What is a financial statement

What is a financial statement

Search the Blog

What Is a Financial Statement?

Scoot over financial health tunnel vision. You can learn how your business is doing holistically by preparing different financial statements. So, what is a financial statement?

Financial statement definition

A financial statement is a collection of your business’s financial information. You can form conclusions about your business’s financial health through financial statement analysis and organization. Statements include line-by-line items as well as total amounts of what you’re looking at. There are three main financial statements: income statement, balance sheet, and cash flow statement.

Each type of financial statement reports varying information during a period (e.g., month, quarter, etc.). Using statements gives you insight into several areas of your business’s financial health.

Here’s the breakdown of what each major financial summary reveals:

Read on to learn more about income statements, balance sheets, and cash flow statements. Find out each statement’s purpose, financial statement parts, and formulas.

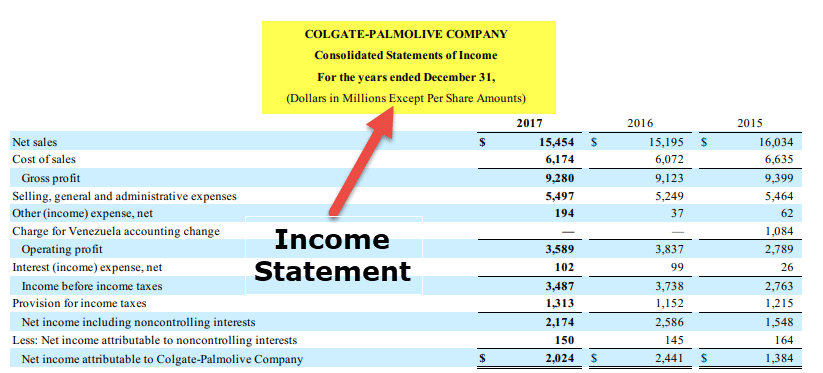

Income statement

An income statement, or profit and loss (P&L) statement, is a summary of your business’s profits and losses during a period. You can prepare the statement monthly, quarterly, or annually. Once you decide on your time frame, break down your business’s revenue and expenses on the statement.

An income statement shows how well your company is doing over time. It measures the profitability of your business.

Look for the bottom line on an income statement to see whether you have a net profit or net loss. This represents whether your business’s net earnings were positive or negative during the period.

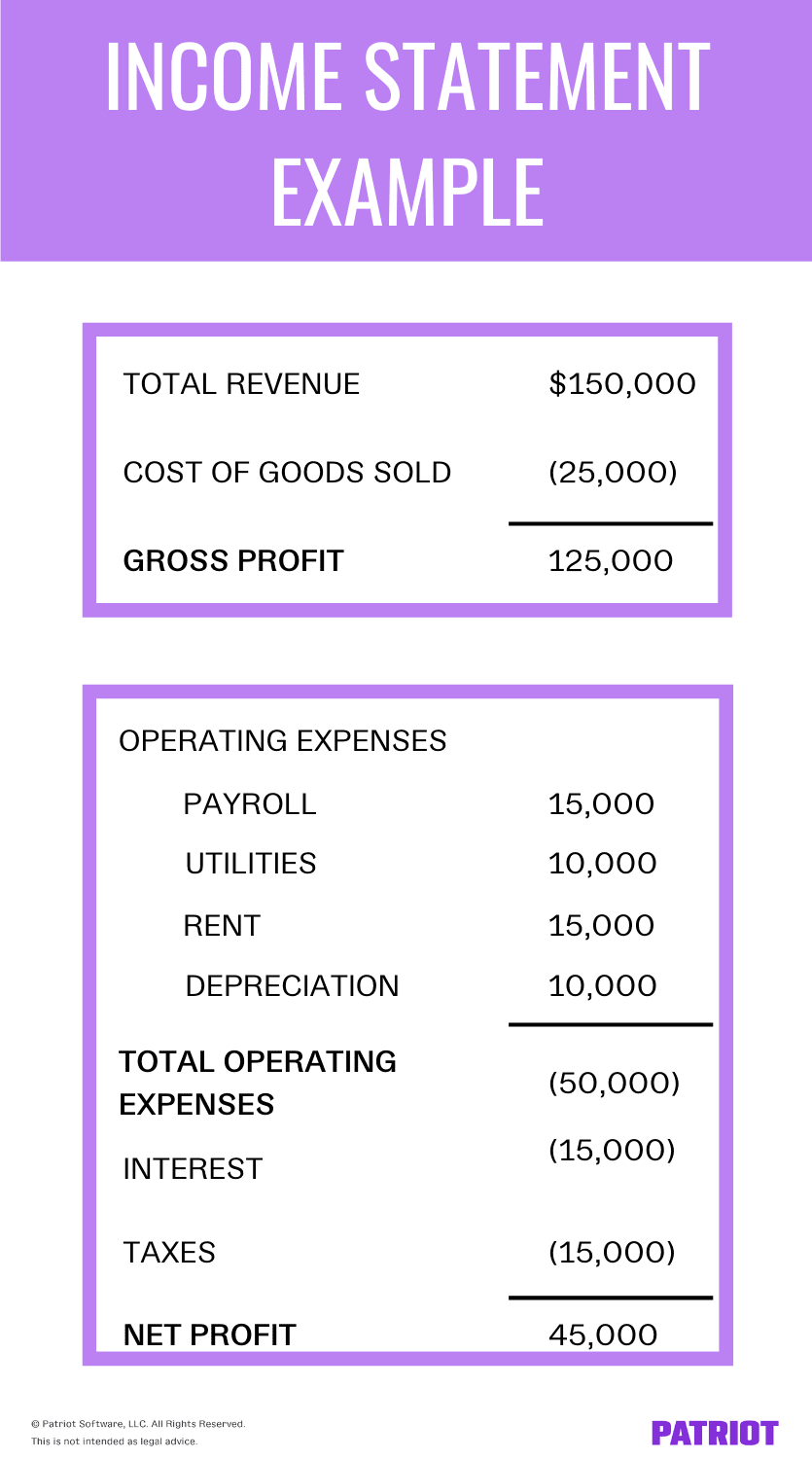

Use the following formula to find your business’s net profit (or net loss) and help you know where to pull information from for your income statement:

Net Profit = (Revenue – COGS) – Expenses

Keep in mind that the income statement doesn’t show overall financial health, money you owe or owed to you, or assets and liabilities.

