

Dennis Hammer is a writer and finance nerd with six years of investing experience. He writes about personal finance for Wealthsimple. Dennis also manages his own investment portfolio and has funded several businesses in the past. Dennis holds a Bachelor’s degree from the University of Connecticut.

Our content is made possible by clients who pay for our smart financial services. Learn more about us here.

When a big, buzzy company has its IPO, the event can dominate financial and business news. But what is this momentous occasion? How does it affect the market? And how can you get involved?

What is an Initial Public Offering (IPO)?

An IPO is the first time a privately held company sells shares to outside investors on a stock exchange. Investors can purchase and trade those shares at will, and the company can no longer control who owns stock.

Why do companies go public? Because it allows stockholders (venture capitalists and/or longtime employees, for instance) to see a return on their investment, and because it’s a powerful way to raise money quickly. The company uses that cash to invest in development, pay off debt, or launch new products. In exchange for funding, traders like you get to own a portion of the company and sell those shares when they (hopefully) increase in value.

An IPO also represents a dramatic shift in the way the company operates. Since it’s no longer a private company, it’s obligated to publish quarterly and annual financial reports so traders know what they’re buying. The company also must give shareholders voting power on some decisions, like who sits on the board of directors.

While IPOs are attractive opportunities to buy shares of hot companies, keep in mind that many trendy IPOs lose stock value on their first day of trading. Facebook, for example, lost value immediately and took more than a year to trade above its IPO price.

How Does an IPO Work?

Acme Inc. wants to go public. They first select an investment bank to walk them through the IPO process. Applicant banks submit bids that outline how much money they’ll raise and how much they’ll charge in fees (usually three to seven percent of the IPO’s total sales price). This process begins about six months to a year before IPO day.

Ultimately, Acme decides to use Globex Bank. Globex doesn’t offer the lowest fees, but they have a reputation of raising the most capital and diversifying risk by selling to a large number of people (rather than a few big buyers).

Globex begins a process called underwriting. This process details the amount of money to be raised, the type of securities Acme will issue, and all fees. Underwriting ensures the success of the IPO. This is similar to how your mortgage bank underwrites your mortgage to make sure it’s a good deal for you and the bank.

Over the next few months, Globex pores over Acme’s financials. They look for ways to sell or write off unprofitable assets to raise the company’s worth as much as possible. Sometimes they hire new managers or directors who have experience running public companies.

Next, Globex files for an IPO with the Securities and Exchange Commission. (If Acme were a UK company, they would file with the Financial Services Authority. If they were Canadian, they would file with their provincial securities regulators.) This “S1” filing includes financial statements, outlines who owns stock before the IPO, and describes the Acme’s management, legal challenges, competition, business model, and how the company is run.

Once the security regulators approve the offering and sets a date for the IPO, Acme and Globex put on a “road show,” presenting the IPO to various interested parties around the country and possibly around the world. They present the company’s financial information and asking price to prospective buyers. Investors submit bids indicating how many shares they want. During this period, Acme also writes new contracts for vendors, completes more financial statements for regulators, and joins the stock exchange.

While meetings with investors are confidential, companies like Acme rarely keep their IPO plans secret. It’s not like massive companies appear suddenly on the stock exchange one day. In fact, it’s usually in their best interest to create as much hype and drama around the process to boost the IPO price.

Investors file their orders to occur the moment the exchange opens on IPO day. The price they pay depends on a lot of factors, like the value of the company and the condition of the market.

After IPO day comes a period of stabilization. Acme doesn’t want its stock to fall below IPO price because that would look bad. To prevent this, Acme gave Globex an overallotment option, which is the ability to sell or short up to 15% more shares than originally planned. If demand looks weak, Globex can buy back some shares at a lower price. The goal here is to reduce the supply, thus raising the demand.

About a month after IPO day, Globex files estimates of Acme’s earnings. Six months later, IPO investors are given permission to trade their shares.

When Can a Company File for an IPO?

There’s no one-size-fits-all metric that defines when a company can file for an IPO. Some companies exist for decades before filing. Others file as soon as they can.

So when does a company file for an IPO? Generally, when it reaches a size where it can no longer get funding from angel investors, venture capital, or private investors. Offering stock to the public gives them an influx of cash to fuel more growth.

