What is decentralized finance

What is decentralized finance

What is Decentralized Finance or DeFi Explained

Applications, Advantages & Challenges

Blockchain has gained momentum over the past few years, and industries from every sector are keen on implementing blockchain technology to develop protocols, applications and benefit from its decentralized and distributed structure. The financial industry is no different and is looking for technologies that provide security and convenience.

Therefore, the use of crypto assets has been increased as an individual from anywhere can access their purchases, make payments and benefit from other advantages as well. Decentralized Finance (DeFi) is the new path used to manage and monitor finances in a decentralized environment with no interference from an intermediary.

With crypto being used in various industries and proving to be a benefit for them, it can be expected that the majority of financial services will look forward to implementing DeFi in their infrastructure. It can bring revolution in the insurance industry due to its applications in lending and borrowing activities.

What Is Decentralized Finance?

Decentralized Finance (DeFi) refers to the financial transactions that eradicate intermediaries between participants. It uses cryptocurrency and blockchain technology to eliminate central authorities and provide peer-to-peer facilities to carry out financial services such as banking, loans, mortgages, and more. The primary purpose here is to establish an open-source, transparent, and permissionless ecosystem without any central authority owning the power over financial transactions. It allows participants to control their assets, efficiently conduct peer-to-peer exchanges and build decentralized applications (dApps).

Once a transaction is carried out in a traditional banking system, its details are recorded in a private ledger owned and monitored by a financial institution. However, in DeFi, the financial transactions are stored in a computer code on a decentralized public ledger. All participants using DeFi applications and platforms have an identical copy of the general ledger.

This ledger holds the information of every transaction in encryption code. Since decentralized blockchain platforms and applications are immutable, the records of ownership cannot be modified or deleted by a third party providing security in verifying transactions and storing their data.

Decentralized Finance works on the traditional financial system and replaces the intermediaries or central authorities with smart contracts. A smart contract is an automated merger, enforces agreements without intermediary involvement, and is easily accessible by anyone with an established internet connection. Most of the protocols work on the Ethereum blockchain, and the decentralized applications are often created using Ethereum.

Applications of DeFi

Some of the applications of decentralized finance are:

1. Decentralized Exchanges (DeX)

Decentralized Exchanges (DeX) allow participants to exchange tokens with other assets in their possession without a need of a custodian. It will enable them to transact peer-to-peer and monitor their funds.

It reduces the risk of theft as crypto assets are not in the exchange custody itself. Some DeX includes Uniwasp, Curve, SushiSwap, AirSwap, etc.

2. Lending and Borrowing platforms

The lending and borrowing protocols are some of the widely used applications in the DeFi ecosystem. Decentralized lending platforms offer loans to businesses or individuals without any involvement of an intermediary. The lending protocols also help individuals to earn interest in their supplied cryptocurrencies and stablecoins.

The lending and borrowing platforms use smart contracts to eliminate intermediaries such as banks, financial institutions, etc., creating an ecosystem where borrowers and lenders can participate in open infrastructure. It assists borrowers by offering them liquidity without selling off their possessed assets and providing lenders the chance to earn interest by loaning crypto assets.

3. Payments

One of the primary applications of DeFi is for making payments and other banking services. The payments will create payments and banking systems to eliminate the third party, and therefore, individuals can directly transfer their cryptocurrency through a secured channel. With DeFi, faster payments and processes can be ensured. It helps large financial institutions streamline market infrastructure and serve wholesale and retail customers in a disciplined manner. It also assists in reaching out to people in a systematic way.

4. Predicting Market

Blockchain-based prediction marketplaces allow users to vote, trade, or bet on the outcomes of future events. DeFi prediction markets combine the knowledge of a particular event through various oracles. These markets have smart contracts that decide how much the individuals will get paid if a specific event occurs. The platforms operate similarly to the traditional prediction markets without an intermediary.

Examples of the DeFi prediction market are Augur, Gnosis, and FTX.