Parts of the income statement

If you want to know how to write a financial statement, take a look at the parts of the income statement:

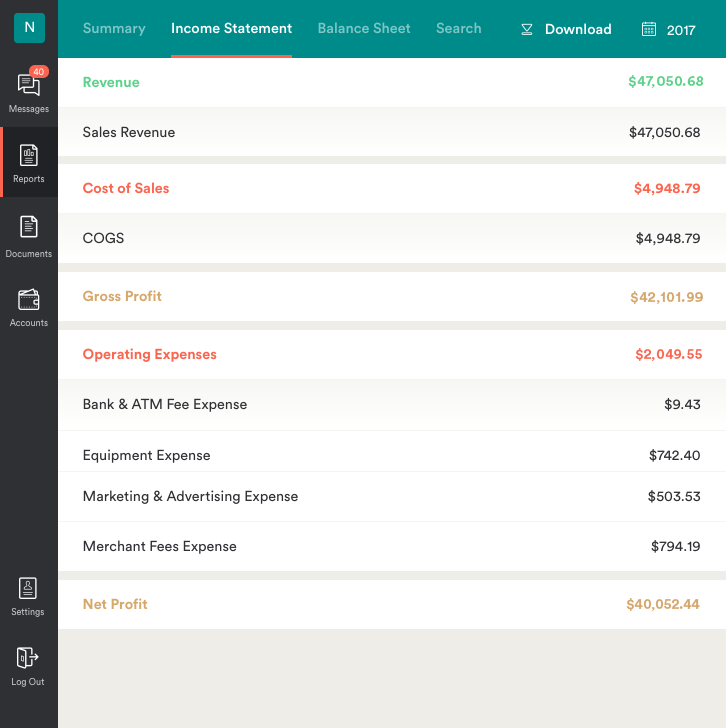

Income statement: Financial statement example

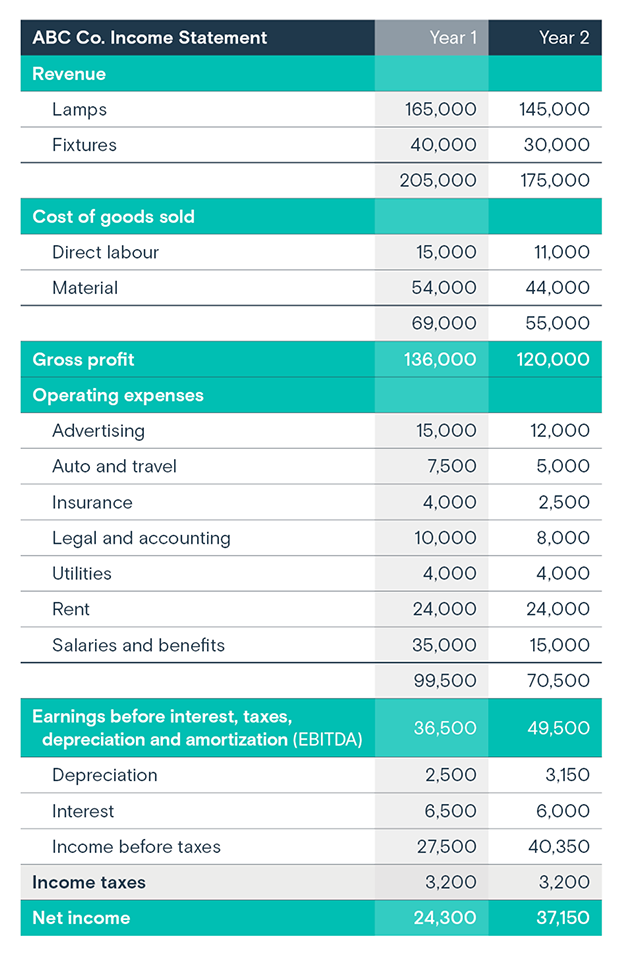

Although they can differ, here’s an example of an income statement:

How to use the income statement

There are a number of ways to use your income statement to make business decisions, including:

Products: You can see which sales items are the most and least profitable. Also, look for any expenses you could reduce or eliminate.

Budget: Use the income statement to find out if you are over or under your business budget. The statement shows how much cash you have left over after expenses. You can use the leftover cash to expand your business, pay yourself and other owners, and pay debt. If you do not have leftover cash, look for ways to adjust your budget.

Financing: Investors, lenders, and vendors often want to look at your business’s income statement. Financial reporting helps these individuals assess the level of risk involved in working with your company.

Balance sheet

The balance sheet summarizes your financial health on a specific date. It shows you what you own and owe by breaking down your assets, liabilities, and equity. You can create a balance sheet at the end of a period, such as monthly or quarterly.

Balance sheets use the following formula:

Equity = Assets – Liabilities

Parts of the balance sheet

So, what’s the breakdown of this type of financial statement? Here are the parts of the balance sheet:

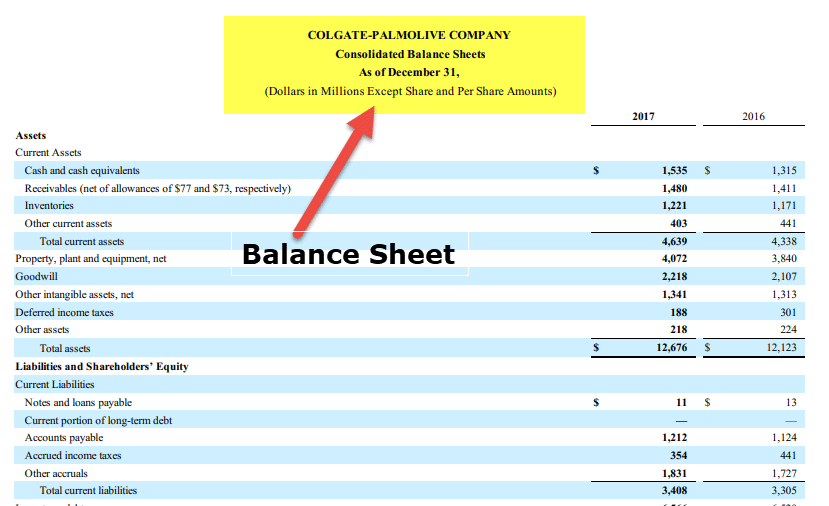

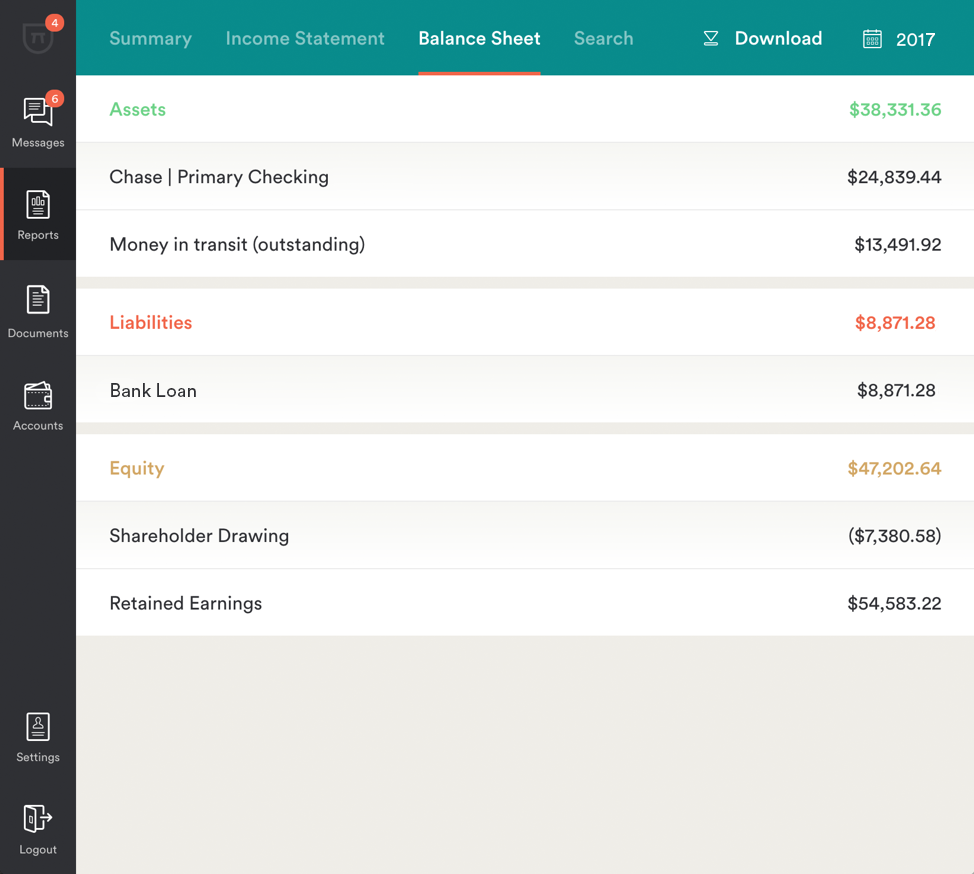

Balance sheet: Financial statement example

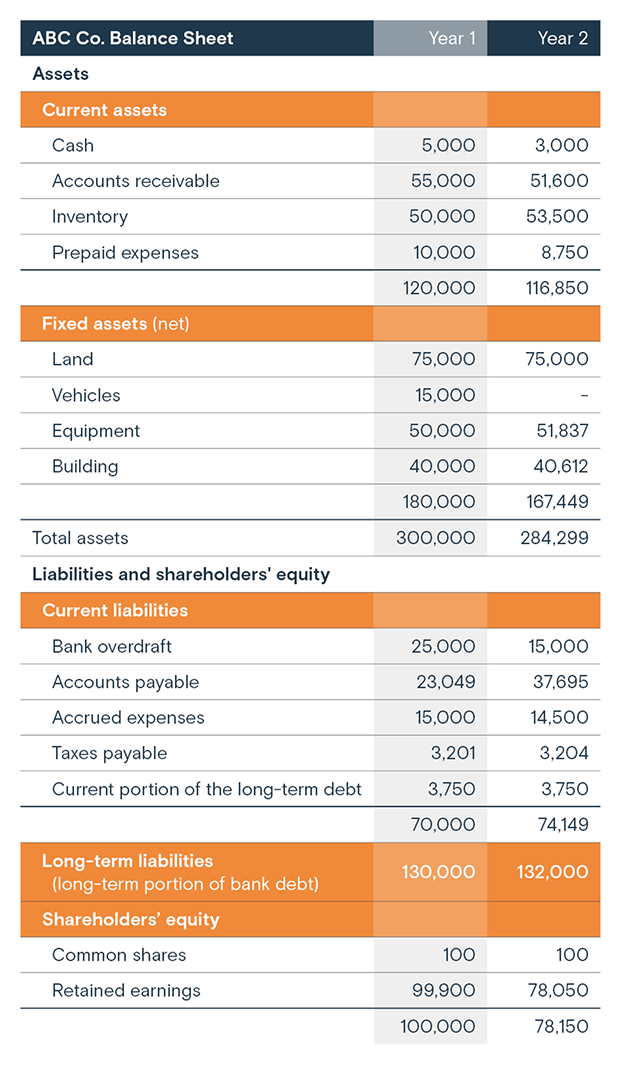

Take a look at the following balance sheet example:

How to use the balance sheet

Use your balance sheet to make business decisions such as:

Spending: You can make decisions about spending and managing your business’s debt by looking at the balance sheet.

Liquidity: How liquid is your business? Because the balance sheet gives you an idea of how quickly you can turn assets into cash, you can see your business’s stability and liquidity. This information helps you determine your ability to finance growth without outside funding.

Net value: Use the balance sheet to find your business’s net value, which is important if you want to incorporate or sell your business. Often, lenders and investors want to see your balance sheet. They use the statement to assess the level of risk involved in working with your business.