But it takes time to reach this point. The company needs to establish a solid market position to attract investors and meet the securities regulators’ qualifications. Regulators want companies to go public to stimulate investment, but they don’t want volatile companies causing people to lose money.

IPOs are also opportunities for prior investors (from when the company was private) to get paid. Once the company goes public, they can sell their shares on the open market. Presumably those shares are worth more than they paid for them. So there could be significant pressure from early investors to go public quickly.

Here are some more signs that a private company is ready to file for an IPO:

The company can afford the IPO process. There are lots of expenses that need to be covered before the company collects investment from public investors.

The company has predictable revenue. The market does not like companies who miss their earnings or who can’t predict what those earnings might be.

The company has growth potential. After all, everyone wants their investment to grow.

The company has strong management with experience running public companies. Leadership quality is critical to investors.

The company has little debt. People won’t pay much for companies saddled with too much debt.

The company is a major player in its industry. Investors will scrutinize the company against its competitors.

The company has a clear five-year business plan (including financials) so investors know what’s in store.

How to Buy IPO Stock

With most stocks, you can simply place an order with your broker and collect your shares. IPO stock, however, is pre-sold to handpicked investors. Orders are already filed before the bell rings on IPO day. This means that IPO stock is inaccessible to most people without special access. There are only four methods of getting your hands on shares of that company who just filed for IPO.

1. Work with an Online Brokerage Who Receives Shares

Some online brokerages are allocated shares from an investment bank to sell to its members. But just because your brokerage has shares doesn’t mean it will sell them to you. It might sell those shares to its highest value clients. Check with your brokerage if you’re interested in a particular IPO stock.

2. Work with an Investment Bank

If you’re often interested in IPO stocks, build a relationship with an investment bank. The majority of shares they acquire will go directly to their customers.

You don’t have to work directly with the original underwriting investment bank. The big players will all get a piece of the IPO. But you’ll pay higher fees and commissions on your investments than you would with an online robo-advisor like Wealthsimple.

3. Find a Mutual Fund with IPO Shares

Some mutual funds are sold IPO stock. Even though the fund technically owns the IPO stock, you’re still invested in the company if you buy shares in that fund. The caveat here is that you’ll also be invested in everything else the fund owns.

4. Wait and Purchase IPO Stocks Like Any Other

You don’t need to own a stock as soon as it’s available. In fact, it’s often smarter to wait until the hype dies down and a stock stabilizes. When Uber went public, its shares fell 7% on the first day of trading. You would have lost money instantly if you bought IPO shares. Give the stock some time to stabilize to make sure you aren’t paying a premium.

If all this talk about IPOs has you eager to get started investing, now might be a good time to join Wealthsimple. We offer state of the art technology, low fees and the kind of personalized, friendly service you might have not thought imaginable from an automated investing service. Get started investing in a matter of minutes.

Guide to Initial Public Offerings (IPO)

Investopedia / Zoe Hansen

What Is an Initial Public Offering (IPO)?

An initial public offering (IPO) refers to the process of offering shares of a private corporation to the public in a new stock issuance for the first time. An IPO allows a company to raise equity capital from public investors.

The transition from a private to a public company can be an important time for private investors to fully realize gains from their investment as it typically includes a share premium for current private investors. Meanwhile, it also allows public investors to participate in the offering.

Key Takeaways

Initial Public Offering (IPO) Explained

How an Initial Public Offering (IPO) Works

Before an IPO, a company is considered private. As a pre-IPO private company, the business has grown with a relatively small number of shareholders including early investors like the founders, family, and friends along with professional investors such as venture capitalists or angel investors.

An IPO is a big step for a company as it provides the company with access to raising a lot of money. This gives the company a greater ability to grow and expand. The increased transparency and share listing credibility can also be a factor in helping it obtain better terms when seeking borrowed funds as well.

When a company reaches a stage in its growth process where it believes it is mature enough for the rigors of SEC regulations along with the benefits and responsibilities to public shareholders, it will begin to advertise its interest in going public.

IPO shares of a company are priced through underwriting due diligence. When a company goes public, the previously owned private share ownership converts to public ownership, and the existing private shareholders’ shares become worth the public trading price. Share underwriting can also include special provisions for private to public share ownership.

Generally, the transition from private to public is a key time for private investors to cash in and earn the returns they were expecting. Private shareholders may hold onto their shares in the public market or sell a portion or all of them for gains.

