What is the average weekly workload in a vc funded startup

What is the average weekly workload in a vc funded startup

How VC’s Look at Startups and Founders

Breaking down the odds.

A Quick Guide to Startup Funding

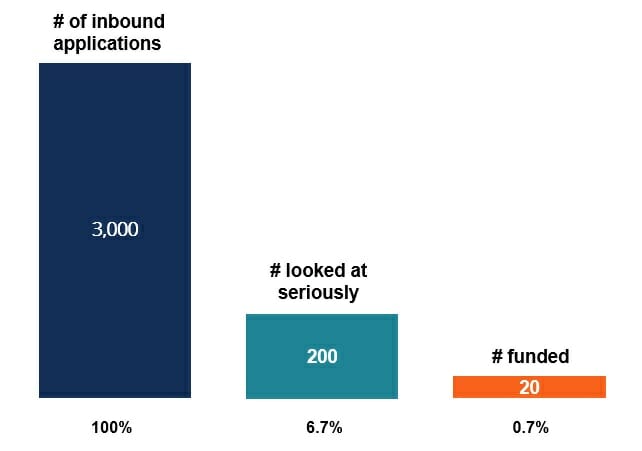

Raising money from a Venture Capital (VC) firm is extremely challenging. The odds of receiving an equity check from Andreessen Horowitz is just 0.7% (see below), and the chances of your startup being successful after that are only 8%. Combined, that’s a 0.05% or 1 in 2000 success rate.

Image data source. Note: graph is not to scale.

So, how can you increase your odds of building a company that will succeed?

This guide highlights what the top venture capital firms look for in a business idea and in a founder.

The Odds of Being Funded by a Top VC

The odds of being funded by Andreessen Horowitz are approximately 0.7%.

Marc Andreessen (founding partner of Venture Capital firm Andreessen Horowitz) recently provided an interesting breakdown of the odds of a startup receiving funding from his firm in an interview at Stanford Graduate Business School.

In the interview, Andreessen explains that there are approximately 4,000 startups a year that are seeking to raise venture capital funding.

Of the 4,000 startups looking for funding, they look at about 3,000 per year, mostly coming from inbound interest. That number breaks down to looking at approximately 12 opportunities per day (50 weeks per year, 5 days per week).

Of the 3,000 they screen, they look at 200 very seriously.

In the end, they invest in about 20 startups each year (0.7%).

The Odds of Succeeding for a Startup Funded by a Top VC

Andreessen goes on to explain that, from an aggregate perspective, the top VCs fund approximately 200 startups per year.

Since there are 4,000 companies looking for funding, that translates to odds of 5.0%.

Of the 200 that are funded by top VCs, 15 of those startups will generate nearly all of the economic return. The rest will either go to zero or limp along without generating much return.

Therefore, even the top VCs tank over half their deals. Thus, they have to be very careful and are somewhat paranoid about being wrong.

The Total Odds of Success Are 1 in 2,000

If the odds of being funded are 0.7%, and the odds of a funded company succeeding are 8%, the total odds of success are 0.05% (1 in 2,000).

What Do VCs Look for in a Startup?

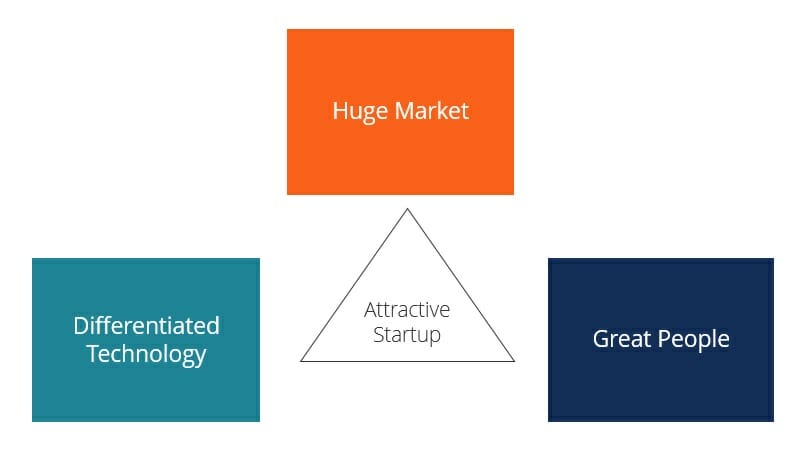

When a sponsor like Andreessen considers funding a startup there are a few main things they look for.