Cash flow statement

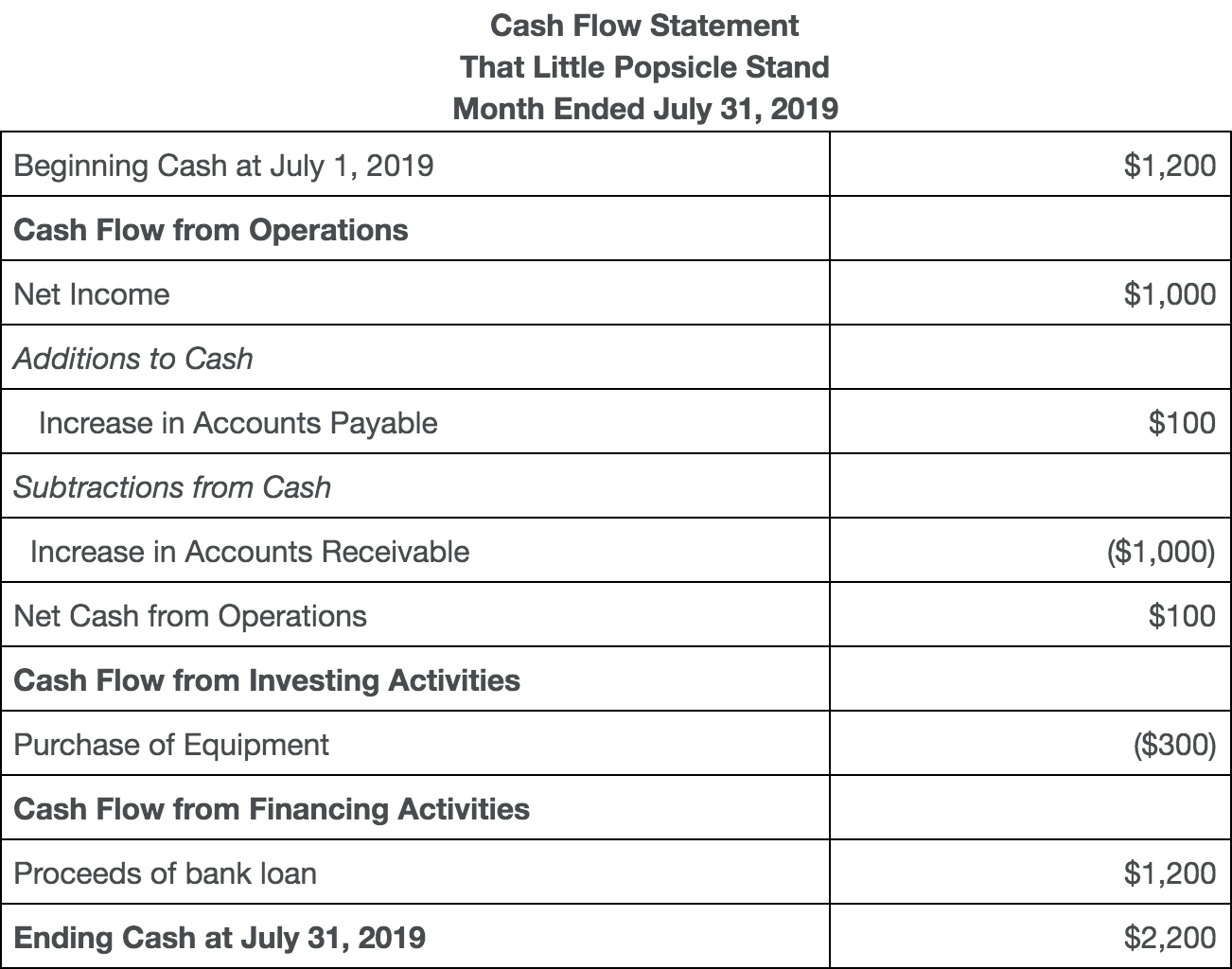

Onto the last of the three most common financial statements: the cash flow statement. So, what is a cash flow statement? In short, the cash flow statement measures money flowing into and out of your business during a period. You can use the cash flow statement to see how much cash you have on hand. Update the cash flow statement daily, weekly, or monthly.

The cash flow statement begins with your starting cash balance. Then, you must include cash inflows and outflows.

Use the following formula to help you set up your cash flow statement:

End Cash Balance = Operations + Investments + Financing

Parts of the cash flow statement

There are three categories of a cash flow statement:

Cash flow statement: Financial statement example

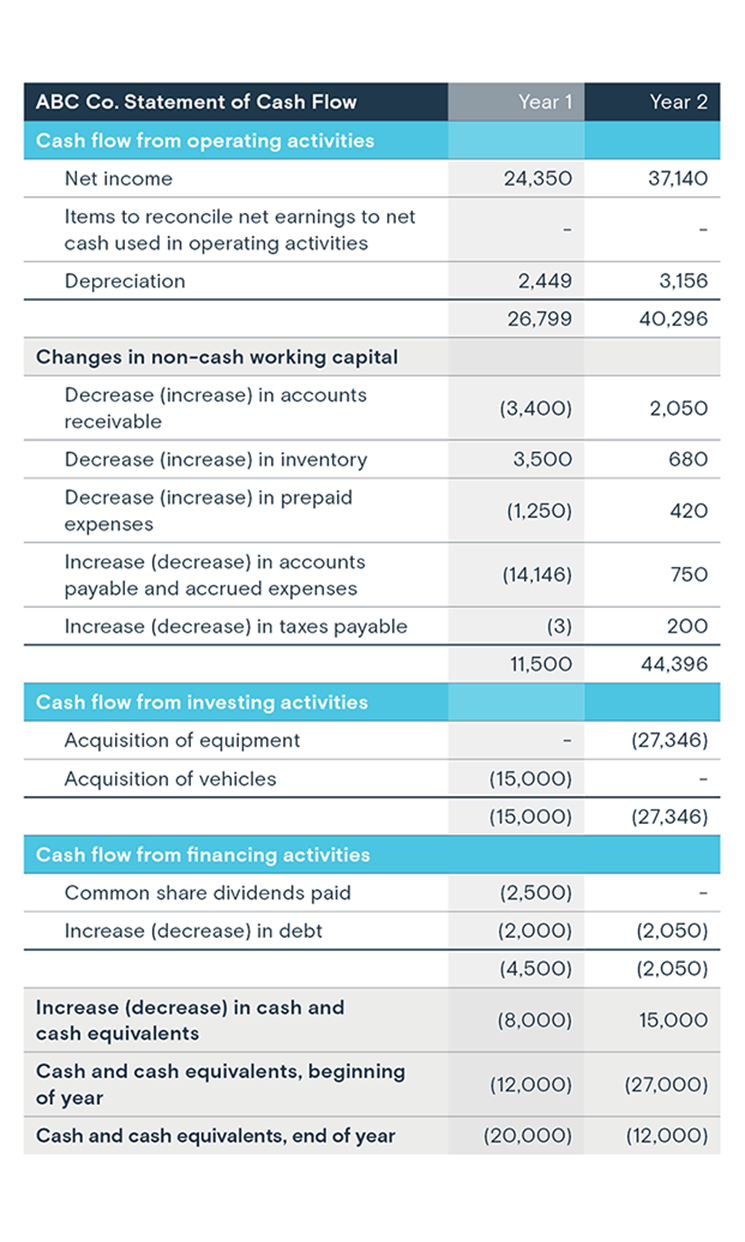

Here’s an example of a cash flow statement:

How to use the cash flow statement

You can use the cash flow statement in a couple of ways, including:

Cash management: The cash flow statement helps you manage incoming and outgoing funds. The statement can also tell you if you need to secure more financing or manage expenses better.