Advantages of DeFi

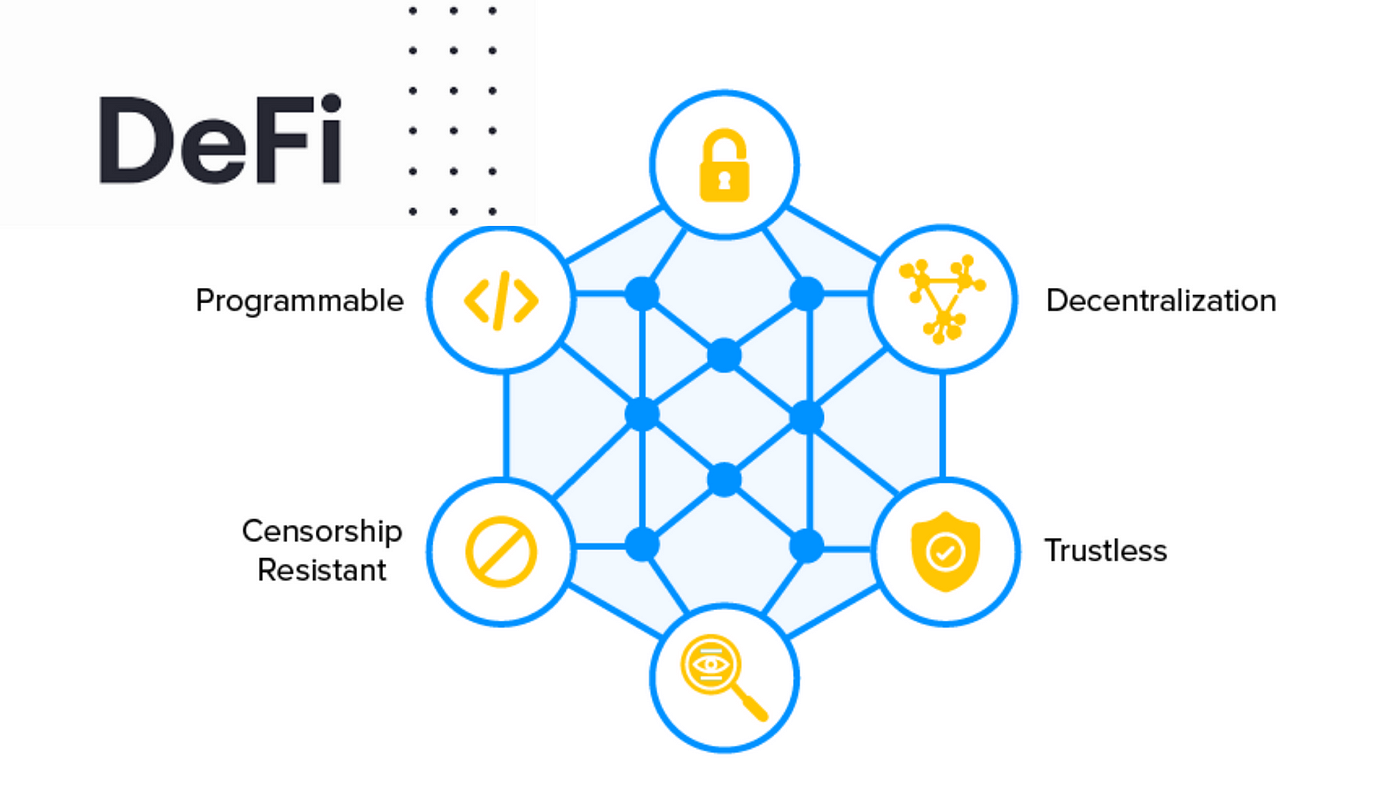

1. Programmability

New financial instruments and digital assets can be built rapidly by taking advantage of the highly programmable smart contracts and their automated execution, which helps run everything smoothly.

2. Immutability

Blockchain’s decentralized nature offers immutability. It indicates that a record, once stored, cannot be modified or deleted through any form. Therefore, decentralized finance is built on the exact nature and provides increased security and audit precision.

