What is the relationship between debt and cost of equity

What is the relationship between debt and cost of equity

How Do Cost of Debt Capital and Cost of Equity Differ?

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit; find her on LinkedIn and Facebook.

Every business needs capital to operate successfully. Capital is the money a business—whether it’s a small business or a large corporation—needs and uses to run its day-to-day operations. Capital may be used to make investments, conduct marketing and research, and pay off debt.

There are two main sources of capital companies rely on—debt and equity. Both provide the necessary funding needed to keep a business afloat, but there are major differences between the two. And while both types of financing have their benefits, each also comes with a cost.

Below, we outline debt and equity capital, and how they differ.

Key Takeaways

Debt Capital

Debt capital refers to borrowed funds that must be repaid at a later date. This is any form of growth capital a company raises by taking out loans. These loans may be long-term or short-term such as overdraft protection.

Debt capital does not dilute the company owner’s interest in the firm. But it can be cumbersome to pay back interest until its loans are paid off—especially when interest rates are rising.

Companies are legally required to pay out interest on debt capital in full before they issue any dividends to shareholders. This makes debt capital higher on a company’s list of priorities over annual returns.

While debt allows a company to leverage a small amount of money into a much greater sum, lenders typically require interest payments in return. This interest rate is the cost of debt capital. Debt capital can also be difficult to obtain or may require collateral, especially for businesses that are in trouble.

Equity Capital

Because equity capital typically comes from funds invested by shareholders, the cost of equity capital is slightly more complex. Equity funds don’t require a business to take out debt which means it doesn’t need to be repaid. But there is some degree of return on investment shareholders can reasonably expect based on market performance in general and the volatility of the stock in question.

Companies must be able to produce returns—healthy stock valuations and dividends—that meet or exceed this level to retain shareholder investment. The capital asset pricing model (CAPM) utilizes the risk-free rate, the risk premium of the wider market, and the beta value of the company’s stock to determine the expected rate of return or cost of equity.

Equity capital reflects ownership while debt capital reflects an obligation.

Typically, the cost of equity exceeds the cost of debt. The risk to shareholders is greater than to lenders since payment on a debt is required by law regardless of a company’s profit margins.

Equity capital may come in the following forms:

Equity capital is reported on the stockholder’s equity section of a company’s balance sheet. In the case of a sole proprietorship, it shows up on the owner’s equity section.

Should a Company Issue Debt or Equity?

Businesses often need external money to maintain their operations and invest in future growth. There are two types of capital that can be raised: debt and equity.

Debt Capital

Debt financing is capital acquired through the borrowing of funds to be repaid at a later date. Common types of debt are loans and credit. The benefit of debt financing is that it allows a business to leverage a small amount of money into a much larger sum, enabling more rapid growth than might otherwise be possible.

In addition, payments on debt are generally tax-deductible. The downside of debt financing is that lenders require the payment of interest, meaning the total amount repaid exceeds the initial sum. Also, payments on debt must be made regardless of business revenue. For smaller or newer businesses, this can be especially dangerous.

Equity Capital

Equity financing refers to funds generated by the sale of stock. The main benefit of equity financing is that funds need not be repaid. However, equity financing is not the «no-strings-attached» solution it may seem.

Shareholders purchase stock with the understanding that they then own a small stake in the business. The business is then beholden to shareholders and must generate consistent profits in order to maintain a healthy stock valuation and pay dividends. Since equity financing is a greater risk to the investor than debt financing is to the lender, the cost of equity is often higher than the cost of debt.

How to Choose Between Debt and Equity

The amount of money that is required to obtain capital from different sources, called cost of capital, is crucial in determining a company’s optimal capital structure. Cost of capital is expressed either as a percentage or as a dollar amount, depending on the context.

Assuming the tax rate is 30%, the above loan would have an after-tax cost of capital of 4.2%.

Cost of Equity Calculations

The cost of equity financing requires a rather straightforward calculation involving the capital asset pricing model or CAPM:

By taking into account the returns generated by the larger market, as well as the individual stock’s relative performance (represented by beta), the cost of equity calculation reflects the percentage of each invested dollar that shareholders expect in returns.

Finding the mix of debt and equity financing that yields the best funding at the lowest cost is a basic tenet of any prudent business strategy. To compare different capital structures, corporate accountants use a formula called the weighted average cost of capital, or WACC.

The WACC multiplies the percentage costs of debt—after accounting for the corporate tax rate—and equity under each proposed financing plan by a weight equal to the proportion of total capital represented by each capital type.

This allows businesses to determine which levels of debt and equity financing are most cost-effective.

