What is internet banking

What is internet banking

Online Banking

What Is Online Banking?

Online banking allows a user to conduct financial transactions via the Internet. Online banking is also known as Internet banking or web banking.

Online banking offers customers almost every service traditionally available through a local branch including deposits, transfers, and online bill payments. Virtually every banking institution has some form of online banking, available both on desktop versions and through mobile apps.

Key Takeaways

Understanding Online Banking

With online banking, consumers aren’t required to visit a bank branch to complete most of their basic banking transactions. They can do all of this at their own convenience, wherever they want—at home, at work, or on the go.

Online banking requires a computer or other device, an Internet connection, and a bank or debit card. In order to access the service, clients need to register for their bank’s online banking service. In order to register, they need to create a password. Once that’s done, they can use the service to do all their banking.

Banking transactions offered online vary by the institution. Most banks generally offer basic services such as transfers and bill payments. Some banks also allow customers to open up new accounts and apply for credit cards through online banking portals. Other functions may include ordering checks, putting stop payments on checks, or reporting a change of address.

Checks can now be deposited online through a mobile app. The customer simply enters the amount before taking a photo of the front and back of the check to complete the deposit.

Online banking does not permit the purchase of traveler’s checks, bank drafts, certain wire transfers, or the completion of certain credit applications like mortgages. These transactions still need to take place face-to-face with a bank representative.

Most banks do not charge fees for online banking.

Advantages of Online Banking

Convenience is a major advantage of online banking. Basic banking transactions such as paying bills and transferring funds between accounts can easily be done 24 hours a day, seven days a week, wherever a consumer wishes.

Online banking is fast and efficient. Funds can be transferred between accounts almost instantly, especially if the two accounts are held at the same institution. Consumers can open and close a number of different accounts online, from fixed deposits to recurring deposit accounts that typically offer higher rates of interest.

Consumers can also monitor their accounts regularly closely, allowing them to keep their accounts safe. Around-the-clock access to banking information provides early detection of fraudulent activity, thereby acting as a guardrail against financial damage or loss.

Disadvantages of Online Banking

For a novice online banking customer, using systems for the first time may present challenges that prevent transactions from being processed, which is why some consumers prefer face-to-face transactions with a teller.

Online banking doesn’t help if a customer needs access to large amounts of cash. While he may be able to take a certain amount at the ATM—most cards come with a limit—he will still have to visit a branch to get the rest.

Although online banking security is continually improving, such accounts are still vulnerable when it comes to hacking. Consumers are advised to use their own data plans, rather than public Wi-Fi networks when using online banking, to prevent unauthorized access.

Additionally, online banking is dependent on a reliable Internet connection. Connectivity issues from time to time may make it difficult to determine if banking transactions have been successfully processed.

Online Banks

Some banks operate exclusively online, with no physical branch. These banks handle customer service by phone, email, or online chat. Online banking is frequently performed on mobile devices now that Wi-Fi and 5G networks are widely available. It can also be done on a desktop computer.

These banks may not provide direct automatic teller machine (ATM) access but will make provisions for consumers to use ATMs at other banks and retail stores. They may reimburse consumers for some of the ATM fees charged by other financial institutions. Reduced overhead costs associated with not having physical branches typically allow online banks to offer consumers significant savings on banking fees. They also offer higher interest rates on accounts.

Prominent online banks in the United States include Ally Bank, Bank5 Connect, Discover Bank, and Synchrony Bank.

What Is Online Banking?

The Balance / Julie Bang

Online banking gives you the ability to manage your bank account over the internet using a computer or mobile device. There’s no need to visit a bank branch, and you can do all of your banking tasks when it’s most convenient for you, including outside of normal banking hours.

Definition and Examples of Online Banking

You can bank online through an online-only bank or online-only credit union or through the suite of online services that most brick-and-mortar banks and local credit unions now offer. You can typically pay bills, transfer funds, apply for a loan, deposit checks, and verify transactions and account balances.

Banks that offer online banking include Bank of America and Wells Fargo.

How Online Banking Works

Online banking is designed to be convenient, saving you time and letting you do your banking on your own schedule rather than only during the hours your local bank branch is open. Almost anything you can do at a traditional bank or credit union location you can accomplish online, starting with opening an account.