3. Interoperability

New DeFi applications or products can be built or modified by combining the existing product with another DeFi product. Developers have the flexibility to create new products on top of existing protocols, customize the user interface and integrate third-party applications. Therefore, DeFi products are often referred to as ‘Money Legos.’

4. Transparency

Public Ethereum blockchain allows every individual participant to broadcast and verify transactions on the network. It boosts qualitative data analysis and ensures that every user can access the network’s activities. DeFi protocols are built with open-source code, allowing individuals to read, modify and use the code to make other DeFi products.

5.Permissionless

Every individual is allowed to use DeFi applications and products as well as build them without any restrictions. It also enables users to direct smart contract contracts through their crypto wallets without any minimum amount of resources.

Challenges Faced While Using DeFi

1. Data feed centralization

Blockchain protocols cannot access off-chain data records or information. Many blockchain technologies use third-party services that allow access to external information.

They work as bridges between blockchains and outside information. The central point of trust in a decentralized infrastructure proves to be the vulnerability for a smart contract. If an external third-party feed corrupted information, then it would disrupt the DeFi protocols.

2. Security risks with smart contracts

As smart contracts form the fundamental backbone of any DeFi protocol or application, the security risk related to them can disrupt the entire application or protocol. Smart contracts are open-source, enabling users and programmers to review them before investing in the DeFi protocol.

They tend to miss flaws in the smart contracts, which raises the threat of a cyberattack. Therefore, developers must ensure their smart contracts go through various audit levels.

Conclusion

In a nutshell, we can say that decentralized finance can prove to be the next big thing in the technology world since it provides advantages to all the sectors looking for a secured financial infrastructure. With blockchain technology as its backbone, DeFi has a high probability of getting incorporated by various organizations.

What is decentralized finance (DeFi)?

Last edited May 2021 — 3 min read

Decentralized finance is quickly rising as a more secure, more transparent, and more efficient alternative to traditional financial services. By eliminating the need for centralized financial institutions, we create a more open and trustworthy financial system, and one that’s far more accessible.

Secured by blockchain technology, decentralized finance will reduce the risks of fraud, corruption and mismanagement of your assets. It will also make managing finance far more cost-effective and efficient, with no more overdraft fees, no costs for wire transfers, and no waiting on banking hours for a transaction to be verified.

Understanding decentralized finance

The term decentralized finance, or DeFi for short, describes a financial system that operates without the need for traditional, centralized intermediaries. We’re used to everything going through a bank and other financial institutions like a global exchange, but DeFi creates a system that can function on its own.

Perhaps the most well-known application of decentralized finance is online transactions through DeFi cryptocurrency, but decentralized finance allows us to handle a number of financial applications – like investing, insurances, exchanging, borrowing, and lending in a more efficient and transparent way.

How does decentralized finance work?

There are two core components that allow a finance system to work; it needs an infrastructure to operate on, and a currency to operate with. In a centralized system, banks and financial institutions act as that infrastructure, while fiat money, like the US dollar, acts as currency. Decentralized finance must replace these components in order to offer a full range of financial services.

Infrastructure

Users can build decentralized apps on Ethereum to establish any financial service, and allow smart contracts to manage those services autonomously.

Currency

In order to create a reliable, secure decentralized finance system, you need a stable currency. Bitcoin is not compatible with the Ethereum platform, and Ether – Ethereum’s own programmable cryptocurrency – is highly volatile.

Decentralized financial services

The benefits of a decentralized finance system stretch beyond online payments. Money transfer is just one aspect of the traditionally centralized financial system, but decentralized finance looks to replace every aspect, including exchanges, loans, insurance, and saving plans.

Smart contracts on Ethereum are what allow these decentralized services to exist, and what allow them to operate fairly and securely.

Below are some of the financial services already supported by Ethereum:

Decentralized borrowing and lending

You could, through decentralized finance, secure a loan in a matter of minutes, without having to go through a complicated or restrictive application process.