How Do You Calculate Debt and Equity Ratios in the Cost of Capital?

The ratio between debt and equity in the cost of capital calculation should be the same as the ratio between a company’s total debt financing and its total equity financing. Put another way, the cost of capital should correctly balance the cost of debt and cost of equity. This is also known as the weighted average cost of capital, or WACC.

Cost of Debt

The cost of debt does not represent just one loan or bond. Cost of debt theoretically shows the current market rate the company is paying on its debt. However, the real cost of debt is not necessarily equal to the total interest paid, because the company is able to benefit from tax deductions on interest paid. The real cost of debt is equal to interest paid less any tax deductions on interest paid.

The dividends paid on preferred stock are considered a cost of debt, even though preferred shares are technically a type of equity ownership.

Cost of Equity

Compared to cost of debt, the cost of equity is complicated to estimate. Shareholders do not explicitly demand a certain rate on their capital in the way bondholders or other creditors do; common stock does not have a required interest rate.

Shareholders do expect a return, however, and if the company fails to provide it, shareholders dump the stock and harm the company’s value. Thus, the cost of equity is the required return necessary to satisfy equity investors.

The most common method used to calculate cost of equity is known as the capital asset pricing model, or CAPM. This involves finding the premium on company stock required to make it more attractive than a risk-free investment, such as U.S. Treasurys, after accounting for market risk and unsystematic risk.

Weighted Average Cost of Capital

WACC takes all capital sources into consideration and ascribes a proportional weight to each of them to produce a single, meaningful figure. In long form, the standard WACC equation is:

T firm’s WACC is the required return necessary to match all of the costs of its financing efforts and can also be a very effective proxy for a discount rate when calculating Net Present Value, or NPV, for a new project.

Difference Between Cost of Equity and Cost of Debt

February 22, 2017 Posted by Dili

Key Difference – Cost of Equity vs Cost of Debt

Cost of equity and cost of debt are the two main components of cost of capital (Opportunity cost of making an investment). Companies can acquire capital in the form of equity or debt, where the majority is keen on a combination of both. If the business is fully funded by equity, cost of capital is the rate of return that should be provided for the investment of shareholders. This is known as cost of equity. Since there is usually a portion of capital funded by debt as well, cost of debt should be provided for debt holders. Thus, the key difference between cost of equity and cost of debt is that cost of equity is provided for shareholders whereas cost of debt is provided for debt holders.

What is Cost of Equity

Cost of Equity is the required rate of return by the equity shareholders. Cost of equity can be calculated using different models; one of the most commonly used one being the Capital Assets Pricing Model (CAPM). This model investigates the relationship between systematic risk and expected return for assets, particularly shares. Cost of Equity can be calculated using CAPM as follows.

Risk Free Rate= (rf)

Risk free rate is the theoretical rate of return of an investment with zero risk. However practically there is no such investment where there is absolutely no risk. The government Treasury bill rate is usually used as an approximation to the risk free rate due to its low possibility of default.

Beta of the Security= (βa)

This measures how much a company’s share price reacts against the market as a whole. A beta of one, for instance, indicates that the company moves in line with the market. If the beta is more than one, the share is exaggerating the market’s movements; less than one means the share is more stable.

Equity Market Risk Premium= (rm – rf)

This is the return that investors expect to be compensated for investing above the risk free rate. Thus, this is the difference between market return and risk free rate.

Cost of Equity = 4% + 1.1 * 6% = 10.6%

Equity capital does not need to pay interest; thus, the funds can be successfully utilized in the business without any additional cost. However, equity shareholders generally expect a higher rate of return; therefore, the cost of equity is higher than cost of debt.

What is Cost of Debt

Cost of debt is simply the interest a company pays on its borrowings. Cost of debt is tax deductible; thus, this is usually expressed as an after tax rate. Cost of debt is calculated as below.

Cost of Debt = r (D)*(1 – t)

Pre-tax Rate = r (D)

This is the original rate at which the debt is issued; thus, this is the pre-tax cost of debt.

Tax Adjustment = (1 – t)

The rate at which tax payable should be deducted by 1 to arrive at the post-tax rate.

Cost of Debt = 5% (1 – 30%) = 3.5%

Tax savings can be made on debt while equity is tax payable. Interest rates payable on debt is generally lower compared to the returns expected by equity shareholders.

Figure 1: Interest is payable on debt

Weighted Average Cost of Capital (WACC)

WACC calculates an average cost of capital considering the weightages of both equity and debt components. This is the minimum rate that should be achieved in order to create shareholder value. Since most companies comprise of both equity and debt in their financial structures, they have to consider both in determining the rate of return that should be generated for the capital holders.