The three qualities they look for in a startup are:

These criteria are quite logical. If the market is too small, it doesn’t matter how great the product or service is, it just won’t have a big impact. If the technology is too similar to other competitors, then the odds of breaking away from the pack are low. Finally, without incredible people, neither of the other two criteria matters.

What Does a Top VC Look for in a Founder?

Of the above three criteria (market, technology, people) most venture capital firms will say the decision largely comes down to people, as opinions on markets and technology are extremely challenging to get right, and are not necessarily that relevant.

In terms of people, the two most important traits are:

Of those two traits, one can be learned (through conditioning), but the other cannot.

We are all born with a certain courage quotient, but that figure can be significantly enhanced through life experience, conditioning, and training.

Genius, on the other hand, is very hard to develop. Intelligence can be improved through reading, continuous learning, etc., but it may not enhance your chance of success.

That’s not to say genius is more important than courage – not at all. Having willpower and not stopping at any obstacle is essential.

What Makes a Good Pitch vs. a Bad Pitch?

Good pitches

A good pitch, according to Andresseen, can walk you through the “idea maze” of how they got from their original concept to a commercial idea that will actually work. There is only a short window of time to present to an investment committee, so the story has to be very succinct, logical, and compelling.

Bad pitches

A bad pitch essentially lacks the qualities of the good pitch list above.

Specifically, a bad pitch may have the following traits:

Helpful Resources For Startups and Founders

If you’re hoping to raise money from a top venture capital firm, then you’ve definitely got your work cut out for you! To help you prepare for your pitch we’ve got plenty of tools and resources to support you. Relevant resources include:

Financial Analyst Certification

Become a certified Financial Modeling and Valuation Analyst (FMVA)® by completing CFI’s online financial modeling classes and training program!

What the enthusiasm for funding startups means for the VC world

More money chasing scarce ideas means that the prices paid for startups rise

F INANCIAL MARKETS are fuelled by stories, and the most skilful storytellers are found in venture capital. For a start, venture capitalists have to listen to a lot of fairy tales from the would-be entrepreneur. “The world will look different in a decade,” he says. “My startup will be the leading business in a new industry.” VCs tell themselves stories about how they can foresee what others cannot, and how this stands to make them a lot of money. And they retell them to potential investors in their funds.

Your browser does not support the element.

Who to believe, when you cannot easily verify such tales? This difficulty is a version of the agency problem of asset management. When venture capital was clubbier, it was manageable. But in recent years investors who are new to the terrain have been piling in. A VC trying to raise money may favour startups of the kind that has done well recently, even if they are not the best long-term bet. Oddball startups with more potential might then be starved of capital.

There is thus a nagging fear that the more money that is funnelled into Silicon Valley and other centres of venture capital, the less “true” innovation will occur. Well perhaps. But it is not obvious that great business ideas are being ignored. The downside of the flood of venture capital is more prosaic. Run-of-the-mill startups are overindulged. And prospective returns are depressed.

More and more pension schemes are looking to alternative investments, including venture capital, to juice up their returns. VC funds have on average beaten the public market, net of fees, over the long run. The best funds do a lot better than the average. But it is not only a matter of returns. Smart investors in public markets realise that they own a lot of companies that are at risk of disruption from emerging technology firms. A good way to balance that risk is to own a stake in the next generation.

More money for new businesses is surely a good thing. Nevertheless there is a lingering disquiet. One source of discomfort is that funds are often narrowly segmented by region, industry, or stage of investment—and sometimes all three. This helps with marketing. Money is attracted to themes that have worked well recently. As Hollywood has discovered, it is easier to sell a variant of an old story than a brand-new one.

There are drawbacks, though. A truly game-changing business may sit astride several themes and be ignored, says Ajay Royan of Mithril, a VC firm based in Austin, Texas. In the public markets buying stuff that has worked well recently is called momentum trading. It does fine much of the time, and has an appeal to the investor who is out of his element in venture-land. By “social-proofing” VC investments the anxious can get more comfortable with the risks, says Mr Royan. “But it can devolve into the VC equivalent of ‘you can’t get fired for buying IBM’.” And the trouble with crowded trades is that they are prone to crashes.