Accounts receivable: Making sure you receive cash from customers in time to pay expenses is crucial to financial health. If your incoming cash is stalled, you might need to adjust your payment terms and conditions to speed up accounts receivable.

You’re just in luck. Check out our FREE guide, Use Financial Statements to Assess the Health of Your Business, to learn more about the different types of financial statements for your business.

Applying financial statements to your business

At first glance, creating and reviewing financial statements can be a little scary. But, as a business owner, it’s your job to keep track of your company’s financial health. Statements give you a clear view of the direction your business is headed. And, they help you plan your next moves to push your company forward. Gather your financial records to put together your statements.

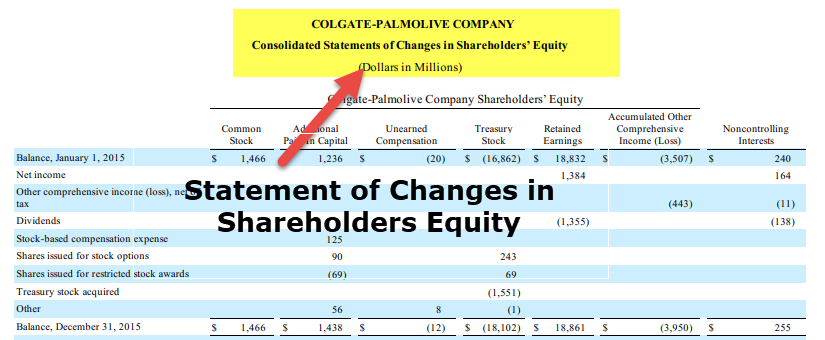

Keep in mind that income statements, balance sheets, and cash flow statements aren’t the only types of financial statements you can use. Many create and analyze four basic financial statements, which includes the statement of retained earnings.

You can make smart decisions by looking at your financial statements. For example, you can use statements to check that you price products or services effectively.

Financial statements help you keep information organized. You don’t want to report incorrect information to the government when you file a small business tax return. Errors on government forms can lead to fines, fees, and other penalties.

The more you check your books, the more likely you will report accurate information and avoid IRS audit triggers. If the IRS audits you, your statements help prove you reported accurate information.

Accounting is probably not the most glamorous aspect of running your business. But, it’s one of the most important. That’s where we come in. Patriot’s accounting software makes it easy to record transactions and generate key financial statements. Plus, we offer free, USA-based support. Start your free trial today!

This article has been updated from its original publication date of January 13, 2017.

This is not intended as legal advice; for more information, please click here.

Financial Statements

Financial Statements Definition

Financial statements are written reports created by a company’s management to summarize the business’s financial condition over a certain period (quarter, six-monthly, or yearly). These statements, which comprise the balance sheet, income statement, cash flow statement, and statement of shareholders’ equity, must be prepared by specified and standardized accounting standards to ensure that reporting is consistent.

Table of contents

You are free to use this image on your website, templates, etc, Please provide us with an attribution link How to Provide Attribution? Article Link to be Hyperlinked

For eg:

Source: Financial Statements (wallstreetmojo.com)

Key Takeaways

Basics of Financial Statement

Now, let’s look at the basics of financial statements and a practical example.

#1 – Balance Sheet

The balance sheet is a financial statement that provides a snapshot of the assets, liabilities, and shareholder’s equity. Many companies use the shareholders’ equity as a separate financial statement. But usually, it comes with the balance sheet.

The equation that you need to remember when you prepare a balance sheet is this –

Assets = Liabilities + Shareholders Equity

Let’s look at a balance sheet so that we can understand how it works –

The balance sheet sometimes gets quite complex. The accountants need to make sure that every record is properly reported so that the total assets Total Assets Total Assets is the sum of a company’s current and noncurrent assets. Total assets also equals to the sum of total liabilities and total shareholder funds. Total Assets = Liabilities + Shareholder Equity read more always equal total liabilities plus shareholders’ equity.

#2 – Income Statement

#3 – Cash Flow Statement

The Cash Flow Statement is the third most important statement every investor should look at.

There are three separate statements of a cash flow Statements Of A Cash Flow A Statement of Cash Flow is an accounting document that tracks the incoming and outgoing cash and cash equivalents from a business. read more statement. These statements are cash flow from the operating activities, cash flow from investing activities, and cash flow from finance activities.

#4 – Statement of Changes in Shareholders Equity

Financial Statements Video

Recommended Articles

This has been a guide to what financial statements are and their definition. Here we discuss the basic overview of financial statements – balance sheet, income statement, cash flows, and statement of changes in shareholders’ equity. You may learn more about basic accounting from the following articles –

Financial Statements

What are Financial Statements?

Financial statements are reports prepared and issued by company management to give investors and creditors additional information about a company’s performance and financial standings. The four general purpose financial statements include:

These reports are prepared in this order and are issued to the public as a full set of statements. This means they are not only published together, but they are also designed and intended to be read and used together. Since each statement only gives information about specific aspects of a company’s financial position, it is important that these reports are used together.

For instance, the balance sheet shows the debt levels of the company, but it can’t show what the debt coverage costs. Both the balance sheet and the income statement are needed to calculate the debt coverage ratio for investors and creditors to see a true picture of the debt burden of a company.

The purpose of these reports is to provide useful financial information to users outside of the company. In essence, these reports complete the fundamental purpose of financial accounting by providing information that is helpful in the financial decision-making process.

Understanding these business financial statements is the first critical step investors, creditors, and you can take to learning about a company’s earnings, profitability, asset management, financial leverage, cash flow, and current shareholders’ stake. Once you understand all of these aspects of a company, you can gauge its relative financial health and determine whether it is worth investing in or loaning money to.

Here are all of the financial statements prepared by companies:

Who Issues Financial Statements?

Companies issue different types of business financial statements for a variety of reasons at a variety of times during the year. Public companies are required to issue audited financial statements to the public at least every quarter. These regulated reports must meet SEC and PCAOB guidelines and often must be reported in a consolidated fashion.

Non-public or private companies generally issue financial sheets to banks and other creditors for financing purposes. Many creditors will not agree to loan funds unless a company can prove that it is financially sound enough to make its future debt payments.

Both public and private companies issue at least 4 financial statements to attract new investors and raise funding for expansions.

Different Types of Financial Statements

Interim Statements

Financial sheets that are issued for time periods smaller than one year are called interim statements because they are used as temporary statements to judge a company’s financial position until the full annual statements are issued.

