What kind of ownership does canada have

What kind of ownership does canada have

How Does Canada’s Home Ownership Rate Look?

Which of these three below doesn’t belong with the other two:

How in the world could the third point be accurate if the first two are as well?

In this market, I’m not surprised by a statistic all that often. When it comes to monthly TRREB data, there’s always a stat or two that might not entirely line up with what I had experienced in the previous month, but for a major statistically-backed trend to come as a surprise is quite rare.

Case in point: home ownership rates in Canada are increasing.

Yes, you read that correctly, and no, it’s not impossible for the three points above to co-exist.

I’ll admit, I certainly wasn’t aware of this, and had I been asked to guess or weigh in on the subject, I’d have assumed that home ownership rates are decreasing.

Think about it this way:

On the one hand, lower interest rates should significantly help buyers get into the market.

On the other hand, prices are rising faster than the savings from low-rate mortgages can offset.

Then again, it’s possible that Canada-wide, home-ownership rates are increasing in the face of decreasing rates in certain cities.

Before I present you with the statistics, let me say this: stats like this are always delayed by 1-2 years. If you want statistics for 2021, your standards are too high. And if you want statistics for 2020, you’re still out of luck.

Trading Economics is a site I frequent for stats and that’s where these were pulled from.

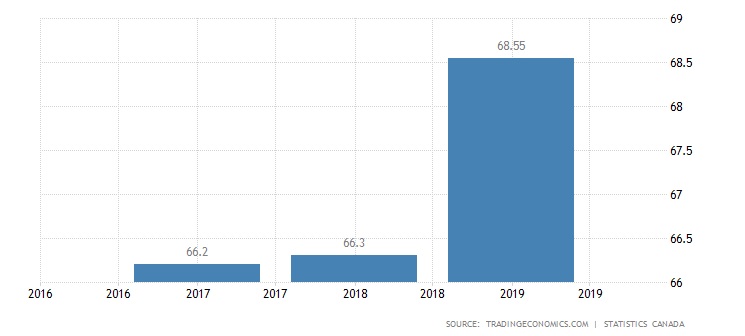

Here’s how the home ownership rate in Canada looks for the last five years for which we have data:

From 2018 to 2019, we saw the home ownership rate increase from 66.3% to 68.55%, which is hardly insignificant.

With an increasing population, we might expect that the number of new dwellings constructed is not in line with the number of new entrants to the market. I certainly would!

Not only that, part of the immigrant population is made of refugees, who aren’t going to be able to afford to buy property, and I would speculate that an individual or a family immigrating to Canada, in general, is less likely to be able to afford a purchase than a Canadian resident already on the ground here. No data to back that up, but I can’t imagine it being the other way around.

So if we’re seeing increasing home ownership rates, how do we make sense of that? What is the root cause?

Perhaps it’s low interest rates.

Perhaps it’s simply a desire among millennials to want to be home-owners. There’s been no shortage of media coverage on this topic over the last year, case in point: “How The Pandemic Pushed Canadian Millennials To Home Ownership”

Whatever the case, with the price of real estate rising each and every year in most Canadian cities, it’s odd to see an increasing rate of home ownership.

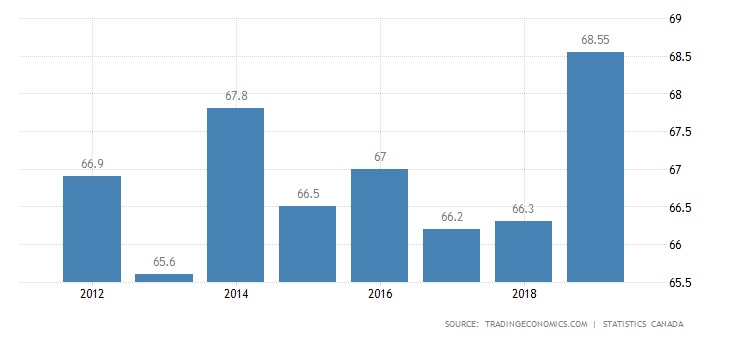

Here’s a 10-year trend:

Here we see that the 68.55% home ownership rate recorded in 2018 is actually a decade-high.

Again, you might not be all that moved by 1% here or 1% there, but we have 38-39 Million people in the country, and how many of them are over 18-years-old? Half? So what’s one percent of that? We’re talking about a lot of people owning or not owning homes when these figures fluctuate by one percent.

We’re two decades into a bull-market now, and so the following 25-year chart may come as a surprise:

We’re sitting at a record-high level of home ownership in Canada, despite the fact that prices have been accelerating almost the entire time.

Perhaps this is a self-fulfilling prophecy: prices are increasing because the proportion of home owners is increasing as well?

Many of the TRB readers have lived in different countries, and/or have parents that have lived abroad as well. From time to time, we discuss how home ownership here in Canada stacks up against the rest of the world, with some readers commenting that it’s too hard, too expensive, and too unfair to would-be owners, with others commenting on how home ownership rates look elsewhere.

So why not paint a pretty picture to address those comments, shall we?

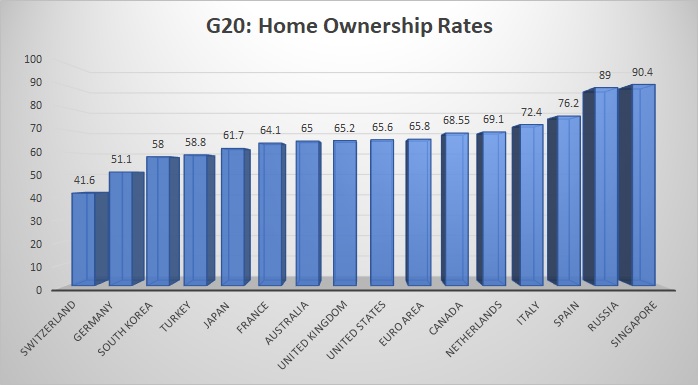

Here’s the rates of home ownership in the G20 countries, for which data is available:

First, and foremost: Singapore.

Singapore is an anomaly in 2021, and they are either way ahead of the rest of us, or they’ve just done something that no other country is going to do.

This is one of the wealthiest countries, not just in Asia, but in the world. They have almost eliminated poverty entirely, and with a ridiculous 90.4% home ownership rate, there’s obviously a “catch,” right?

Housing estates also follow a standard ‘formula’. Approximately 20 to 40 HDB blocks form an estate. Each estate is designed to be self-contained with amenities within walking distance from each other. Almost all public housing estates follow this system and configuration. HDB blocks are also being built with standardized construction systems. Flats all follow relatively standardized sizes and configurations. A system of construction using standardized prefabricated concrete pieces has greatly decreased construction time and cost. This enables flats to be built quickly, efficiently and of high quality.

That certainly explains a ridiculous 90% home ownership rate!

It also explains why Canada’s 68.55%, while trailing the “leader” by over twenty percent, is actually about as high as we can reasonably expect to get.

As for Russia, I don’t even know what to say. That’s a complex government and political system that I don’t understand at all. So I’ll just leave it at that.

So Canada is sandwiched between “Euro Area” and the Netherlands, which is another very, very complicated real estate market!

A client of mine who lives in the Netherlands told me the following about how their real estate market works:

Forms of Business Ownership in Canada

Advantages and Disadvantages of Each Form of Business

Hero Images/Hero Images/Getty Images

When you’re considering the legal structure of your business, in Canada you have four forms of business ownership to choose from, a sole proprietorship, a partnership, a corporation, or a cooperative.

Each of these forms of business ownership has advantages and disadvantages that you will want to weigh before choosing a particular form of business for your new venture. First, let’s look at the advantages and disadvantages of sole proprietorships, the most popular form of business ownership.

The Advantages of a Sole Proprietorship

The simplest form of business is the sole proprietorship, a business owned and operated by one individual. You can operate a sole proprietorship under your own name, or under another name you’ve chosen (as long as you don’t add any of the legal designations of other forms of business, such as Ltd. or Inc.)

