What is a pivot point

What is a pivot point

Forex Pivot Points

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

What Are Forex Pivot Points?

A pivot point is an indicator developed by floor traders in the commodities markets to determine potential turning points. In the forex and other markets, day traders use pivot points to determine likely levels of support and resistance, and thus possible turning points from bullish to bearish or vice versa.

Key Takeaways

Understanding Forex Pivot Points

Unlike most technical indicators, pivot points are intended to predict market turning points. They are calculated using simple math and the previous day’s high, low, and closing prices. In the forex market, pivot points are calculated using the entire 24-hour trading period, with the price at the end of the U.S. «session» deemed the closing price.

The classic pivot point calculations produce the pivot point itself, the strongest of the indicators, as well as three levels of support and three levels of resistance. The location of price relative to the main pivot point is used to judge whether a given trading session has a generally bullish or bearish bias.

Pivot points form the foundation of much of the technical analysis used by day traders, although their effectiveness in indicating turning points may be due to the fact that they are so popular as an indicator market behavior at the given levels is something of a self-fulfilling prophecy. Longer-term pivot points can also be calculated using weekly, monthly, quarterly, or annual prices.

Trading With Pivot Points

No matter how accurate pivot points are at predicting turning points, traders still need a viable system to win with them consistently. As with all trading systems, that requires an entry method, a stop-loss trigger, and a profit target or exit signal.

Some day traders use pivot points to determine levels of entry, stops, and profit-taking by trying to determine where the majority of other traders may be doing the same. Forex pivot point calculators are available free of charge across the internet through retail forex brokers and third-party websites.

The most successful trading methods use pivot points with other technical indicators, such as trend lines, Fibonacci levels, moving averages, previous highs and lows, and previous closing prices.

Basic Pivot Point Formula

The formula for calculating the primary pivot point (using the previous day’s prices):

Investopedia does not provide tax, investment, or financial services and advice. The information is presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Investing involves risk, including the possible loss of principal.

What is a pivot point

A Pivot Point is a popular indicator commonly used by technical traders to determine the overall market trends, as well as potential support/resistance levels over different time frames.

Floor traders–the original day traders–are credited with being the first to use Pivot Points to set key levels.

At the beginning of each day, they would look the previous day’s High, Low and Close to calculate support and resistance levels for the current day’s trading.

Table of Contents

So what exactly IS a Pivot Point?

Essentially, a Pivot Point is the average of the High, Low and Closing prices from a previous trading session.

Pivot Points act as a leading/predictive indicator in that on the subsequent day, trading that goes above the Pivot Point is considered a bullish signal, while trading that goes below it is considered a bearish signal.

In Pivot Trading, the general trend is that if the market opens above or below the pivot, the price action has a strong tendency to remain above/below the pivot for that trading session.

Keeping this in mind, as it allows you to avoid much of the market noise that may show up later in the day.

On the other hand, if the market opens or trades at extreme support or resistance levels, it has a general tendency to trade back to the pivot.

Traders should remember this to avoid buying high or selling low even as the price moves away from the pivot.

The Opening, High, and Closing Prices are used to calculate Pivot Points based on the chart’s timeframe.

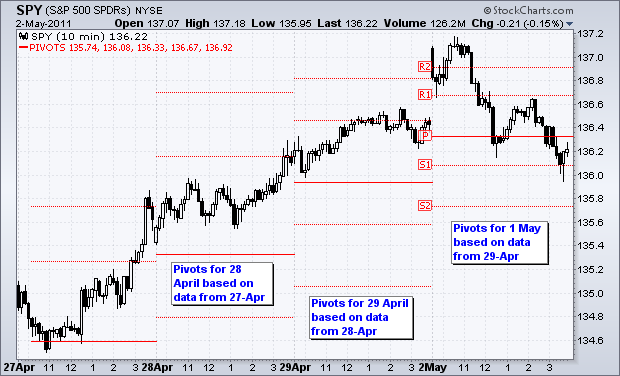

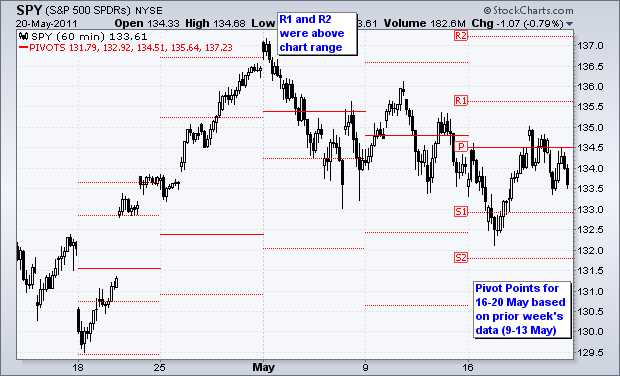

Short-term timeframes of less than 15 minutes use data from the previous day; medium-term charts (30-minute and 60-minute) use data from the previous week, while daily charts use data from the previous month.

Meanwhile, weekly and monthly charts use data from the previous year.

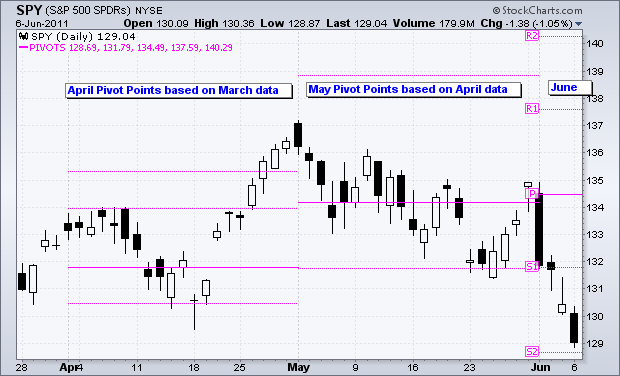

Pivot Points for 10-Minute S&P 500 Chart

Pivot Points for 60-Minute S&P 500 Chart

Pivot Points for Daily S&P 500 Chart

There are several different versions of Pivot Points in use today. Standard Fibonacci and Demark Pivot Points are among the most common.

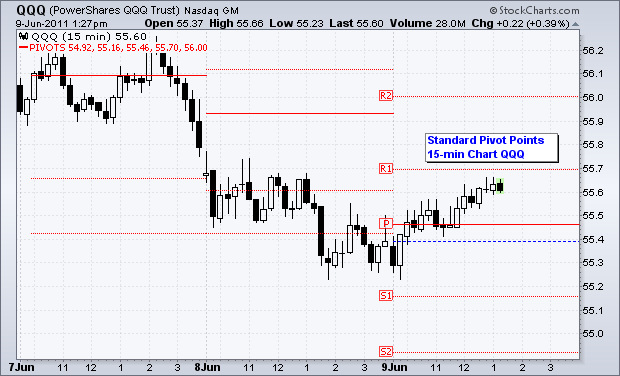

Standard Pivot Points

Standard Pivot Points are the most basic Pivot Points. To calculate Standard Pivot Points, you start with a Base Pivot Point, which is the simple average of High, Low and Close from a prior period. A Middle Pivot Point is represented by a line between the support and resistance levels.

The chart below shows Standard Pivot Points on a 15-minute chart for the Nasdaq 100 ETF (QQQ) for June 9th. All the levels remained constant throughout the day.

2. Fibonacci Pivot Points

Just like Standard Pivot Points, Fibonacci Pivot Points also start with a Base Pivot Point. The main difference is that they also incorporate Fibonacci levels in their calculations.

Most traders use 38.2%, 61.8% and 100% retracements in their calculations and, therefore, Fibonacci Pivot Points represent three support and three resistance levels.

The main logic behind Fibonacci Pivot Points is that many traders love using Fibonacci Ratios.

Both Pivot Points and Fibonacci Ratios are used to find support and resistance levels.

With so many traders using both tools in their analysis, they can easily become self-fulfilling.

The Base Pivot Point, support and resistance levels for Fibonacci Pivot Points are calculated as follows:

The chart below depicts Fibonacci Pivot Points on a 15-minute chart for the Dow Industrials SPDR (DIA).

StocksToTrade—now better than ever! We ushered in the New Year with some major advancements that include 3 unique features, exclusive to our Platform.

3. Demark Pivot Points

Demark Pivot Points are not actual Pivot Points, in the real sense of the word, but rather are used to show the relationship between the Open and Close.

Unlike the other two types of Pivot Points, Demark Pivot Points only feature a single support and resistance level.

The following set of operations are used to calculate Demark Pivot Points:

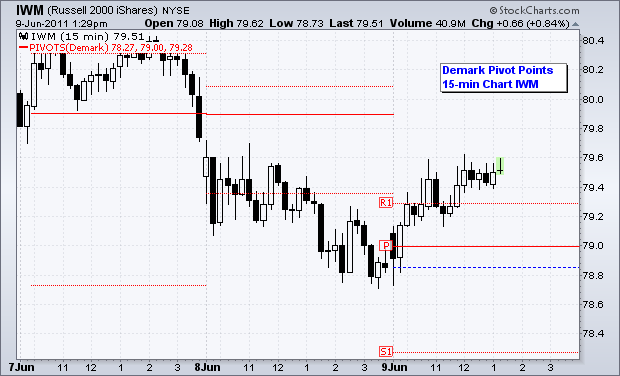

The chart below depicts Demark Pivot Points on a 15-minute chart for Russell 2000 ETF (IWM).

Setting the Tone with Pivot Points

Pivot points are used to set the tone for price action.

A move above the Pivot Point shows strength in the market while one below it shows weakness.

A move above the Pivot Point indicates strength and signals the trader to look at the first resistance as a target.

A break above the first resistance indicates even more strength and the trader should now target the second resistance level.

The converse also applies. A move below the pivot indicates weakness and the trader should look at the first support level as a target. A break below the first support level indicates even more weakness and the trader should look at the second support level as a target.

The Best Pivot Point to Use?

As with other technical indicators, there is no single best Pivot Point that will work for all traders, all of the time.

The best advice is to use your Pivot Point of choice with other technical analysis tools, including MACD, candlesticks and RSI.

Most charting software uses Standard Pivot Points.

You can choose to chart your own Pivot Points using other methods and try them out to see what works best for you.

Check out STT’s new Twitter Streams! One of our most important new releases of 2017 is the inclusion of Twitter as a source of data for keeping up to date with the latest social discussions on a given stock. Every Stock tab includes a Twitter data feed which focuses only on tweets mentioning the company being tracked.

One Platform. One System. Every Tool

Interested in trying the number 1 trading platform? Get started risk free.

Are you looking for the top stocks to watch as the market continues its recovery? Well, you have that in common with a.

Patterns are just one variable to consider before entering a trade. Before you jump into a trade based solely on.

In the current market, it’s more difficult to find great stocks to trade and execute your plan… Stocks are.

Leave a Comment Cancel reply

Comments

I have the program and thought it was part of the purchase.Thanks

This email is magical. I can’t wait to study this over and over!! Very exciting pivot points!

I’m going to have to go back a couple of times to get this one.

More information of this kind, please! This is what newbies are longing for.

Thanks. This is helpful but a bit TMI for me. Thank God for STT and Oracle!

Hello

just like to ask you like in a different scenario of next day opening, if a stock opens gap-up or vise versa i.e. gap down situations, then will it affect the Standard method of pivot points calculations or will it be the same.

** Results not typical or guaranteed. Past performance is not indicative of future returns and financial investing isinherently risky. All content is provided subject to the qualifications and limitations set forth in ourTerms of Service and Use.

This is for informational purposes only as StocksToTrade is not registered as a securities broker-dealeror an investment adviser. No information herein is intended as securities brokerage, investment, tax,accounting or legal advice, as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

StocksToTrade cannot and does not assess, verify or guarantee the adequacy, accuracy orcompleteness of any information, the suitability or profitability of any particular investment,or the potential value of any investment or informational source. The reader bears responsibility forhis/her own investment research and decisions, should seek the advice of a qualified securities professional before making any investment,and investigate and fully understand any and all risks before investing.

should seek the advice of a qualified securities professional before making any investment,and investigate and fully understand any and all risks before investing.

Pivot Points Trading Strategy: What Is It and How to Integrate It

The concept of support and resistance is the most important one in technical analysis. The support level is often viewed as a floor, where the price struggles to pass while the resistance is a ceiling where the price struggles to move higher. Support and resistance levels are usually signs of indecision between bears and bulls.

There are many ways of drawing the support and resistance levels. In this article, we will look at a guide on how to draw Pivot Points in Trading and use them in the market.

What is a Pivot Point?

A pivot point is a level where the sentiment of the market changes from being bullish to bearish. The vice versa is also true. If the price moves past the first support or resistance, the market tends to expect that it will move to the second level.

Therefore, pivot points are important tools that many pros use to identify where the price will move to next. They are also used to locate take-profit and stop-loss.

Types of pivot points

There are four main ways of drawing the pivot points. These are:

While we recommend using the standard method.

As you begin, there is always an eternal debate among market participants on the close, open, high, and low prices because the forex market is usually open 24 hours every day.

While we recommend that you calculate these pivot points yourself, you can use the free pivot points provided by a number of online platforms. As you do this, we recommend that you establish how they calculated these points.

Standard Pivot Points

The standard pivot point is calculated in a simple way. First, you calculate the pivot point (PP). You do this by adding the high, low, and close, and then divide the result by three.

The first resistance (R1) is calculated by multiplying 2 with the PP and then you subtract the low (2xPP) – low. The first support (S1) is calculated by (2XPP) – high.

The S2 and R2 are calculated by:

R2 = PP + (high-low)

S2 = PP – (High – Low)

The R3 and S3 are calculated by:

R3 = High + 2(PP-low)

S3 = Low – 2(High – PP)

Woodie Pivot Points

The Woodie pivot points are calculated differently from the standard or classical pivot points. They are calculated using the formula below.

First, you calculate the pivot point (PP) using the following formula: (H+L+2C)/4

R1 = (2xPP) – Low

R2 = PP + High – Low

S1 = (2 x PP) – High

S2 = PP – High + Low

Here are a few things about the Woodie Pivot Points.

First, as mentioned, the PP are calculated using a different formula than the classic points. Second, there are traders who prefer these points because they put more weight to the previous period’s closing price.

Fibonacci Pivot Points

The concept of Fibonacci Retracement is very essential in the market. It is essential because it has been used successfully for more than a century.

And it is also used to calculate pivot points!

The following formula is used:

First, you calculate the pivot point using the following formula: (H + L + C) / 3

The R1 is calculated by PP + ((High – Low) x 0.382). The R2 is calculated by PP + (High – Low) x0.618 and the R3 is calculated by PP + ((High – Low) x 1.000.

The S1 is calculated by PP – ((High – Low) x 0.382. The R2 is calculated by PP – ((High – Low) x 0.618 while the S3 is calculated by PP – ((High – Low) x 1.000.

As you have seen, we have not calculated the Camarilla pivot points. This is simply because it is not a very popular type of pivot points.

Camarilla pivot points

Camarilla pivot point is also a relatively popular type of point in the market. The difference is that it introduces the concept of Fibonacci lines in the calculation. The tool’s calculation is a relatively long one. The first step is to add the high, low, and closing price and then divide the 3.

To get the first resistance, you use the following formula:

For S1, you do the opposite:

| closing – ((high – low) x 1.0833) |

You should then repeat these for the rest of the support and resistance levels.

Pivot Points trading strategies

Now that you know about pivot points, it is important that you know how to use them in the markets!

Let’s see how to apply it in practice.

You just need to go find a chart you want to analyze and select the type of pivot point that you want to use and the number of back pivots. In most cases, three will be enough.

After this, select the number of levels of the points you want to use. If the price is at the pivot point level, there is no need for having support and resistance 3 and above. Finally, you can change the colours of these pivot points for easier identification.

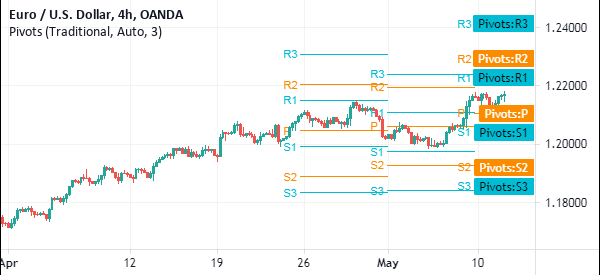

For example, in the EUR/USD pair, we have added a standard pivot point with three back pivots. We have also added the first and second support and resistance levels.

Therefore, in this chart, we see that the pair dropped and hovered close to the first level of resistance and then rose back. At the time of writing, the price is at the pivot point level. Therefore, if the price rises above this level, the next level to watch is the first resistance, and so on.

Final thoughts

Pivot points are important tools that can help you identify areas of potential support and resistance levels. They are used by most professional day traders. In this article, we have looked at what they are, how to use them, and some of the strategies to use them.

Pivot Points

Tools used by day traders

What are Pivot Points?

Pivot points refer to technical indicators used by day traders to identify potential support and resistance price levels in a securities market. They are based on the previous day’s high, low, and closing prices. Traders use pivot points and the support and resistance levels they provide to determine potential entry, exit, and stop-loss prices for trades.

CFI’s Financial Modeling and Valuation Analyst (FMVA)™ certification program can provide you with a toolset that you can use to become a world-class financial analyst!

Originally, pivot points were developed by floor traders who worked in a fast-moving environment in the equity and commodities markets. At the start of each trading day, they would use the previous day’s high, low, and close prices to calculate the pivot for the current trading day.

The pivot point is then used to identify two support and two resistance levels for the day. The support and resistance levels are determined based on the difference between the previous day’s high and low prices and the pivot point.

Calculation Techniques

The main technique that most traders use to calculate pivot points is the five-point system. The system uses the previous day’s high, low, and close prices, as well the support and resistance levels. The five-point system uses the following equations:

Pivot point (P) = (Previous High + Previous Low + Previous Close)/3

S1= (P x 2) – Previous high

S2 = P – (Previous High – Previous Low)

R1 = (P x 2) – Previous Low

R2 = P + (Previous High – Previous Low)

Day Trading with Pivot Points

When calculating pivot points, the point acts as the primary support or resistance level. High volume trading often occurs when price is at or near the pivot point. The following are the main trading strategies used with pivot points:

1. Pivot point bounces

If the price action hesitates and bounces back before reaching the pivot level, you should enter the trade in the direction of the bounce. If you are testing the trade with price above the pivot line, and the price moves close to the pivot line and bounces back to the upside, you should enter a long (buy) trade.

On the other hand, if you are testing a pivot line from the lower side and the price bounces back to the downside after hitting the pivot, you should sell short. The stop-loss for the trade is located above the pivot line if the trade is short, and below the pivot line if the trade is long.

2. Pivot point breakout

When the price action breaks through the pivot line – such as crossing from below it to above it – the trade should continue in the direction of the breakout. If the breakout is bearish, the trade should be short, while for a bullish breakout, the trade should be long. A good place to implement a stop-loss order is slightly to the other side of the pivot line. For example, if buying long based on price crossing above the pivot line, a sell-stop would be placed a bit below the pivot line.

CFI’s Financial Modeling and Valuation Analyst (FMVA)™ certification program teaches you skills that you can use to evaluate a company’s value on the market!

Why Day Traders Prefer Pivot Points

Day traders often prefer using pivot analysis over other technical indicators for several reasons. They include:

1. High accuracy

The pivot point is considered one of the most accurate indicators in the market. This explains why a majority of day traders like using it to determine trade entry or exit points. It enables traders entering the market to follow the overall flow of the market since it uses the previous day’s trading action to predict the current day’s likely action.

2. Short time frames

Unlike other trading tools that use long time frames, the pivot point indicator obtains data from a single day of trading. It takes the previous day’s high, low and close prices to predict probable support and resistance levels. Although pivot trading is primarily applied on the daily time frame, pivots can also be calculated for much shorter time frames, such as the hourly or 15-minute charts.

3. Easy to use

The pivot point indicator is an easy to use tool that’s been incorporated in most trading platforms. The platforms automatically calculate support and resistance levels, so the trader doesn’t have to do it manually. After getting the pivot levels, the trader can concentrate on figuring out their approach to the market for the day.

Uses of Pivot Points

1. Determine market trends

Traders can use pivot points to determine market trends depending on the direction of the price action. When the price action remains or drops below the pivot level, it shows a bearish market. On the other hand, when the price action remains or crosses above the pivot, it shows that the market is bullish.

2. Enter and exit the market

Traders can also use the pivot point system to make a decision on when to enter and exit the market. For example, a trader can set a stop-loss near any of the identified support or resistance levels.

Related Readings

Thank you for reading CFI’s guide on Pivot Points. To keep learning and developing your knowledge of financial analysis, we highly recommend the additional resources below:

Pivot points

Pivot points are horizontal support and resistance lines

Pivot points are horizontal support and resistance lines placed on a price chart. The prices that they are placed at are calculated from the previous periods’ price data. For example, daily pivot points use the data from the previous day. They are important because they are prices at which traders enter or exit the markets.

They make strong levels of support and resistance because many traders, as well as financial institutions and banks, use them.

Before computers and charts became a key tool that traders use so effectively, floor traders determined key buying and selling levels using calculations based on the data from the previous trading day. Pivot points are still extensively used today and they are very useful in determining entry and exit points.

Although any time period can be used to calculate them, daily and weekly pivot points are the most commonly used. Monthly pivot points are also common, although they are not used as much as daily or weekly.

The following chart shows you what they look like on a chart:

How to use pivot points

An important aspect to know about pivot points is that each level can be used for support or resistance. For example, the level R1 will generally be a strong resistance level. However, if the price breaks through and comes back down to it, it will also be a strong support level.

If the price is below the main pivot point, it means that market sentiment is likely to be negative and if the price is above the main pivot point, it is likely to be positive.

As with all support and resistance levels, there is strength in numbers. The more pivots that line up, the greater the potential will be for price to react at those levels. So for example, if a weekly and a daily pivot point are at the same price level, this will make even more substantial support or resistance level.

Types of pivot points

There are different types of pivot points that are calculated and they revolve around what is called the main pivot point or daily pivot, the point at which the market is said to “pivot” around. After the main pivot point has been calculated, this is then used to calculate the other corresponding pivots points.

The pivot points above the daily pivot are labelled as resistance pivots, notably R1, R2, etc. If they are below, they are support pivots, labelled S1, S2, etc.

They are mostly calculated using a 5-point-system, comprised of:

Mid-pivot points

Pivot points that are between the pivot points are call mid-pivots. They are labelled differently. The mid-pivot between the S1 and S2 is labelled as M1, the mid-pivot between the S1 and the main pivot is M2 and so on.

Calculating pivot points

Where the calculations state a price, it is referring to the price of the previous period, for example, the closing price is the previous day’s closing price.

Main pivot/Pivot point

Pivot point = (Highest price + Lowest price + Closing price) / 3

The first resistance level R1

R1 = (Pivot point *2) – Lowest price

The second resistance level R2

R2 = Pivot point + (Highest price – Lowest price)

The first support level S1

S1 = (Pivot point*2) – The highest price

The second support level S2

S2 = Pivot point – (Highest price – Lowest price)

Calculating mid-pivots

Mid-pivots are simply halfway between the main pivot points. The calculations for mid-pivots are as follows:

Trading platforms have tools to calculate pivot points

It is important to note that there are many charting packages that provide these calculations automatically and others, such as MetaTrader 4, have the ability to install customised pivot point calculators. However, it is still useful to know the calculations in case you ever need them.

Different closing times will affect the calculations

Different markets have different closing prices that will affect the calculations.

The forex market, for example, is open for 24 hours and so the closing price is not easy to identify.

In contrast, the stock exchange has a clearly defined closing time and so the closing price is easily determined. However, with the forex market, there are no open and closing times during the week for the market as a whole. You must, therefore, choose which particular trading session you wish to use for the closing price.

The following is a list of the most common closing times for the major markets

Calculating weekly and monthly pivots

:max_bytes(150000):strip_icc()/Group1805-3b9f749674f0434184ef75020339bd35.jpg)

:max_bytes(150000):strip_icc()/P2-ThomasCatalano-d5607267f385443798ae950ece178afd.jpg)