Some VC funds will fall prey to the vices of asset gathering—telling a good story about the latest fad to maximise the amount of fee-paying money under management. But there is a culture that militates against this. The best VC firms pride themselves on being oversubscribed. They turn money away. And an industry that hears a lot of fairy tales has some inbuilt discipline. Venture capitalists have to kiss a lot of frogs to find a prince—even a halfway handsome frog. The average VC firm screens 200 targets a year, but makes only four investments, according to one study.

The trouble with abundant capital instead is more straightforward. More money chasing scarce ideas and talent means that the prices paid for startups rise, which all else equal means returns fall. And the absence of cash constraints can spoil a promising startup. If it blows a lot of money on marketing, the resulting growth can distract the founders from underlying faults with the product. Telling a good story is vital in the startup business. But there is a danger in believing your own fairy tales.

This article appeared in the Finance & economics section of the print edition under the headline «The frog chorus»

What is VC Funding? Everything You Need to Know

The short answer is venture capital funding, or VC funding, is capital that you get from investment groups that work with startups and small businesses. 3 min read

Entrepreneurs commonly ask, “What is VC funding?” The short answer is venture capital funding, or VC funding, is capital that you get from investment groups that work with startups and small businesses. These groups oversee the money of investors who want to invest in companies with strong growth potential in exchange for an equity share in the business. VC funding is one way for small businesses to get money to start or grow their business.

Most venture capital investments are considered to be high risk / high reward opportunities. Investors look at a company’s size, assets, and product development pipeline when choosing their VC investment. Compared to other types of investments like hedge funds or mutual funds, venture capital funds focus only on early-stage investments. Changes in the investing world have made venture capital investments more accessible to a wider variety of legitimate investors.

Venture capital firms typically take an active role with their investments and often request a seat on the board, so they can provide more guidance. It is common for a VC fund to invest smaller amounts of money in a larger number of startups in hopes that at least a few of the companies will grow into larger, profitable companies. Spreading out the capital helps the funds lessen some of the risk that comes with investing in new companies.

How Do VC Funds Work?

Depending on how mature the business is when the investment occurs, VC investments are classified as either seed capital, early-stage capital, or expansion-stage capital. No matter what stage the investment is in, they all follow the same basic process:

Stages of VC Funding

Not every startup uses VC funding, however. Less than 1 percent of all startups land a deal with a VC fund. Getting the right VC investors can start the company on the right foot and help it gain powerful partners and funding. Paying attention to technology VCs are funding can also help entrepreneurs and investors know new trends in technology. Before bitcoin was a household term, it landed deal with VC funds in 2014 that started its growth trajectory.

The first stage of VC funding is for seed capital. This round is called the seed round because it is the earliest stage possible. Seed capital is typically small and given to companies that don’t have a product that is ready for commercial distribution. Money gained in a seed round is usually used for research and development, which means startup leaders are pitching an idea, not a tangible product. Seed capital is also often used to hire more team members and do research into the marketability of a product.

If you need help with knowing what VC funding is, you can post your legal need on UpCounsel’s marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

All Encompassing Startup Fundraising Guide

Everything you need to know about fundraising for your startup. Learn how to raise and track your fundraising with these tools.

Overview

Startups are in constant competition for two resources: capital and talent. Without capital, a business fails to exist. Without talent, a business fails to flourish.

This guide is intended to help you understand the the venture markets and improve your likelihood of raising venture capital. We will cover the history of venture capital, the investor thought process, finding and pitching investors, sharing data and documents, closing your new investors, and building strong relationships to help with future fundraises. Note: You can find the resources (blogs, podcasts, videos, books, etc.) used to fuel this guide in the resources tab located in the top right.

If you’ve raised venture capital before, you already have some combination of a great product, a highly functioning team, and a growing market. Before we jump into these aspects, we need to take a step back and study the history of venture capital.

As recent as the 1990s, the venture capital space was dominated by a few large firms that did incredibly well. Capital was enough of a scarcity that it was a differentiator for these large firms. As the internet skyrocketed in the 90s and early 2000s, in turn the cost of starting a company started to decline (and still is today). Fast forward to 2005, and Y Combinator is started. Y Combinator cracked the code on scaling entrepreneurship and used their founder and investor network to help more companies succeed.

Further reading and resources to help you learn more about venture capital:

Are you ready to raise capital?

First things first, you need to ask yourself, “are we ready to raise venture capital?” Or better yet, “what do I have to offer a potential investor?” As we previously mentioned, to raise venture capital you need some sort of combination of a compelling market, qualified team, or strong product.

