What is equity and debt finance

What is equity and debt finance

Debt Financing vs. Equity Financing: What’s the Difference?

Debt Financing vs. Equity Financing: An Overview

When financing a company, «cost» is the measurable expense of obtaining capital. With debt, this is the interest expense a company pays on its debt. With equity, the cost of capital refers to the claim on earnings provided to shareholders for their ownership stake in the business.

Key Takeaways

Debt Financing

When a firm raises money for capital by selling debt instruments to investors, it is known as debt financing. In return for lending the money, the individuals or institutions become creditors and receive a promise that the principal and interest on the debt will be repaid on a regular schedule.

Equity Financing

Equity financing is the process of raising capital through the sale of shares in a company. With equity financing comes an ownership interest for shareholders. Equity financing may range from a few thousand dollars raised by an entrepreneur from a private investor to an initial public offering (IPO) on a stock exchange running into the billions.

If a company fails to generate enough cash, the fixed-cost nature of debt can prove too burdensome. This basic idea represents the risk associated with debt financing.

Example

Provided a company is expected to perform well, you can usually obtain debt financing at a lower effective cost.

From this example, you can see how it is less expensive for you, as the original shareholder of your company, to issue debt as opposed to equity. Taxes make the situation even better if you had debt since interest expense is deducted from earnings before income taxes are levied, thus acting as a tax shield (although we have ignored taxes in this example for the sake of simplicity).

However, if a company fails to generate enough cash, the fixed-cost nature of debt can prove too burdensome. This basic idea represents the risk associated with debt financing.

The Bottom Line

Companies are never totally certain what their earnings will amount to in the future (although they can make reasonable estimates). The more uncertain their future earnings, the more risk is presented. As a result, companies in very stable industries with consistent cash flows generally make heavier use of debt than companies in risky industries or companies who are very small and just beginning operations. New businesses with high uncertainty may have a difficult time obtaining debt financing and often finance their operations largely through equity. (For related reading, see «Should a Company Issue Debt or Equity?»)

Debt and Equity Financing

Hero Images/Getty Images

When you decide to start a small business, one of your first questions is likely to be how to raise money to finance your business operations. No matter how you plan to obtain financing for your business, you need to spend some time developing a business plan. Only then should you go forward with financing plans for even a simple small business.

Equity Financing

You may have some cash you want to put into the business yourself, so that will be your initial base. Maybe you also have family or friends who are interested in your business idea and they would like to invest in your business. That may sound good on the surface to you, but even if this is the best arrangement for you, there are factors you must consider before you jump in. If you decide to accept investments from family and friends, you will be using a form of financing called equity financing.

One thing that you want to be clear about is whether your family and friends want to invest in your business or loan you some money for your business. That is a crucial distinction! If they want to invest, then they are offering you equity financing. If they want to loan you money for your business, then that is quite different and is actually considered debt financing.

Advantages of Equity Financing

Disadvantages of Equity Financing

Debt Financing

If you decide that you do not want to take on investors and want total control of the business yourself, you may want to pursue debt financing in order to start up your business. You will probably try to tap your own sources of funds first by using personal loans, personal loans, home equity loans, and even credit cards. Perhaps family or friends would be willing to loan you the necessary funds at lower interest rates and better repayment terms. Applying for a business loan is another option.

Advantages of Debt Financing

Disadvantages of Debt Financing

For a new business, commercial banks may require you to pledge your personal assets before they will give you a loan. If your business goes under, you will lose your personal assets.

Any time you use debt financing, you are running the risk of bankruptcy. The more debt financing you use, the higher the risk of bankruptcy. Calculate the debt to equity ratio to determine how much debt your firm is in compared to its equity.

Some will tell you that if you incorporate your business, your personal assets are safe. Don’t be so sure of this. Even if you incorporate, most financial institutions will still require a new business to pledge business or personal assets as collateral for your business loans. You can still lose your personal assets.

Which is best; debt or equity financing? It depends on the situation. Your financial capital, potential investors, credit standing, business plan, tax situation, the tax situation of your investors, and the type of business you plan to start all have an impact on that decision. The mix of debt and equity financing that you use will determine your cost of capital for your business.

Two More Traditional Sources of Capital for Your Business

Besides debt and equity financing, there are two other traditional sources of capital for your business. Operating revenue and the sale of assets can also generate money for your firm. Make your financing decisions wisely!

Equity Financing vs. Debt Financing: What’s the Difference?