The composition of debt and equity is also vital for a company and should be at an acceptable level at all times. There is no specification of an ideal ratio as to how much debt and how much equity a company should have. In certain industries, especially in capital intensive ones, a higher proportion of debt is deemed to be normal. The following two ratios can be calculated to find the mixture of debt and equity in capital.

Debt Ratio = Total debt / Total assets *100

Debt to Equity Ratio = Total debt/Total equity *100

What is the difference between Cost of Equity and Cost of Debt?

Cost of Equity vs Cost of Debt

Summary – Cost of Debt vs Cost of Equity

The principle difference between cost of equity and cost of debt can be attributed to whom the returns should be paid. If it is for the shareholders, then cost of equity should be considered and if it is to the debt holders, then cost of debt should be calculated. Even though tax savings are available on debt, a high portion of debt in the capital structure is not regarded as a healthy sign.

Reference:

1. “Cost Of Equity – Complete Guide To Corporate Finance.” Investopedia. N.p., 03 June 2014. Web. 20 Feb. 2017.

2. “Cost Of Debt.” Investopedia. N.p., 30 Dec. 2015. Web. 20 Feb. 2017.

3. “Weighted Average Cost of Capital.” Weighted Average Cost of Capital (WACC) | Formula | Example. N.p., n.d. Web. 20 Feb. 2017.

4. “Debt vs. Equity — Advantages and Disadvantages.” Findlaw. N.p., n.d. Web. 20 Feb. 2017.

Image Courtesy:

1. “Greece gmnt bonds”By Verbal.noun at English Wikipedia (CC BY 3.0) via Commons Wikimedia

Related posts:

About the Author: Dili

Dili has a professional qualification in Management and Financial Accounting. She has also completed her Master’s degree in Business administration. Her areas of interests include Research Methods, Marketing, Management Accounting and Financial Accounting, Fashion and Travel.

Leave a Reply Cancel reply

Featured Posts

Difference Between Coronavirus and Cold Symptoms

Difference Between Coronavirus and SARS

Difference Between Coronavirus and Influenza

Difference Between Coronavirus and Covid 19

You May Like

Difference Between Saturn and Jupiter

Difference Between Sodium Carbonate and Sodium Bicarbonate

Difference Between Prilosec and Prilosec OTC

Difference Between Prom Dress and Wedding Dress

Difference Between Slang and Dialect

Latest Posts

Copyright © 2010-2018 Difference Between. All rights reserved. Terms of Use and Privacy Policy: Legal.

Cost of Capital

Meaning

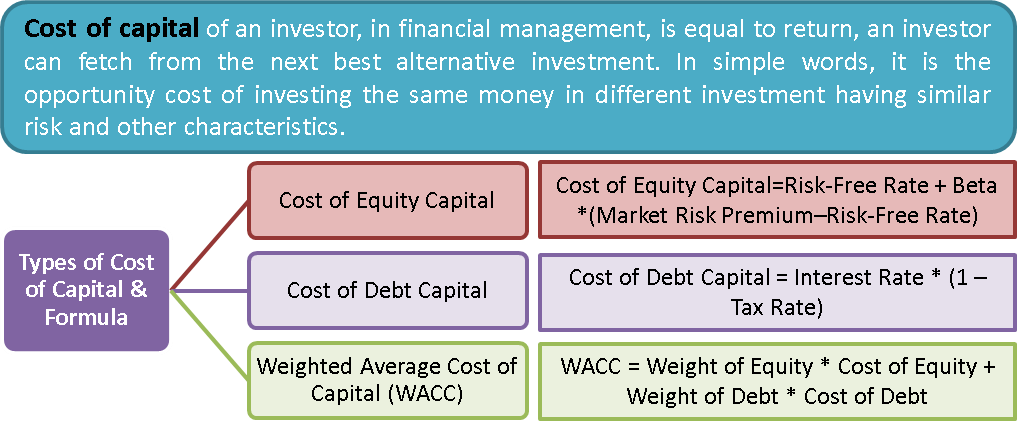

What is the cost of capital? The cost of capital of an investor in financial management is equal to the return an investor can fetch from the next best alternative investment. In simple words, it is the opportunity cost of investing the same money in a different investment having similar risks and other characteristics. From a financing angle, it is simply the cost paid for using the capital. Alternatively, a percentage return on investment that convinces an investor to invest in a particular project or company is the appropriate cost of capital for that investor.

Types of Cost of Capital

The term cost of capital is vague in general. Does it not clarify which capital we are talking about? It could be equity or debt, or any other source of capital. We can classify the cost of capital into the following broad classifications.

Cost of Equity

The cost of equity is the cost of using the money of equity shareholders in the operations. We incur this in the form of dividends and capital appreciation (increase in stock price). Most commonly, the cost of equity is calculated using the following formula:

The formula for Cost of Equity Capital = Risk-Free Rate + Beta * (Market Risk Premium – Risk-Free Rate)

Cost of Debt

The cost of debt capital is the cost of using a bank’s or financial institution’s money in the business. The banks get their compensation in the form of interest on their capital. The formula for calculating the cost of debt is as follows.

Cost of Debt Capital = Interest Rate * (1 – Tax Rate)

Also, visit Cost of Preference Share Capital to learn more about it.

Weighted Average Cost of Capital (WACC)

Most of the time, we also use WACC in place of the cost of capital because of its frequent and vast utilization, especially when evaluating existing or new projects. As the term itself suggests, WACC is the weighted average of all types of capital present in the capital structure of a company. Assuming these two types of capital in the capital structure, i.e., equity and debt, we can calculate the WACC using the following formula:

WACC = Weight of Equity * Cost of Equity + Weight of Debt * Cost of Debt.

To understand why we use capital values (market value or book value) as weights of each capital, visit: Market vs. Book Value Weights

You can also take a quick quiz here:

Quiz on Cost of Capital

This quiz will help you to take a quick test of what you have read here.

SHARE YOUR RESULTS

There are practically 2 important participants relevant for using this concept, i.e., the company’s financial managers or the investor.

How and Why do Financial Managers Use it?

Typically, financial managers use WACC as a benchmark or a qualifying criterion for selecting the new projects of a company or evaluating the existing projects. If a company is accepting or implementing projecting with IRR less than WACC, it means that it is not getting the best use of the investor’s capital and hence diminishing the wealth of the investors. Indirectly, it signals the investors to switch their capital to better investments. If they remain invested in the company, there are chances that they may not earn their required rate of return.

How and Why do Investors use it?

Investors can use it to judge the riskiness of the investment in a company’s stock. Note that the cost of capital is not a very authoritative metric to guide risk, especially when there are other good metrics to get a better view of risk.

Factors Affecting Cost of Capital

There are various factors that can affect the cost of capital. Some fundamental factors are as follows:

Primarily, the market opportunity available to entrepreneurs is the most contributing factor. If no new profitable businesses are available in the market, a business person would not need money. Therefore the demand for money will fall, resulting in a fall in the cost of capital.

Preferences of capital providers in terms of consumption or savings are other important factors that vary from person to person and country to country. If the capital providers bent towards consumption, the supply of capital would reduce and thereby increase in cost.

We have already discussed the importance of risk. The higher the risk, the higher the required rate of return and vice versa.

In economics, it is said that inflation plays an important role in deciding this cost. The higher the inflation, the higher would be expectations of the capital providers. Else they may opt to consume or invest somewhere else.

Источники информации:

- http://www.investopedia.com/ask/answers/032515/how-does-company-choose-between-debt-and-equity-its-capital-structure.asp

- http://www.investopedia.com/ask/answers/021115/how-do-you-calculate-ratio-between-debt-and-equity-cost-capital.asp

- http://www.differencebetween.com/difference-between-cost-of-equity-and-vs-cost-of-debt/

- http://efinancemanagement.com/investment-decisions/cost-of-capital

:max_bytes(150000):strip_icc()/biopic_2__claire_boytewhitebw-5bfc261bc9e77c00262f61d9.png)

:max_bytes(150000):strip_icc()/CharleneRhinehartHeadshot-CharleneRhinehart-ca4b769506e94a92bc29e4acc6f0f9a5.jpg)

:max_bytes(150000):strip_icc()/KSchmitt2019Color-67b7647ab8114851ab0fd161242d5f89.jpg)

:max_bytes(150000):strip_icc()/Dr.JeFredaR.Brownheadshot-JeFredaBrown-1e8af368a1ea4533a21868d8a951895a.jpg)

:max_bytes(150000):strip_icc()/SuzannesHeadshot-3dcd99dc3f2e405e8bd37271894491ac.jpg)

:max_bytes(150000):strip_icc()/picture-53893-1440688982-5bfc2a88c9e77c005143c705.png)

:max_bytes(150000):strip_icc()/PortraitHeadshot-DavidKindness-DavidKindness-2318e84654364a0584b715e44c99f13a.jpg)