Understanding How VCs Work

To understand if you’re ready to raise venture capital, you need to understand how VC firms function and how you can fit into their larger vision. In simplest terms, VCs go through a consistent life cycle that goes something like this: raise capital from LPs, generate returns through risky venture investments, generate returns in 10-12 years, and do it again.

A Compelling Market

The best chance of being one of these companies that creates the huge returns for a fund, have a compelling market. As Scott Kupor, Managing Director at a16z puts it, “Everything starts and ends with addressable market.” As a founder, it is your duty to model the total addressable market and paint a picture of how you will penetrate the market to become a “home run” investment. Without a compelling market, a VC fund will have a tough time justifying making an investment in your company. With that being said, if a market is not big enough right now, strong and innovative companies can find and create new ones (E.g. Uber’s TAM ).

Markets fluctuate and you may have an investor that invests in specific products or teams to differentiate themselves.

The Product

The Team

While the team may have no direct attribution to how large of returns your company can generate, it can display your ability to execute on the vision. Having a well experienced team is a great way to portray your credibility. Some very early stage investors, such as the Hustle Fund, may even place the most stress on the team when making an investment decision. As Elizabeth Yin of the Hustle Fund puts it, “of the two things I am most interested in for early stage investments is the assessment of the team… how well do they know the market? Are they executing?, etc.”

So the question is not, “are we ready to fundraise?” It should be, “do we have the market, product, or team to warrant an investment from an investor?” If so, it is time to get started on the fundraising process.

Further reading and resources to help you determine if you’re ready to raise venture capital:

Finding the Right Investors

When you’ve determined you are ready to raise capital, you’ll find that the fundraising process often mirrors a traditional sales process. Like any sales process, the fundraising process starts by finding qualified investors (leads) that you’ll build a relationship with the end goal of them writing a check.

Fundraising is often compared to a cocktail party, when the waiter comes around with a tray of snacks, you should always take one. You’ll never know when the waiter will make it back to you. The same with VC capital. However, it is important to remember that the average VC + Founder relationship is 8-10 years so you’ll want to make sure you’re starting with the right people to build a valuable and long-term relationship.

Regardless of how you get a meeting, it is vital to do your research beforehand. Start with current connections and do what you can to get an introduction. Other founders and current investors are a great source for finding new investors. Go into the first meeting full of knowledge and ready to question investors.

Further reading and resources for finding the right investors:

Pitching Your Company Effectively

Just landed your first meeting? Great! But the pitching does not start yet. Many founders will walk into their first meeting and immediately start flipping through their deck and give the same presentation to each investor. However, you need to remember you are selling your company and want to make sure your pitch is as tailored as possible to each investor.

The first meeting should be most valuable for you as a founder. This is your opportunity to ask questions so you can figure out their pain points, figure out their motives, and other nuanced things you may not be able to find in internet research to tailor your pitch for future meetings.

If you’ve done your research and asked the right questions, you’ll be armed with the information you need to effectively pitch your company. At the end of the day, pitching is storytelling and it is your job to figure out how each potential investor fits into the narrative. If done correctly, you’ll be able to control the conversation and better your chances of setting future meetings.

Further reading and resources for pitching your company to investors:

Data, Documents, and Due Diligence

Once you’ve determined an investor is the right fit for your company, you’ll need to share data and different documents with your investors.

Data & Metrics

At some point throughout the process, investors will need to see the metrics behind your business. You should have a deep understanding of your key metrics and have them ready to share at any time. Generally, we’ll see that metrics potential investors want to see fit into one of the following categories:

Documents & Due Diligence

Going from “I’d like to close” to actually closing is a big difference. When facing due diligence it is important to be prepared, understand the process, and do your part to speed up the process as much as possible.

There are a number of different corporate documents, protocols, references, etc. that you’ll need during the due diligence process. To learn more about the specific documents head over to our fundraising resources section.

Signaling most certainly matters throughout this process. You’re likely only meeting a few times before jumping into a 8-10 year relationship so everything will be magnified throughout the process. Be prepared and transparent throughout the due diligence to help avoid speed bumps and start your relationship off on the right foot.

Further reading and resources for sharing data, decks, and documents:

Nurturing for Later Rounds

Inevitably, you’ll hear a slew of “no’s” and maybe’s” throughout the fundraising process. An investor “no” can always be turned into a “yes” at a future date. As you would nurture a lost deal in a sales process, the same should be done with your potential investors.

If you’ve asked the right questions, you should have a good idea of what they’re excited about and be ready to pull the trigger to pick the conversation back up. How exactly do you keep potential investors engaged? We have found it best to send out a short update on the state of the business and industry. Share a promising metric or two showing strong growth in the business and any significant wins/improvements. If possible, address any concerns with the industry, team, product, etc. that you have discussed in the past with numbers. Hundreds of emails land in investor’s inboxes so be sure to include a quick snippet of what your company does and any personal notes.

By building a strong relationship with potential investors, it will make it that much easier when you set out to raise at a future date. Most importantly, make sure you are armed with the right information and data to stay top of mind.

Startup Funding Tracking

We’ve talked with a lot of founders who have raised money, and we continue to hear the same things: Fundraising is a difficult and time-consuming process, one that is often unstructured and chaotic. Done poorly, it can cost startup leaders countless hours of valuable time—not to mention their valuable sanity.

One of the key challenges of the fundraising process is it is non-linear. Seasoned founders will tell you that fundraising is essentially a sales process, requiring a founder to prospect, nurture and move potential investors through a “pipeline.” While this is true, it doesn’t tell the full story.

Most sales interactions have a natural order to them, an order that both sides generally understand. The fundraise process? Not so much. There is no proven playbook for getting funded, because every company is different, and so is every investor. Often, these interactions need to be managed on a case-by-case basis.

When managing a fundraise, a little structure goes a long way. We’ve built our Fundraising CRM to help founders track their fundraise simply, but effectively. Use it properly, and you’ll be on well your way to completing your round.

How the CRM Works

The Fundraising CRM is free for all users. To get started with your raise, login to your Visible account and check out the “Fundraising section”

To help get started, we include generic pipeline stages that are easily customizable to fit the needs of your fundraise. We’ve included what we have found to be the most common stages for an investor:

A crucial part of the fundraising process is keeping your eyes on communication and making sure you’re nurturing investors through the funnel, especially if you have a lengthy fundraising cycle. The notes section of each contact can be used to keep tabs on your communication and meetings with different investors. We hope this tool will help simplify your fundraising process and get funded faster.

Startup Fundraising Resources

At certain points in a company’s life, fundraising becomes a full time job for the founders or CEO. That is, of course, in addition to all the other full time jobs that come along with being a startup founder — hiring, selling, cleaning up dirty dishes. Constant outreach, pitching, deck revisions, not to mention the time spent answering diligence requests.

One of our goals at Visible is to improve the fundraising process for companies and there are a ton of other great tools and resources that focus on the same thing. We’ve curated 100s of fundraising articles and resources for our Founders Forward Newsletter. You can find our favorite startup fundraising resources below:

Startup Funding Tools

Foresight

Product, market and team get a lot of investors excited but not having your numbers down is a dealbreaker and hints at a lack of professionalism. Foresight helps you make sure you know your numbers as well as any CFO or accountant would. By the way, we spoke with Taylor Davidson, founder of Foresight, to get some insight into his best practices for building a great startup financial model.

Visible

Hey! That’s us! As we mentioned above, we offer a fundraising CRM to help founders track their fundraise from start to finish. Visible is the best way to report your performance numbers to your potential investors, helping you combine data, visualizations, and narrative to tell a compelling story about the growth of your business.

Startup Fundraising Content

Venture Deals: Be Smarter Than Your Lawyer and VC

This is, without a doubt, the best book you can read on venture financing. Buy it for yourself and for every single person on your team.

The 20 Minute VC Podcast

We’ve talked before about the importance of thinking like an investor. This interview podcast gives you a look inside the thought process for investors like Mark Suster, Kanyi Maqubela, and Aaron Harris.

Elizabeth Yin Blog

Elizabeth Yin is a co-founder and General Partner at Hustle Fund, a pre-seed fund for software entrepreneurs. Previously, Elizabeth was a partner at 500 Startups where she invested in seed stage companies and ran the Mountain View accelerator. Elizabeth covers the ins and outs of venture fundraising on her blog.

Berkshire Hathaway’s Letters to Shareholders

While he is known as an investor, Buffett is also an entrepreneur whose Shareholder letters are a masterclass on how to attract and retain long-term investors for your business. For a free compendium of Buffett resources, check out BuffettFAQ

Founders Forward Newsletter

We search the web for the best tips to attract, engage and close investors, then deliver them to thousands of inboxes every week. Subscribe for the Founders Forward Newsletter here.

Startup Fundraising Platforms

SeedInvest

For high-growth companies with proven traction, SeedInvest is a great platform to connect with over 14,000 individual accredited investors.

Angellist Funds

Raising on Angellist – where many top investors run what are known as “Syndicates” – can be a great way to tap into a network of well connected VCs, Entrepreneurs, and Angels.

Seedrs

Seedrs has helped European companies of all sizes – from idea stage to the publicly traded firms – raise capital more efficiently.

Kickfurther

If your company is dependent on effective inventory purchasing and management then Kickfurther, where you leverage backers and people who love your brand to fund inventory purchase orders, can be a great place to look.

Republic

Since the SEC enacted the Title III of the JOBS Act a majority of the US population can invest in startups for the first time. In order to allow more investors to invest in more startups, the team at Republic built a platform for startups to raise capital from the new found investors.

Earnest Capital

Earnest Capital provides early-stage funding, resources and a network of experienced advisors to founders building sustainable profitable businesses.

Startup Fundraising Fun

Venture Data Reports

We collect all of the venture fundraising data from the Pro Rata Newsletter. Every month we consolidate this data, add in qualitative data and context, and turn it into a easily digestible venture data report. Check out a recent Venture Data Report here.

The Pro Rata Newsletter

“Dive into the world of dealmakers across VC, PE and M&A. By Dan Primack, the best-sourced deals reporter on Earth.”

The Understandable Guide to Startup Funding Stages

Use our startup funding guide to raise, engage, and leverage your current or future startup funding.

Startup Stages

Building a startup is hard. As a startup founder, you are focused on building your product, hiring great talent, and attracting capital to your business. There are a few ways to finance your startup. Most startups use personal or family and friend capital, customer revenue, debt financing, or venture capital to grow their business.

When first launching your startup, finding the initial capital can almost feel impossible. If not for personal capital or friends/family capital, most founders look to venture capital. If a startup decides to raise venture capital, they will likely raise multiple rounds and go through different stages.

For example, when you are raising the first capital for your business this is called seed stage. As you grow and raise more capital, the round names progress as well. After the seed stage comes Series A, Series B, Series C, and so on. Below we define and take a deeper dive into the different startup funding stages.

There are multiple stages of startup funding: Seed, Series A, Series B, Series C, and so forth. Startups should be conscientious about the funding rounds that they will go through, which are generally based on the current maturity and development of the company. Here’s an overview of the major startup stages.

Seed funding is a startup’s earliest funding stage. Often, seed funding comes from angel investors, friends and family members, and the original company founders. An early-stage startup may also look for funding through bank loans, but angel investments are usually preferred. Seed funding is used to start the company itself, and consequently, it’s a fairly high risk: the company has not yet proven itself within the market. There are many angel investors that specifically focus on seed funding opportunities because it allows them to purchase a part of the company’s equity when the company is at its lowest valuation.

After Series A funding comes Series B funding. Series B funding occurs after the company has already been developed through Series A funding but now needs to expand further. A company attempting to acquire Series B funding will have already proven itself at market. It will have a high amount of active users and user activity, but may need to still establish itself to truly begin growing revenue.

Finally, there’s Series C funding. Series C funding is for established businesses that are interested in scaling, such as businesses that want to expand into new markets. Series C funding is sought by companies that have already become successful, and are trying to expand that success. Series C funding may also be used by successful companies that are experiencing short-term challenges that need to be addressed.

Multiple rounds of Series A, Series B, and Series C funding may be procured. They are named A, B, and C because of the stage of development the company is in when procuring the funding, rather than because they are procured one after another. A startup can expect to go through all these stages of funding if it is successful, from initial seed funding to Series C funding. Most companies are going to be continuously gaining additional funding for the purposes of growth.

Each stage of the startup funding process operates very similarly, despite the different stages the business might be in. During the startup funding process, the company has to be able to establish it’s valuation, and will need to have clear plans for how it is planning to use the money it procures. Each round of funding will also, by necessity, dilute the company’s equity.

Pre-Seed Funding

Over the last few years, a new funding stage has emerged, pre-seed funding. Learn more about pre-seed funding and what it means for your fundraising efforts below:

What is pre-seed funding?

A pre-seed round is a round of venture capital that is generally the first round of institutional capital that a startup raises. A pre-seed round generally allows a founding team to find product-market fit, hire early employees, and test go-t0-market models.

Related Reading: What is Pre-Seed?

What is the average pre-seed funding amount?

How to acquire pre-seed funding?

Raising a pre-seed round mirrors a traditional B2B sales process. You will be talking and adding investors to the top of your funnel, pitching and negotiating in the middle of the funnel, and hopefully closing them at the bottom of the funnel. Learn more about building a fundraising process in our guide, “All-Encompassing Startup Fundraising Guide.”

We sat down with Jonathan Gandolf, CEO of The Juice, every week during his pre-seed raise to breakdown what he was learning along the way. We boiled down the conversations into 8 episodes. Give it a listen below:

How long does pre-seed funding last?

As a general rule of thumb, funding should last somewhere between 12 and 18 months. It should be enough capital to allow you to comfortably hit your goals and forecast you laid out during your pitching and fundraising process.

Who invests in pre-seed rounds?

One of the plus side of a pre-seed round is that it opens up more types of investors as the check sizes are generally smaller:

Active pre-seed stage investors

As we mentioned, there are many dedicated pre-seed funds that are popping up in the space. Check out a few of our favorites below:

Find more pre-seed investors in our investor database, Visible Connect, here.

Seed Funding

As we mentioned earlier, “Seed funding is a startup’s earliest funding stage. Often, seed funding comes from angel investors, friends and family members, and the original company founders.” More investors have become keen on being an early investor into a startup so they have access to invest again at later stages.

Raising seed stage funding is a major accomplishment for a startup. Seed stage funding is the initial surge of capital into the business. At this point, a startup is largely an idea and will have little to no revenue. This stage is generally when a product and go-to-market strategy are being built and developed.

Over the past couple of years seed stage funding has exploded in round size. What used to be regarded as a few small checks from family and friends has turned into a multimillion dollar round. Check it out:

There are generally 3 ways a founder can go after raising a seed round. The first, and most common, is finding that the time is not right for the startup is not scalable and the startup goes defunct. The second, is finding that the seed stage capital was all that the company needed to get going and can fund the growth of the business via customer revenue and debt financing. The last option and most traditional route is raising future startup funding rounds; Series A, Series B, Series C, etc. More on this below!

Series A Funding

After raising a Seed Round it’s time for a company to advance to a later round of venture capital financing, that means Series A funding. For many startups, the idea of Series A funding is intimidating — yet it can also be a make or break time for a business.

What is series A funding?

When a company is first founded, stock options are generally sold to the company’s founders, those close to them, and angel investors. After this, a preferred stock can be sold to investors in the form of a Series A. Series A allows investors to get in early with a business that they truly believe in. It’s a mutually beneficial relationship for both the company and the future stock holders.

What is the average series A funding amount?

How to acquire series A funding?

A company’s valuation will be impacted by a number of factors, including the company’s management, size, track record, risk, and potential for growth. Analysts can be called in for a professional valuation of the business. During a Series A funding round, a business usually will not yet have a proven track record, and may have a higher level of risk.

During a Series A round, investors will usually be able to purchase from 10% to 30% of the business. Series A investments are generally used to grow the business, often in preparation for entering into the market. The company itself will be able to decide how much it wants to sell during its Series A round, and may want to retain as much of the company control as possible.

Month-over-month growth = (This month – Last month) / (Last month)

If your startup measures year-over-year or week-over-week growth instead, simply substitute the annually or weekly number into the monthly slot and the formula works the same.

Like MRR, your target monthly growth rate for earning attention from Series A VCs will vary. However, Tunguz puts 15-20% monthly growth as a solid range to hit in order to attract investors.Be careful to chart out your monthly growth over an extended period to ensure that you aren’t experiencing inconsistent results or your perceived long-term growth isn’t hiding a trend toward declining numbers. Potential investors are going to interrogate those numbers and examine trends. You don’t want to be the last person in the room to vet your own results.

If you’re conducting responsible, consistent financial planning, you can start to forecast when your startup will be ready for its Series A. Talk to your seed investors early to get their feedback on your plans and brainstorm strategies to maintain or increase your revenue growth. Also, your investors likely see a variety of deals on a regular basis, while you’ll maybe pitch a few times a year. Lean on their expertise to identify other intangible factors in the fundraising market and prepare yourself for a successful round.

How long does series A funding last?

Once the funding round has been completed, the company will usually have working capital for six months to 18 months. From there, the company may either be able to move to market or may instead progress to another series of funding. Series A, B, and C funding rounds are all based on stages that the company goes through during its development.

It is important to remember that when raising your Series A you are setting goals and objectives for what that capital will do to your business. You need to raise enough capital to help you achieve these goals so you can go on to raise a Series B or future round of capital.

Series B Funding

Once a business has been launched and established, it may need to acquire Series B funding. A business will only acquire Series B funding after it has started its operations and proven its business model. Series B funding is generally less risky than Series A funding, and consequently there are usually more interested investors.

What is series B funding?

As with Series A funding, the company begins with a valuation. From there, it publicizes the fact that it’s looking for Series B funding. The company will be selling its equity at the valuation that is settled upon, and investors are free to make offers regarding this valuation. A startup that gets to Series B funding is already more successful than many startups, which will not go beyond their initial seed capital.

What is the average series B funding amount?

How to acquire series B funding?

Sometimes Series B funding will come from the same investors who initially offered Series A funding. Other times, Series B funding may come from additional investors, or from firms that specialize in investing. Either way, investors are usually going to be paying more for less equity than investors did in prior funding rounds, because the company’s valuation will have scaled. A Series B funding valuation will need to consider the company’s current performance and its future potential for growth.

Analysts can be used to price a company looking for Series B funding. However, it should also be noted that the company itself has more negotiating power as a Series B company, as it has proven itself to be successful.

How long does series B funding last?

Once Series B funding has been procured, the business will need to use this money to further stabilize, improve its operations, and grow. At this point, the startup should be in a good position. If the startup needs further money after it develops, to grow and expand, it may need to embark upon a Series C funding round.

Series C Funding

Series C funding is meant for companies that have already proven themselves as a business model but need more capital for expansion. Like Series B funding, Series C investors will often be entrepreneurs and individuals who have already invested in the company in the past. A startup may connect with their angel investors and Series A and Series B investors first when trying to procure Series C funding.

What is series C funding?

If a business has made it to Series C funding they are already quite successful. Whereas earlier stage rounds are used to help a startup find traction and grow, by the time a startup raises their Series C they are already established and growing.

Since the business is already established and just needs its funds to grow or expand, it is less likely to be a risk. At this point, the startup is no longer really a “startup,” but rather an established business with a proven business model, which needs to either expand its product offerings, expand into new markets, or expand its marketing output.

By raising a Series C a business will be able to make strategic investments. This could mean investing in market expansion, new products, or even acquiring other companies.

What is the average series C funding amount?

How to acquire series C funding?

When approaching a Series C valuation, your company likely speaks for itself and will have more inbound requests from investors. These investors will likely be later stage VC funds, private equity firms, and banks.

How long does series C funding last?

Depending on the business strategy, a Series C round may be the end of the road in terms of venture capital financing. At this point, the company is likely headed in a strong direction and owns a large % of an addressable market. However, some companies go on to raise their Series D, Series E, Series F, and even Series G.

Later Startup Funding Stages

Series D Funding

A Series D funding round may occur if the company was not able to raise enough money through its Series C. This often has implications for the business. Series D funding occurs when the business was not able to meet its targets with its Series C, and consequently it can mean that the business is now at a lower valuation. Being priced at a lower valuation is usually very negative for a business.

If Series D funding is necessary, due to challenges that the company is facing, then it may be the only way for the startup to survive. However, it generally devalues the company, and may shake future investor faith.

Series E Funding

Series E funding may be necessary if Series D funding isn’t able to meet the company’s needs for capital. This is, again, a very bad sign, and very few companies are going to survive to Series E funding. Series E funding will only occur if the business still hasn’t been able to make up its own capital but the business is still struggling to remain active and private.

Series F & G Funding

Finally, very few companies are going to make it to Series F funding or Series G funding, but it is possible. Some notable financial services have found themselves getting Series F or Series G funding, because capital is so inherent to the ways that they do business. Every round of funding represents new opportunity for the business, but also presents the possibility of diluting the company’s equity and valuation.

Looking to raise? Track your fundraising or find investors with Visible Connect.