The one advantage that traditional banks and credit unions have had over their online counterparts is the ability to withdraw funds using an ATM. Increasingly, online banks and credit unions are providing access to a network of ATMs that won’t charge you a fee. Some financial institutions will reimburse your ATM fees up to a certain amount each month.

Opening Accounts

You can open checking, savings, and other types of accounts online, often without the hassle of printing or physically signing anything. With electronic signature capability, the entire process might now take less than 10 minutes.

If you’re a customer of a financial institution that offers online banking, you can register for online access through its website. At a minimum, you’ll usually need the following items to get started online:

You will need the same things, excluding the bank account number, to open an account with an online-only bank or credit union with which you do not have an existing relationship. You may be asked for additional ID verification, such as a driver’s license.

Registration involves setting up a log-in—often your email address—and password. Once you complete registration, you can log into your account and start banking online with only your internet-enabled device.

Paying Bills

Instead of writing checks to pay bills, your bank can print and mail a check for you month after month. But for greater convenience, it’s also possible to send money to a payee electronically, even if the amount you owe changes every month.

Transferring Funds

If you need to move money from your checking account to your savings account or into a certificate of deposit (CD), you can carry out these intrabank transfers online. You can even link your accounts at different banks or send money to friends and family almost instantly through person-to-person services accessible through your bank.

Applying for Loans

Getting a loan is traditionally a paperwork-intensive process, but it doesn’t have to be. Filling in your application online speeds the credit-check process, enabling your bank or credit union to respond with an answer more quickly. Some financial service providers with online loan applications make funds available the same day you get approved for a loan. Other lenders that operate entirely online can make near-instant lending decisions.

Depositing Checks

When someone pays you with a check, it’s easy to deposit the check from home if you have a smartphone. Using a mobile check deposit, you snap a photo of the check through the mobile app of your bank and submit it for payment. There’s no need to mail the check.

Viewing Current and Past Transactions

Most credit unions and banks make it easy to check your available balance, verify your latest transactions went through, and review previous monthly statements online. You should be able to search transactions by time frame and type, such as a bank card payment.

Staying Informed

Another big benefit of online banking is the ability to set up alerts. You can receive a text or email when your bank notices potentially fraudulent activity or your balance goes below a certain amount. You can be notified when deposited money is available and when a check has cleared.

These alerts are great for informational purposes, but more important, they can help you quickly stop criminal acts. For instance, if you are notified of a change in your password, and you did not make that change, you can immediately contact your bank and ask it to prevent the perpetrator from draining your account.

Online Banking vs. Traditional Banking

There are important benefits to be gained by using a bank through which you primarily or exclusively manage your account online, but traditional banks have advantages, too.

Better Interest Rates

Online-only banks tend to offer a higher annualized interest rate, often referred to as the «annual percentage yield» (APY), on your deposits. That’s because they don’t have the overhead of brick-and-mortar banks and can pass some of the savings along to you. However, the online division of some traditional banks may also offer competitive rates. Online banks also tend to offer a lower interest rate on loans, which is called the «annual percentage rate» (APR).

You generally want higher interest rates on savings accounts so you can make your money work harder for you. On the flip side, lower interest rates are desirable when you borrow, because they reduce the total cost of the loan. It’s smart to shop around and compare online bank rates to traditional bank rates, but you’ll almost always do better online.

Lower Fees

Online-only banks typically charge lower fees than traditional brick-and-mortar institutions for the same reasons they pay more in interest. In fact, they are less likely to charge fees for certain services or for failing to maintain a minimum average balance.

In-Person Transactions

Despite offering the ability to deposit checks via mobile deposit or withdraw money through affiliated ATMs, an online bank may be impractical if you frequently make large deposits or withdrawals and need to do so through a bank teller. Some banks have a daily mobile deposit amount limit and ask you to visit an ATM or branch to make deposits exceeding that limit. This may prove difficult if your bank doesn’t have a large network of free ATMs or a branch nearby.

Most banks also place daily limits on the amount you can withdraw from ATMs. If you need more cash and can’t convince your bank to increase the limit, you’ll need to request a cash advance in person, which you can’t do if you can’t visit a branch.

Traditional banks can also provide notary services, safe deposit boxes, and cashier’s checks. Online-only banks typically can’t.

Consider keeping accounts at both an online-only bank and a traditional bank to capitalize on higher-interest savings account rates and low fees at the former while retaining the option to use in-person services at the latter.

Technology Issues

If you’re not comfortable with technology, banking online may come with a steep learning curve. Glitches can also happen, and if your computer—or the bank’s system—is down, you may have to put off a pressing transaction.

For complex situations, like pesky customer service issues or discussions about different types of loans, you might benefit from a face-to-face meeting at a traditional bank.

Safety Issues

In many respects, online banking is more secure than traditional banking. Having your pay directly deposited into your bank account eliminates the risk of someone stealing your check from the mail. Plus, no one can copy your account information from checks that you send out; bank computers send that information back and forth securely, without storing it.

If fraud or errors occur during an electronic funds transfer, federal law often protects you, as long as you act quickly.

Online scams such as phishing schemes that use an email or text to get you to divulge important information are cause for concern. As long as you send information only to people you trust, and through authentic websites, you can avoid many of them. Be careful about what you click on, and contact your financial institution if you have any concerns.

What is Internet Banking? Which bank’s Internet Banking should I use?

In order to bring convenience as well as serve customers anywhere and anytime, banks have now deployed the service. Internet Banking their own, and each different bank will have its own name for that service, but does everyone know Internet Banking what? Why is it an important service for every bank? Please join the virtual currency Blog to learn in the article below!

What is Internet Banking?

Internet Banking (also known as Online Banking) is an online banking service of banks that allows their customers to manage their accounts, and perform transactions such as money transfer, savings deposit, bill payment, financial services, top-up, tax payment. no need to go to the bank’s transaction counters and no need to need a card to operate at the machines TMJ which only requires an Internet-connected device such as a computer or phone along with an account provided by the bank upon registration.

To use the Internet banking service, customers must register for the service at the branch/transaction office of that bank and maintain the service monthly for a fee of around 10 thousand VND depending on the bank and you will find it convenient. great benefits such as:

– Transact anytime, anywhere, just need the Internet without going to the Bank or going to the ATM

– Safe and secure with two-factor authentication system

Features of Internet banking

When registering for Internet Banking service, you can perform the following tasks with only one account:

– Money transfer includes money transfer within the same banking system, domestic money transfer, interbank money transfer or future money transfer orders can be placed. In particular, you can transfer money from the card to the card or to the card account.

– Query account balance, savings deposit balance, statement of transactions that have occurred in a certain period of time.

– Pay bills online: Pay electricity, water, phone bills, telecommunications charges, pay taxes, pay tuition fees, recharge e-wallets…

Payment of financial services such as loan interest, insurance premiums, securities investments, etc.

– Pay taxes: taxes, fees, charges and state budget revenues…

– Deposit online savings and withdraw that savings anytime, anywhere without procedures. Moreover, some banks support online savings with higher interest rates at the counter about 0,1%-0,3%/month.

And many other features such as querying the bank’s information about fee schedule, exchange rate, interest rate, etc.

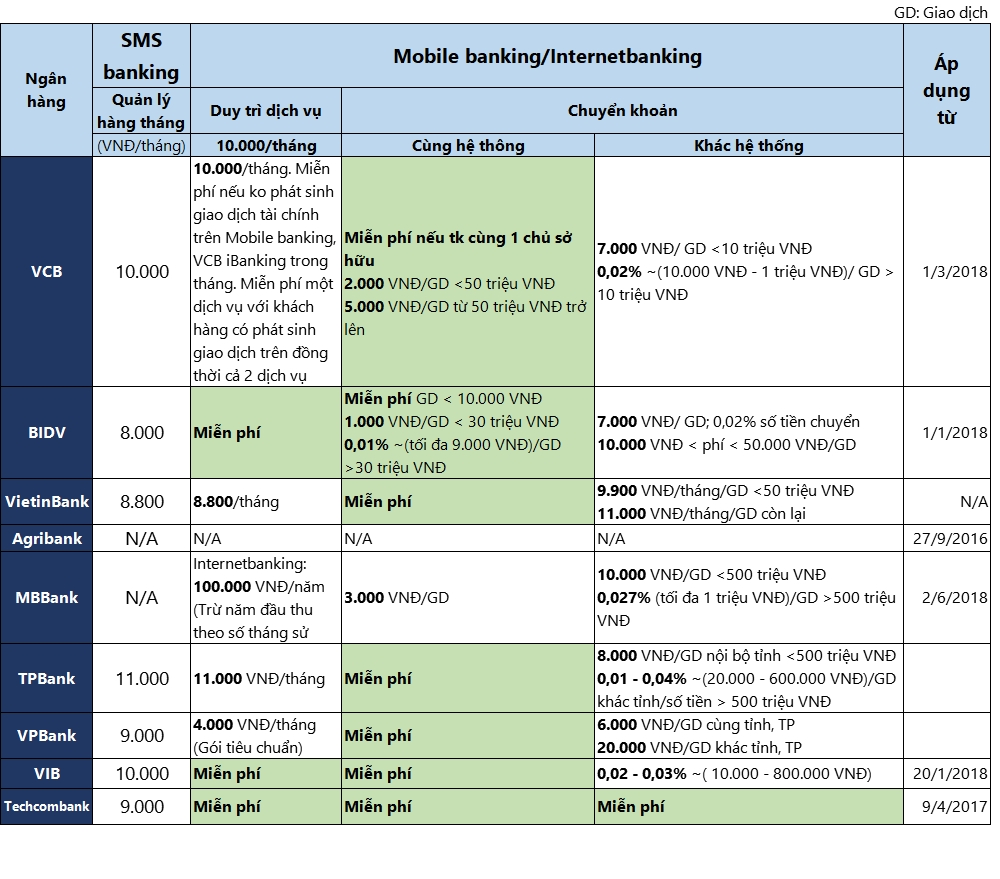

Which bank’s Internet Banking service fee is the cheapest?

Which bank’s Internet Banking should I use?

Basically, the safety and convenience of Internet Banking services of banks are similar, so the cost to use Internet Banking will be the criterion for many customers to choose the Internet Banking service of the bank. there.

And from the above service fee table, you can see

For account maintenance fees: There are three banks free to maintain accounts for customers: VietinBank, VIB, Techcombank.

For e-banking servicesAccording to the survey, Techcombank is currently the bank with the best incentives, while it is still free of all service fees for e-banking. Techcombank said that there is no end date for this incentive program. Besides, banks like TPBank, VIB also offer quite cheap online money transfer fees compared to other banks.

It can be seen that, with the retail customer segment as the target, banks like Techcombank, TPBank or VPBank are doing their job well, «satisfying» individual customers with services as well as preferential rates they offer.

Conclusion

Above is the article “What is Internet Banking? Which bank’s Internet Banking should I use? of the Virtual Currency Blog, hopefully through the article you can understand more about the service Internet Banking It’s very hot right now and know how to use it Internet Banking of any bank.

If you have difficulty using Internet Banking Then leave a comment below of Cryptocurrency Blog OK, we will reply to you as soon as possible. And don’t forget to give yourself a Like, Share and rate 5 stars below. Good luck.

– Electronic Banking –

Electronic banking is a form of banking that uses the internet, computers and electronic signals to enable banking transactions.

Through electronic banking, people can conduct banking activities from their homes, rather than going to a physical/traditional bank.

In this article, we will look at everything you should know about electronic banking. Also, we’ll see the history, importance, and types of e-banking services.

What is Banking?

Banking is an industry that handles cash, credit, and other financial transactions for individual consumers and businesses alike.

Banking provides the liquidity needed for families and businesses to invest in the future and is one of the key drivers of the U.S. economy.

You can use the products and services offered by a bank or credit union to protect your money, to borrow more, and to build savings.

Banking means you won’t have to save up before going to college or buying a house. Companies can use loans to start hiring immediately to build for future demand and expansion.

In short, banking provides the means for further financial growth.

Types of Banking

Banking comprises many activities that can be done through several financial institutions that accept deposits from individuals and other entities, and then use this money to offer loans and to invest and earn profit.

Banks can be placed into certain categories based on the type of business they conduct. Commercial banks provide services to private individuals and businesses.

Retail banking provides credit, deposit, and money management to individuals and families.

1. Community Banking

Community banks are smaller than commercial banks. They concentrate on the local market. They provide more personalized service and build relationships with their customers.

2. Internet Banking

Internet banking provides these services via the world wide web. The sector is also called e-banking, online banking, and net banking. Most other banks now offer online services.

There are many online-only banks. Since they have no branches, they can pass cost savings onto the consumer.

3. Savings and Loan Banking

Savings and loans are specialized banking entities, created to promote affordable homeownership. Often these banks will offer a higher interest rate to depositors as they raise money to lend for mortgages.

4. Credit Unions

Credit unions are financial institutions that operate similarly to standard banks in many ways, but with a different structure. Customers own their credit unions.

This ownership structure allows them to provide low-cost and more personalized services. You must be a member of their field of membership to join.

That could be employees of companies or schools or residents of a geographic region.

5. Investment Banking

Investment banking finds funding for corporations through initial public stock offerings or bonds. They also facilitate mergers and acquisitions.

The largest U.S. investment banks include Bank of America, Citigroup, Goldman Sachs, J.P. Morgan Chase, Wells Fargo, Charles Schwab, and Morgan Stanley.

After Lehman Brothers failed in September 2008, signaling the beginning of the global of the late-2000s, investment banks became commercial banks.

That allowed them to receive government bailout funds. In return, they must now adhere to the Dodd-Frank Wall Street Reform and Consumer Protection Act regulations.

6. Merchant Banking

Merchant banking provides similar services for small businesses. They provide mezzanine financing, bridge financing, and corporate credit products.

7. Sharia Banking

Sharia banking conforms to the Islamic prohibition against interest rates. Also, Islamic banks don’t lend to alcohol and gambling businesses.

Borrowers profit-share with the lender instead of paying interest. Because of this, Islamic banks avoided the risky asset classes responsible for the 2008 financial crisis.

What is Electronic Banking?

Internet Banking, also known as net banking or online banking, is an electronic payment system that enables the customer of a bank or a financial institution to make financial or non-financial transactions online via the internet.

This service gives online access to almost every banking service, traditionally available through a local branch including fund transfers, deposits, and online bill payments to the customers.

After registering for online banking facilities, a customer need not visit the bank every time he/she wants to avail a banking service. It is not just convenient but also a secure method of banking.

Unique User/Customer IDs and passwords secure net banking portals.

Special Features of Electronic Banking

Here are some of the best features of Electronic banking:

History of Electronic Banking

For decades financial institutions have used powerful computer networks to automate millions of daily transactions.

In the 1950s the Bank of America was one of the first institutions to develop the idea that electronic computers could take over the banking tasks of handling checks and balancing accounts, which was, at that time, extremely labor-intensive.

Other institutions gradually joined the effort and progressed away from using paper checks and toward all-electronic banking.

The first electronic banking machines were able to keep records of deposits and withdrawals from each client, make account balance information available instantaneously, monitor overdrafts, stop payments, and hold funds.

The machines responsible for this work today are as exact and reliable as the banking industry requires them to be.

Importance of E-banking

We will look at the importance of electronic banking for banks, individual customers, and businesses separately.

Banks

Customers

Businesses

E-banking Services

In simple words, e-banking refers to a banking arrangement, with which the customer can perform various transactions over the internet, which is end-to-end encrypted, i.e. it is completely safe and secure.

E-banking promotes paperless/cashless transactions. It comes with a number of rights, responsibilities, and fees as well. The range of services covered under E-banking are:

1. Internet Banking

A banking facility is provided to the customers through which the customers are able to perform several monetary and non-monetary transactions, using the internet, through the bank’s website or application.

2. Mobile Banking

Almost all the banks have designed their mobile applications with which you can perform transactions at your fingertips.

For this, four things are required–a smartphone, internet, mobile application, and mobile banking service enabled in your bank account.

3. ATM

Automated Teller Machine, popularly known as ATM is one of the most common and initial services, provided under e-banking.

It is not just a machine with which you can withdraw cash as and when required, but it also allows you to check your account status, transfer fund, deposit fund, changes mobile number, change Debit Card PIN, i.e. Personal Identification Number.

4. Debit Card

Debit cards are used in our day-to-day life so as to perform the end number of transactions.

However, debit cards are linked to the customer’s bank account and so the customer only needs to swipe the card, in order to make payment at Point of Sale (POS) outlets, online shopping, ATM withdrawal.

In this way, the amount is deducted from the customer’s account directly.

5. Credit Card

Just like a debit card, a credit card is also a payment card that the bank issue to the customers at their request, after checking their credit score and history.

It enables the cardholder to borrow funds up to the pre-approved limit and make payments. The banks that issue the card grant the limit.

The cardholder promises to repay the amount within a stipulated time, with some charges, for the use of a credit card.

6. Point of Sale (POS)

Points of sale system refer to the point, in terms of date, time, and place (retail outlet) where the customer makes a payment, using a plastic card, for the purchase made or services received.

7. Electronic Data Interchange (EDI)

EDI is a new mode of communicating information between businesses electronically using a standardized format, which was conventionally paper-based.

8. Electronic Fund Transfer (EFT)

When money is transferred electronically from one bank to another, it is called an electronic fund transfer. It covers direct debit, direct deposits, wire transfers, NEFT, RTGS, IMPS, etc.

Levels of E-banking

Banks offer various types of services through electronic banking platforms. These are of three levels of services:

1. This is the basic level of service that banks offer through their websites.

Through this service, the bank offers information about its products and services to customers. Further, some banks may receive and reply to queries through e-mail too.

2. At this level, banks allow their customers to submit instructions or applications for different services, check their account balance, etc.

However, banks do not permit their customers to do any fund-based transactions on their accounts.

3. In the third level, banks allow their customers to operate their accounts for funds transfer, bill payments, purchase and redeem securities, etc.

Most traditional banks offer e-banking services as an additional method of providing service. Further, many new banks deliver banking services primarily through the internet or other electronic delivery channels.

Also, some banks are ‘internet only’ banks without any physical branch anywhere in the country.

Benefits of E-banking

6. Better Rates, Lower Fees

The lack of significant infrastructure and overhead costs allow direct banks to pay higher interest rates or annual percentage yields (APYs) on savings.

The most generous of them offer as much as 1% to 2% more than you’ll earn on accounts at a traditional bank—a gap that can really add up with a high balance.

While some direct banks with especially generous APYs offer only savings accounts, most of them offer other options including high-yield savings accounts, certificates of deposit (CDs), and no-penalty CDs for early withdrawal.

7. Better Online Experiences

Traditional banks are investing heavily in improving their virtual presence and service, including launching apps and upgrading websites. But overall, direct banks appear to retain an edge when it comes to the online banking experience.

A 2018 Bain and Company survey of retail banking customers found traditional banks lagged behind direct banks in the areas that mattered most to customers, including the quality of the banking experience and the speed and simplicity of transactions.

In a nutshell, any type of banking transaction performed through electronic mode comes under E-banking.

It is a secure, fast, and convenient electronic banking facility that allows its customers to undertake online banking services anytime during the day and at any place using the internet, for which the customers used to visit the banks in earlier days.

Cons of Internet Banks

Banking with an online institution also has its share of drawbacks and inconveniences.

1. No Personal Relationships

A traditional bank provides the opportunity to get to know the staff at your local branch.

That can be an advantage if and when you need additional financial services, such as a loan, or when you have to make changes to your banking arrangements.

A bank manager usually has some discretion in changing the terms of your account if your personal circumstances change, or in reversing a mandatory fee or service charge.

2. Less Flexibility With Transactions

In-person contact with a banking staffer isn’t only about getting to know you and your finances. For some transactions and problems, it’s invaluable to head to a bank branch.

Take, for example, depositing funds—the most basic of banking transactions. Depositing a check is possible with a direct bank by using its banking app to capture both the front and back of the check.

However, depositing cash is downright cumbersome at many online banks.

So, it’s worth checking the bank’s policy if this is something you plan to do frequently. International transactions may also be more difficult, or even impossible, with some direct banks.

3. The Absence of Their Own ATMs

Since they lack their own banking machines, online banks rely on having customers use one or more ATM networks such as those from AllPoint and Cirrus.

While these systems offer access to tens of thousands of machines across the country—even around the world—it’s worth checking the available machines near where you live and work.

Check, too, for any fees you may rack up for ATM use. While many direct banks offer free access to network ATMs or will refund any monthly charges you incur, there are sometimes limits on the number of free ATM transactions you can make in a given month.