Meanwhile, the public market opens up a huge opportunity for millions of investors to buy shares in the company and contribute capital to a company’s shareholders’ equity. The public consists of any individual or institutional investor who is interested in investing in the company.

Overall, the number of shares the company sells and the price for which shares sell are the generating factors for the company’s new shareholders’ equity value. Shareholders’ equity still represents shares owned by investors when it is both private and public, but with an IPO, the shareholders’ equity increases significantly with cash from the primary issuance.

History of IPOs

The term initial public offering (IPO) has been a buzzword on Wall Street and among investors for decades. The Dutch are credited with conducting the first modern IPO by offering shares of the Dutch East India Company to the general public.

Since then, IPOs have been used as a way for companies to raise capital from public investors through the issuance of public share ownership.

Through the years, IPOs have been known for uptrends and downtrends in issuance. Individual sectors also experience uptrends and downtrends in issuance due to innovation and various other economic factors. Tech IPOs multiplied at the height of the dotcom boom as startups without revenues rushed to list themselves on the stock market.

What Is the IPO Process?

The IPO process essentially consists of two parts. The first is the pre-marketing phase of the offering, while the second is the initial public offering itself. When a company is interested in an IPO, it will advertise to underwriters by soliciting private bids or it can also make a public statement to generate interest.

The underwriters lead the IPO process and are chosen by the company. A company may choose one or several underwriters to manage different parts of the IPO process collaboratively. The underwriters are involved in every aspect of the IPO due diligence, document preparation, filing, marketing, and issuance.

Steps to an IPO

Advantages and Disadvantages of an IPO

The primary objective of an IPO is to raise capital for a business. It can also come with other advantages as well as disadvantages.

Advantages

One of the key advantages is that the company gets access to investment from the entire investing public to raise capital. This facilitates easier acquisition deals (share conversions) and increases the company’s exposure, prestige, and public image, which can help the company’s sales and profits.

Increased transparency that comes with required quarterly reporting can usually help a company receive more favorable credit borrowing terms than a private company.

Disadvantages

Companies may confront several disadvantages to going public and potentially choose alternative strategies. Some of the major disadvantages include the fact that IPOs are expensive, and the costs of maintaining a public company are ongoing and usually unrelated to the other costs of doing business.

Fluctuations in a company’s share price can be a distraction for management, which may be compensated and evaluated based on stock performance rather than real financial results. Additionally, the company becomes required to disclose financial, accounting, tax, and other business information. During these disclosures, it may have to publicly reveal secrets and business methods that could help competitors.

Rigid leadership and governance by the board of directors can make it more difficult to retain good managers willing to take risks. Remaining private is always an option. Instead of going public, companies may also solicit bids for a buyout. Additionally, there can be some alternatives that companies may explore.

Can raise additional funds in the future through secondary offerings

Attracts and retains better management and skilled employees through liquid stock equity participation (e.g., ESOPs)

IPOs can give a company a lower cost of capital for both equity and debt

Significant legal, accounting, and marketing costs arise, many of which are ongoing

Increased time, effort, and attention required of management for reporting

There is a loss of control and stronger agency problems

IPO Alternatives

Direct Listing

A direct listing is when an IPO is conducted without any underwriters. Direct listings skip the underwriting process, which means the issuer has more risk if the offering does not do well, but issuers also may benefit from a higher share price. A direct offering is usually only feasible for a company with a well-known brand and an attractive business.

Dutch Auction

In a Dutch auction, an IPO price is not set. Potential buyers can bid for the shares they want and the price they are willing to pay. The bidders who were willing to pay the highest price are then allocated the shares available.

Investing in an IPO

When a company decides to raise money via an IPO it is only after careful consideration and analysis that this particular exit strategy will maximize the returns of early investors and raise the most capital for the business. Therefore, when the IPO decision is reached, the prospects for future growth are likely to be high, and many public investors will line up to get their hands on some shares for the first time. IPOs are usually discounted to ensure sales, which makes them even more attractive, especially when they generate a lot of buyers from the primary issuance.

Initially, the price of the IPO is usually set by the underwriters through their pre-marketing process. At its core, the IPO price is based on the valuation of the company using fundamental techniques. The most common technique used is discounted cash flow, which is the net present value of the company’s expected future cash flows.