Interim financial statements are most commonly issued quarterly or semi-annually, but it is not uncommon for companies to issue monthly reports to creditors as part of their loan covenants. Quarterly statements, as the name implies, are issued every quarter and only include financial data from that three-month span of time. Likewise, semi-annual statements include data from a six-month span of time.

Since these interim statements cover a smaller time period, they also track less financial history. This is why annual financial statements are generally more reliable and better represent a company’s true financial position.

Annual Statements

The annual financial statement form is prepared once a year and cover a 12-month period of financial performance. Generally, these statements are issued at the end of a company’s fiscal year instead of a calendar year. A company with a June year-end would issue annual statements in July or August; where as, a company with a December year-end would issue statements in January or February.

Public companies are required by the SEC and the PCAOB to issue both interim and annual statements. A CPA firm must always audit annual statements, but some interim statements can simply be reviewed by a qualified firm.

Financial Statement Analysis

Who Uses Financial Statements and What Are They Used For?

Financial statements are mainly prepared for external users. There users are people who are outside of the company or organization itself and need information about it to base their financial decisions on. These external users typically fall into four main categories:

Investors and creditors analyze this set of statements to base their financial decisions on. They also look at extra financial reports like financial statement notes and the management discussion.

The income statement and balance sheet accounts are compared with each other to see how efficiently a company is using its assets to generate profits. Company debt and equity levels can also be examined to determine whether companies are properly funding operations and expansions.

Most investors and creditors use financial ratios to analyze these comparisons. There is almost no limit to the amount of ratios that can be combined for analysis purposes.

These ratios by themselves rarely give outside users and decision makers enough information to judge whether or not a company is fiscally sound, however. Investors and creditors generally compare different companies’ ratios to develop an industry standard or benchmark to judge company performance.

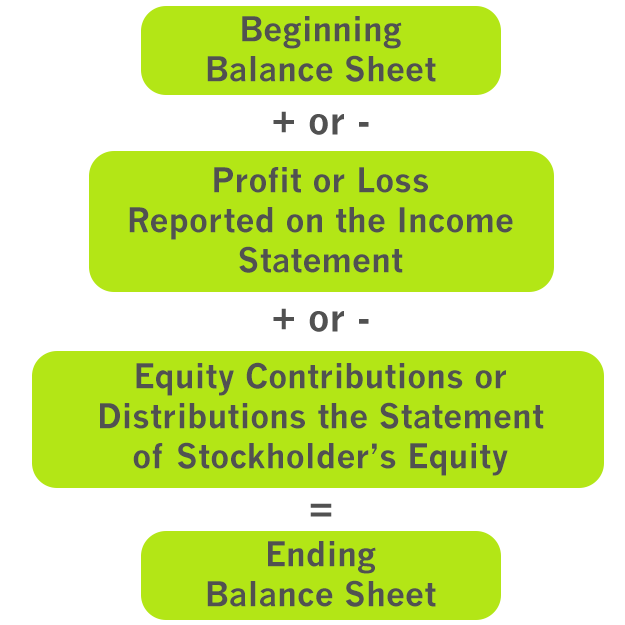

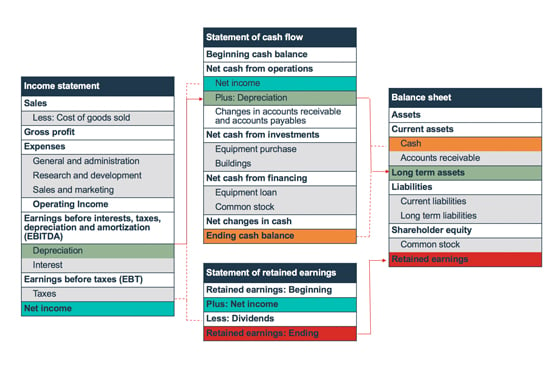

Financial Statement Template and Form

Here’s a sample financial statement template that shows the order of how each statement works together to report the full economic position of a company beginning with the balance sheet.

As you can see, everything starts with the prior period’s balance sheet. This is the starting point for all of the reports because it shows the asset, liability, and equity accounts at the beginning of the period. From this starting point, we can add or subtract the operating activities reported on the income statement. This includes all revenues and expenses that the company incurred during the year.

We also need to add or subtract the amount of money investors put contributed or withdrew from the company during the year. This information is reported on the statement of stockholder’s equity for corporations or the statement of partner’s equity for partnerships. Once all the operating, financing, and investing activities are added to the beginning balance sheet, investors, creditors, and management can analyze the ending balance sheet and see how well the company performed during the period.

Here are the main financial sheets that are prepared by most companies. These examples should answer the question, “what is a financial statement?” We’ll also talk about some extra styles of statements and other reports that are commonly issued. Here’s the list of the most popular ones.

Financial statements

Financial statements are a key tool for running your business. They’re a snapshot of your company’s finances and give crucial information about your business performance. They’re also the foundation for planning your future course.

Financial statements are also used by bankers, investors and others to assess the health and liquidity of your business and make decisions that affect it.

“Financial statements show the sustainability of your business and allow you to make educated financial decisions to ensure it is as successful as it can be,” says Grant Godfrey, a Senior Account Manager at BDC.

Financial statements

Analyze your financial information and attract potential investors.

The Understand Your Financial Statements guide will be sent to you by email.

Financial statements can provoke discussion and show if you’re on track so you can know early and often where to pivot and how to pivot.

Senior Account Manager, BDC

What are financial statements?

Financial statements are a set of documents that show your company’s financial status at a specific point in time. They include key data on what your company owns and owes and how much money it has made and spent.

There are four main financial statements:

Financial statements may be prepared for different timeframes. Annual financial statements cover the company’s latest fiscal year. Companies may also prepare interim financial statements on a monthly, quarterly or semi-annual basis.

Interim statements sometimes include fewer components than year-end statements. For example, they may lack a cash flow statement and a statement of retained earnings.

Financial statements generally give information for both the latest period and the prior period to make comparisons easier. For example, a financial statement covering January 1 to December 31, 2021, would include the statements for both that year and the previous year— January 1 to December 31, 2020.

What are the elements of financial statements?

1. Balance sheet

The balance sheet shows what the company owns and how much it owes at the end of the period. It is based on the equation:

Assets = Liabilities + Shareholders’ Equity

Below is a sample balance sheet.

2. Income statement

An income statement shows the profitability of your business. It details how much money your business earned and spent. The income statement is also sometimes referred to as a profit-loss statement or an earnings statement.

Below is an example of an income statement.