One of the biggest advantages of a sole proprietorship is that setting up and administering the business is comparatively easy and inexpensive. For instance, in most provinces, if you choose the sole proprietor form of business ownership and operate it under your own name, you don’t even have to register your business.

(Note that while the basic procedure for setting up a business is the same, no matter what part of Canada you live in, the details are different in each province and territory. For start-up information for particular provinces, such as business registration procedures for each form of business, see:

And even if you do have to register your sole proprietorship with your province or territory, it’s a lot more inexpensive to register than a corporation. Nor do you have to make annual filings when you run a sole proprietorship (although in some provinces, such as Ontario, you have to renew your sole proprietorship business registration every five years).

Another of the big advantages of the sole proprietorship form of business ownership is the tax simplicity. As a sole proprietor, you declare your business income on your personal income tax form, rather than having to file a separate tax form, (as you would have to do if you chose the corporate form of business ownership).

Too many small business owners, the best advantage of the sole proprietorship is that as a sole proprietor, you own 100% of your business. You’re the one that runs your small business and no one else can tell you what to do or how to do it.

Disadvantages of Sole Proprietorships

What appears to be an advantage at first look can also be a serious disadvantage. When it comes to disadvantages of a sole proprietorship, being the sole owner can be disastrous if things go badly.

If you set up your business as a sole proprietorship, legally your business is considered to be an extension of yourself, meaning that you assume all responsibilities for the business. This means that as a sole proprietor, you are personally responsible for all the debts and liabilities of your business. So if your business fails, any of your assets, including your personal assets, can be seized and used to discharge the liability you’ve incurred.

This personal liability is the biggest disadvantage of choosing to operate as a sole proprietorship. Other disadvantages of sole proprietorships include a lack of tax flexibility, the increased difficulty of raising money and the potential for weak management if the sole owner doesn’t have all the skills or knowledge necessary to lead the company well.

The Partnership Form of Business Ownership

If you don’t want to go it alone and be the sole owner and operator of your business, you may wish to legally set up your business as a partnership.

You can create a partnership between two people, or among thirty; the law doesn’t set a limit on how many partners may be involved.

There are three types of partnership in Canada, but whether you can legally set up any kind of partnership other than a general partnership depends on what province or territory your business will operate in and what kind of business you’re in.

The General Partnership

The most common type of partnership is a general partnership. In a general partnership, each partner is jointly and severally liable for the debts of the partnership.

The Limited Partnership

A limited partnership is an arrangement where a person can contribute to a business without being involved in the affairs of the partnership. As a limited partner, your liability to the firm or its creditors is limited to the amount you invest in the firm. To remain a limited partner, you must take no part in the management of the firm or act on behalf of the company, or you become a general partner. (In some provinces, only certain kinds of businesses are allowed to operate as limited partnerships.)

The Limited Liability Partnership

In Canada, a limited liability partnership is usually only available to groups of professionals, such as lawyers, accountants, and doctors. These partnership agreements are governed by specific provincial legislation. For instance, currently, in Ontario, only lawyers, chartered accountants, and certified general accountants may form a Limited Liability Partnership.

Advantages and Disadvantages of a Partnership

A partnership can sign contracts and borrow money in its own right, which eases some of the liability burdens a sole proprietorship would bear.

The main advantage of the partnership, however, lies in the working relationship between the partners rather than in the legal structure of the company. The most successful partnerships are those where the partners have complementary talents and are comfortable sharing decision making. If one partner has skills and talents the other doesn’t, a partnership can truly be a match made in heaven.

And partnerships have the same tax simplicity that sole proprietorships have. Partnerships do not have to file separate income tax returns or pay separate income tax, as the financial information from the partnership is combined with the personal income of the partners to determine their overall tax liability. In other words, if you choose the partnership form of business ownership, you’ll still file your taxes using the T1 income tax form.

Another disadvantage of a partnership that many people don’t think of until it happens is that partnerships can be the messiest, a most acrimonious form of business ownership to dissolve. If you do decide to form a partnership of any type, a partnership agreement is essential. 10 Questions Good Partnership Agreements Need to Answer explains what such an agreement should cover.

Many people are uncomfortable with the sole proprietorship and partnership forms of business ownership because of the amount of personal liability involved. If this describes you, you may wish to consider incorporating your business.

Advantages and Disadvantages of the Corporation

A corporation (or limited company) is a distinct legal entity separate from its owners or shareholders. Therefore, no member of the company can be held personally liable for the debts, obligations or acts of the company. A shareholder is only liable for the unpaid portion of shares owned.

While this limited liability is an advantage, a corporation is the most expensive and difficult form of business ownership to set up and operate, especially as you may want to incorporate your business federally as well as provincially, an entirely separate procedure.

Federal incorporation gives a company the right to operate under its corporate name throughout Canada, while provincial incorporation gives a company the right to operate under its corporate name in a particular province.

How To Incorporate Your Business in Canada outlines the steps to form a corporation.

Corporations are certainly more expensive to administer because they must file annual income tax returns with the Canada Customs and Revenue Agency (CRA), the provincial Ministry of Finance (and possibly other provinces in which the corporation does business).

But depending on the type of business you’re starting and your plans for your business, forming a corporation could be your best choice.

The Cooperative Form of Business Ownership

A cooperative is a legally incorporated business owned and controlled by its members. A cooperative is able to enter into contracts under its corporate name. Liability for the individual members of a cooperative is limited to the extent of the value of shares held.

You can only legally structure your business as a cooperative if your business is organized as, and will be operated as, a cooperative according to the Canada Cooperatives Act. For more information on how a cooperative operates and how a cooperative differs from other businesses, see Industry Canada’s Incorporation Kit for Cooperatives.

Structure Your Business Even Before You Name It

The legal form of business ownership you choose will affect everything from the administrative costs of setting up and operating your business, through your tax planning. It’s a decision you need to make even before you choose a name for your business.

However, bear in mind that choosing a form of business ownership is not a decision that you can’t alter when your circumstances change. Many small businesses, for instance, start out as sole proprietorships and then become corporations at a later date. So pick the form of business ownership that’s right for your current circumstances, and review your decision as your business grows.

In This Section

What Kind of Economy Does Canada Have?

In these days when we have heard so much debate about private enterprise, it is interesting to observe that Canadians have gone in for public enterprise much more than we have.

When the Dominion was first formed, the federal government undertook to build and operate a railway that would unite the Maritime Provinces with Central Canada. As a business proposition it did not pay, it could not pay, and it was never intended to pay. It was a great public work to draw the country together.

Similarly when the Dominion acquired the country west of the Great Lakes out to the Pacific, the federal government undertook to provide a railway that would tie the West to the East—the Canadian Pacific Railway. It too was started as a government concern, and though later turned over to a private corporation, it had to be heavily subsidized by the government. Otherwise private capital would not touch it.

In both these early ventures the Canadian people and their government were giving bold recognition to the fact that the profit motive was not sufficient to meet the needs of the nation.

Today there are only two railway systems in the country, both operating from the Atlantic to the Pacific. One is the privately owned Canadian Pacific (17,058 miles). The other is the Canadian National (22,586 miles), which is owned and operated by the federal government.

You may have heard this railway cited as convincing proof that public ownership does not pay. But one can just as truthfully argue that it proves the failure of private enterprise. Most of it, the rest being what the federal government had built and operated, is made up of the wrecks of private undertakings: railways that had become heavily mortgaged to the government and then had gone broke. Not from choice but out of necessity—national necessity—the government undertook this enormous extension of public ownership.

Moreover, the Canadian government owns and operates one of the two telegraph systems of the country, one of the two big hotel chains, and a fleet of steamships. They were all taken over when the railways were nationalized—for Canada, in contrast to the United States, has not believed in divorcing these lines of business.

They seem to like it

Public ownership and operation of other utilities is also common in Canada. The “Hydro” Commission of the Ontario government has long supplied at cost most of the power consumed in the province. Its success stimulated the development of provincial and municipal power systems throughout the country, particularly in the West. In that part of the country the telephone systems have also been commonly public enterprises from the time they were first installed. The same has been true of municipal transportation.

Perhaps stranger still to us is what happened when prohibition was repealed in Canada—a decade before we repealed it, because in Canada the constitution was not involved. The Canadians refused to restore the old private liquor traffic. Instead, each of the provinces established a public monopoly, with conveniently located government stores selling liquor only in containers for consumption off the premises. Unlike most other government businesses in Canada, which have been operated to serve the public at cost, this one has been run for profit—and the profits have been very large.

During the 1930’s the Dominion government entered two other fields which we Americans also usually regard as within the proper domain of private enterprise: radio and air transportation.

The Canadian Broadcasting Corporation (CBC) of the federal government owns and operates the only national chain of stations in the country. There are still 100 private stations; but these are supervised by CBC, and their total power is scarcely more than a quarter that of CBC stations. There are also private airlines in Canada, but the only national system, operating from Atlantic to Pacific is the federal government’s Trans-Canada Airlines.

The motive behind these latest government enterprises was the same as that which had prompted the federal government to build railways. National unity had to be promoted in the face of the sectional pull exerted by our country. Canadians believe the result has justified the effort.

Our major political parties may differ somewhat on the issue of government versus private enterprise, but the corresponding parties in Canada do not. The Conservatives have been just as responsible as the Liberals for all this development. As a rule, Canadian public enterprises in the economic field are kept out of politics.

What did World War I do to Canada?

The depression taught the United States, rather painfully, how much our economic welfare is bound up with that of the rest of the world. But Canada is three or four times more dependent upon foreign trade than we are. It cannot help itself. Nature is responsible for the situation.

During the opening years of this century, the mainspring of Canadian prosperity was the rapid development of the Prairie Provinces. People were rushing in to build a whole new society on a foundation of wheat. It was a fat land, best suited to the production of this king of all grains.

Industrial Europe was willing to pay a profitable price for all that the Canadian prairie could supply. Wheat poured out of the West and across the Atlantic. The Dominion became one of the world’s chief exporters of wheat.

When World War I jumped the prices of food fast and far, the Canadian West almost doubled its wheat acreage and increased its livestock by a third. War demands caused an unprecedented exploitation of the country’s forest and mineral resources also-in British Columbia, in northern Ontario and Quebec, and in the Maritimes. Yet of all the extractive industries, agriculture still supplied the great bulk of Canadian exports.

Another industry, however, was catching up and at the end of the war accounted for more exports than agriculture. It was manufacturing. World War I made the Dominion one of the leading manufacturing countries in the world and transferred to Canadian ownership much of the foreign capital invested in the country.

World War I had yet another important effect. Up to this time the external economic relations of Canada had been chiefly with Britain. Thenceforth they were with the United States. We got more than half the Canadian trade, and New York replaced London as the money market in which Canada was most interested. It was then that American investments in Canada began to be heavy.

Between the wars

The 1920’s saw further important changes in the national economy of Canada. British Columbia became a great exporter of lumber. Much more important was the gigantic expansion of its pulp and paper industry to meet the demands of the Orient as well as of the United States. Greater still was the development of mining and smelting in that part of the Dominion. The immense power required by these new industries was got by harnessing the tumbling rivers to provide electricity.

The same kind of development, only much more of it, took place in northern Ontario and Quebec—on the Pre-Cambrian shield. This development was highly important to the prosperity of Central Canada, which then became more industrialized that ever. It supplied these provinces with a new mainspring to replace the old one that was pretty well worn out—the expansion on the prairie. The products of the new North were almost all exported, and most of the income they brought back was spent in the protected domestic market.

The new pulp and paper plants, smelters, and hydroelectric developments required huge capital expenditures. Where did the money come from? Some from the United States, but relatively little. Most came from Canadian savings. The ownership of the country’s wealth was more than ever concentrated in Central Canada, and there chiefly in Montreal and Toronto.

Centralized financial control did not mean a greater unification of the economic life of the Dominion, however. When the prairie was the one great area producing for export and the market was across the Atlantic, the main movement of the country’s trade was transcontinental. It bound eastern and western Canada together. Now there were two new important export areas. Their trade flowed north and south, for their principal market was in the United States. So the new movement of trade made for regional independence instead of the interdependence that the old movement had promoted.

In one fundamental respect the Canadian economy was still the same. Though the country had added two baskets (pulp and paper, and metals) to its one (wheat), all three baskets still had to go to market outside the country. Canada could not escape from its vital dependence on foreign trade, and in a way this dependence was greater than before. It was extended beyond the prairie, where the alternative was wheat or subsistence farming, to other big regions, where the alternative was worse. There it was lumber or nothing, pulp and paper or nothing, nonferrous metals or nothing.

The depression which began in 1929 hit Canada much harder than the United States, for the prosperity of Canada was much more tied up with international trade. The provinces that suffered most were the Prairies, for the collapse of the grain market shattered the foundations of their economic life. A great readjustment then began, at first slowly and then more rapidly. It was a shift from wheat to mixed farming. The result was that western Canadian farmers got a lower income than before. But they were also less dependent on world conditions.

Forestry: 244,564,571. 429,079,260

Trapping: 6,572,824. 23,801,213

Fisheries: 35,593,009. 64,821,702

Electric Power: 142,320,725. 200,345,240

Mining: 374,415,674. 514,109,951

Manufactures*: 1,428,286,778. 3,309,973,758

Construction: 176,661,077. 310,917,190

Custom & Repair: 99,086,100. 139,349,000

What now and in future?

By the time World War II broke, Canada, like our country, had pretty well recovered from the depression. As the first war changed us from a debtor to a creditor nation, so the second World War changed Canada into one of the three or four creditor countries of the world. Once again the prairie prospered greatly. This time, however, barely a third of its total production was wheat. Feed grains took its place, for there was a great swing to livestock (beef and pork), dairying, and poultry.

As before, however, most of the production was for export. This of course revived the problem of markets at the end of the war, for Canada cannot begin to consume the food that its West is capable of producing.

This is equally true of other main lines of production. The war caused an enormous expansion that put Canada in top position among the nations of the world in production of nickel, newsprint, asbestos, platinum, and radium; second in gold, aluminum, wood pulp, hydroelectric power, and the building of cargo ships; third in copper, lead, and zinc; and fourth in the production of war supplies for the United Nations—that is, in manufacturing.

Most of us have little idea of the huge size of some of these Canadian industries. Take newsprint, for example. Canada has a mill capacity four times that of any other country. It is equal to the combined capacities of the United States, Britain, Norway, Sweden, and Finland. Canada can use only a small percentage of the newsprint turned out by its mills. We produce no comparable surplus, not even of cotton. And newsprint is only one of many surpluses that Canada must export if it is to maintain its standard of living.

All this means that Canada is very much more interested than we are in getting the freest possible international trade in peacetime. We talk of that as something desirable, but Canadians see it as a necessity.

Ownership

You can own a rental property by yourself or in partnership with other owners.

Co-owner

Most of the time, if you own the rental property with one or more persons, we consider you to be a co-owner. For example, if you own a rental property with your spouse or common-law partner, you are a co-owner.

In some cases, if you are a co-owner, you have to determine if a partnership exists.

Partner in a Partnership

A partnership is a relationship between two or more people carrying on a business, with or without a written agreement, to make a profit. If there is no business in common, there is no partnership.

That is, co-ownership of a rental property as an investment does not make a partnership. To help you determine if you are in a partnership, see the partnership law for your province or territory. For more information, go to Income Tax Folio S4-F16-C1, What is a Partnership?

Your share of the partnership income

A partnership that carries on a business in Canada, or a Canadian partnership with Canadian or foreign operations or investments, has to file a T5013 slip, Partnership Information Return, for its fiscal period if either of the following occur:

If you are a partner in any of these types of partnerships, the partnership has to give you two copies of a T5013 slip, to file with your income tax and benefit return. For more information on this return, go to Sole proprietorships and partnerships or see the T4068, Guide for the Partnership Information Return (T5013 Forms).

Вопрос по английскому

Answer the questions.

1. What does Canada consist of?

2. Where is it situated?

3. What oceans is Canada washed by?

4. What are there in the eastern part of the country?

5. What are the main Canadian islands?

6. What are the largest rivers?

7. What is the size of Canada?

8. What is its area?

9. What is the capital of Canada? Where is it situated? What is it famous for?

10. What are the most developed industries?

11. What are grown in Canada?

12. What are the official languages?

Canada is an independent federative state. It is one of the most developed countries. Canada consists of ten provinces and two territories.

It is situated on the North American continent. The country is washed by the Pacific Ocean in the west, by the Atlantic Ocean in the east and by the Arctic Ocean and its seas in the north. About 2 percent of the Canadian territory is covered by glacier ice.

The eastern parts of the country are mainly valleys and plains. The western territories are occupied by the Cordilleras.

The main Canadian islands are Newfoundland, Victorian Island, Baffin Island and others. There are a lot of rivers and lakes in Canada. The largest rivers are the Nelson, the Ottawa, the Mackenzie and the Yukon.

In size Canada is the second in the world after Russia. Its area is almost 10 million km2. The capital of Canada is Ottawa, which is situated on the bank of the Ottawa River. It is famous for its beautiful parks. It is also known as the city of bridges.

The most developed industries are timber, mining, chemical, meat and milk and food industries. Canada grows wheat, barley, flax, potatoes, vegetables and fruit. Fishing is also one of the prosperous industries.

Official languages of Canada are English and French. Canada is a founding member of the United Nations. It has been active in a number of major UN agencies.

1. What does Canada consist of?

Canada consists of ten provinces and two territories.

2. Where is it situated?

It is situated on the North American continent.

3. What oceans is Canada washed by?

The country is washed by the Pacific Ocean in the west, by the Atlantic Ocean in the east and by the Arctic Ocean and its seas in the north.

4. What are there in the eastern part of the country?

The eastern parts of the country are mainly valleys and plains.

5. What are the main Canadian islands?

The main Canadian islands are Newfoundland, Victorian Island, Baffin Island and others.

6. What are the largest rivers?

The largest rivers are the Nelson, the Ottawa, the Mackenzie and the Yukon.

7. What is the size of Canada?

In size Canada is the second in the world after Russia.

8. What is its area?

Its area is almost 10 million km2.

9. What is the capital of Canada? Where is it situated? What is it famous for?

The capital of Canada is Ottawa, which is situated on the bank of the Ottawa River. It is famous for its beautiful parks. It is also known as the city of bridges.

10. What are the most developed industries?

The most developed industries are timber, mining, chemical, meat and milk and food industries. Fishing is also one of the prosperous industries.

11. What are grown in Canada?

Canada grows wheat, barley, flax, potatoes, vegetables and fruit.

12. What are the official languages?

Official languages of Canada are English and French.

Источники информации:

- http://www.thebalancesmb.com/choosing-a-form-of-business-ownership-2947251

- http://www.historians.org/about-aha-and-membership/aha-history-and-archives/gi-roundtable-series/pamphlets/em-47-canada-our-oldest-good-neighbor-(1946)/what-kind-of-economy-does-canada-have

- http://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/rental-income/ownership.html

- http://otvet.mail.ru/question/229031053

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/small_business_owner-970532960-b609ce395fea4b7c8ed54167259db9e8.jpg)

:max_bytes(150000):strip_icc()/SusanWardLaptop2crop1-57aa62eb5f9b58974a12bac9.jpg)