Underwriters and interested investors look at this value on a per-share basis. Other methods that may be used for setting the price include equity value, enterprise value, comparable firm adjustments, and more. The underwriters do factor in demand but they also typically discount the price to ensure success on the IPO day.

It can be quite hard to analyze the fundamentals and technicals of an IPO issuance. Investors will watch news headlines but the main source for information should be the prospectus, which is available as soon as the company files its S-1 Registration. The prospectus provides a lot of useful information. Investors should pay special attention to the management team and their commentary as well as the quality of the underwriters and the specifics of the deal. Successful IPOs will typically be supported by big investment banks that can promote a new issue well.

Overall, the road to an IPO is a very long one. As such, public investors building interest can follow developing headlines and other information along the way to help supplement their assessment of the best and potential offering price.

The pre-marketing process typically includes demand from large private accredited investors and institutional investors, which heavily influence the IPO’s trading on its opening day. Investors in the public don’t become involved until the final offering day. All investors can participate but individual investors specifically must have trading access in place. The most common way for an individual investor to get shares is to have an account with a brokerage platform that itself has received an allocation and wishes to share it with its clients.

Performance of IPOs

Several factors may affect the return from an IPO which is often closely watched by investors. Some IPOs may be overly hyped by investment banks which can lead to initial losses. However, the majority of IPOs are known for gaining in short-term trading as they become introduced to the public. There are a few key considerations for IPO performance.

Lock-Up

If you look at the charts following many IPOs, you’ll notice that after a few months the stock takes a steep downturn. This is often because of the expiration of the lock-up period. When a company goes public, the underwriters make company insiders, such as officials and employees, sign a lock-up agreement.

Lock-up agreements are legally binding contracts between the underwriters and insiders of the company, prohibiting them from selling any shares of stock for a specified period. The period can range anywhere from three to 24 months. Ninety days is the minimum period stated under Rule 144 (SEC law) but the lock-up specified by the underwriters can last much longer. The problem is, when lockups expire, all the insiders are permitted to sell their stock. The result is a rush of people trying to sell their stock to realize their profit. This excess supply can put severe downward pressure on the stock price.

Waiting Periods

Some investment banks include waiting periods in their offering terms. This sets aside some shares for purchase after a specific period. The price may increase if this allocation is bought by the underwriters and decrease if not.

Flipping

Flipping is the practice of reselling an IPO stock in the first few days to earn a quick profit. It is common when the stock is discounted and soars on its first day of trading.

Tracking IPO Stocks

Closely related to a traditional IPO is when an existing company spins off a part of the business as its standalone entity, creating tracking stocks. The rationale behind spin-offs and the creation of tracking stocks is that in some cases individual divisions of a company can be worth more separately than as a whole. For example, if a division has high growth potential but large current losses within an otherwise slowly growing company, it may be worthwhile to carve it out and keep the parent company as a large shareholder then let it raise additional capital from an IPO.

From an investor’s perspective, these can be interesting IPO opportunities. In general, a spin-off of an existing company provides investors with a lot of information about the parent company and its stake in the divesting company. More information available for potential investors is usually better than less and so savvy investors may find good opportunities from this type of scenario. Spin-offs can usually experience less initial volatility because investors have more awareness.

IPOs are known for having volatile opening day returns that can attract investors looking to benefit from the discounts involved. Over the long term, an IPO’s price will settle into a steady value, which can be followed by traditional stock price metrics like moving averages. Investors who like the IPO opportunity but may not want to take the individual stock risk may look into managed funds focused on IPO universes. But also look out for so-called hot IPOs that could be more hype than anything else.

What Is the Purpose of an Initial Public Offering?

An IPO is essentially a fundraising method used by large companies, in which the company sells its shares to the public for the first time. Following an IPO, the company’s shares are traded on a stock exchange. Some of the main motivations for undertaking an IPO include: raising capital from the sale of the shares, providing liquidity to company founders and early investors, and taking advantage of a higher valuation.

Can Anybody Invest in an IPO?

Oftentimes, there will be more demand than supply for a new IPO. For this reason, there is no guarantee that all investors interested in an IPO will be able to purchase shares. Those interested in participating in an IPO may be able to do so through their brokerage firm, although access to an IPO can sometimes be limited to a firm’s larger clients. Another option is to invest through a mutual fund or another investment vehicle that focuses on IPOs.

Is an IPO a Good Investment?

IPOs tend to garner a lot of media attention, some of which is deliberately cultivated by the company going public. Generally speaking, IPOs are popular among investors because they tend to produce volatile price movements on the day of the IPO and shortly thereafter. This can occasionally produce large gains, although it can also produce large losses. Ultimately, investors should judge each IPO according to the prospectus of the company going public as well as their financial circumstances and risk tolerance.

How Is an IPO Priced?

When a company goes IPO, it needs to list an initial value for its new shares. This is done by the underwriting banks that will market the deal. In large part, the value of the company is established by the company’s fundamentals and growth prospects. Because IPOs may be from relatively newer companies, they may not yet have a proven track record of profitability. Instead, comparables may be used. However, supply and demand for the IPO shares will also play a role on the days leading up to the IPO.

Что такое IPO и зачем это нужно

В сети можно часто встретить истории о том, как компании вышли на биржу и провели IPO, по итогам которых основатели бизнеса стали миллиардерами. Тем не менее, не все знают о том, какой объём работы стоит за этим процессом перехода компании от частной к публичной. Сегодня мы рассмотрим этот процесс по шагам.

Что такое IPO

Когда компания хочет предложить свои акции широкой общественности, она проводит IPO(Initial Public Offering – IPO). Соответственно, статус организации меняется — вместо частной (акционером не может стать любой желающий) она становится публичной (акционером может стать любой желающий).

У частных компаний могут быть акционеры, но их не так много, и такие компании сталкиваются с требованиями регулирующих органов, отличных от тех, которые предъявляются к публичным. Процесс подготовки первичного размещения акций IPO) занимает от нескольких месяцев до года и стоит компании довольно существенных средств.

Подробнее об организации IPO на Московской бирже читайте здесь.

Зачем компании проводят IPO

Все дело в деньгах — компания хочет привлечь средства. После получения эти деньги могут использоваться для развития бизнеса или, к примеру, реинвестиций в инфраструктуру.

Первые шаги при подготовке к IPO

Компания, которая собралась на биржу, нанимает инвестиционный банк (или несколько банков), которые будут заниматься процессом организации IPO. Теоритически, возможно организовать торговлю своими акциями и самостоятельно, но на практике так никто не поступает. Банки, занимающиеся организацией IPO, называются андеррайтерами.

После того, как банк нанят — например, Goldman Sachs или Morgan Stanley — между их представителями и руководством компании проходят переговоры, в ходе которых определяется цена акций, предлагаемых для покупки, их тип, и общая сумма средств, которые планируется привлечь.

После того, как подписано соглашение между компанией и андеррайтером, последний подает инвестиционный меморандум в регулирующий орган конкретной страны. В США — это Комиссия по ценным бумагам (SEC), а в России – Банк России. В этом документе содержится подробная информация о предложении и компании — финансовая отчетность, биографии руководства, перечисляются существующие юридические проблемы организации, цель привлечения средств и раскрывается список текущих акционеров компании. Затем регулирующий орган проверяет представленную информацию, и, в случае необходимости, запрашивает дополнительные данные. Если вся информация корректна, то назначается дата IPO, а андеррайтер готовит все финансовые данные компании.

В чем интерес андеррайтеров

Инвестиционные банки вкладывают свои средства в организацию IPO и «покупают» акции компании, до того, как они окончательно попадут в листинг биржи. Банки зарабатывают на разнице между ценой акций, которую они уплатили до IPO, и той ценой, которая устанавливается на момент старта торгов. Когда на IPO выходит перспективная компания, конкуренция банков за право стать андеррайтором её IPO может быть очень серьезной.

Для привлечения интереса к IPO андеррайтеры часто проводят рекламную кампанию (Road Show), в ходе которой представляют собранную ранее информацию о финансовых показателях компании перспективным инвесторам, иногда даже в разных частях света. Обычно Road Show устраивается для крупных инвесторов. Часто таким инвесторам предлагают купить акции до начала официальных торгов — этот процесс называется allocation.

Цена акций, биржа

При приближении даты IPO, андеррайтер и компания, выходящая на биржу, договариваются о цене акций. Цифра может зависеть от множества факторов: перспективности самой компании, результатов Road Show и текущей рыночной ситуации.

Аналогично с андеррайтерами, за размещение крупных и перспективных компаний конкурируют и биржи, для которых появление такой компании в листинге означает повышение общей ликвидности и объёмов торгов. Также играет свою роль и престиж. В случае такой популярной компании, представители бирж выступают перед её руководством, объясняя плюсы размещения акций на своей площадке.

Покупка акций при IPO

Частные инвесторы никак не могут купить акции компании до официального старта торгов. Часто в первые дни торгов акции новых компаний подвержены сильным колебаниям, поэтому обычно аналитики советуют не торопиться с совершением сделок, а выждать пока цена установится на более или менее стабильном уровне.

Почему российские компании проводят IPO за границей

В последнее время российские компании стали проявлять определенную активность и на Московской бирже («Яндекс» провел дополнительное размещение акций, а «Дождь», «Большой город» и Slon.ru планируют объединиться в холдинг и осуществить IPO). Тем не менее, большая часть биржевой активности российских компаний происходит за рубежом.

Вот что на этот счет думает главный экономист ITinvest Сергей Егишянц:

Всё очевидно: капиталы на Западе — поэтому там и размещают свои ценные бумаги компании со всего мира, в том числе российские. В последнее время набирают популярность IPO в КНР — потому что местный рынок капитала тоже раздулся до изрядных масштабов, поэтому привлечь китайские деньги стремятся многие.

На российские площадки западные и восточные инвесторы не спешат — по многим причинам (защита прав собственности не вызывает энтузиазма, ёмкость рынка на порядки меньше и т.п.). Теоретически, конечно, и в России капиталов немало, но это только если смотреть формально: ясно же, что большая часть свободных (!) активов, которыми владеют крупные бизнесмены и некоторые политики, размещена отнюдь не на счетах в Сбербанке, а в западных офшорах, фондах и банках. В подобных условиях поведение российских фирм, ищущих размещения на Западе, вполне естественно.

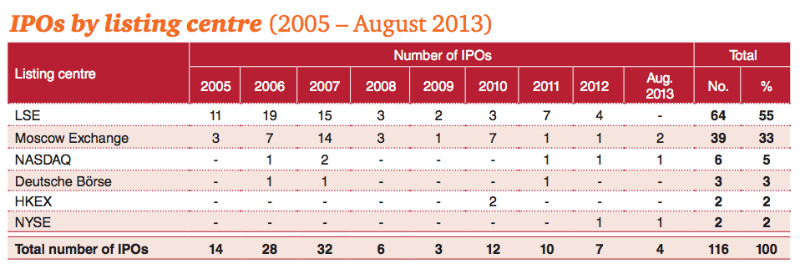

IPO российсих компаний в 2005-2013 гг. Источник данных: PWC

Плюсы и минусы проведения IPO

Сам факт проведения IPO для компании обычно позитивен, ведь это означает, что она достаточно выросла, чтобы претендовать на привлечение капитала подобным способом — к нему прибегают только тогда, когда нужно действительно много денег на масштабное расширение. Кроме того, публичные компании привлекают куда больше внимания, что облегчает им найм персонала и процесс маркетинга.

Среди недостатков IPO можно отметить усиливающее после выхода на биржу внимание к компании со стороны регулирующих органов — существует большое количество требований как государства, так и самих биржевых площадок, которые компании, торгующиеся на них, должны исполнять. В частности это касается выпуска финансовой отчетности. Кроме того, основатели компании не всегда могут после IPO сразу продать свои акции и стать миллионерами, поскольку это может снизить их курс и капитализацию бизнеса.

:max_bytes(150000):strip_icc()/Dr.JeFredaR.Brownheadshot-JeFredaBrown-d3030528e27543ac8056ff2c138d109d.jpg)

:max_bytes(150000):strip_icc()/jason_mugshot__jason_fernando-5bfc261946e0fb00260a1cea.jpg)

:max_bytes(150000):strip_icc()/mansaPicture_08T-Copy-JuliusMansa-127908fd255745b5886a16fced0cdb7b.jpg)

:max_bytes(150000):strip_icc()/SuzannesHeadshot-3dcd99dc3f2e405e8bd37271894491ac.jpg)

:max_bytes(150000):strip_icc()/IPO-final-0a0a9ea9c5be4c1082332426db768005.png)