4. More Limited Services

Some direct banks may not offer all the comprehensive financial services that traditional banks offer, such as insurance and brokerage accounts.

Traditional banks sometimes offer special services to loyal customers, such as preferred rates and investment advice at no extra charge.

In addition, routine services such as notarization and bank signature guarantee are not available online.

Types of Fund Transfers using Electronic Banking

NEFT

National Electronic Fund Transfer (NEFT) is a payment system that allows one-to-one fund transfer.

RTGS

Real-Time Gross Settlement (RTGS) is a continuous settlement of funds individually on an order by order basis.

IMPS

Immediate Payment System (IMPS) is another payment method that transfers funds in real-time.

Frequently Asked Questions

1. How Can I Use Internet Banking?

To use internet banking, you must have an operating account in any bank or a financial institution. You need to register for online banking at the bank to obtain a unique ID and password.

For that, you can download the net-banking application form from your bank’s net-banking website or visit the bank and fill in the form.

2. Can I Change My Internet Banking Password?

After logging in to the net-banking portal for the first time, all the users must change the password which is issued by the bank.

Also, you should change your password at least once every two months.

3. Precautions for Internet Banking

More Frequently Asked Questions

4. What Is User ID in Net-Banking?

Most of the banks provide internet banking ID and password as and when you apply for a new account.

If you haven’t received your user ID and password, you need to apply for net-banking at the bank by filling and submitting an application form.

After verification, you will receive a unique user ID and password to login to net banking.

5. Are Electronic Banking and Internet Banking the Same?

No. Electronic banking is a broad term or category which includes various forms of banking services and transactions performed through electronic means such as internet banking, mobile banking, telebanking, ATMs, debit cards, and credit cards.

Internet banking is one of the latest additions to electronic banking. Thereby, internet banking is a part of electronic banking.

In conclusion, any type of banking transaction performed through electronic mode comes under E-banking.

It is a secure, fast, and convenient electronic banking facility that allows its customers to undertake online banking services anytime during the day and at any place using the internet.

If this was helpful, do well to share with your family and friends, and also, leave your opinions in the comment below.

E-banking

Definition: E-banking is a blanket term used to indicate a process through which a customer is allowed to carry out, personal or commercial banking transactions using electronic and telecommunication network.

It is a product offered by banks which facilitates online banking, with the help of which the customer can have access to the bank account in just one click.

E-banking covers facilities such as – fund transfer, checking account statements, utility bill payments, opening of bank account, locating nearest ATM, obtain information on financial products and services, applying for loans, etc. using a personal computer, smartphone, laptop or personal digital assistant.

Let’s look at the types of digital payments:

E-banking Services

In simple words, e-banking refers to a banking arrangement, with which the customer can perform various transactions over the internet, which is end-to-end encrypted, i.e. it is completely safe and secure.

E-banking promotes paperless/cashless transactions. It comes with a number of rights, responsibilities and fees as well. The range of services covered under E-banking are:

Benefits of E-banking

In a nutshell, any type of banking transaction performed through electronic mode comes under E-banking.

It is a secure, fast and convenient electronic banking facility that allows its customers to undertake online banking services anytime during the day and at any place using the internet, for which the customers used to visit the banks in earlier days.

:max_bytes(150000):strip_icc()/img_9801__jake_frankenfield-5bfc261946e0fb002600684b.jpg)

:max_bytes(150000):strip_icc()/IMG_7291_Crop-SomerAnderson-fdd793749683441487bbf0bd73328c59.jpg)

:max_bytes(150000):strip_icc()/SuzannesHeadshot-3dcd99dc3f2e405e8bd37271894491ac.jpg)

:max_bytes(150000):strip_icc()/PritchardJustinJacketSized-5b7485a846e0fb0050436534.jpg)

:max_bytes(150000):strip_icc()/KhadijaKhartit-4f144e2b63ee4dd4af60ac8a02233c50.jpg)

:max_bytes(150000):strip_icc()/chavez.ariana.headshotcopy-0c7aa0509fad42a885bf4fe42fe0a83f.jpg)

:strip_icc()/what-is-an-online-bank-315204_final-98ce36e857d245d2867e28fa4c189111.png)