To supplement an income statement, a business may also prepare a statement of comprehensive income. This reports revenues and expenses that haven’t yet been realized, such as unrealized gains or losses from:

3. Cash flow statement

The cash flow statement, sometimes called a statement of changes in financial position, shows how money has moved through your business during the period.

Here is an example of a cash flow statement.

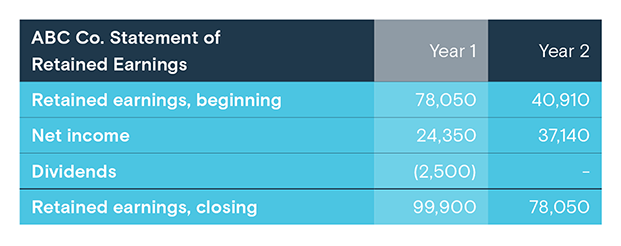

4. Statement of retained earnings

The statement of retained earnings shows the cumulative earnings of the business after any dividends or distributions to shareholders. As well, this statement, sometimes called a statement of changes in equity, also shows the change in the retained earnings account between the opening and closing periods on each balance sheet.

Sample retained earnings statement:

5. Notes to the financial statements

Notes to the financial statements disclose the assumptions made in preparing the statements and help interpret and analyze the information. They typically explain:

We take our time going through the financials. We look at them from front to back. We look at every page and every line item.

Senior Account Manager, BDC

What are the types of financial statements?

There are four types of financial statements. Each has a different level of complexity, validity and cost.

1. Internally prepared

Internally prepared statements are prepared by a company without involvement of an external accounting professional. Interim financial statements are often internally prepared.

2. Notice to reader

Notice to reader (NTR) is the most basic type of financial statement prepared by an accountant. NTR usually relies entirely on the information provided by the company, with little or no validation or auditing of figures by the accountant.

However, depending on the accountant, they may perform some limited tasks, such as:

It’s important to check what services are included. NTR may be suitable for smaller or less complex companies preparing year-end financial statements.

“The validity of notice-to-reader can vary a lot depending on the accounting firm,” Godfrey says. “Some just regurgitate the client-prepared information. Others have the same reliability and depth as review engagement.”

3. Review engagement

Review engagement is the next step up in sophistication. This type of statement usually involves some validation by the accountant. This could include reviewing the company’s:

A review engagement may be suitable for mid-sized and more complex businesses. This type of statement may also be required by lenders, investors, other partners or someone interested in buying the company.

4. Audited statements

Audited financial statements provide the highest level of assurance of the validity of the information. The accountant may:

“Audited statements provide validity and involve a deep dive into a company,” Godfrey says. “The accountant makes sure the financials are accurate and correct.”

Audited statements may be suitable for larger businesses and those contemplating a substantial loan or investment.

How are the different financial statements connected?

All four financial statements are linked. For example, net income is recorded at the bottom of the income statement (see below). It is also found on the cash flow statement and statement of retained earnings. After dividends are subtracted, we get retained earnings, which are stated on the balance sheet.

Why are financial statements important and how do I use financial statements to build my business?

Financial statements are important for many reasons and are a key tool for building your business.

What is the difference between financial statements and financial reporting?

Financial reporting is the obligation to provide financial documents in specific situations. Financial reporting may be required by:

Reporting requirements may obligate a business to disclose both year-end financial statements and interim (monthly, quarterly or semi-annual) documents, such as an interim balance sheet and income statement, aged receivables and payables, and a margin report.

What is the most important financial statement?

All financial statements are equally important.

Who prepares an annual financial statement?

Year-end financial statements are usually prepared by an accountant, but smaller businesses often prepare them internally—for example, with the help of a bookkeeper. Interim financial statements are typically prepared internally.

Get a full picture of your business’s financial health by downloading our free guide: Understand Your Financial Statements.

You can also use our free Financial statements template to help you get started.

Useful resources

Ratio calculators

Financial ratios are a way to evaluate the performance of your business and identify potential problems. Each ratio informs you about factors such as the earning power, solvency, efficiency and debt load of your business.

Financial Statements 101

Financial statements are like the financial dashboard of your business. They tell you where your money is going, where it’s coming from, and how much you’ve got to work with. They’re super helpful for making smart business moves. And they’re 100% necessary if you want to get a loan or bring on investors.

If you’re looking for a good intro to financial statements, read on. We’ll go over the basics of each financial statement, and how to read (and use) them—so your business runs like a well-oiled machine.

What are financial statements?

Financial statements are reports that summarize important financial accounting information about your business. There are three main types of financial statements: the balance sheet, income statement, and cash flow statement.

Together, they give you—and outside people like investors—a clear picture of your company’s financial position.

We’ll look at what each of these three basic financial statements do, and examine how they work together to give you a full picture of your company’s financial health.

The balance sheet

A balance sheet is a snapshot of your business finances as it currently stands. It tells you about the assets you own, and liabilities (i.e., debts) you owe, at a particular point in time.

How often your bookkeeper prepares a balance sheet for you will depend on your business. Some businesses get daily or monthly financial statements, some prepare financial statements quarterly, and some only get a balance sheet once a year.

For example, banks move a lot of money, so they prepare a balance sheet every day. On the other hand, a small Etsy shop might only get a balance sheet every three months.

Balance sheets are broken up into three general categories: assets, liabilities, and equity.

Here’s an example of what a balance sheet looks like if you’re a Bench customer.

Assets

Assets are anything valuable that your company owns.

On the Bench balance sheet shown above, assets consist of:

Money in a checking account and

Money in transit (being transferred from another account)

But total assets can also include things like equipment, furniture, land, buildings, notes receivable, and even intangible property such as patents and goodwill.

Liabilities

Liabilities are debts you owe to other people. On our balance sheet example above, the only liability is a bank loan. But total liabilities can also include credit card debt, mortgages, and accrued expenses such as utilities, taxes, or wages owed to employees.

Equity

Equity is the remaining value of the company after subtracting liabilities from assets. This might be retained revenue—money the company has earned to date—as in the example above.

Equity can also consist of private or public stock, or else an initial investment from your company’s founders.

It’s important to note that equity is only the “book value” of your company. It’s not your business’ market value if you wanted to sell the business. When selling a business, buyers usually pay more than the book value of the business based on things like the company’s annual earnings, the market value of tangible and intangible property it owns, and more.

The balance sheet formula

To grasp how the three categories on the balance sheet work together, remember this formula:

Equity = Assets – Liabilities

To put it simply: Whatever value (equity) your business actually has consists of what it owns (assets) minus what it owes (liabilities).

Using the balance sheet in real life

Here’s an example to explain how it works. Let’s say you run a food cart selling vegan, gluten-free, organic popsicles.