J.B. Maverick is an active trader, commodity futures broker, and stock market analyst 17+ years of experience, in addition to 10+ years of experience as a finance writer and book editor.

Equity Financing vs. Debt Financing: An Overview

To raise capital for business needs, companies primarily have two types of financing as an option: equity financing and debt financing. Most companies use a combination of debt and equity financing, but there are some distinct advantages to both. Principal among them is that equity financing carries no repayment obligation and provides extra working capital that can be used to grow a business. Debt financing on the other hand does not require giving up a portion of ownership.

Companies usually have a choice as to whether to seek debt or equity financing. The choice often depends upon which source of funding is most easily accessible for the company, its cash flow, and how important maintaining control of the company is to its principal owners. The debt-to-equity ratio shows how much of a company’s financing is proportionately provided by debt and equity.

Key Takeaways

Equity Financing

Equity financing involves selling a portion of a company’s equity in return for capital. For example, the owner of Company ABC might need to raise capital to fund business expansion. The owner decides to give up 10% of ownership in the company and sell it to an investor in return for capital. That investor now owns 10% of the company and has a voice in all business decisions going forward.

The main advantage of equity financing is that there is no obligation to repay the money acquired through it. Of course, a company’s owners want it to be successful and provide the equity investors with a good return on their investment, but without required payments or interest charges, as is the case with debt financing.

Equity financing places no additional financial burden on the company. Since there are no required monthly payments associated with equity financing, the company has more capital available to invest in growing the business. But that doesn’t mean there’s no downside to equity financing.

In fact, the downside is quite large. In order to gain funding, you will have to give the investor a percentage of your company. You will have to share your profits and consult with your new partners any time you make decisions affecting the company. The only way to remove investors is to buy them out, but that will likely be more expensive than the money they originally gave you.

Debt Financing

Debt financing involves the borrowing of money and paying it back with interest. The most common form of debt financing is a loan. Debt financing sometimes comes with restrictions on the company’s activities that may prevent it from taking advantage of opportunities outside the realm of its core business. Creditors look favorably upon a relatively low debt-to-equity ratio, which benefits the company if it needs to access additional debt financing in the future.

The advantages of debt financing are numerous. First, the lender has no control over your business. Once you pay the loan back, your relationship with the financier ends. Next, the interest you pay is tax-deductible. Finally, it is easy to forecast expenses because loan payments do not fluctuate.

The downside to debt financing is very real to anybody who has debt. Debt is a bet on your future ability to pay back the loan.

What if your company hits hard times or the economy, once again, experiences a meltdown? What if your business does not grow as fast or as well as you expected? Debt is an expense and you have to pay expenses on a regular schedule. This could put a damper on your company’s ability to grow.

Finally, although you may be a limited liability company (LLC) or other business entity that provides some separation between the company and personal funds, the lender may still require you to guarantee the loan with your family’s financial assets. If you think debt financing is right for you, the U.S. Small Business Administration (SBA) works with select banks to offer a guaranteed loan program that makes it easier for small businesses to secure funding.

Equity Financing vs. Debt Financing Example

There could be many different combinations with the above example that would result in different outcomes. For example, if Company ABC decided to raise capital with just equity financing, the owners would have to give up more ownership, reducing their share of future profits and decision-making power.

Conversely, if they decided to use only debt financing, their monthly expenses would be higher, leaving less cash on hand to use for other purposes, as well as a larger debt burden that it would have to pay back with interest. Businesses must determine which option or combination is the best for them.

Special Considerations

Choosing which one works for you is dependent on several factors such as your current profitability, future profitability, reliance on ownership and control, and whether you can qualify for one or the other. The different types and sources for each type of financing are described in more detail below.

Debt Financing

Some sources of debt financing are:

The ability to secure debt financing is largely based on your existing financials and creditworthiness.

Equity Financing

Some sources of equity financing are:

Securing equity financing can be a simpler process than debt financing, but you need to have an extremely attractive product or financial projections, as well as being able to surrender a portion of your company and oftentimes a good amount of control.

Why Would a Company Choose Debt Over Equity Financing?

A company would choose debt financing over equity financing if it doesn’t want to surrender any part of its company. A company that believes in its financials would not want to miss on the profits they would have to pass to shareholders if they assigned someone else equity.

Is Debt Cheaper Than Equity?

Depending on your business and how well it performs, debt can be cheaper than equity, but the opposite is also true. If your business turns no profit and you close, then in essence your equity financing costs you nothing. If you take out a small business loan via debt financing and you turn no profit, you still need to pay back the loan plus interest. In this scenario, debt financing costs more. However, if your company sells for millions of dollars, the amount you pay shareholders could be much more than if you had kept that ownership and simply paid a loan. Each circumstance is different.

Is Debt Financing or Equity Financing Riskier?

It depends. Debt financing can be riskier if you are not profitable as there will be loan pressure from your lenders. However, equity financing can be risky if your investors expect you to turn a healthy profit, which they often do. If they are unhappy, they could try and negotiate for cheaper equity or divest altogether.

The Bottom Line

Debt and equity financing are ways that businesses acquire necessary funding. Which one you need depends on your business goals, tolerance for risk, and need for control. Many businesses in the startup stage will pursue equity financing, while those already established and those who have no problem with debt and possess a strong credit score might pursue traditional debt financing types like small business loans.

Debt vs Equity Financing

Comparing the pros and cons of both, and understanding the relationship between WACC and leverage

Debt vs Equity Financing: Which is Best?

Debt vs Equity Financing – which is best for your business and why? The simple answer is that it depends. The equity versus debt decision relies on a large number of factors such as the current economic climate, the business’ existing capital structure, and the business’ life cycle stage, to name a few. In this article, we will explore the pros and cons of each, and explain which is best, depending on the context.

Definition of terms

From a business perspective:

We recommend reading through the articles first if you are not familiar with how stocks and bonds work.

How does capital structure influence the debt vs equity decision?

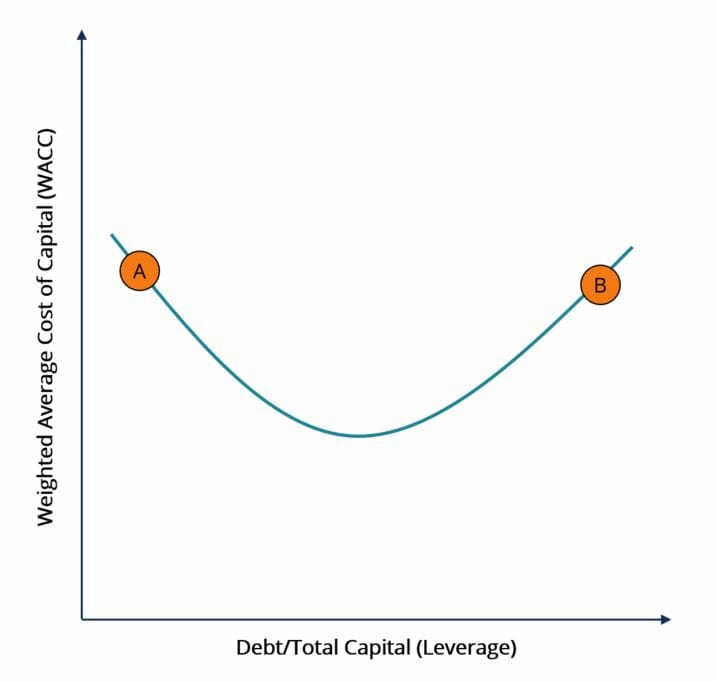

To answer this question, we must first understand the relationship between the Weighted Average Cost of Capital (WACC) and leverage. Generally speaking, the best capital structure for a business is the capital structure that minimizes the business’ WACC. As the chart below suggests, the relationships between the two variables resemble a parabola.

At point A, we see a capital structure that has a low amount of debt and a high amount of equity, resulting in a high WACC. At point B, we see the opposite: a capital structure with a high amount of debt and a low amount of equity – which also results in high WACC. In order to minimize WACC, the capital structure must consist of a balanced combination of debt and equity.

Why is too much equity expensive?

The Cost of Equity is generally higher than the Cost of Debt since equity investors take on more risk when purchasing a company’s stock as opposed to a company’s bond. Therefore, an equity investor will demand higher returns (an Equity Risk Premium) than the equivalent bond investor to compensate him/her for the additional risk that he/she is taking on when purchasing stock. Investing in stocks is riskier than investing in bonds because of a number of factors, for example:

Thus, financing purely with equity will lead to a high WACC.

Why is too much debt expensive?

While the Cost of Debt is usually lower than the cost of equity (for the reasons mentioned above), taking on too much debt will cause the cost of debt to rise above the cost of equity. This is because the biggest factor influencing the cost of debt is the loan interest rate (in the case of issuing bonds, the bond coupon rate).

As a business takes on more and more debt, its probability of defaulting on its debt increases. This is because more debt equals higher interest payments. If a business experiences a slow sales period and cannot generate sufficient cash to pay its bondholders, it may go into default. Therefore, debt investors will demand a higher return from companies with a lot of debt, in order to compensate them for the additional risk they are taking on. This higher required return manifests itself in the form of a higher interest rate.

Thus, financing purely with debt will lead to a higher cost of debt, and, in turn, a higher WACC.

It is also worth noting that as the probability of default increases, stockholders’ returns are also at risk, as bad press about potential defaulting may place downward pressure on the company’s stock price. Thus, taking on too much debt will also increase the cost of equity as the equity risk premium will increase to compensate stockholders for the added risk.

Learn more about Warren Buffet’s thoughts on equity vs debt.

Optimal capital structure

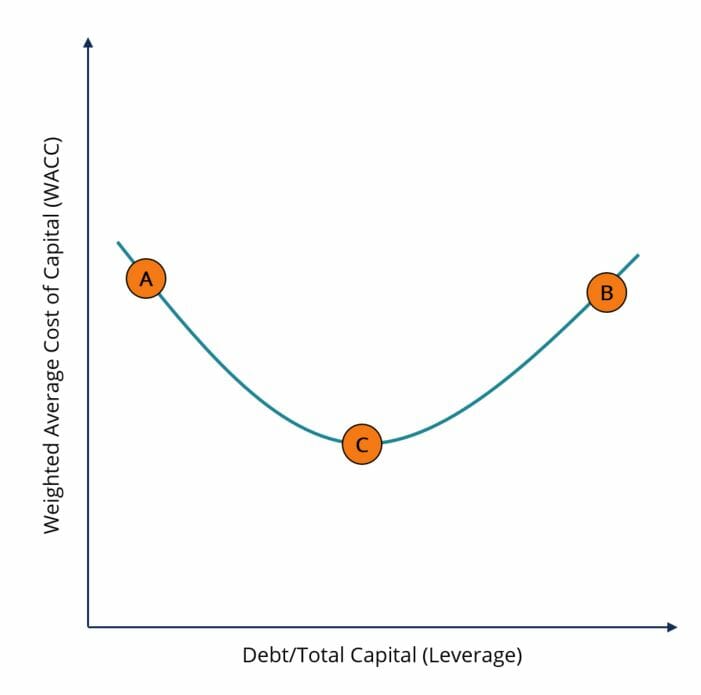

The optimal capital structure is one that minimizes the Weighted Average Cost of Capital (WACC) by taking on a mix of debt and equity. Point C on the chart below indicates the optimal capital structure on the WACC versus leverage curve:

If the business is at point A on the curve, issuing debt would bring down its WACC. If the business is at point B on the curve, issuing equity would bring down its WACC. For more details on calculating WACC, click here.

Other factors to consider

Below are other important factors that need to be taken into consideration when making a financing decision:

The table below easily summarizes the debt vs equity decision:

*Assuming all other factors remain the same

More resources

Thank you for reading this guide on debt vs equity and the pros and cons of each type of financing. To keep learning and advancing your career as an analyst, the following CFI resources will also be helpful:

Search the Blog

Debt Financing vs. Equity Financing

As a small business owner, you know that it’s hard to gain business capital. But, you need money to grow your business. Whether you are looking for startup or expansion funds, you usually have two options: debt financing vs. equity financing. Know the difference between equity and debt financing to choose the right one for your company.

What is debt financing?

With debt financing, you borrow money from an outside entity to fund your business. You must pay the money back, plus interest, in portions by a designated period. Banks typically issue debt financing, but private companies and friends and family are also sources you can use. You maintain all your business ownership when you use debt financing.

Lenders don’t have a say in business decisions or earn part of your profit. You only owe the loan amount, interest, and bank fees.

Types of debt financing

Though there are many types, the following are common options for debt financing.

SBA loans

The Small Business Administration offers several SBA loan programs for small business owners. The loan comes from a bank, but it is backed by the SBA. The SBA loan guarantee reduces the bank’s risk level, helping your chances of approval and getting favorable terms.

Commercial bank loans

Business bank loans can be difficult for startups to get. But, they are an option for established small businesses. To get a commercial bank loan, you need a solid business plan, a good small business credit score, and collateral. Banks offer different rates and payment terms, so you should check with several before agreeing to a loan.

Working capital loan

Working capital loans are short-term debts that help you pay for everyday business operations. You do not use a working capital loan to buy long-term assets or equipment. This debt financing option often works well for seasonal businesses, as it helps during slow cash flow months. When sales peak, business owners can pay back the debt quickly.

Equipment leasing

Equipment leasing works like a commercial loan, but it is used to fund business equipment. You pay a fixed monthly payment over a designated time period. The lease payments are less than the amount it would cost to buy the equipment. Usually, you have the option to buy the equipment at the end of the lease.

Debt financing vs. equity financing: A look at debt financing

To compare your funding options for small business, you need to know the advantages and disadvantages of each. Take a look at the following pros and cons of debt financing.

Advantages of debt financing

Disadvantages of debt financing

What is equity financing?

Equity financing is money paid to your business by an outside entity. The funds come from an investor, not a lender. With equity financing, you do not have to make repayments or pay interest.

Instead of paying back a loan, you share your profits with the investor. The investor gains some ownership of your business by investing.

When you use equity financing, you issue the investor shares of equity in your business. The number of shares issued should be proportional to the amount of money invested.

The investor puts money into the business with the hope that the value of their shares will grow. Investors can also earn dividends. Dividends are regular payments made to shareholders out of a business’s profits.

Types of equity financing

The following are common types of equity financing to consider for your small business.

Private investors

A private investor is anyone who invests in your business and is not affiliated with a bank. A private investor could be an employee, local business owner, or supplier. It could even be your friends and family members. Look for private investors within your personal and professional networks.

Venture capital

Venture capitalists provide investments for new, rapidly growing companies. Venture capitalists have strict rules for investing, so their funds are not available to many small businesses. Because the companies they invest in pose higher risks, they expect to receive a larger return.

Employee stock ownership plan

An employee stock ownership plan (ESOP) is a trust that gives ownership to employees. You sell stock in the company to your employees. An ESOP gives employees a greater stake in the company’s success, but it can be expensive to maintain. You must be in business for at least three years to establish an ESOP.

Angel investors

Angel investors are wealthy groups or individuals who put money into small businesses and startups. The terms of angel investments are often more favorable than lender terms. Angel investors focus more on building up your business than their possible profits.

Debt financing vs. equity financing: A look at equity financing

You’ve already taken a look at the pros and cons of debt financing. Now, check out the advantages and disadvantages of equity financing below.

Advantages of equity financing

Disadvantages of equity financing

Choosing between debt and equity financing

The right funding option is different for every business owner when it comes to equity financing vs. debt financing. Often, new small businesses struggle to get equity financing, so they must take on debt. Established businesses are usually able to get a wider variety of financing options.

For lenders and investors, providing financing comes down to risk vs. reward. If you experience small business bankruptcy, debt holders have priority over equity holders for recovering funds. Investors have a greater risk, and they expect a larger reward.

You can use a mix of debt and equity financing to lessen the disadvantages of each. By using both options, you reduce the amount of debt you owe and business ownership you give to investors.

Источники информации:

- http://www.thebalancesmb.com/debt-and-equity-financing-393248

- http://www.investopedia.com/ask/answers/042215/what-are-benefits-company-using-equity-financing-vs-debt-financing.asp

- http://corporatefinanceinstitute.com/resources/knowledge/finance/debt-vs-equity/

- http://www.patriotsoftware.com/blog/accounting/what-is-debt-financing-vs-equity-financing-difference/

:max_bytes(150000):strip_icc()/ChristinaMajaski-5c9433ea46e0fb0001d880b1.jpeg)

:max_bytes(150000):strip_icc()/CharleneRhinehartHeadshot-CharleneRhinehart-ca4b769506e94a92bc29e4acc6f0f9a5.jpg)

:max_bytes(150000):strip_icc()/KatrinaAvilaMunichiellophoto-9d116d50f0874b61887d2d214d440889.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-763163459-5c587ddbc9e77c00016b3ff2.jpg)

:max_bytes(150000):strip_icc()/25348402-CA6C-44B7-B352-690E9A46E695-80a32ee53e7648669212f763738e653d.jpeg)

:max_bytes(150000):strip_icc()/picture-53889-1440688003-5bfc2a8846e0fb0083c04dc5.jpg)

:max_bytes(150000):strip_icc()/PortraitHeadshot-DavidKindness-DavidKindness-2318e84654364a0584b715e44c99f13a.jpg)

:max_bytes(150000):strip_icc()/SuzannesHeadshot-3dcd99dc3f2e405e8bd37271894491ac.jpg)