Compound is an Ethereum-based app that facilitates decentralized, peer-to-peer borrowing and lending. Compound automatically connects lenders with borrowers, and autonomously manages loans using smart contracts. This has led to a rise in popularity of what is known as ‘yield farming’, as anyone is able to lend their crypto assets and earn interest in the process.

You can also use Compound to deposit your cryptocurrency as collateral and borrow fiat money against it.

Decentralized exchange

The decentralized exchange (DEX) allows us to buy, sell, and trade cryptocurrencies on the Ethereum platform, without having to go through an exchange operator; without the need for sign-ups or ID verification; and without any fees for withdrawing funds. Furthermore, exchanging with DEX doesn’t require any initial deposit, unlike centralized exchanges.

Trades are executed autonomously, with the terms and process guided by smart contracts.

Decentralized insurance

Smart contracts in the decentralized finance system make peer-to-peer, decentralized insurance possible too. In a decentralized finance system, you can connect with anyone around the world who is willing to insure your assets, and on the other end, you can insure other people’s assets at a premium, without ever having to go through an insurance company or agent. Everything happens autonomously, with smart contracts ensuring a fair, secure, and trustworthy process.

We can help

Over 70,000 businesses use GoCardless to get paid on time. Learn more about how you can improve payment processing at your business today.

Decentralized Finance (DeFi) Definition

Investopedia / Joules Garcia

What Is Decentralized Finance (DeFi)?

Decentralized finance (DeFi) is an emerging financial technology based on secure distributed ledgers similar to those used by cryptocurrencies. The system removes the control banks and institutions have on money, financial products, and financial services.

Some of the key attractions of DeFi for many consumers are:

Key Takeaways

Click Play to Learn What Decentralized Finance (DeFi) Is

Understanding Decentralized Finance (DeFi)

To understand decentralized finance and how it works, it helps to understand how centralized finance differs from DeFi.

Centralized Finance

In centralized finance, your money is held by banks, corporations whose overarching goal is to make money. The financial system is full of third parties who facilitate money movement between parties, with each one charging fees for using their services. For example, say you purchase a gallon of milk using your credit card. The charge goes from the merchant to an acquiring bank, which forwards the card details to the credit card network.

The network clears the charge and requests a payment from your bank. Your bank approves the charge and sends the approval to the network, through the acquiring bank, back to the merchant. Each entity in the chain receives payment for its services, generally because merchants must pay for your ability to use credit and debit cards.

All other financial transactions cost money; loan applications can take days to be approved; you might not even be able to use a bank’s services if you’re traveling.

Two of DeFi’s goals are to reduce transaction times and increase access to financial services.

Decentralized Finance

Decentralized finance eliminates intermediaries by allowing people, merchants, and businesses to conduct financial transactions through emerging technology. This is accomplished through peer-to-peer financial networks that use security protocols, connectivity, software, and hardware advancements.

From anywhere you have an internet connection, you can lend, trade, and borrow using software that records and verifies financial actions in distributed financial databases. A distributed database is accessible across various locations; it collects and aggregates data from all users and uses a consensus mechanism to verify it.

Decentralized finance uses this technology to eliminate centralized finance models by enabling anyone to use financial services anywhere regardless of who or where they are.

DeFi applications give users more control over their money through personal wallets and trading services that cater to individuals.

While taking control away from third parties, decentralized finance does not provide anonymity. Your transactions may not have your name, but they are traceable by the entities that have access. These entities might be governments, law enforcement, or other entities that exist to protect people’s financial interests.

How Does DeFi Work?

Decentralized finance uses the blockchain technology that cryptocurrencies use. A blockchain is a distributed and secured database or ledger. Applications called dApps are used to handle transactions and run the blockchain.

In the blockchain, transactions are recorded in blocks and then verified by other users. If these verifiers agree on a transaction, the block is closed and encrypted; another block is created that has information about the previous block within it.

The blocks are «chained» together through the information in each proceeding block, giving it the name blockchain. Information in previous blocks cannot be changed without affecting the following blocks, so there is no way to alter a blockchain. This concept, along with other security protocols, provides the secure nature of a blockchain.

DeFi Financial Products

Peer-to-peer (P2P) financial transactions are one of the core premises behind DeFi. A P2P DeFi transaction is where two parties agree to exchange cryptocurrency for goods or services without a third party involved.

To fully understand this, consider how you get a loan in centralized finance. You’d need to go to your bank or another lender and apply for one. If you were approved, you’d pay interest and service fees for the privilege of using that lender’s services.

Peer-to-peer lending under DeFi doesn’t mean there won’t be any interest and fees. However, it does mean that you’ll have many more options since the lender can be anywhere in the world.

In DeFi, you’d use your decentralized finance application (dApp) to enter your loan needs, and an algorithm would match you up with peers that meet your needs. You’d then need to agree to one of the lender’s terms and receive your loan.

The transaction is recorded in the blockchain; you receive your loan after the consensus mechanism verifies it. Then, the lender can begin collecting payments from you at the agreed-upon intervals. When you make a payment via your dApp, it follows the same process in the blockchain; then, the funds are transferred to the lender.

DeFi Currency

DeFi is designed to use cryptocurrency for transactions. The technology is still developing, so it is difficult to determine precisely how existing cryptocurrencies will be implemented, if at all. Much of the concept revolves around stablecoin, a cryptocurrency backed by an entity or pegged to fiat currency like the dollar.

The Future of DeFi

Decentralized finance is still in the beginning stages of its evolution. For starters, it is unregulated, which means the ecosystem is still riddled with infrastructural mishaps, hacks, and scams.

Current laws were crafted based on the idea of separate financial jurisdictions, each with its own set of laws and rules. DeFi’s borderless transaction ability presents essential questions for this type of regulation. For example, who is responsible for investigating a financial crime that occurs across borders, protocols, and DeFi apps? Who would enforce the regulations, and how would they enforce them?

The decentralized finance ecosystem’s open and distributed nature might also pose problems to existing financial regulation.

Other concerns are system stability, energy requirements, carbon footprint, system upgrades, system maintenance, and hardware failures.

Many questions must be answered and advancements made before DeFi becomes safe to use. Financial institutions are not going to let go of one of their primary means of making money—if DeFi succeeds, it’s more than likely that banks and corporations will find ways to get into the system; if not to control how you access your money, then at least to make money from the system.

What Does Decentralized Finance Do?

The goal of DeFi is to get rid of the third parties that are involved in all financial transactions.

Is Bitcoin a Decentralized Finance?

Bitcoin is a cryptocurrency. DeFi is being designed to use cryptocurrency in its ecosystem, so Bitcoin isn’t DeFi as much as it is a part of it.

What Is Total Value Locked in DeFi?

Total value locked (TVL) is the sum of all cryptocurrencies staked, loaned, deposited in a pool, or used for other financial actions across all of DeFi. It can also represent the sum of specific cryptocurrencies used for financial activities, such as ether or bitcoin.

Investing in cryptocurrencies and other Initial Coin Offerings (“ICOs”) is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Since each individual’s situation is unique, a qualified professional should always be consulted before making any financial decisions. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein.

Decentralized Finance For Absolute Beginners

What Is Defi and How Does It Work?

Defi In Short:

In layman terms :

Defi is nothing but the amalgamation of traditional banking services with blockchain technology

Defi comprises of various financial instruments like

A smart contract is a type of Ethereum account that can hold funds and can send/refund them based on certain rules. No one can alter that smart contract when it’s live — it will always run as programmed.

These smart contracts are public and open to be audited, which ensures that any bad contracts can be easily identified by the community and can be scrutinised.

The DefI ecosystem does have a decentralized community of technical members, for example Ethereum blockchain network over which DefI’s are hosted has the Ethereum community who can read code.