At the end of June, you get a balance sheet from your bookkeeper. It looks like this:

June Balance Sheet

| Category | Amount |

|---|---|

| Assets | |

| Bank account | $1,200 |

| Liabilities | |

| Credit card debt | $400 |

| Equity | |

| Retained earnings | $800 |

Not bad! It’s summer, your busiest time of year. One month passes.

At the end of July, your balance sheet shows this:

July Balance Sheet

| Category | Amount |

|---|---|

| Assets | |

| Bank account | $2,200 |

| Liabilities | |

| Credit card debt | $400 |

| Equity | |

| Retained earnings | $1,800 |

This is useful information. But it’s not the full picture.

Do your balance sheets tell you…

…how many popsicles you sold? No.

…how much cash you received? No.

…how much it cost you to make the popsicles you sold? No.

…how much you spent on expenses? No.

This is where the income statement comes in.

The income statement

While the balance sheet is a snapshot of your business’s financials at a point in time, the income statement (sometimes referred to as a profit and loss statement) shows you how profitable your business was over an accounting period, such as a month, quarter, or year. It shows you how much you made (revenue) and how much you spent (expenses).

Here’s an example of an income statement, from the Bench app.

Revenue: how much you earned from selling popsicles

Cost of Goods Sold (COGS): the total amount it cost you to make the popsicles: popsicle sticks, locally-sourced ingredients, etc. (here’s a fuller explanation of COGS)

Operating Expenses: the cost of running your business, not including COGS

Gross Profit: tells you how profitable your products are

When you subtract the COGS from revenue, you see just how profitable your products are. This is very useful. In the above example, the revenue is about 10x the COGS, which is a healthy gross profit margin.

If your COGS and revenue numbers are close together, that means you’re not making very much money per sale.

Net Profit: tells you how profitable your business is

Just because your products are profitable, doesn’t mean your business is profitable. You could be making a killing on every popsicle, but spending so much on advertising that you walk away with nothing.

Using the income statement in real life

Suppose we have an income statement for July that looks like this:

July Income Statement

| Category | Amount |

|---|---|

| Revenue | |

| Sales revenue | $1,000 |

| COGS | $100 |

| Gross Profit | $900 |

| Expenses | |

| Interest expense | $100 |

| Electricity expense | $50 |

| Maintenance expense | $50 |

What does the income statement tell us that the balance sheet doesn’t?

With this info, you know how many more popsicles you have left in inventory—and how many more you should be prepared to make next July.

What else? There are two expenses here besides interest expense: electricity and maintenance. Looking back over your income statements, you’ll be able to see which months you spend more on electricity, and roughly how often you need to pay for maintenance on your popsicle cart.

More importantly, you’ll be able to plan ahead for more expensive months (electricity-wise) and know roughly how much money to set aside for maintenance.

You can only get this kind of information from the income statement.

But what’s missing?

Does your income statement tell you…

…how much money you have in the bank? No.

…how much money you owe to your credit card company? No.

…how much equity you have in the business? No.

…how much money you had one month ago vs. six months or a year ago? No.

To get that info, you need snapshots of your business’s finances. You get those from the balance sheet.

Most small businesses track their financials only using balance sheets and income statements. But depending on how you do your financial reporting, you may need a third type of statement.

The cash flow statement

The cash flow statement tells you how much cash entered and left your business over a particular time period.

Cash flow statements (also known as the statement of cash flows) are typically only prepared for companies that use the accrual accounting method. This is because under the accrual method, a company’s income statement might include revenue that the company has earned but not yet received, and expenses the company has incurred but not yet paid.

Here’s an example cash flow statement, using our popsicle stand from before:

The cash flow statement has three parts:

Cash Flows from Operations. This is what you make and spend in the normal course of doing business.

Cash Flow from Investing Activities. This is money you invest—in this case, by purchasing new equipment for your business.

Using the cash flow statement in real life

The cash flow statement tells you how much cash you collected and paid out over the year. This can help you predict future cash surpluses and shortages, and help you plan to have enough cash on hand to cover rent or pay the heating bill.

What does this cash flow statement tell you?

To increase your company’s cash flow from operating activities, you need to speed up your accounts receivable collection. That could mean telling customers you’ll only accept cash rather than I.O.U.s, or requiring your customers to pay outstanding invoices within 15 days rather than 30 days.

In either case, your cash flow statement has shown you a different side of your business—the cash flow side, which is invisible on your balance sheets and income statements.

Using financial statements to grow your business

Once you get used to reading financial statements, they can actually be fun. By analyzing your net income and cash flows, and looking at past trends, you’ll start seeing many ways you can experiment with optimizing your financial performance.

Here are a few practical ways financial statements can help your business grow.

Investing in assets

Securing a loan

One person can only serve so many popsicles. Suppose you can’t keep up with demand during the busy summer months. The line at your cart grows so long some days, people get frustrated and leave before they even buy one of your popsicles.

At this point, it may make sense to hire a second (seasonal) employee and get a bigger cart. But you need a loan in order to do that.

Before lending you more money, the bank will want to know about your company’s financial position. They want to know how much you make, how much you spend, and how responsible your company’s management is with your business finances. This information is a good indicator of whether you’ll be in business long enough to pay off your loan.

That’s when financial statements are invaluable. With properly prepared balance sheets and income statements, you’re equipped to prove your business is sustainable—and get ahold of the resources you need to expand it.

Taxes

Finally, without properly prepared financial statements, filing your taxes can be a nightmare. Not only do financial statements tell you how much income to report, but they also give you an overview of the expenses you’ve incurred—some of which can be written off as small business tax deductions.

How Bench can help

By carefully collecting data and crunching the numbers, you can prepare your own financial statements. But, chances are, you didn’t start your own business so you could be hunched over a calculator every night. That’s where a bookkeeper comes in handy.

An experienced bookkeeper can prepare your financial statements for you, so you can make smart financial decisions without all the tedious paperwork. Plus, when it’s time to file your income taxes, you’ll know your financials are 100% comprehensive and correct, ready to be handed off to your accountant.

Don’t have a bookkeeper? Check out Bench. We’ll do your bookkeeping for you, prepare financial statements every month, and give you access to the Bench app where you can keep tabs on your finances. Learn more.

What’s Bench?

We’re an online bookkeeping service powered by real humans. Bench gives you a dedicated bookkeeper supported by a team of knowledgeable small business experts. We’re here to take the guesswork out of running your own business—for good. Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month. Get started with a free month of bookkeeping.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein.