What is a credit default swap

What is a credit default swap

Credit Default Swap (CDS)

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

Investopedia / Mira Norian

What Is a Credit Default Swap (CDS)?

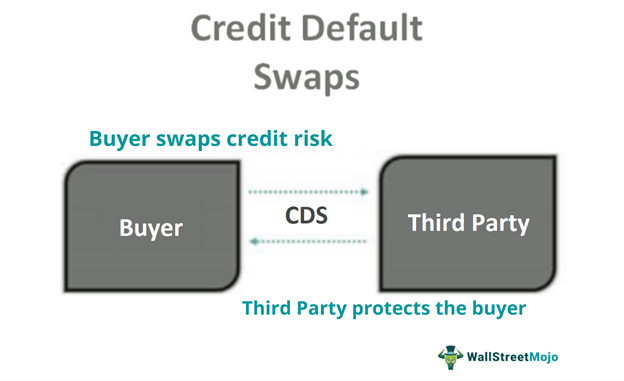

The term credit default swap (CDS) refers to a financial derivative that allows an investor to swap or offset their credit risk with that of another investor. To swap the risk of default, the lender buys a CDS from another investor who agrees to reimburse the lender in the case the borrower defaults. Most CDS contracts are maintained via an ongoing premium payment similar to the regular premiums due on an insurance policy. A lender who is worried about a borrower defaulting on a loan often uses a CDS to offset or swap that risk.

Key Takeaways

How Credit Default Swaps (CDSs) Work

CDSs require at least three parties:

Debt securities often have longer terms to maturity, making it harder for investors to estimate the risk of the investment. That’s why these contracts are an extremely popular way to manage risk. The buyer makes payments to the seller until the contract’s maturity date. In return, the seller agrees that (in the event that the debt issuer defaults or experiences another credit event) the seller will pay the buyer the security’s value as well as all interest payments that would have been paid between that time and the maturity date.

The credit event is a trigger that causes the buyer of protection to terminate and settle the contract. Credit events are agreed upon when the trade is entered into and are part of the contract. The majority of single-name CDSs are traded with the following credit events as triggers:

Credit default swaps are traded over-the-counter (OTC), which means they are non-standardized and not verified by an exchange. That’s because they are complex and often bespoke. There is a lot of speculation in the CDS market, where investors can trade the obligations of the CDS if they believe they can make a profit.

Special Considerations

Although CDSs guarantee payments through maturity, they do not necessarily need to cover the entirety of the bond’s life. For example, imagine an investor is two years into a 10-year security and thinks that the issuer is in credit trouble. The bond owner may choose to buy a credit default swap with a five-year term that would protect the investment until the seventh year when the bondholder believes the risks will fade.

It is even possible for investors to effectively switch sides on a CDS to which they are already a party. For example, if the seller of a CDS believes that the borrower is likely to default, that party can buy their own CDS from another institution or sell the contract to another bank in order to offset the risks. The chain of ownership of a CDS can become very long and convoluted, which makes tracking the size of this market difficult.

Here’s another thing to remember about CDSs. When a credit event occurs, the contract may be settled physically, which has historically been the most common method, or by cash. In a physical settlement, sellers received an actual bond at part by the buyer. Cash settlement, though, became the more preferred method when the purpose of CDSs shifted from hedging tools to speculation. In this type of settlement, the seller is responsible for paying the buyer for losses.

Mitigating the Risk

A credit default swap is effectively an insurance policy against non-payment. The buyer can shift some or all that risk onto an insurance company or other CDS seller in exchange for a fee. By doing this, the buyer receives credit protection while the seller guarantees the creditworthiness of the debt security. This means the buyer is entitled to the par value of the contract by the seller along with any unpaid interest if the issuer ever defaults.

Remember, the credit risk isn’t eliminated. Rather, it is shifted to the CDS seller. If the debt issuer does not default and if all goes well, the CDS buyer ends up losing money through the payments on the CDS. The buyer, on the other hand, stands to lose a much greater proportion of their investment if the issuer defaults and didn’t buy a CDS. As such, the more the holder of a security thinks their issuer will default, the more desirable a CDS becomes. As such, it ends up costing more.

A credit default swap is the most common form of credit derivative and may involve municipal bonds, emerging market bonds, mortgage-backed securities (MBS), or corporate bonds.

Example of a CDS

Alternatively, imagine an investor who believes that Company A is likely to default on its bonds. The investor can buy a CDS from a bank that will pay out the value of that debt if Company A defaults. A CDS can be purchased even if the buyer does not own the debt itself. This is a bit like a neighbor buying a CDS on another home in her neighborhood because she knows that the owner is out of work and may default on the mortgage.

If Lender A advances a loan to Borrower B with a mid-range credit rating, Lender A can increase the quality of the loan by buying a CDS from a seller with a better credit rating and financial backing than Borrower B. In this case, the risk doesn’t go away, but it is reduced through the CDS.

Great Recession

CDSs played a key role in the credit crisis that eventually led to the Great Recession. One of the primary causes of the meltdown stemmed from the risk that CDS sellers defaulted at the same time the borrower defaulted. CDS sellers like Lehman Brothers, Bear Stearns, and AIG all defaulted on their CDS obligations.

European Sovereign Debt Crisis

Credit default swaps were widely used during the European sovereign debt crisis. In September 2011, investors believed that Greece’s government bonds had nearly a 100% probability of default. Many hedge funds even used CDS as a way to speculate on the likelihood that the country would default.

How Does a Credit Default Swap Work?

A credit default swap is a financial derivative contract that shifts the credit risk of a fixed income product to a counterparty in exchange for a premium. Essentially, credit default swaps serve as insurance on the default of a borrower. As the most popular form of credit derivatives, buyers and sellers arrange custom agreements on over-the-counter markets which are often illiquid, speculative, and difficult for regulators to trace.

What Is an Example of a Credit Default Swap?

A credit default swap essentially ensures that the principal or any owing interest payments will be paid over a predetermined time period. Typically, the investor will buy a credit default swap from a large financial institution, who for a fee, will guarantee the underlying debt.

What Are Credit Default Swaps Used for?

Credit default swaps are primarily used for two main reasons: hedging risk and speculation. To hedge risk, investors buy credit default swaps to add a layer of insurance to protect a bond, such as a mortgage-backed security, from defaulting on its payments. In turn, a third party assumes the risk in exchange for a premium. By contrast, when investors speculate on credit default swaps, they are betting on the credit quality of the reference entity.

What to know about credit default swaps — a type of insurance for certain investments

Twitter LinkedIn icon The word «in».

LinkedIn Fliboard icon A stylized letter F.

Flipboard Facebook Icon The letter F.

Email Link icon An image of a chain link. It symobilizes a website link url.

From their birth in the aftermath of the Exxon Valdez oil spill to the unregulated chaos of the 2008 financial crisis, credit default swaps (CDSs) have played a major role in how financial institutions attempt to mitigate risk.

Here’s what you need to know about these unique products.

What is a credit default swap?

A CDS is a financial derivative that involves the actions of three parties: an issuer, an investor, and a CDS seller. The issuer offers debt securities such as bonds or MBSs. In a typical scenario, the investor owns the debt securities and purchases a CDS contract from the CDS seller to hedge or protect their investment.

«Essentially, the investor ‘swaps’ the risk to the CDS seller,» says Dean Kaplan, president and CEO of the Kaplan Group. «The seller of the CDS is like an insurance company — it collects premiums for selling credit default swaps and then hopes that the amounts it pays out on defaults that occur cost less than the amount collected.»

If the original debt securities covered by the CDS perform as promised, the CDS seller keeps the premiums as profit and has no further obligation. The investor receives the principal and interest from the issuer as promised and, assuming the premiums were reasonable, enjoys any profit that is generated.

Important: The issuer is not a party to the CDS and, in fact, the CDS is not tied to the debt securities but only refers to them as «reference obligations.»

If a negative event such as default occurs, the CDS seller is required to meet the terms of the contract including paying the investor the principal and any unpaid interest payments the issuer failed to make through the maturity of the CDS contract. This could result in a substantial loss to the CDS seller.

How do credit default swaps work?

When a CDS functions as insurance, it is effectively a hedging tool to protect against a negative event related to the reference obligations. CDS contracts have another use as well. Some investors use CDS contracts to speculate about the creditworthiness of specific debt issuers.

Someone with a positive view of the credit quality of a company, for example, could become a CDS seller to an investor with a negative view. The seller would be taking a long view on the creditworthiness of the issuer while the investor could be seen as taking a short view.

Note: Neither party in a CDS contract needs to own the underlying debt securities in order to buy or sell the CDS

The price of the premiums paid to the seller are referred to as the spread and reflect the market’s view of the issuer’s creditworthiness. The better the creditworthiness, the lower the premiums and the smaller the spread. As creditworthiness worsens, the reverse is true — premiums rise and the spread goes higher.

CDS contracts, which are traded over the counter (OTC) have historically been non-standardized and unregulated. Since the 2008 financial crisis, clearing houses have provided standardized contracts and some regulation to the CDS market.

Note: Premiums on investment grade debt are typically set at an annual rate of 1% of par value and 5% on high-yield debt.

How to buy credit default swaps

CDSs are primarily sold by hedge funds and banks and bought by institutional investors like pension funds, other banks, and insurance companies. «[Because of] the size and nature of a CDS, retail investors cannot invest directly,» says Matthew Stratman, lead financial advisor, South Bay Planning Group at Western Financial Securities.

«CDS funds targeted at retail investors have struggled to perform well,» adds Kaplan, including two ETFs, TYTE and WYDE. Another ETF that had been announced earlier last year by Simplify Credit Hedge with ticker CDX withdrew their application before they launched.»

Among the few survivors is Fidelity® Global Credit Fund (FGBFX), which has a strategy that includes investing at least 80% of fund assets in debt securities, hedging those investments with derivatives — including credit default swaps.

Example of a credit default swap

A good example of a credit default swap is the 1994 swap involving Exxon, J.P. Morgan, and the European Bank of Reconstruction and Development (EBRD).

Pros and cons of credit default swaps

The primary purpose and main advantage of credit default swaps is risk protection or insurance against a negative credit event for institutional investors and hedge funds. For those who have access, CDSs have two additional important advantages — the ability to enhance portfolio yield for sellers and the fact they do not require exposure to the underlying fixed income products.

Despite improvements since 2008, CDS contracts are still less regulated than exchange-traded products. In addition to the risk of default by the borrower, CDSs have an additional risk for the investor if the seller defaults. This «double whammy» is known as double default. Finally, the seller stands to lose a substantial amount of money if the borrower defaults..

Provides risk protection

Are traded OTC and not well regulated

Enhances portfolio yield

Are subject to seller’s creditworthiness

Doesn’t require exposure to underlying debt (bonds, MBSs, etc.)

Means the seller’s losses could be substantial

Credit Default Swap

Insurance against non-payment

What is a Credit Default Swap (CDS)?

A credit default swap (CDS) is a type of credit derivative that provides the buyer with protection against default and other risks. The buyer of a CDS makes periodic payments to the seller until the credit maturity date. In the agreement, the seller commits that, if the debt issuer defaults, the seller will pay the buyer all premiums and interest that would’ve been paid up to the date of maturity.

Through a credit swap, a buyer can take risk control measures by shifting the risk to an insurance company in exchange for periodic payments. Just like an insurance policy, a CDS allows purchasers to buy protection against an unlikely event that may affect the investment.

Uses of Credit Default Swap (CDS)

Investors can buy credit default swaps for the following reasons:

Speculation

An investor can buy an entity’s credit default swap believing that it is too low or too high and attempt to make profits from it by entering into a trade. Also, an investor can buy credit default swap protection to speculate that the company is likely to default since an increase in CDS spread reflects a decline in creditworthiness and vice-versa.

A CDS buyer might also sell his protection if he thinks that the seller’s creditworthiness might improve. The seller is viewed as being long to the CDS and the credit while the investor who bought the protection is perceived as being short on the CDS and the credit. Most investors argue that a CDS helps in determining the creditworthiness of an entity.

Arbitrage

Arbitrage is the practice of buying a security from one market and simultaneously selling it in another market at a relatively higher price, therefore benefiting from a temporary difference in stock prices. It relies on the fact that a firm’s stock price and credit default swaps spread should portray a negative correlation. If the company’s outlook improves, then the share price should increase and the CDS spread should tighten.

However, if the company’s outlook fails to improve, the CDS spread should widen and the stock price should decline. For example, when a company experiences an adverse event and its share price drops, an investor would expect an increase in CDS spread relative to the share price drop. Arbitrage could occur when the investor exploits the slowness of the market to make a profit.

Hedging

Hedging is an investment aimed at reducing the risk of adverse price movements. Banks may hedge against the risk that a loanee may default by entering into a CDS contract as the buyer of protection. If the borrower defaults, the proceeds from the contract balance off with the defaulted debt. In the absence of a CDS, a bank may sell the loan to another bank or finance institution.

However, the practice can damage the bank-borrower relationship since it shows the bank lacks trust in the borrower. Buying a credit default swap allows the bank to manage the risk of default while keeping the loan as part of its portfolio.

A bank may also take advantage of hedging as a way of managing concentration risk. Concentration risk occurs when a single borrower represents a sizeable percentage of a bank’s borrowers. If that one borrower defaults, then this will be a huge loss to the bank.

The bank can manage the risk by buying a CDS. Entering into a CDS contract allows the bank to achieve its diversity objectives without damaging its relationship with the borrower since the latter is not a party to the CDS contract. Although CDS hedging is most prevalent among banks, other institutions like pension funds, insurance companies, and holders of corporate bonds can purchase CDS for similar purposes.

Risks of Credit Default Swap

One of the risks of a credit default swap is that the buyer may default on the contract, thereby denying the seller the expected revenue. The seller transfers the CDS to another party as a form of protection against risk, but it may lead to default. Where the original buyer drops out of the agreement, the seller may be forced to sell a new CDS to a third party to recoup the initial investment. However, the new CDS may sell at a lower price than the original CDS, leading to a loss.

The seller of a credit default swap also faces a jump-to-jump risk. The seller may be collecting monthly premiums from the new buyer with the hope that the original buyer will pay as agreed. However, a default on the part of the buyer creates an immediate obligation on the seller to pay the millions or billions owed to protection buyers.

The 2008 Financial Crisis

Companies that traded in swaps were battered during the financial crisis. Since the market was unregulated, banks used swaps to insure complex financial products. Investors were no longer interested in buying swaps and banks began holding more capital and becoming risk-averse in granting loans.

The Dodd-Frank Wall Street Report Act of 2009 was introduced to regulate the credit default swap market. It phased out the riskiest swaps and prohibited banks from using customer deposits to invest in swaps and other derivatives. The act also required the setting up of a clearinghouse to trade and price swaps.

Related Readings

Thank you for reading CFI’s guide on Credit Default Swap. To discover other avenues of investment besides credit default swaps, check out the following resources from CFI:

The Pros and Cons of Credit Default Swaps

How a Boring Insurance Contract Almost Destroyed the Global Economy

Spencer Platt / Getty Images

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

A credit default swap (CDS) is a financial derivative that guarantees against bond risk. It allows one lender to «swap» its risk with another.

Swaps work like insurance policies. They allow purchasers to buy protection against an unlikely but devastating event. Like an insurance policy, the buyer makes periodic payments to the seller.

Most of these swaps protect against the default of high-risk municipal bonds, sovereign debt, and corporate debt. Investors also use them to protect against the credit risk of mortgage-backed securities, junk bonds, and collateralized debt obligations.

How Credit Default Swaps Work

Here’s an example to illustrate how swaps work. Say a company issues a bond. Several companies purchase the bond, thereby lending the company money. They want to make sure they don’t get burned if the borrower defaults, so they buy a credit default swap from a third party.

That third party agrees to pay the outstanding amount of the bond if the lender defaults. Most often, the third party is an insurance company, bank, hedge fund, central counterparty, or reporting dealer. The swap seller collects premiums for providing the swap, usually on a quarterly basis.

Pros of Credit Default Swaps

Swaps protect lenders against credit risk. That enables bond buyers to fund riskier ventures than they might otherwise. Investments in risky ventures spur innovation and creativity, which boost economic growth. This is how Silicon Valley became America’s innovation hub.

Companies that sell swaps protect themselves with diversification. If a company or even an entire industry defaults, they have the fees from other successful swaps to make up the difference. If done this way, swaps provide a steady stream of payments with little downside risk.

Cons of Credit Default Swaps

On the other hand, swaps were largely unregulated until 2010. That meant there was no government agency to make sure the seller of the swap had the money to pay the holder if the bond defaulted. In fact, most financial institutions that sold swaps were undercapitalized. They only held a small percentage of what they needed to pay the insurance. The system worked until the debtors defaulted.

Unfortunately, the swaps gave a false sense of security to bond purchasers. They bought riskier and riskier debt, thinking the CDS protected them from any losses.

Protect lenders against risk

Provide a stream of payments

Unregulated until 2010

Gave a false sense of security

How Swaps Caused the 2008 Financial Crisis

These companies didn’t expect all the debt to come due at once. When Lehman declared bankruptcy, AIG didn’t have enough cash on hand to cover swap contracts. The Federal Reserve had to bail it out.

Even worse, banks used swaps to insure complicated financial products. They traded swaps in unregulated markets where buyers had no relationships to the underlying assets. They didn’t understand their risks. When they defaulted, swap sellers such as MBIA, Ambac, and Swiss Re were hit hard.

Overnight, the CDS market fell apart. No one bought them because they realized the insurance wasn’t able to cover large or widespread defaults. They accumulated capital and made fewer loans. That cut off funding for small businesses and mortgages. These were both large factors that kept unemployment at record levels.

Dodd-Frank Reforms

In 2010, the Dodd-Frank Wall Street Reform Act regulated credit default swaps in three ways:

Many banks shifted their swaps overseas to avoid U.S. regulation. Although all G-20 countries agreed to regulate them, many were behind the United States in finalizing the rules. But that changed in October 2011, when the European Economic Area regulated swaps with the MiFID II.

The JPMorgan Chase Swap Loss

The bank’s London desk executed a series of complicated trades that would profit if corporate bond indexes rose. One, the Markit CDX NA IG Series 9 maturing in 2017, was a portfolio of credit default swaps. That index tracked the credit quality of 121 high-quality bond issuers, including Kraft Foods and Walmart. When the trade started losing money, many other traders began taking the opposite position. They hoped to profit from JPMorgan’s loss, thus compounding it.

The loss was ironic. JPMorgan Chase first introduced credit default swaps in 1994. It wanted to insure itself against the risk of default on the loans it held on its books, but these products ultimately led to some of its greatest losses.

The Greek Debt Crisis and CDS

Swaps’ false sense of security also contributed to the Greek debt crisis. Investors bought Greek sovereign debt, even though the country’s debt-to-gross domestic product ratio was higher than the European Union’s 60% limit. The investors also bought CDS to protect them from the potential of default.

In 2012, these investors found out just how little the swaps protected them. Greece required the bondholders to take a loss on their holdings. The CDS did not protect them from this loss. That should have destroyed the CDS market. It set a precedent that borrowers, like Greece, could intentionally circumvent the CDS payout. The International Swaps and Derivatives Association ruled that the CDS must be paid, regardless.

Credit Default Swap

Credit Default Swaps (CDS) Definition

A Credit Default Swap (CDS) is a financial agreement between the CDS seller and buyer. The CDS seller agrees to compensate the buyer in case the payment defaults. In return, the CDS buyer makes periodic payments to the CDS seller till maturity.

Table of contents

Key Takeaways

Credit Default Swap Explained

CDS were invented so that the buyer could shift the burden of risk Shift The Burden Of Risk Risk shifting is the process of transferring risk from one party to another, where ownership of risk is transferred from one organization to another in exchange for fees. It is most commonly found in the financial sector. read more in case of payment defaults. It acts like an insurance policy wherein the buyer is supposed to make regular periodic payments to the seller. Typically, buyers swap to protect against the default of government bonds, corporate debt, and sovereign debt.

You are free to use this image on your website, templates, etc, Please provide us with an attribution link How to Provide Attribution? Article Link to be Hyperlinked

For eg:

Source: Credit Default Swap (wallstreetmojo.com)

Although similar, CDS is different from insurance. Unlike insurance sellers, CDS sellers are not required to be regulated entities. Although most CDS sellers are banks, some sellers are less accountable. Unlike insurance, CDS sellers are not required to maintain a reserve. As a result, if there is a default, a CDS seller might lack the funds to pay the buyer back.

Credit Default Swap Examples

Consider the following example. A company issues a bond; the bondholders bear the risk of non-payment. To shift this risk exposure, bondholders could buy a CDS from a third party. This will shift the burden of risk from the bondholder to the third party. In return, the buyer of CDS pays interest periodically. Usually, these third parties are banks, hedge fund Hedge Fund A hedge fund is an aggressively invested portfolio made through pooling of various investors and institutional investor’s fund. It supports various assets providing high returns in exchange for higher risk through multiple risk management and hedging techniques. read more companies, and insurance companies.

Pricing of CDS

The pricing of CDS is determined by the Hull and White valuation model. The details of the pricing model are as follows.

This is the most used CDS valuation. According to Bloomberg, the following equation gives the present value of payments to be made for the agreed period:

The next task is to calculate the spread of CDS which could be calculated using the following equation:

Pros and Cons of CDS

CDS has the following advantages. These swaps protect the buyer against the risk of non-payment by an entity. The cost of such protection is very low. Due to the lower risk, the buyer can invest in riskier investments. This simply means more investment and could push the national economy upwards.

The sellers have a portfolio with a vast diversity of such swaps, which covers the risk of one or more swaps going default. So at the end of the day, they end up making a good profit.

CDS disadvantages are overlooked. The swaps went unregulated for the longest time till 2010. There was no one to ensure whether the seller of CDS had enough reserve money to pay the buyer in case of a default. CDS sellers further mitigate risk by hedging Hedging Hedging is a type of investment that works like insurance and protects you from any financial losses. Hedging is achieved by taking the opposing position in the market. read more with other CDS deals.

How CDS caused the financial crisis of 2008?

Frequently Asked Questions (FAQs)

The credit default swap index (CDX) tracks and evaluates total returns for different areas of the bond issuer market, allowing the index’s overall return to be compared to funds that invest in similar products.

Almost anyone can purchase a CDS. Like most other derivatives, credit default swaps can be employed by investors who do not own the asset but want to profit by holding a position in it. Such an agreement is called a naked credit default swap.

Recommended Articles

This has been a guide to Credit Default Swap (CDS) and its Definition. Here we discuss how credit default swap work along with pricing, examples, pros & cons You can learn more from the following articles –

:max_bytes(150000):strip_icc()/adam_hayes-5bfc262a46e0fb005118b414.jpg)

:max_bytes(150000):strip_icc()/TimothyLi-picture1-4fb5c746f503451bacfee414a08f5c1f.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/trader-grimacing-56a9a7e63df78cf772a942a5.jpg)

:max_bytes(150000):strip_icc()/Amadeo-Closeup-582619cd3df78c6f6acca4e6.jpg)

:max_bytes(150000):strip_icc()/charles-potters-headshot-4ec0031ad04c431b946ada0aa7564592.jpg)

:max_bytes(150000):strip_icc()/KyraBakerTheBalanceheadshot-16c2975b05f542529537e9b5d5fa68e0.jpg)