This open-source based community helps keep developers in check, but this need will diminish over time as smart contracts become easier to read and other ways to prove trustworthiness of code are developed.

Now that we have some basic understanding how Defi functions it is imperative to understand what actually makes DefI stand out. IT is their projects or to say their DefI protocols which makes it unique as a fintech platform. To further understand the DefI working mechanism let’s discuss few of the DefI project

DefI Protocols Worth Understanding

Defi systems can be categorized into following :

These lending Defi protocols allows user to borrow cryptocurrency as a loan depending upon the user repaying capacity, apart from lending user can simply lock their cryptos to Defi exchanges or Centralized crypto exchanges to earn some passive income

To Learn more about Crypto lending : like Staking & Yield Farming

A Beginner’s Guide to Decentralized Finance (DeFi)

TL;DR

DeFi lets users access crypto financial services with just no more than a wallet with some crypto. A range of DApps facilitates lending, liquidity provision, swaps, staking, and more across many blockchains.

While Ethereum was DeFi’s original home, most blockchains with smart contract capabilities now host DeFi DApps. Smart contracts are essential to the services DeFi offers, which include staking, investing, lending, harvesting, and more.

So far, DeFi has allowed people to optimize their yield, join decentralized marketplaces, access banking services, and engage in quick borrowing and lending. However, DeFi isn’t without its risks, and you should always research any project carefully before taking risks.

Introduction

Entering the DeFi world can be exciting to many but confusing as well. After some time HODLing, it’s common to wonder how you can squeeze some extra gains out of your portfolio. However, there’s a lot to unpack when it comes to DeFi.

When used responsibly, DeFi DApps and projects can become powerful tools. But if you jump in too soon, it’s easy to become overwhelmed and make unwise investment decisions. The best way to get involved is to learn the risks and find what’s suitable for you. With this in mind, let’s explore the basics you’ll need when starting your DeFi journey.

What is Decentralized Finance (DeFi)?

What are the main advantages of DeFi?

Traditional finance relies on institutions such as banks to act as intermediaries and courts to provide arbitration.

DeFi applications don’t need any intermediaries or arbitrators. The code specifies the resolution of every possible dispute, and the users maintain control over their funds at all times. This automation reduces the costs associated with providing and using these products and allows for a more frictionless financial system.

Another significant advantage of such an open ecosystem is the ease of access for individuals who otherwise wouldn’t have access to any financial services. Since the traditional financial system relies on the intermediaries making a profit, their services are typically absent from locations with low-income communities. However, with DeFi, the costs are significantly reduced, and low-income individuals can also benefit from a broader range of financial services.

What are the potential use cases for DeFi?

Borrowing and lending

Since these lending services are built on public blockchains, they minimize the amount of trust required and have the assurance of cryptographic verification methods. Lending marketplaces on the blockchain reduce counterparty risk and make borrowing and lending cheaper, faster, and available to more people.

Monetary banking services

As the blockchain industry matures, there’s an increased focus on creating stablecoins. They are crypto assets usually pegged to real-world assets that are easily digitally transferable. As cryptocurrency prices can fluctuate rapidly at times, decentralized stablecoins could be adopted for everyday use as digital currencies that are not issued and monitored by a central authority.

Insurance on the blockchain could eliminate the need for intermediaries and allow the distribution of risk between many participants. This could result in lower premiums with the same quality of service.

Decentralized marketplaces

Blockchain technology may also be used to issue and allow ownership of a wide range of conventional financial instruments. These applications would work in a decentralized way that cuts out custodians and eliminates single points of failure.

Other projects may allow the creation of derivatives, synthetic assets, decentralized prediction markets, and many more.

Yield optimization

Of course, you can do this manually. Using a smart contract, however, saves time and optimizes compounding. Your funds are usually pooled together with other users’, meaning that gas fees are shared across all members of the yield optimizing smart contract.

What role do smart contracts play in DeFi?

Most of the existing and potential applications of decentralized finance involve creating and executing smart contracts. While a usual contract uses legal terminology to specify the terms of the relationship between the entities entering the contract, a smart contract uses computer code.

Since their terms are written in computer code, smart contracts have the unique ability to enforce those terms in an automated manner. This enables the reliable execution and automation of many business processes that currently require manual supervision.

Using smart contracts is faster, easier, and reduces the risk for both parties. On the other hand, smart contracts also introduce new types of risks. As computer code is prone to have bugs and vulnerabilities, the value and confidential information locked in smart contracts are at risk.

What challenges does DeFi face?

What are the risks of DeFi?

While the DeFi world can offer appealing APYs, it is not without risks. Even though they are decentralized, you are essentially consuming financial services, and some of the risks are familiar:

Where can I find DeFi projects?

Finding projects and DeFi protocols will require some research. Online forums, messengers, and websites can help you learn about new opportunities. However, you need to be extremely careful with any information you find. Always be cautious and double-check the safety of any project you read or hear about.

What do I need to access DeFi projects?

To connect to DeFi DApps, you’ll need:

At its most basic, that’s all you’ll need. If you don’t feel comfortable setting this up yourself, you can still access some DeFi services through a centralized entity. We’ll cover this in a later section discussing centralized finance (CeFi).

DeFi vs traditional finance

DeFi also offers financial services that aren’t available in the traditional realm. By layering different DeFi services (sometimes known as DeFi legos), it’s possible to create brand new products that utilize multiple platforms. This flexibility allows for innovative products that anyone can develop strategies for.

DeFi vs centralized finance (CeFi)

Even in the crypto world, not every financial service is decentralized. For example, staking through a centralized exchange like Binance often requires you to give up custody of your tokens. In this case, you must trust the centralized entity that deals with your funds.

The majority of the services offered will be the same. They likely are done through the same DeFi platforms that a user can access directly. However, CeFi takes away the often complicated nature of managing DeFi investments yourself. You may also have extra guarantees on your deposits.

CeFi is neither worse nor better than DeFi. Its suitability depends on your wants and needs. While you may sacrifice some control in CeFi, you often receive stronger guarantees and offload some responsibility for handling assets and executing transactions.

What is the difference between DeFi and open banking?

DeFi, however, proposes an entirely new financial system that is independent of the current infrastructure. DeFi is sometimes also referred to as open finance.

For example, open banking could allow the management of all traditional financial instruments in one application by securely drawing data from several banks and institutions.

Decentralized finance, on the other hand, could allow the management of entirely new financial instruments and new ways of interacting with them.

Closing thoughts

Decentralized finance is focused on building financial services separate from the traditional financial and political system. This would allow for a more open financial system and could potentially prevent precedents of censorship, financial surveillance, and discrimination worldwide.

While a tempting idea, not everything benefits from decentralization. Finding the use cases that are most suitable for the characteristics of blockchains is crucial in building a valuable stack of open financial products.

If successful, DeFi could take power away from large centralized organizations and put it in the hands of the open-source community and the individual. Whether that will create a more efficient financial system will be decided once DeFi is ready for mainstream adoption.

Источники информации:

- http://gocardless.com/en-us/guides/posts/what-is-decentralized-finance/

- http://www.investopedia.com/decentralized-finance-defi-5113835

- http://medium.com/crypto-wisdom/crypto-basics-what-is-decentralised-finance-defi-7f137d7369db

- http://academy.binance.com/en/articles/the-complete-beginners-guide-to-decentralized-finance-defi

:max_bytes(150000):strip_icc()/profilepic__rakesh_sharma-5bfc262dc9e77c00517eda0b.jpg)

:max_bytes(150000):strip_icc()/amilcar-AmilcarChavarria-7c0945d94896428a8f57a6a56d4710c8.jpeg)

:max_bytes(150000):strip_icc()/IMG_5330-abb96c81199643e9b6ec5835b3daeb02.jpeg)